Wisconsin Shareholders Agreement - Short Form

Description

How to fill out Shareholders Agreement - Short Form?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Wisconsin Shareholders Agreement - Short Form in mere moments.

If you already have a subscription, Log In and download the Wisconsin Shareholders Agreement - Short Form from the US Legal Forms library. The Download button will be visible on every form you encounter. You can find all previously acquired forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit it, fill it out, print, and sign the downloaded Wisconsin Shareholders Agreement - Short Form. Each form you have added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Wisconsin Shareholders Agreement - Short Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/state.

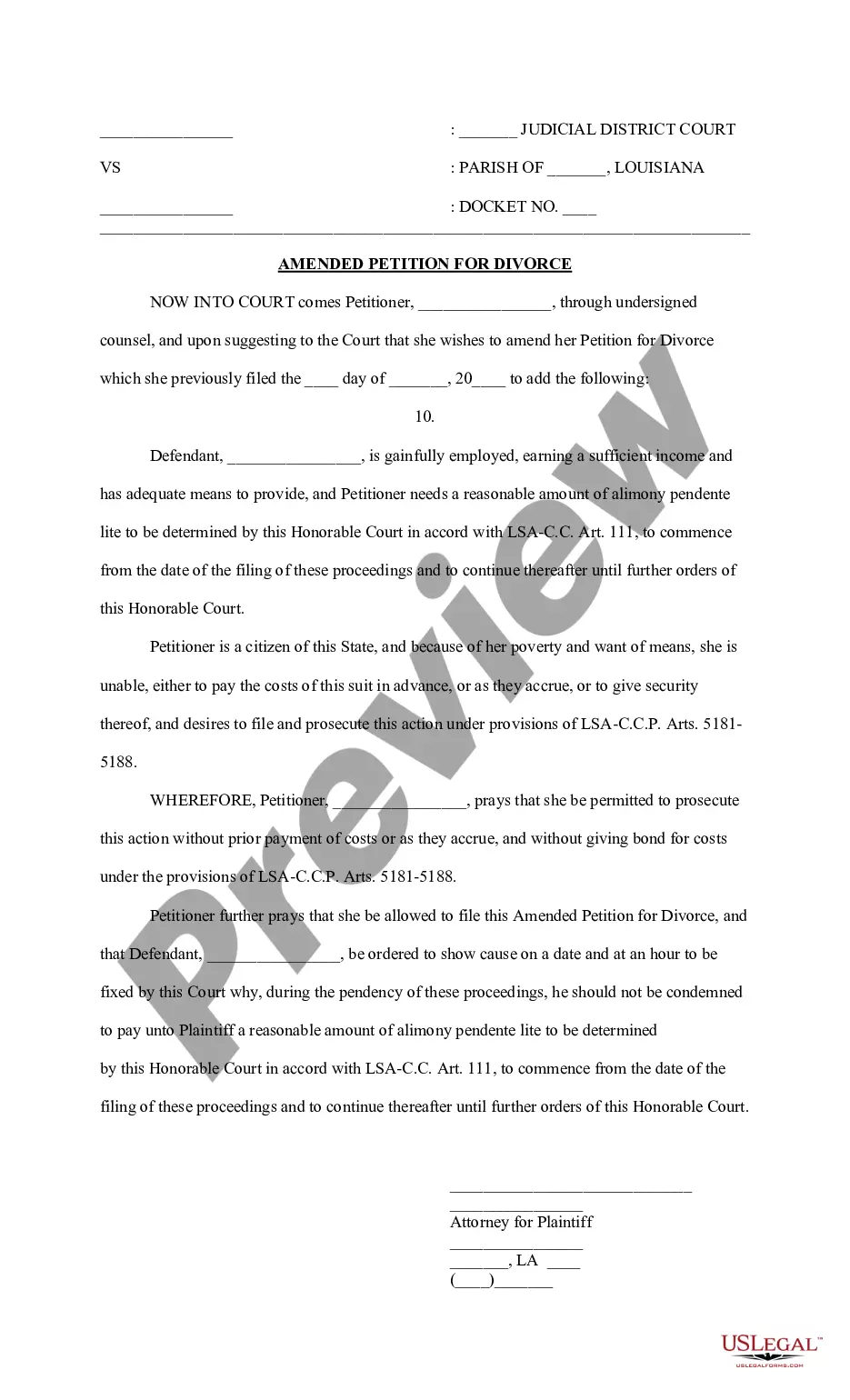

- Click the Review button to examine the contents of the form.

- Check the description of the form to confirm you have selected the right one.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Next, choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

A Wisconsin withholding exemption certificate allows employees to claim exemption from income tax withholding under certain conditions. This form is essential for ensuring employees are taxed appropriately based on their individual circumstances. As a business owner, understanding these certificates can complement your Wisconsin Shareholders Agreement - Short Form by providing clarity on financial responsibilities and tax obligations.

Setting up a shareholders agreement involves outlining the rights and responsibilities of each shareholder within the business. Begin by discussing key terms, such as voting rights, dividend distribution, and exit strategies. You can use templates from uslegalforms to create a tailored Wisconsin Shareholders Agreement - Short Form that meets your specific needs and protects all parties involved.

Certain individuals, such as non-residents and certain types of non-profit organizations, may be exempt from Wisconsin income tax. Active duty military personnel also have specific exclusions. If you are navigating tax responsibilities related to your business, a Wisconsin Shareholders Agreement - Short Form can help solidify the legal framework while ensuring compliance.

Wisconsin Form 5S is used to establish a S Corporation's income and expenses for tax purposes. This form allows the corporation to report earnings to the IRS and the state of Wisconsin efficiently. For business owners considering a Wisconsin Shareholders Agreement - Short Form, maintaining proper tax documentation is essential for clear and organized financial management.

A Notice of Assessment Wisconsin is an official document issued by the Department of Revenue that outlines tax liabilities. It informs taxpayers of the amount of tax owed based on their filed returns or other assessments. Understanding your Notice of Assessment can help you effectively respond and consider a Wisconsin Shareholders Agreement - Short Form for clarity in your business operations.

Creating a Wisconsin Shareholders Agreement - Short Form is straightforward when you leverage resources like uslegalforms. Begin by defining the goals and expectations of all shareholders. Use a structured template to draft the agreement, ensuring every important aspect is covered, such as management roles, contributions, and exit strategies. Once drafted, review the agreement together to make necessary adjustments before finalizing it.

Establishing a Wisconsin Shareholders Agreement - Short Form involves gathering all potential shareholders to discuss important terms and conditions. Start by identifying key elements that will govern your relationship, such as ownership structure and profit distribution. Following careful negotiations and agreement on these terms, documenting them in a formal agreement is essential for clarity and legal protection.

To obtain a Wisconsin Shareholders Agreement - Short Form, consider utilizing online legal service platforms like uslegalforms. These platforms offer templates and guides designed to simplify the process of creating a shareholders agreement tailored to your needs. You can easily customize agreements to reflect your specific business requirements and ensure legal compliance.

A Wisconsin Shareholders Agreement - Short Form should outline key components such as ownership percentages, voting rights, and responsibilities of shareholders. It should address how decisions are made and how disputes will be resolved. Including buy-sell provisions is crucial, as it ensures a smooth transition and prevents conflicts if a shareholder wants to exit the business.

A shareholder agreement is often referred to as a stockholder agreement or a buy-sell agreement. These terms emphasize the agreement's focus on equity ownership and the conditions for buying and selling shares. Exploring a Wisconsin Shareholders Agreement - Short Form can provide valuable insights into the similarities and differences between these types of agreements.