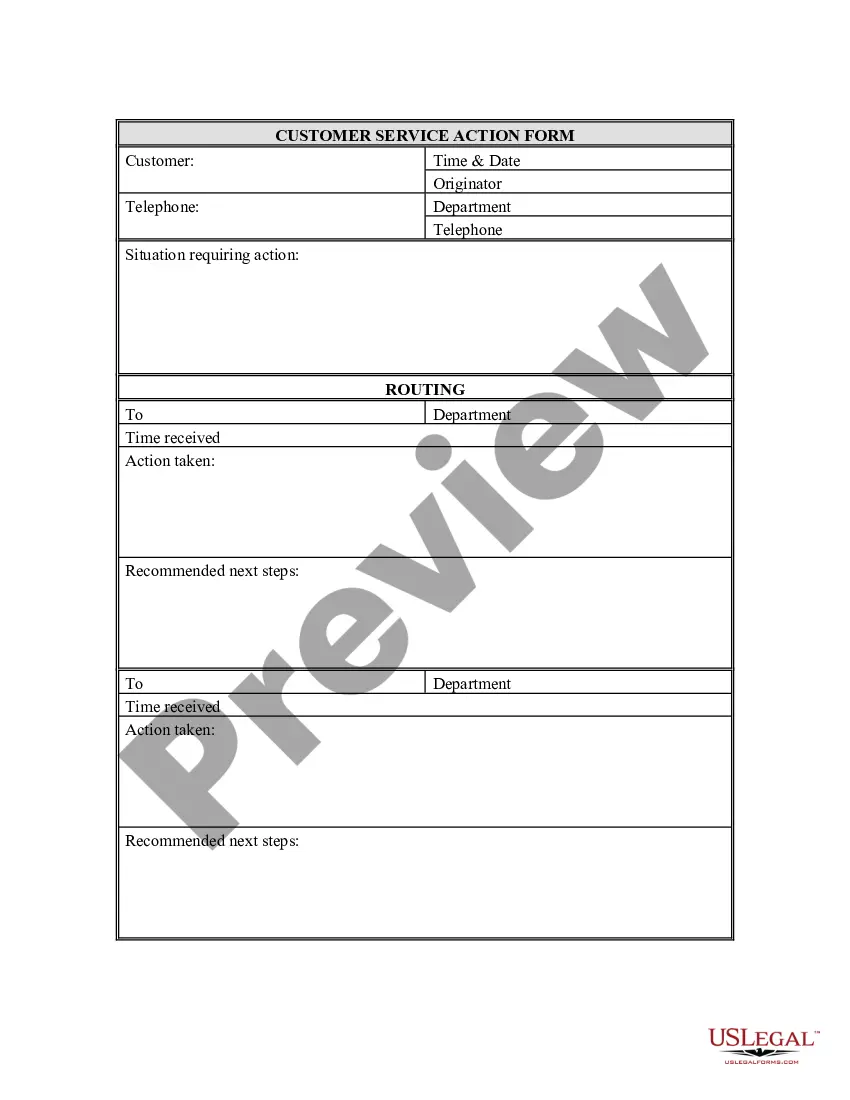

Puerto Rico Customer Service Action Form

Description

How to fill out Customer Service Action Form?

You might spend hours online trying to locate the legal document template that fulfills the state and federal requirements you seek.

US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

You can conveniently download or print the Puerto Rico Customer Service Action Form from your account.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, edit, print, or sign the Puerto Rico Customer Service Action Form.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/area that you select. Check the form description to confirm you have chosen the correct form.

Form popularity

FAQ

Submit your Form 8821 securely at IRS.gov/Submit8821. Fax. Fax your Form 8821 to the IRS fax number in the Where To File Chart. Mail. Mail your Form 8821 directly to the IRS address in the Where To File Chart.

SBA requires you to complete the IRS Form 8821 as a part of your disaster loan application submission. The form authorizes the IRS to provide federal income tax information directly to SBA. Although the form is available online, it cannot be transmitted electronically.

How to speak directly to an IRS agentCall the IRS at 1-800-829-1040 during their support hours.Select your language, pressing 1 for English or 2 for Spanish.Press 2 for questions about your personal income taxes.Press 1 for questions about a form already filed or a payment.Press 3 for all other questions.More items...?

Taxpayer Assistance Centers operate by appointment. Follow these guidelines: If your area has a high or substantial transmission rate or you aren't fully vaccinated, wear a mask. Stay 6 feet away from others.

If you qualify for our assistance, which is always free, we will do everything possible to help you. Visit or call 877-777-4778.

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time, unless otherwise noted (see telephone assistance for more information).

Missing IRS Stimulus or Tax Refund PaymentsCall 1-800-919-9835 (IRS Informational Hotline) for assistance.You will be instructed to complete Form 3911 to complete initiate a "trace" of the EIP (Economic Impact Payment)Fax: 855-332-3068 or Mail:

Provide your name, Social Security number (and spouse's name and SSN, if applicable), street address, city, state, zip code, fax number, email address and employer identification number (EIN). Indicate which tax form you used, either 1040 or 1040EZ, and note the tax period or year for which you are requesting help.

How Can You Speak Directly With An Agent at the IRS?Call the IRS telephone number at 1-800-829-1040.The automated system will ask you to select your preferred language.Once you've set your language, choose option 2 for Personal Income Tax instead.Press 1 for form, tax history, or payment.More items...?

Fax: (855) 215-1627 (within the U.S.)