Wisconsin Guaranty by Corporation - Complex

Description

How to fill out Guaranty By Corporation - Complex?

Are you currently in the placement that you require papers for both organization or specific purposes almost every working day? There are tons of authorized papers themes available on the net, but locating ones you can rely is not easy. US Legal Forms provides thousands of kind themes, much like the Wisconsin Guaranty by Corporation - Complex, that happen to be published to fulfill state and federal specifications.

When you are presently informed about US Legal Forms site and get a free account, simply log in. Afterward, you may down load the Wisconsin Guaranty by Corporation - Complex design.

Should you not provide an accounts and need to start using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is to the appropriate area/area.

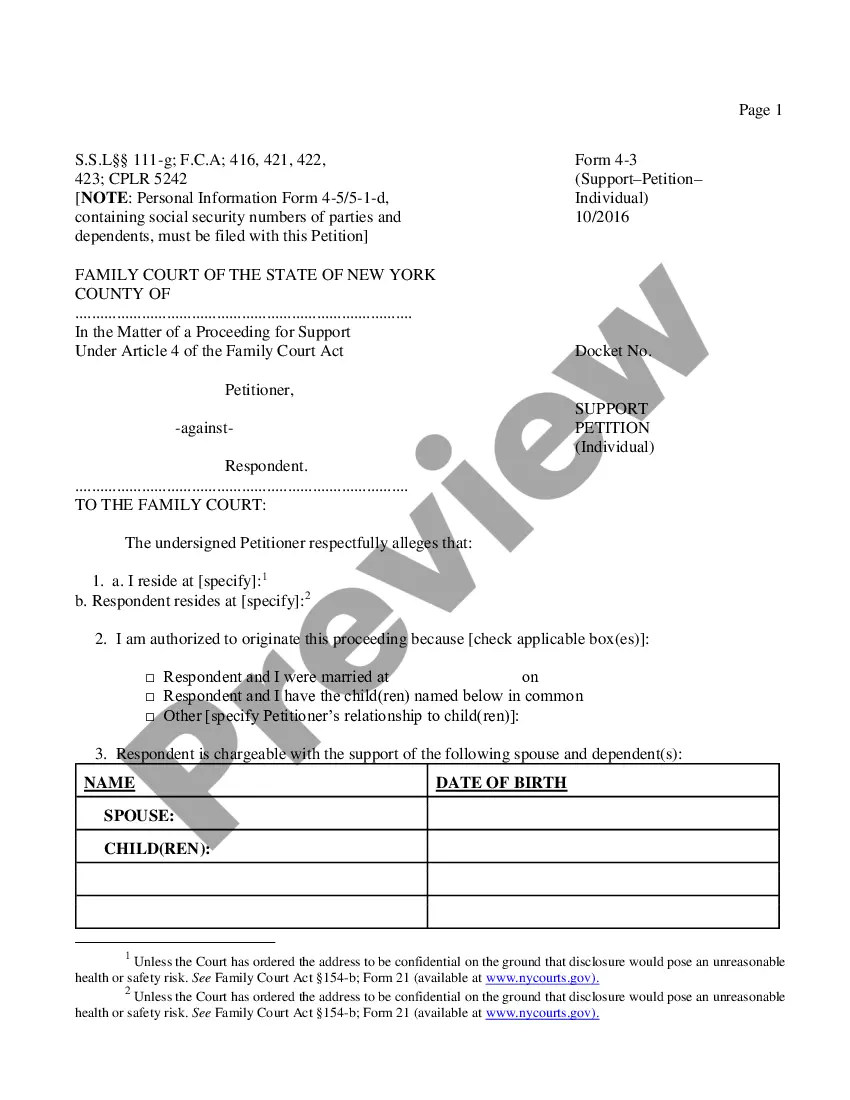

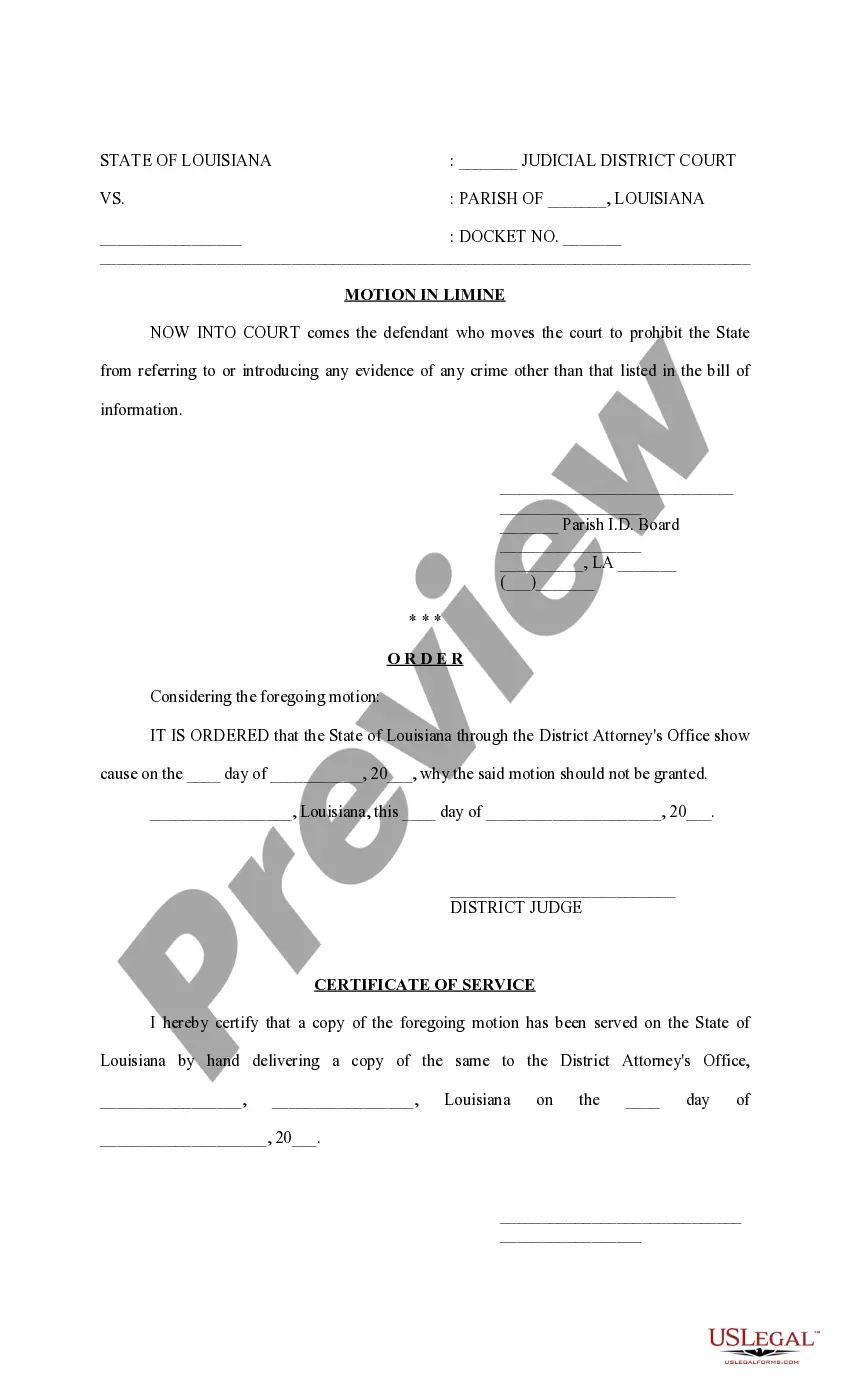

- Take advantage of the Review button to review the shape.

- See the information to ensure that you have chosen the appropriate kind.

- In the event the kind is not what you are looking for, make use of the Research discipline to find the kind that suits you and specifications.

- Whenever you discover the appropriate kind, just click Buy now.

- Choose the costs program you need, submit the required details to make your money, and pay for your order with your PayPal or charge card.

- Choose a handy document formatting and down load your backup.

Get each of the papers themes you possess bought in the My Forms food list. You can get a more backup of Wisconsin Guaranty by Corporation - Complex anytime, if needed. Just click the needed kind to down load or printing the papers design.

Use US Legal Forms, by far the most comprehensive assortment of authorized varieties, to save efforts and avoid mistakes. The support provides expertly manufactured authorized papers themes which you can use for a selection of purposes. Produce a free account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

State guaranty funds guarantee payment for insurance policyholders should the insurance company default. The fund only covers beneficiaries of insurance companies where the insurer is licensed to sell products in that state.

Reviews and approves new life, accident, health, auto, property, casualty, and other types of policies that are sold in Wisconsin. Examines the financial condition of insurance companies and reviews their corporate activities. Reviews rates filed by insurance companies doing business in the state.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The Wisconsin Insurance Security Fund is a non-profit legal entity created by the Wisconsin legislature to protect Wisconsin resident policyholders in the event of an insolvency of a member insurance company.

The Guaranty Fund is funded through assessments against member insurers made after a member insurer is declared insolvent by a court of law. These funds are used to pay valid claims, as well as administrative expenses.