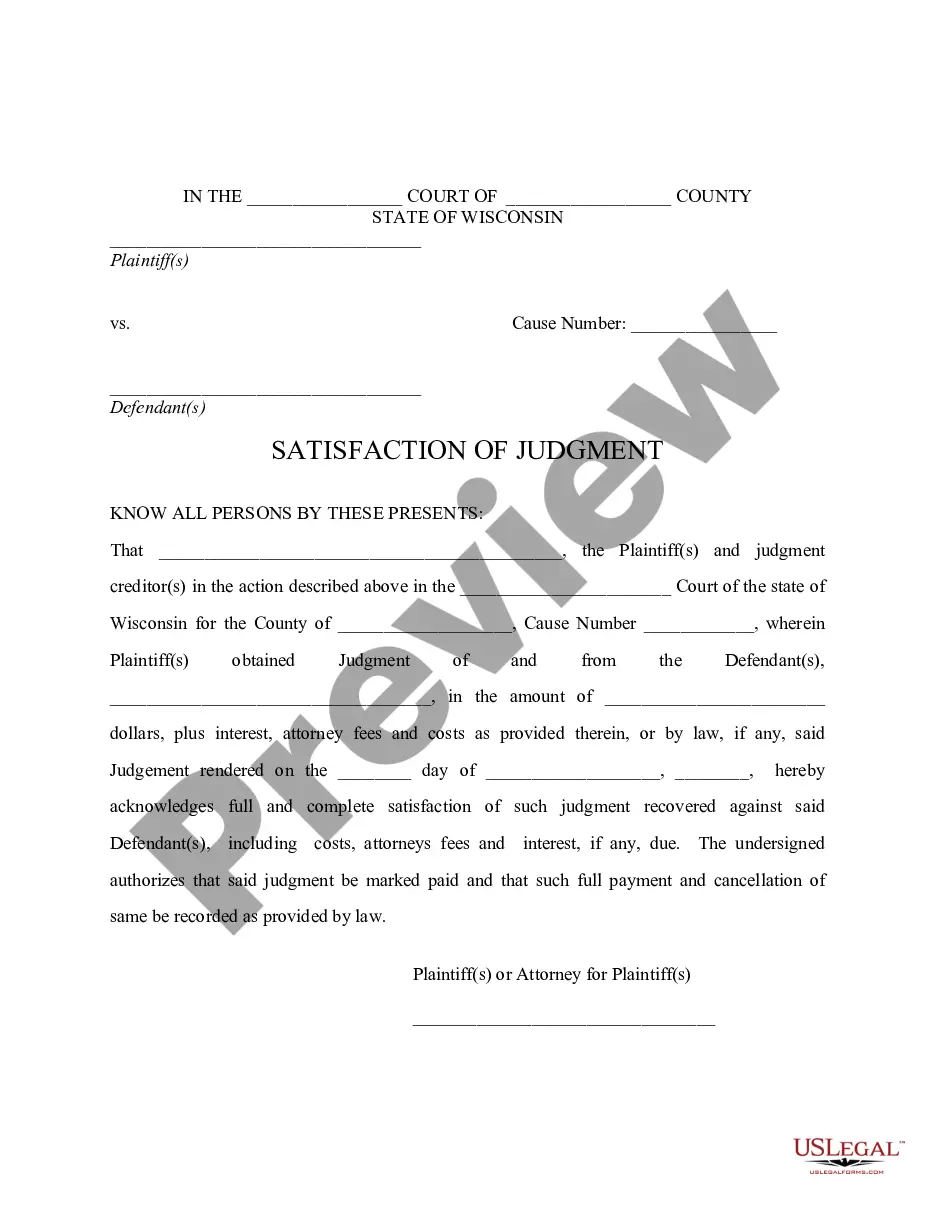

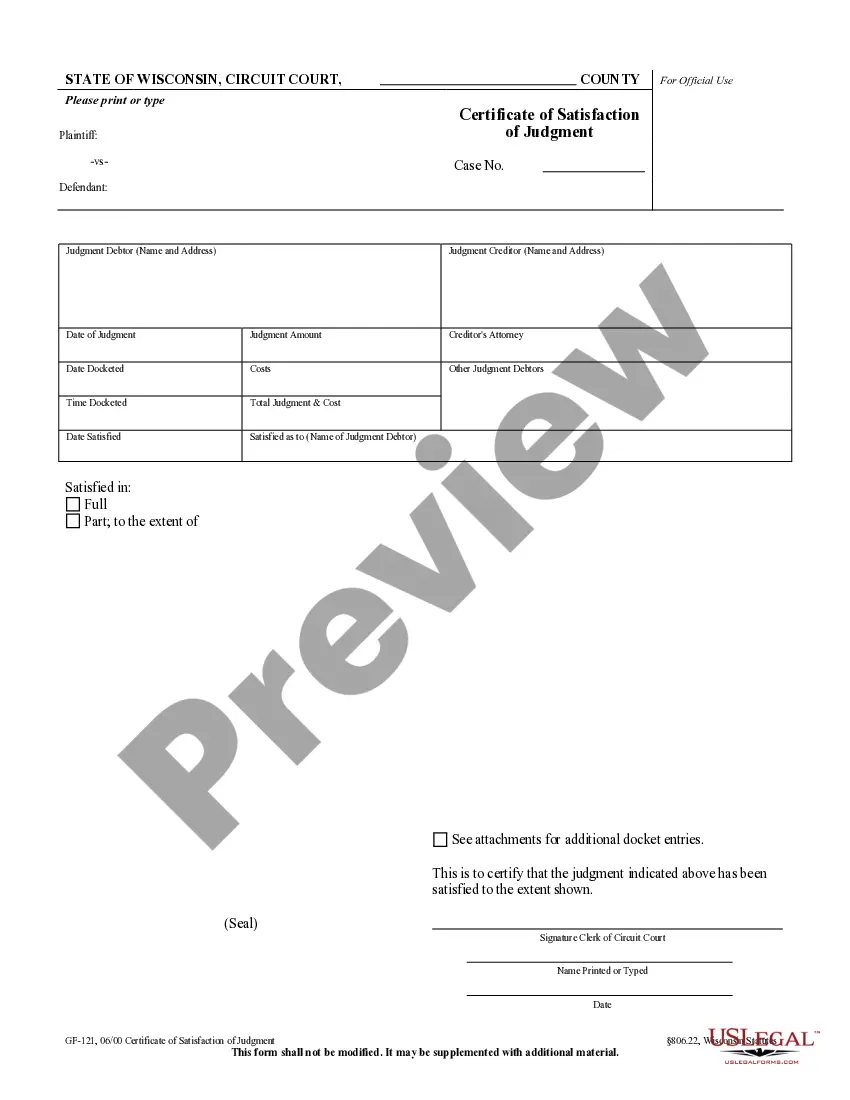

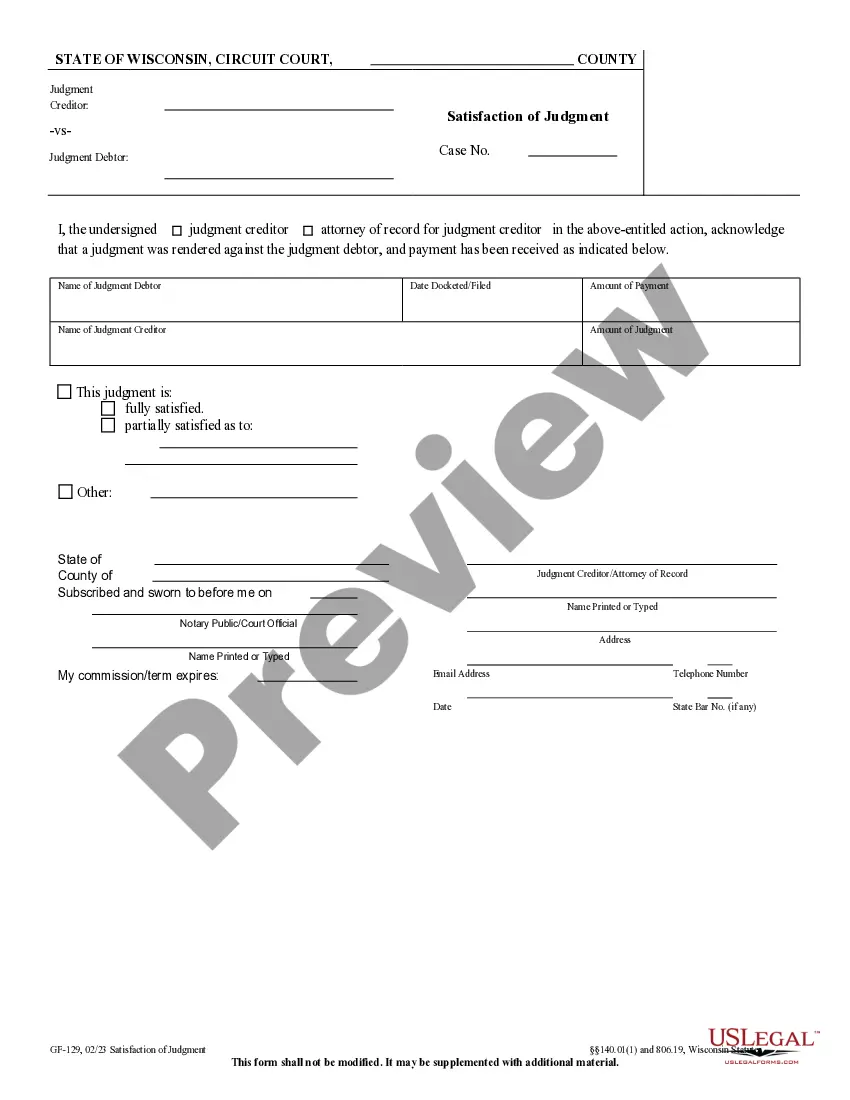

This form is a satisfaction of judgment. Filed by the judgment creditor when the judgment debtor has fully satisfied the judgment debt. Filing of the satisfaction releases the debtor from the judgment. Adapt to fit your circumstances.

Wisconsin Satisfaction of Judgment

Description

How to fill out Wisconsin Satisfaction Of Judgment?

Out of the large number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for efficiency. All of the documents available on the service have already been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, click Download and access your Form name from the My Forms; the My Forms tab keeps all your downloaded forms.

Stick to the tips below to obtain the form:

- Once you see a Form name, ensure it’s the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Search for a new template through the Search engine in case the one you have already found isn’t correct.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

When you have downloaded your Form name, you can edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab can be reused many times, or for as long as it remains to be the most updated version in your state. Our service offers quick and simple access to samples that suit both lawyers as well as their customers.

Form popularity

FAQ

Paying down or paying off the amount associated with the judgment will have no impact on the credit score.Even though a satisfied judgment does not have a positive impact on score, a lender may consider it a good sign of willingness to pay and may override the score and grant the credit Matt may seek in the future.

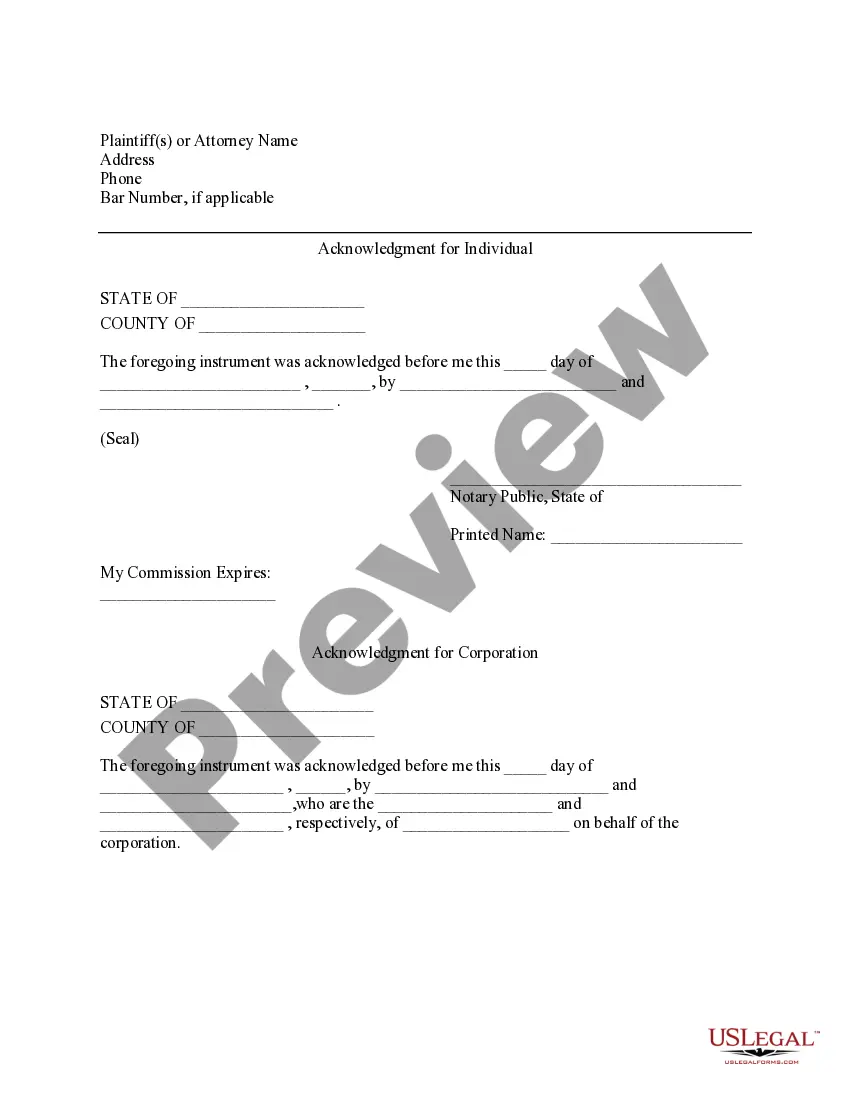

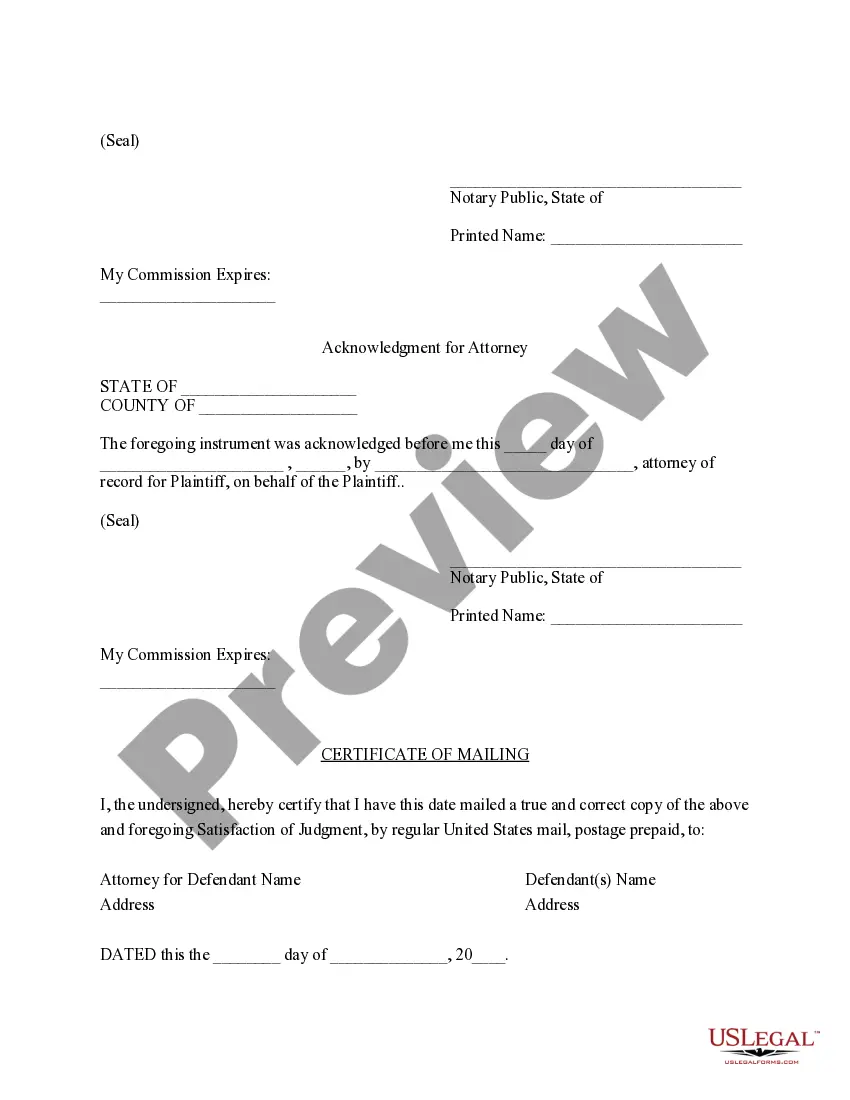

A court form that the judgment creditor must fill out, sign, and file with the court when the judgment is fully paid. If no liens exist, the back of the Notice of Entry of Judgment can be signed and filed with the court. (See judgment creditor, judgment .)

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments satisfied or not aren't going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.If a civil judgment is still on your credit report, file a dispute with the appropriate credit reporting agencies to have it removed.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Request the court to validate the judgment. Verify information provided from the court. Dispute any inaccuracies found. Consider professional help.