Wisconsin Subcontract for Construction of Portion of or Materials to go into Building

Description

How to fill out Subcontract For Construction Of Portion Of Or Materials To Go Into Building?

Have you ever been in a situation where you need documents for either business or personal purposes almost every day.

There are many legal document templates available online, but finding reliable ones can be challenging.

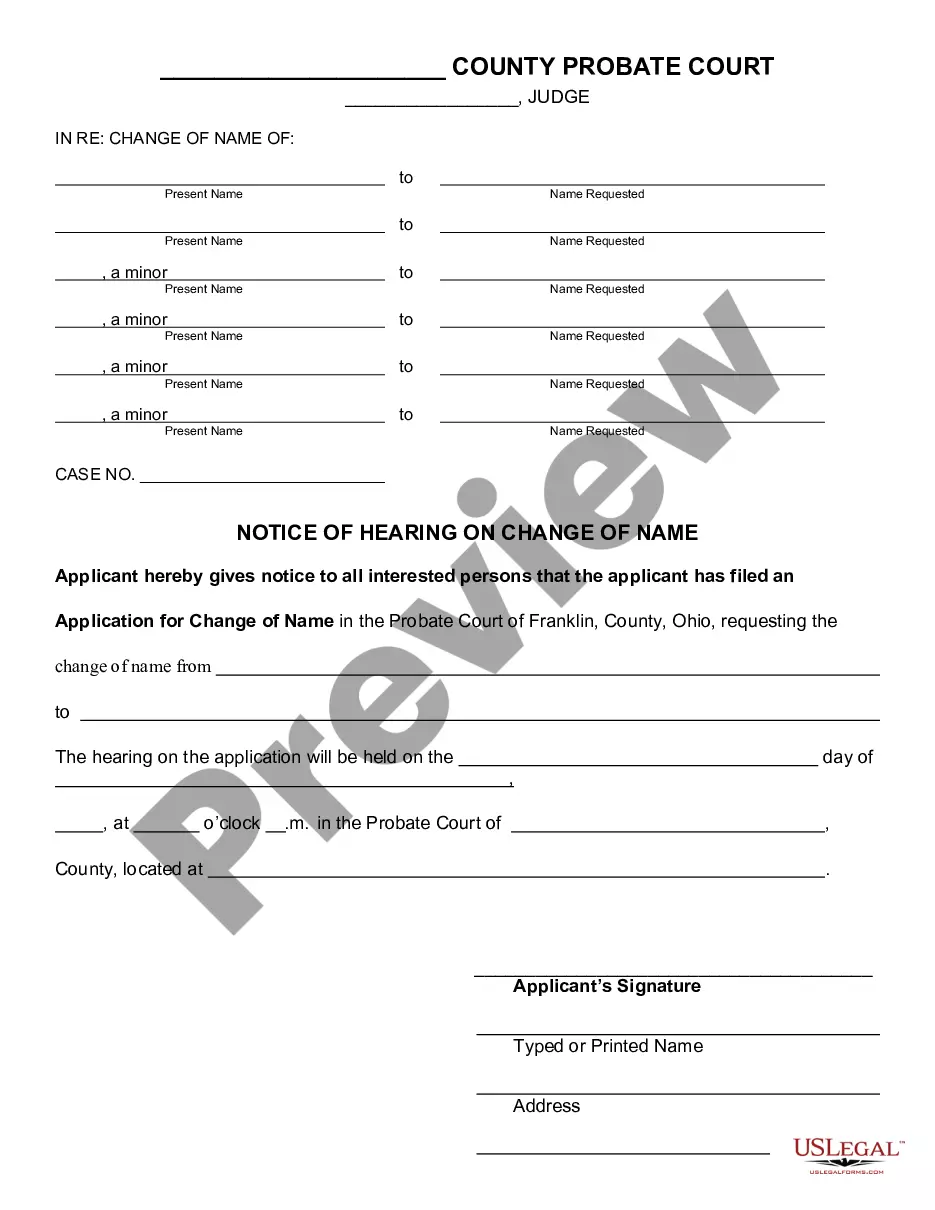

US Legal Forms offers a vast array of form templates, like the Wisconsin Subcontract for Construction of a Portion of or Materials to be Entered into a Building, which can be customized to meet federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Wisconsin Subcontract for Construction of a Portion of or Materials to be Entered into a Building template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

- Use the Review button to examine the form.

- Read the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs.

- Once you have obtained the correct form, click Acquire now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- You can find all the document templates you have purchased in the My documents section. You can always get an additional copy of the Wisconsin Subcontract for Construction of a Portion of or Materials to be Entered into a Building as needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

The role of the owner on a construction project is to develop the program for the building, define the scope of the project, create the budget, and provide the funding for the project.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

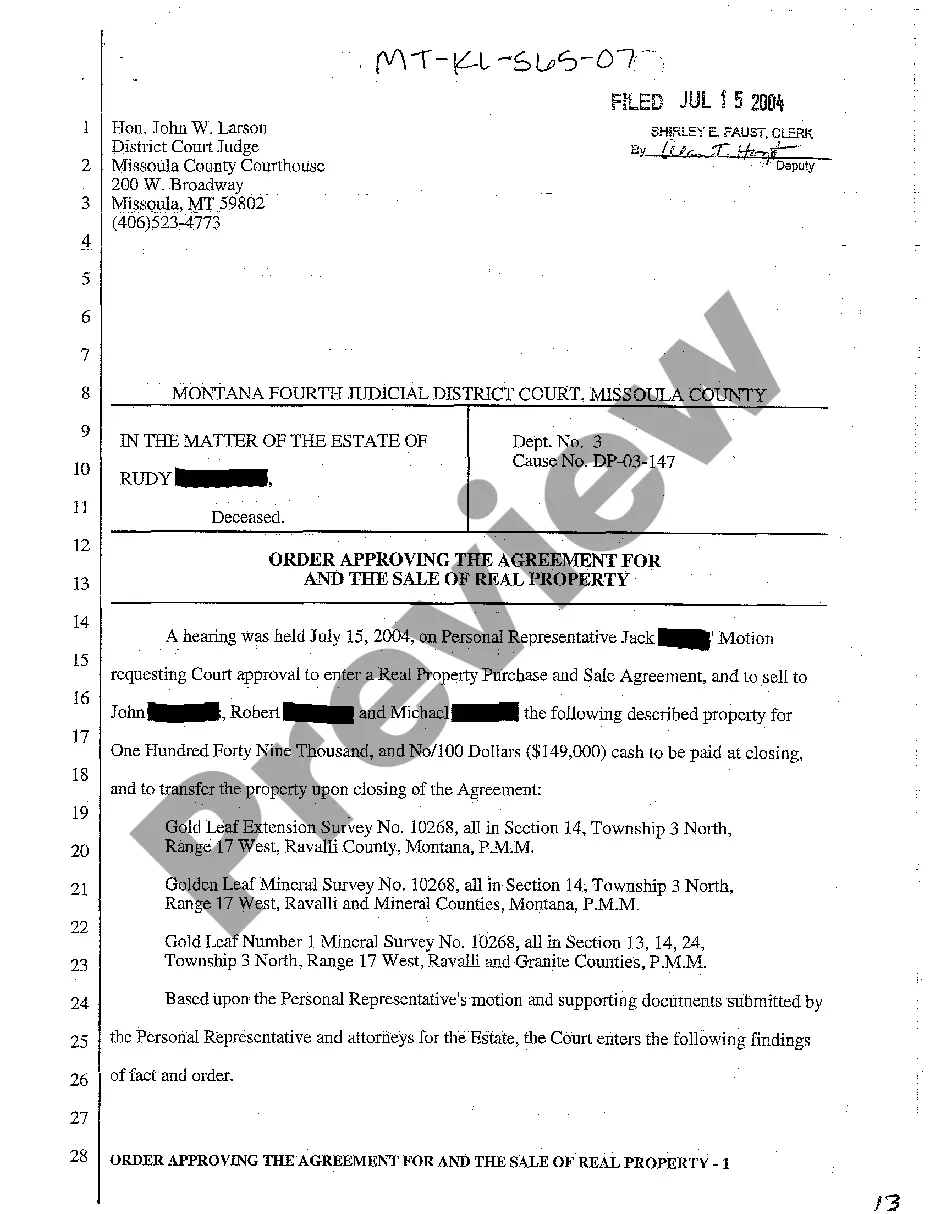

A subcontractor agreement is a contract between a contractor and a subcontractor to perform a portion of work that is part of a larger construction project. A subcontractor doesn't have an agreement with the property owner directly.

Per Wisconsin law, if a contractor purchases construction materials for use in a real property construction project or repair, the contractor is considered the end user of those materials. That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable.

In very broad terms, on construction projects, materials are sourced by the contractor and the client pays the contractor after they have been delivered to site.

Any business that only makes sales that are not subject to sales or use tax under ch. 77, Wis. Stats., may complete an Affidavit of Exempt Sales Form. This is certification that all sales the business makes in Wisconsin are exempt from the Wisconsin sales and use tax.

Builders are responsible for managing, coordinating, and working on the construction. They are also responsible for repairing and maintaining commercial and residential buildings. They oversee a project by either making arrangements with subcontractors to finish specific jobs or doing the work themselves.

Construction negligence occurs whenever a project does not follow existing safety rules or standards of care and becomes a danger to workers or the public. Negligence that occurs during a building or repair project is a common form of construction negligence.

As far as how to notify a contractor that he or she didn't get the job, a short handwritten letter, brief email or a quick phone call should suffice. Most contractors appreciate hearing why you didn't choose them, if you're comfortable providing that type of feedback.