Wisconsin Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Agreement For Withdrawal Of Partner From Active Management?

You might spend hours on the web searching for the legal document template that meets the federal and state requirements you seek.

US Legal Forms provides thousands of legal templates that have been reviewed by professionals.

You can obtain or generate the Wisconsin Agreement for Withdrawal of Partner from Active Management through my service.

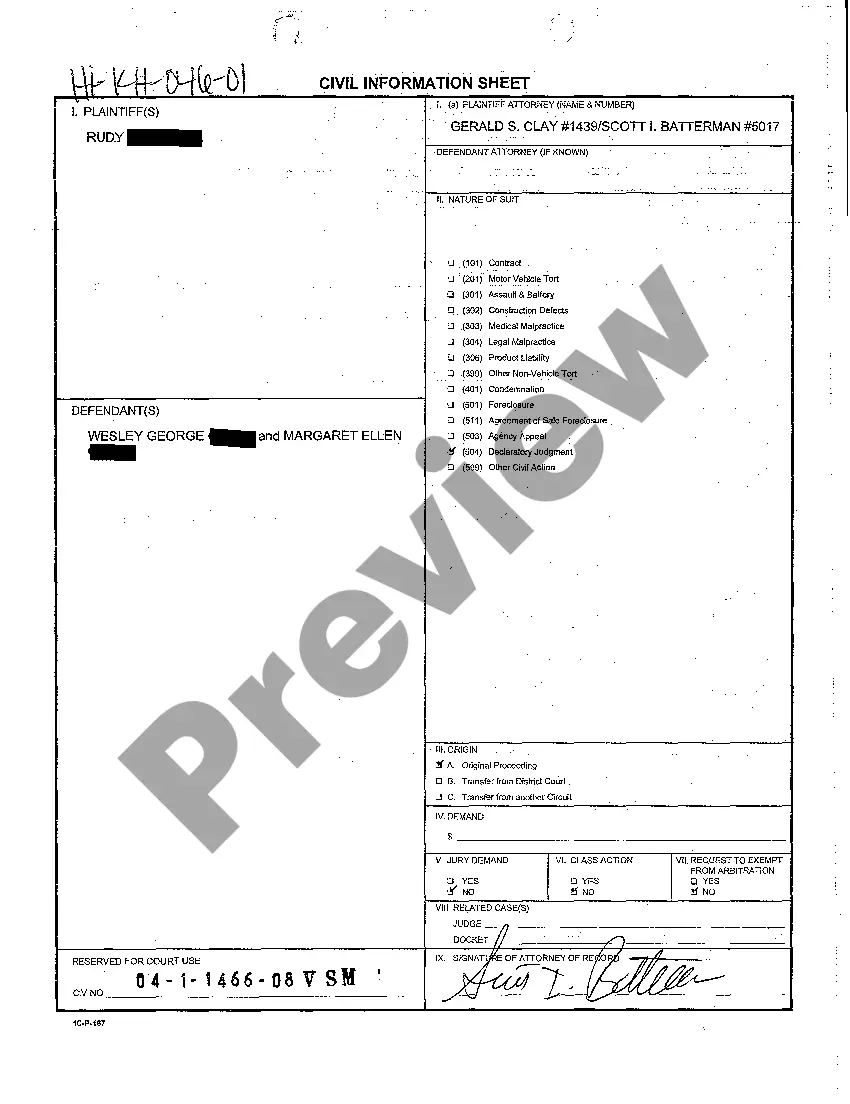

If available, utilize the Preview button to view the document template as well. In order to find another version of your form, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, modify, print, or sign the Wisconsin Agreement for Withdrawal of Partner from Active Management.

- Every legal document template you buy is yours forever.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form summary to confirm you have chosen the right template.

Form popularity

FAQ

Dissolving an LLC means formally ending the business entity, which involves legal filings and asset distribution. Terminating an LLC can informally refer to ceasing operations without completing the legal dissolution process. Utilizing a Wisconsin Agreement for Withdrawal of Partner from Active Management can clarify terms during either process.

Dissolving your LLC is advisable if you no longer wish to conduct business, as it eliminates ongoing fees and obligations. Keeping it inactive can lead to unnecessary expenses and administrative headaches. If you have partners, a Wisconsin Agreement for Withdrawal of Partner from Active Management may clarify the process of dissolution.

Removing someone from an LLC in Wisconsin typically requires a vote among the remaining members or compliance with the operating agreement. It is crucial to document the removal properly to prevent potential disputes. A Wisconsin Agreement for Withdrawal of Partner from Active Management can provide a structured approach to this process.

To close an S Corp in Wisconsin, submit the Articles of Dissolution to the appropriate state department after settling all liabilities. Notify all shareholders to ensure understanding of their rights regarding asset distribution. A Wisconsin Agreement for Withdrawal of Partner from Active Management can be helpful in these discussions.

Closing out an S Corp involves filing Articles of Dissolution and ensuring all debts are satisfied. It is also vital to distribute remaining assets among shareholders properly. Utilize a Wisconsin Agreement for Withdrawal of Partner from Active Management for clarity in these transitions, particularly if partners are involved.

To remove a partner from an LLC in Wisconsin, follow the procedures in your operating agreement. Generally, the remaining members must consent to the removal. Implementing a Wisconsin Agreement for Withdrawal of Partner from Active Management streamlines this process and clarifies any residual obligations.

Removing someone from a limited company typically necessitates a vote among shareholders to approve the removal. It’s essential to follow the procedures outlined in your company’s governing documents. Using a Wisconsin Agreement for Withdrawal of Partner from Active Management can facilitate a clear and orderly transfer of responsibilities.

Upon dissolving an S Corp, any remaining assets after settling debts must be distributed to shareholders according to their ownership percentages. This process must adhere to both state laws and internal agreements. To manage any partner withdrawals effectively, consider a Wisconsin Agreement for Withdrawal of Partner from Active Management.

To dissolve an S Corp in Wisconsin, you must file Articles of Dissolution with the state and settle all financial obligations. Inform shareholders and obtain their approvals as needed. Utilizing a Wisconsin Agreement for Withdrawal of Partner from Active Management may assist in clarifying any partner-specific responsibilities during the dissolution process.

When you dissolve an S corporation, the corporation becomes responsible for its outstanding debts. Creditors can pursue the corporation for repayment, but generally, shareholders are protected from personal liability. However, it's wise to document agreements such as the Wisconsin Agreement for Withdrawal of Partner from Active Management to address any partner responsibilities.