Wisconsin Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

If you need to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and convenient search feature to find the documents you need.

Many templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to create an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Leverage US Legal Forms to get the Wisconsin Personal Guaranty - General in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and hit the Download button to access the Wisconsin Personal Guaranty - General.

- You can also retrieve forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for your specific city/state.

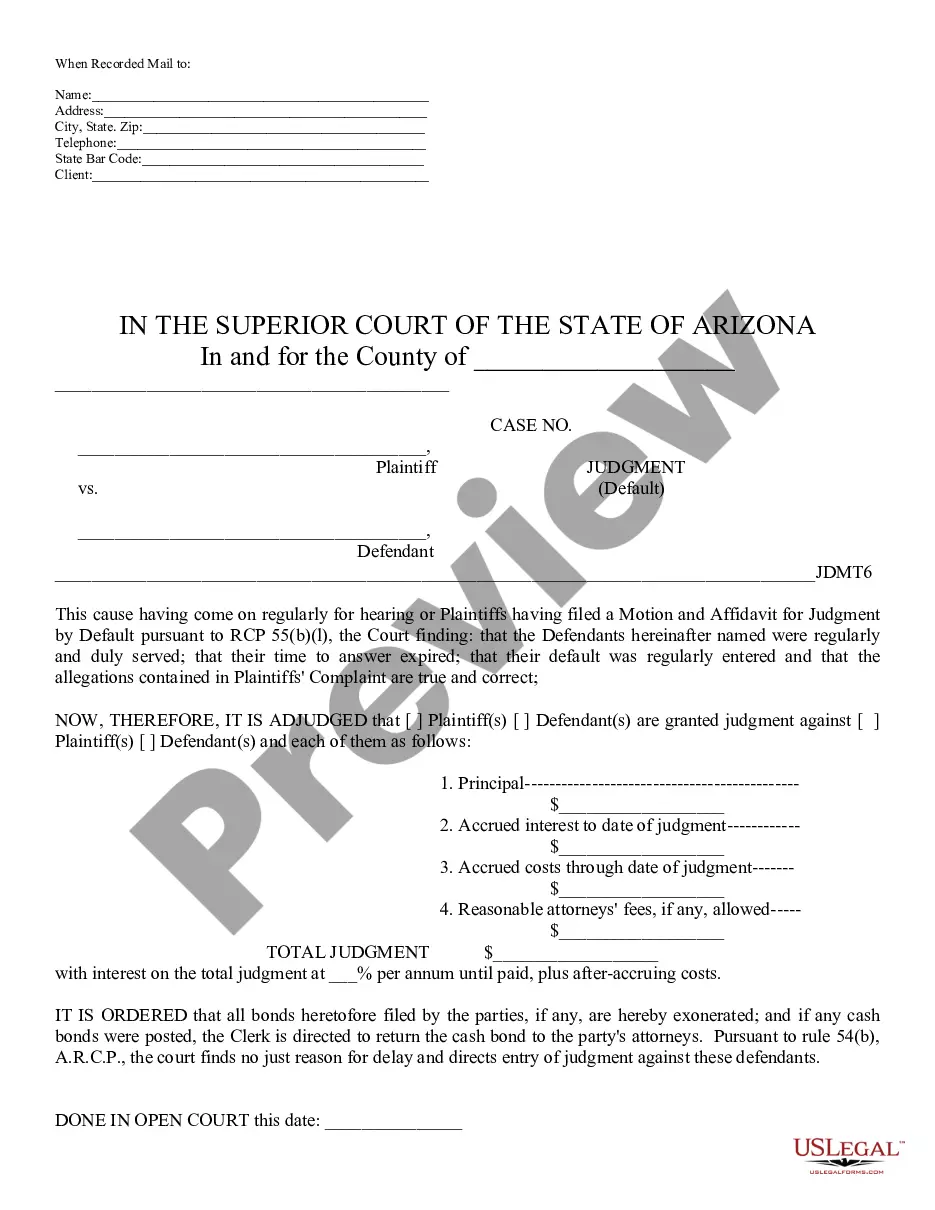

- Step 2. Use the Preview option to examine the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

Collecting on a personal guarantee requires clear communication and documentation. Begin by notifying the guarantor of the default and explain the situation calmly. If necessary, you can consult the legal framework surrounding Wisconsin Personal Guaranty - General to navigate your rights and options effectively. Using a platform like US Legal Forms can help guide you through the collection process.

A suitable guarantor usually has a steady income and good credit standing. This person takes on a significant responsibility, so they should be trustworthy and financially sound. Within the realm of Wisconsin Personal Guaranty - General, selecting the right individual as a guarantor can offer peace of mind for both lenders and borrowers.

A personal guarantor can be anyone with sufficient financial stability, often family members or close friends. Additionally, business associates can also step in, provided they trust the borrower. It's important that the guarantor feels comfortable with the terms of the Wisconsin Personal Guaranty - General, as their credit may be affected by the borrower's actions.

In Wisconsin, anyone who meets certain criteria can serve as a personal guarantor. Typically, a guarantor needs to be an adult and have a strong credit history. However, it is crucial for the guarantor to understand their financial obligations. A well-informed decision helps ensure that both the borrower and guarantor manage risks effectively.

Yes, personal guarantees generally hold up in court, provided they meet legal requirements. A well-drafted agreement that clearly outlines the terms and the responsibilities of the guarantor is typically enforceable. Consulting an experienced legal platform, like US Legal Forms, can help ensure that your Wisconsin personal guaranty is robust and legally sound.

To create a valid personal guarantee, you must provide identifiable information, such as your name and Social Security number, along with a clear commitment to assume the financial responsibility. The agreement typically needs to be in writing and signed to hold up legally. Understanding these elements is crucial for anyone engaging in a Wisconsin personal guaranty.

In Wisconsin, a will does not need to be formally recorded before the death of the person who made it, but it must be filed with the court after their death to enter the probate process. Once filed, the will becomes a public document. Engaging with USLegalForms can assist you in understanding the implications of this process as you navigate the Wisconsin Personal Guaranty - General requirements. This way, you can ensure transparency and adherence to the law in managing the estate.

To file a claim against an estate in Wisconsin, you need to submit a written claim to the personal representative of the estate. Be sure to include your contact information, the nature of the claim, and any relevant supporting documents. To ensure your claim meets the Wisconsin Personal Guaranty - General protocols, you might find the templates available through USLegalForms helpful. Following the proper procedures ensures your claims are considered fairly and efficiently.

In Wisconsin, direct filing of a will is not typically available. You must take the will to the appropriate probate court and file it in person or via mail. To streamline the process, USLegalForms provides insights on how to prepare your documents efficiently, helping you adhere to the Wisconsin Personal Guaranty - General requirements. This ensures you complete all necessary steps correctly without confusion.

If you fail to file a will in Wisconsin, the estate may be handled as an intestate estate, meaning state laws will determine how assets are distributed. This situation can lead to potential disputes among heirs and additional delays in settling the estate. To avoid this outcome, consider utilizing the resources from USLegalForms to assist with filing a will as part of the Wisconsin Personal Guaranty - General process. Proper documentation helps prevent administrative challenges for your loved ones.