Wisconsin Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Are you currently in a situation where you require documents for business or specific purposes almost every day.

There are numerous legal document templates available on the web, but locating ones that you can trust isn't easy.

US Legal Forms offers a vast array of document templates, such as the Wisconsin Corporate Guaranty - General, which can be tailored to meet state and federal requirements.

Select the pricing plan you prefer, fill out the required details to create your account, and pay for the order using PayPal or a credit card.

Choose a convenient document format and download your copy.

- If you are already aware of the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Corporate Guaranty - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it's for the correct city/county.

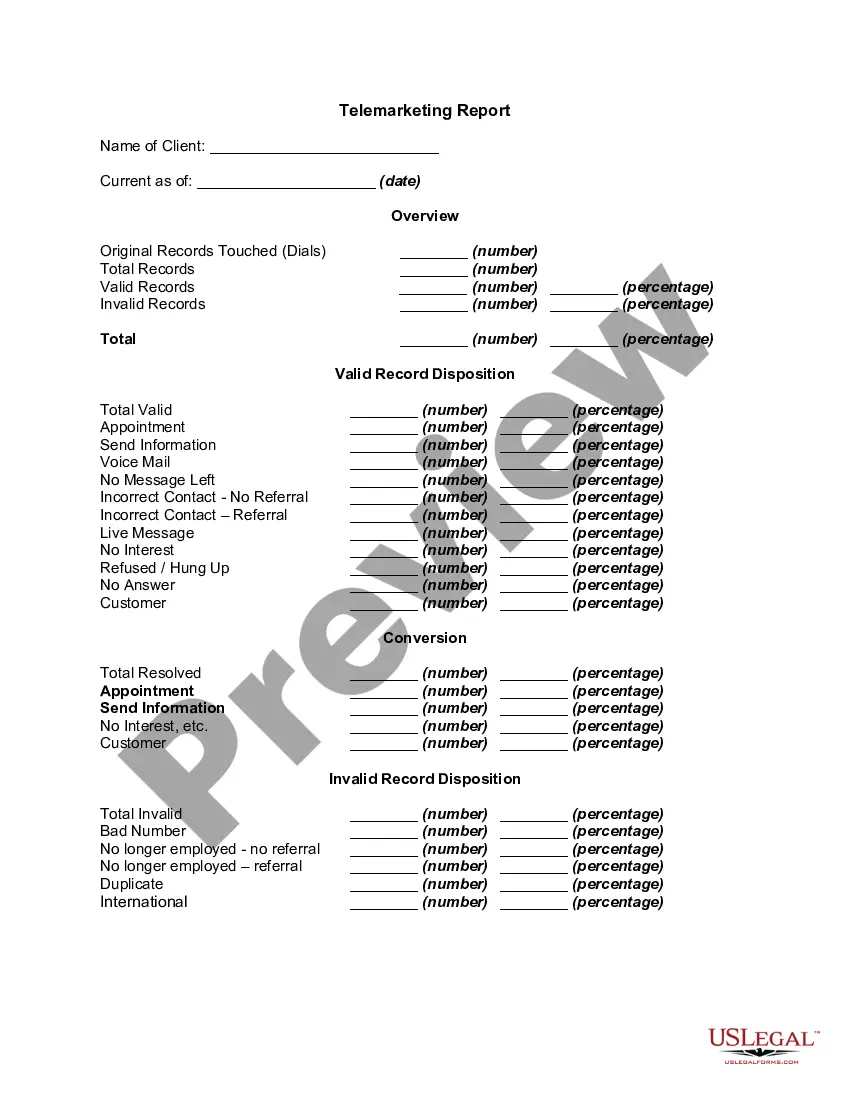

- Use the Preview feature to view the form.

- Review the details to ensure that you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the document that suits your needs and requirements.

- Once you find the correct form, simply click Get now.

Form popularity

FAQ

Yes, every business entity in Wisconsin is required to designate a registered agent. This individual or business entity will receive legal documents on behalf of your corporation. Having a registered agent is essential for maintaining compliance and enhances the credibility associated with the Wisconsin Corporate Guaranty - General.

Yes, registering with the Wisconsin Department of Financial Institutions is a necessary step for all businesses operating in the state. This helps to maintain transparency and accountability in business practices. By completing this registration, you lay a strong foundation for your enterprise, complying with the Wisconsin Corporate Guaranty - General.

Absolutely, you need to register your business in Wisconsin to legally conduct operations. This registration establishes your business as a legal entity and protects your personal assets. When you register, you also ensure compliance with the Wisconsin Corporate Guaranty - General, which is beneficial for your business growth.

Yes, if you intend to operate your business under a name different from your legal business name, you must register a DBA, or 'Doing Business As,' in Wisconsin. This registration is necessary to inform the public about the true owner of the business. It enhances your credibility and aligns with the principles of the Wisconsin Corporate Guaranty - General.

A corporate guardian in Wisconsin is responsible for protecting the interests of a business and ensuring compliance with legal obligations. This role involves overseeing business activities and making important decisions that support organizational health. Understanding the importance of this role is vital when considering the Wisconsin Corporate Guaranty - General.

Yes, if you plan to operate a business in Wisconsin, you need to register with the Wisconsin Department of Financial Institutions. This step is essential to ensure compliance with state laws. By registering, you secure a legal framework for your operations and establish a business identity, which is crucial for the Wisconsin Corporate Guaranty - General.

Generally, homeowners cannot deduct HOA fees on their individual tax returns; however, if the property is rental or business property, certain fees may qualify for deductions. It’s crucial to consult a tax professional to explore your specific situation. This understanding helps homeowners and businesses alike remain compliant with the Wisconsin Corporate Guaranty - General.

The IRS treats Homeowners Associations as tax-exempt organizations under certain conditions, allowing them to avoid certain taxation. However, to maintain this status, they must adhere to specific guidelines and file the required tax forms. Proper navigation of these rulings is crucial for HOA compliance with the Wisconsin Corporate Guaranty - General.

In Wisconsin, Homeowners Associations typically file Form 1120-H for their tax return. This form allows the HOA to report any income, expenses, and distributions. By understanding the filing requirements and implications under the Wisconsin Corporate Guaranty - General, you can effectively manage your HOA’s financial responsibilities.

Wisconsin Form 3 is a corporate income tax return form specifically for corporations that qualify under certain criteria. It is used to report income, deductions, and credits applicable to Wisconsin corporations. For businesses under the Wisconsin Corporate Guaranty - General, filing the correct forms ensures you meet your tax obligations effectively.