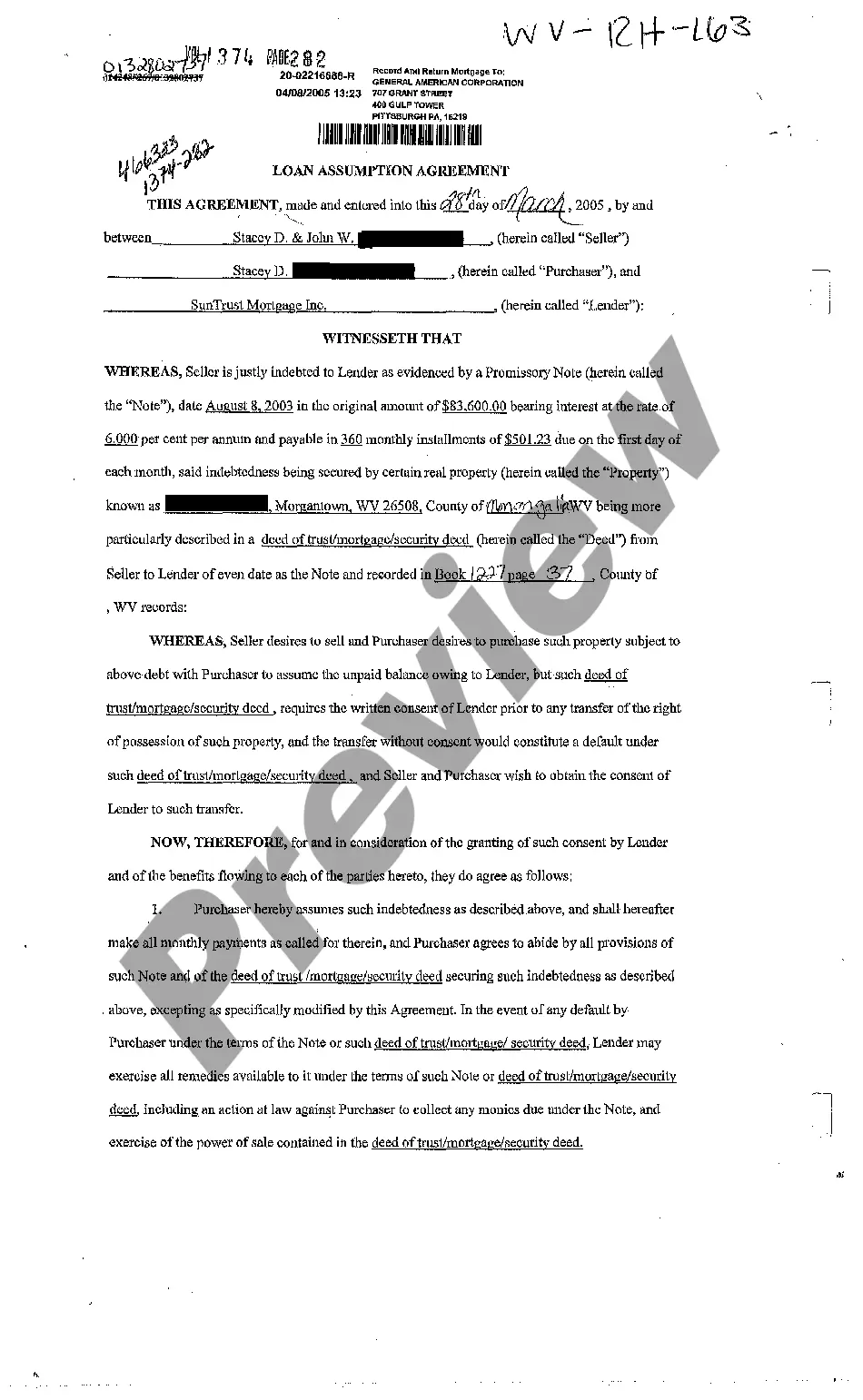

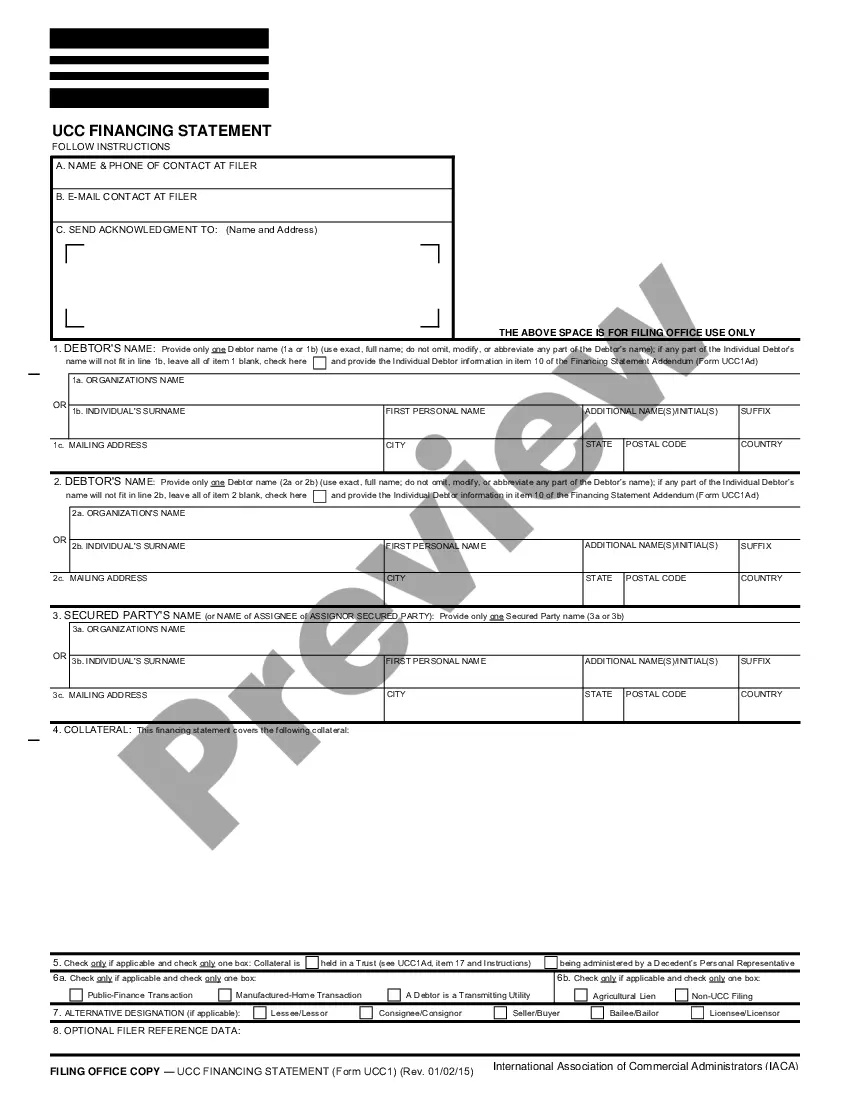

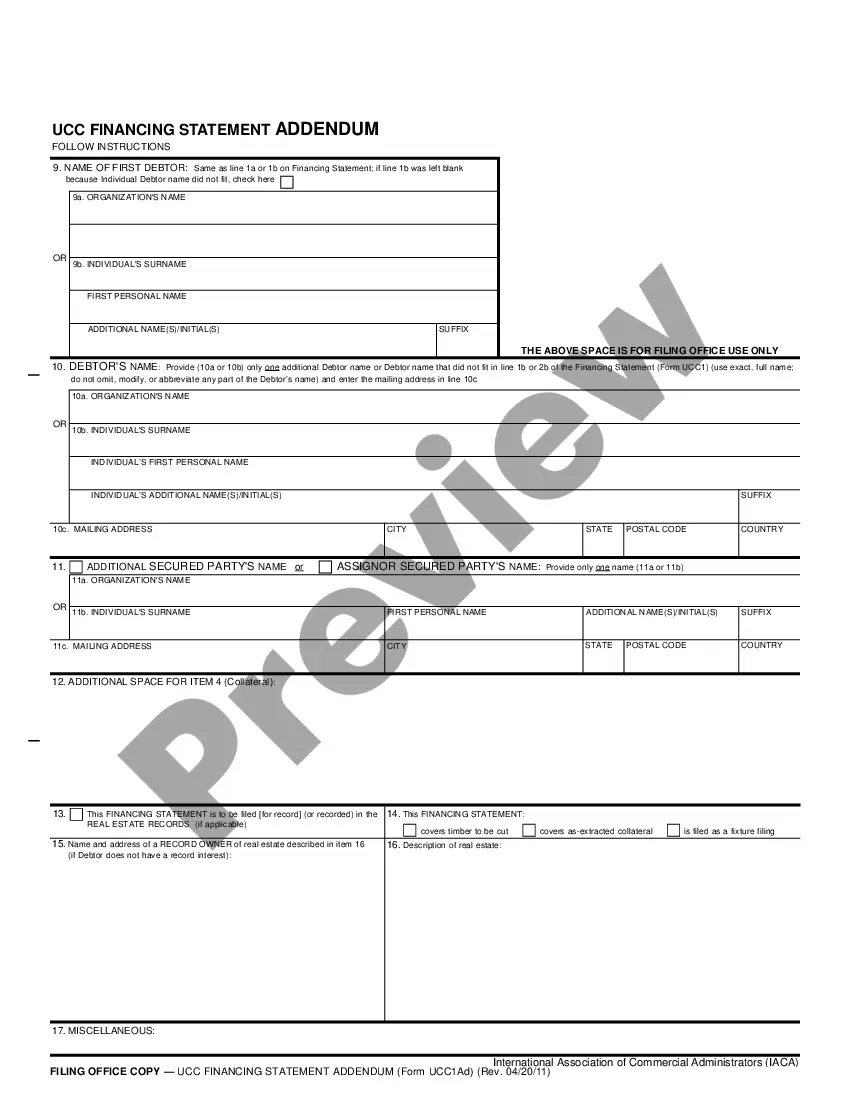

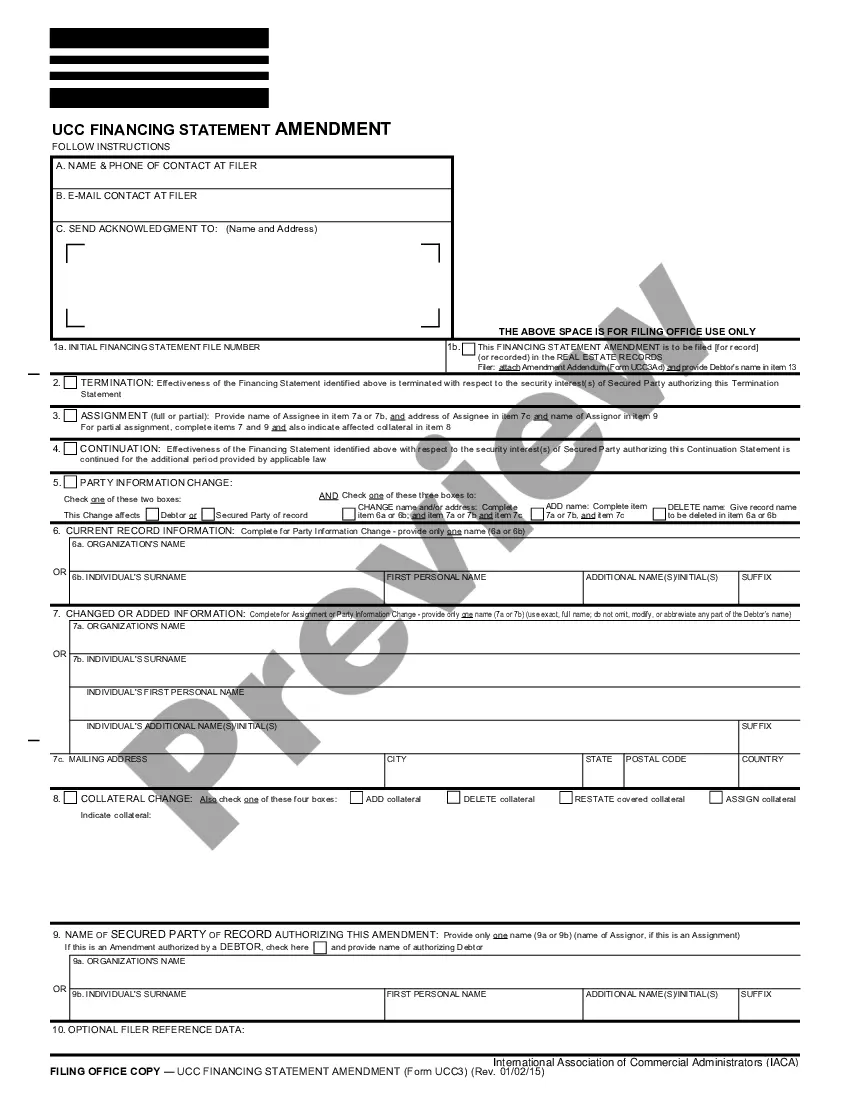

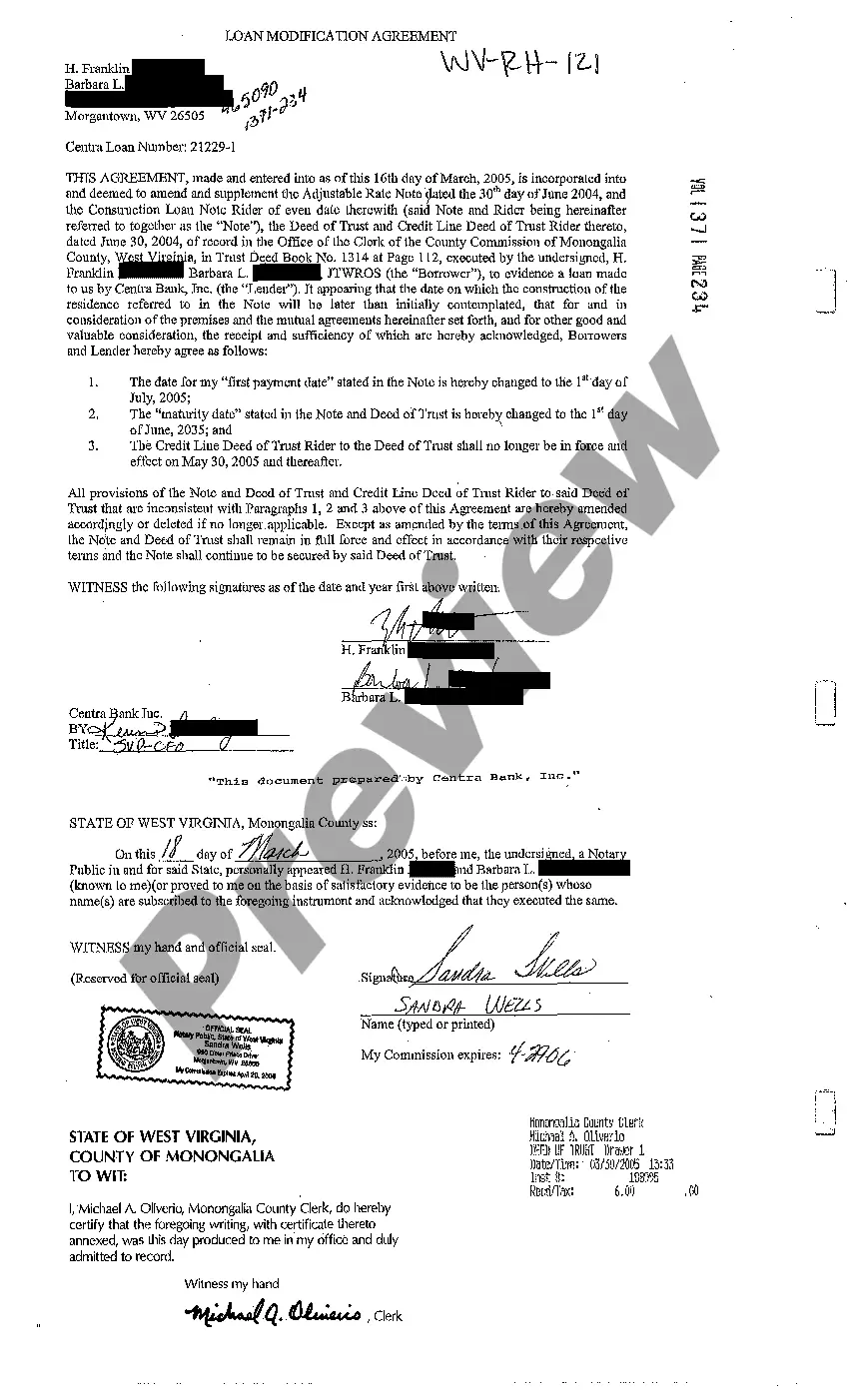

West Virginia Loan Modification Agreement

Description

How to fill out West Virginia Loan Modification Agreement?

Among numerous paid and free examples that you find online, you can't be sure about their reliability. For example, who made them or if they are competent enough to deal with what you require those to. Keep relaxed and make use of US Legal Forms! Locate West Virginia Loan Modification Agreement templates developed by skilled legal representatives and get away from the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access all of your earlier saved templates in the My Forms menu.

If you are utilizing our service the first time, follow the tips listed below to get your West Virginia Loan Modification Agreement fast:

- Make certain that the file you discover applies in the state where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another example using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you’ve signed up and purchased your subscription, you can use your West Virginia Loan Modification Agreement as many times as you need or for as long as it remains active where you live. Revise it with your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

The most common examples of hardship include: Illness or injury. Change of employment status. Loss of income.

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

A loan modification is a change that the lender makes to the original terms of your mortgage, typically due to financial hardship. The goal is to reduce your monthly payment to an amount that you can afford, which you can achieve in a variety of ways.

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.Some banks even offer a notary who will come to your home.