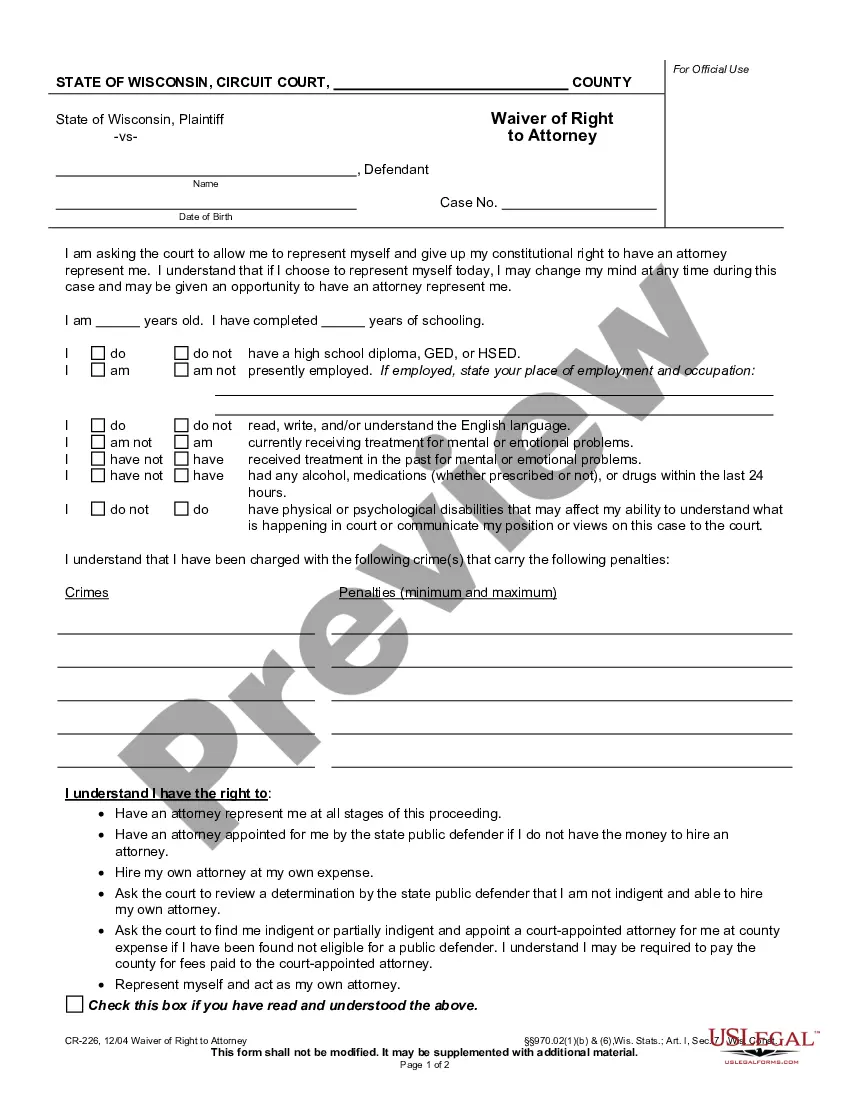

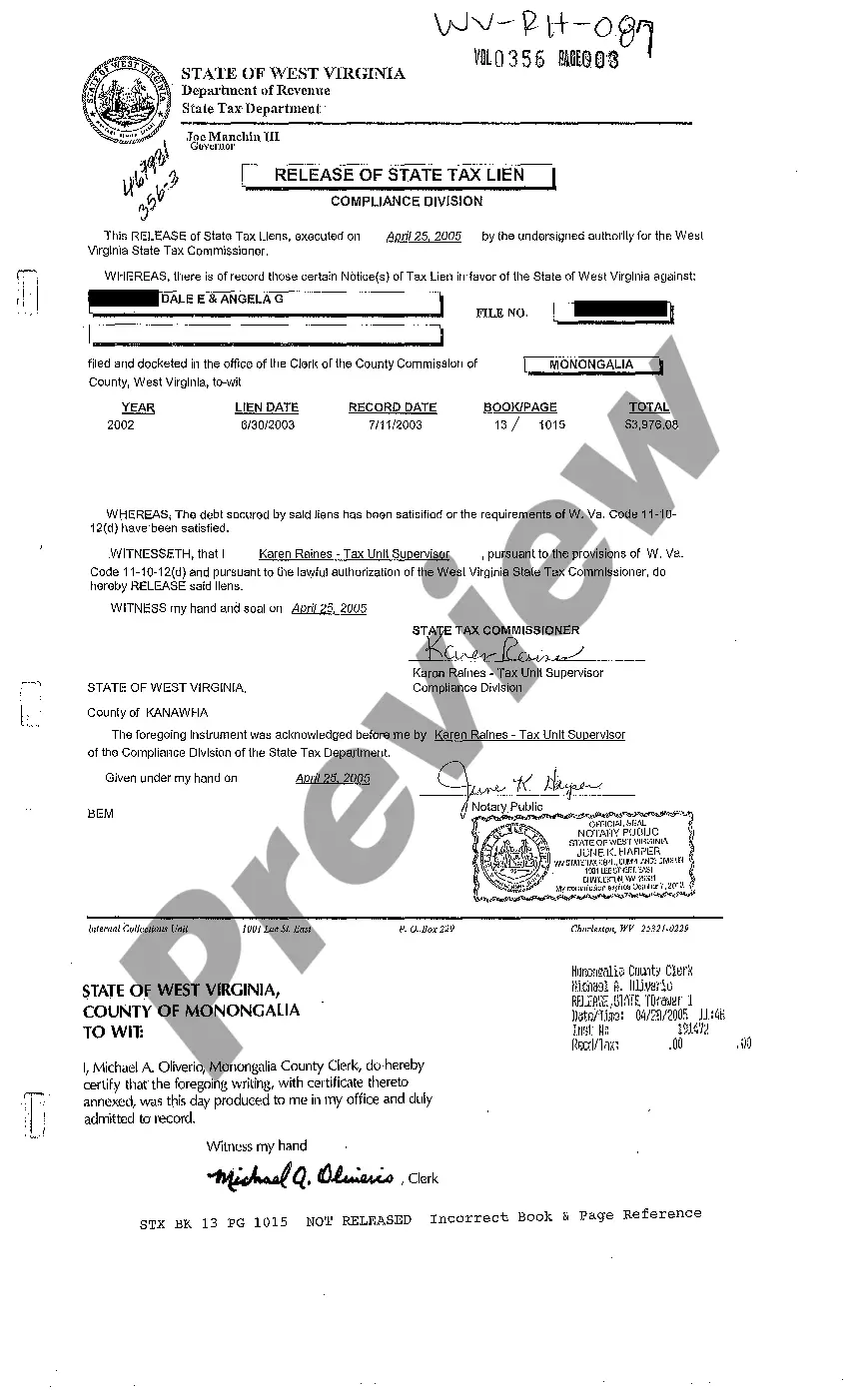

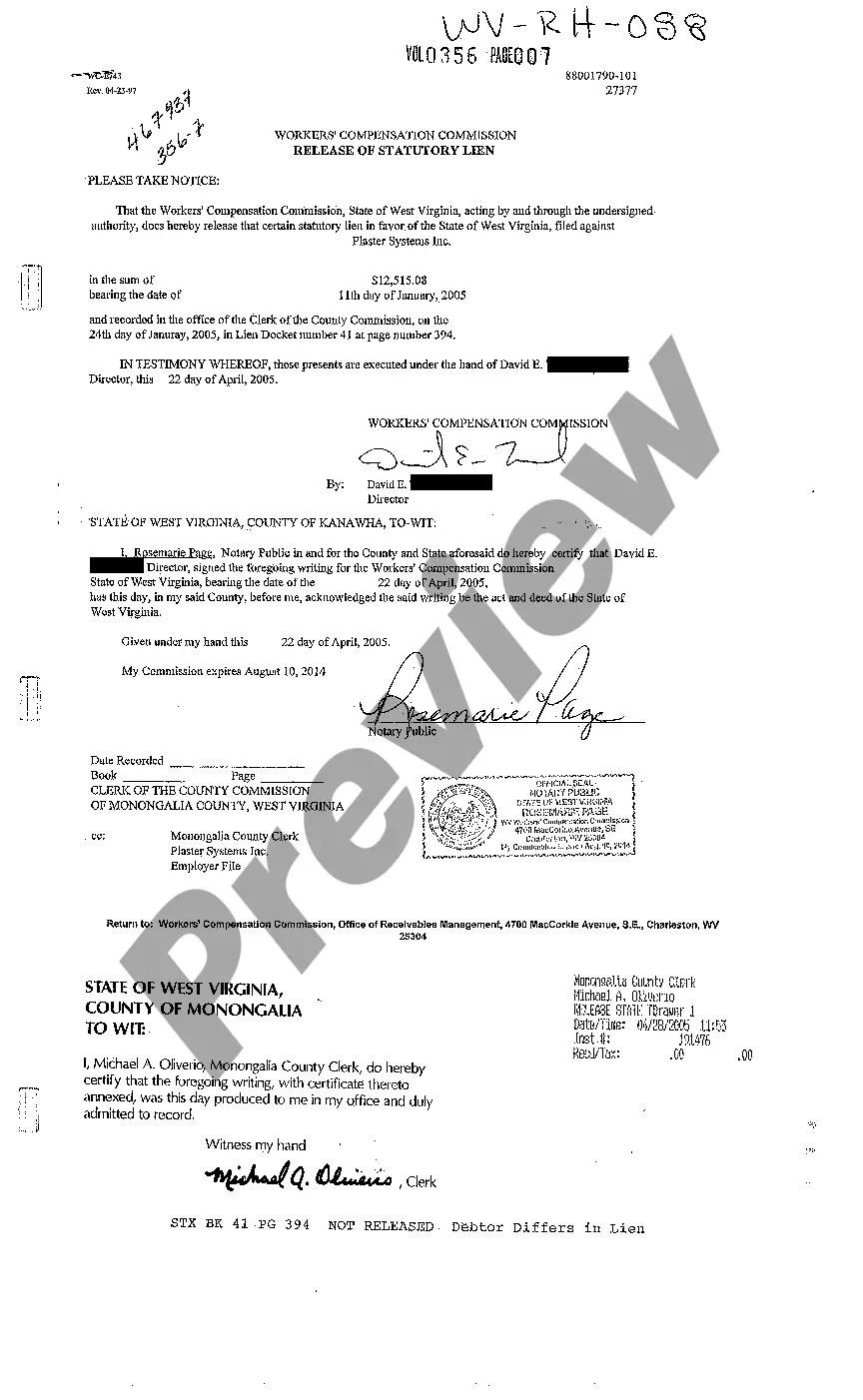

This is an Income Assignment Order for Unpaid Fines and Other Financial Penalties, to be used by the Courts in the State of Wisconsin. This form is used as a formal order of the Court, requiring any person owing income or money to a Defendant, to pay a portion of the amount to the Clerk of Court.

Wisconsin Income Assignment Order for Unpaid Fines and Other Financial Penalties

Description

How to fill out Wisconsin Income Assignment Order For Unpaid Fines And Other Financial Penalties?

Out of the multitude of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms prior to buying them. Its complete catalogue of 85,000 templates is categorized by state and use for efficiency. All the forms on the platform have been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, press Download and get access to your Form name from the My Forms; the My Forms tab keeps all your saved forms.

Follow the guidelines listed below to obtain the document:

- Once you see a Form name, make certain it’s the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Look for a new template using the Search field if the one you have already found is not appropriate.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

When you’ve downloaded your Form name, you may edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service provides easy and fast access to samples that fit both legal professionals as well as their clients.

Form popularity

FAQ

The fine itself typically goes to the general fund of the jurisdiction that imposed it, to be used for any government purpose whatsoever.

: finely crushed or powdered material (such as ore) also : very small particles in a mixture of various sizes.

As an adjective, fine means "high quality" or "unblemished" like fine china.Fine also means that things are okay or acceptable, like when someone asks how you are and you reply, I'm fine. When you are caught doing something wrong, paying a fine, money paid as a penalty, may result.

To charge someone an amount of money as a punishment for not obeying a rule or law: Drivers who exceed the speed limit can expect to be fined heavily.

As per Oxford Dictionary: Fine is a sum of money exacted as a penalty by a court of law or other authority. Penalty is a punishment imposed for breaking a law, rule, or contract.

Monetary charges imposed upon individuals who have been convicted of a crime or a lesser offense. A fine is a criminal sanction. A civil sanction, by contrast, is called a penalty. The amount of a fine varies with the severity of the offense.

Fines are monetary punishments for infractions, misdemeanors or felonies. Fines are intended to deter crime, punish offenders, and compensate victims for losses.

Criminal fines are penalties imposed on defendants after conviction, intended as both deterrence and punishment. The amount of a fine is set by statute and based on the severity of the crime. For misdemeanors, fines may be relatively small. For felonies, fines are typically larger.

Court fines can be ordered in a variety of civil cases, ranging from citations for traffic incidents to fines for drunk and disorderly conduct. Court fines can consist of fees, in addition to court costs. Court fines can be ordered as part of someone's sentence, or it can constitute the entire sentence.

Definition of Fine and Penalty: A fine refers to a monetary charge or payment imposed upon a person who has been convicted of a crime or minor offence. A penalty refers to a punitive measure that the law imposes for the performance of an act or for the failure to perform a certain act.