Washington Resolution of Meeting of LLC Members to Open Bank Accounts

Description

How to fill out Resolution Of Meeting Of LLC Members To Open Bank Accounts?

Locating the correct authorized document template can be a challenge.

Certainly, there are many templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast collection of templates, such as the Washington Resolution of Meeting of LLC Members to Open Bank Accounts, suitable for both business and personal needs.

If the form does not suit your requirements, use the Search field to find the right document. Once satisfied, click the Buy now button to purchase the form. Choose your preferred pricing plan and provide the necessary details. Create an account and complete the transaction using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Fill out, modify, print, and sign the downloaded Washington Resolution of Meeting of LLC Members to Open Bank Accounts. US Legal Forms is the largest database of legal forms where you can explore numerous document templates. Utilize this service to acquire well-crafted paperwork that meets state regulations.

- All templates are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and press the Download button to obtain the Washington Resolution of Meeting of LLC Members to Open Bank Accounts.

- You can also access previous legal forms you've purchased through your account.

- Visit the My documents section to download additional copies of the documents you need.

- For new users of US Legal Forms, follow these straightforward steps.

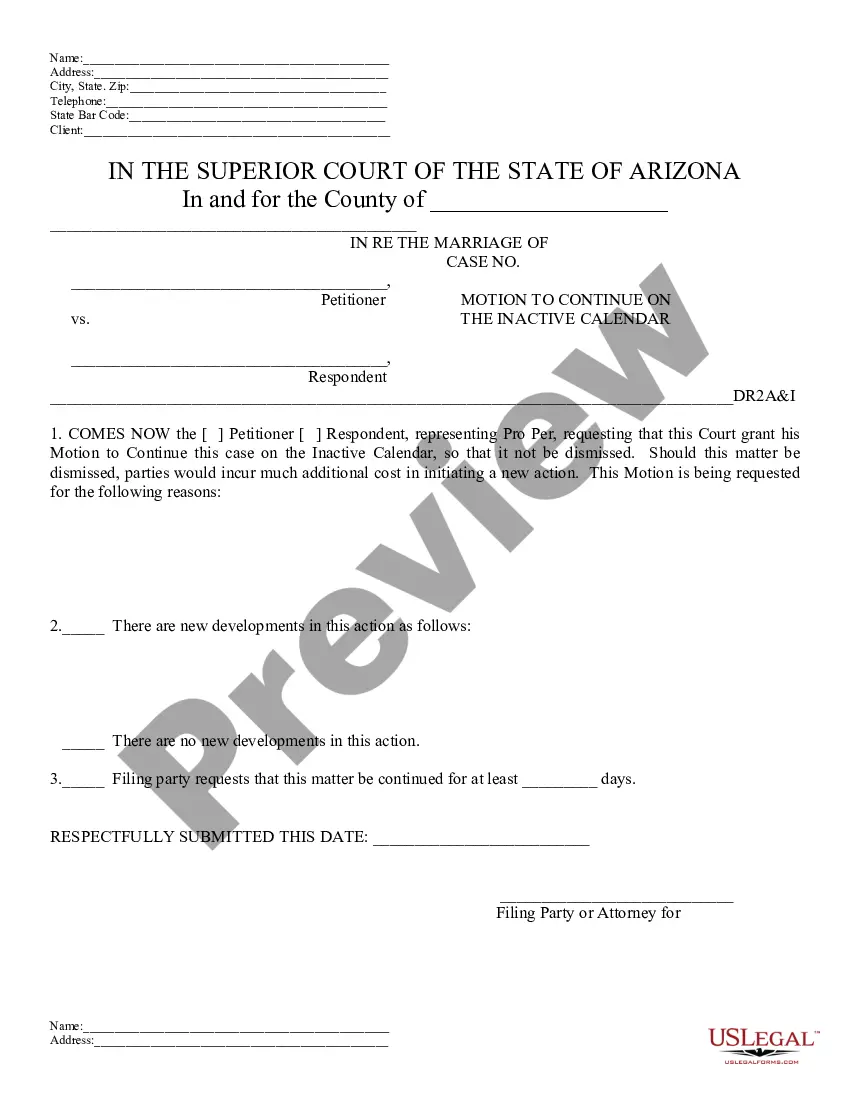

- First, ensure you have selected the correct form for your region. You can review the form using the Preview button and examine the summary to confirm it is appropriate for you.

Form popularity

FAQ

Yes, a bank account can be opened with a circular resolution, provided it meets the legal requirements set by the bank. A circular resolution allows LLC members to approve decisions without a formal meeting, but it still must detail the decision to open the account. Ensure that the circular resolution aligns with the standards of the Washington Resolution of Meeting of LLC Members to Open Bank Accounts for full compliance.

The validity period of a board resolution for opening a bank account can vary based on the bank's policies and state regulations. Generally, it remains effective until the resolution is formally revoked or replaced by a new resolution. In the context of a Washington Resolution of Meeting of LLC Members to Open Bank Accounts, it is advisable to check with your chosen bank regarding their specific requirements. This ensures that your resolution remains valid and accessible for any necessary updates.

When you create a resolution to open a bank account, you need to include the following information:The legal name of the corporation.The name of the bank where the account will be created.The state where the business is formed.Information about the directors/members.More items...

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

Our banking resolution is the simplest way for a company to authorize opening a bank account. A banking resolution is required to properly record company decisions and to prove to financial institutions that the person applying for an account is authorized to act on behalf of the company.

All General Partners must be present to open the account. If one of the General Partners is another business, an authorizing representative of that business must also be present. If you would like to add an authorized signer to your account, they must also be present.

Most banks require business customers to provide their employer identification number (EIN) in order to open a business checking account or savings account, though some may permit sole proprietors to open a small business account with just their Social Security Number.

The operating agreement is essential if your LLC has more than one member. This document will let the bank know who has permission to draw on the account for funds with their signature. If there are several members in your LLC, generally they will all need to be present when you open the account.

How to write Corporate/board Resolution to Open Bank Account?corporate name and address.the title i.e CORPORATE/BOARD RESOLUTION TO OPEN BANK ACCOUNT.the date which the resolution passed.the purpose of opening a bank account.the Bank name and address where the account will be opened,More items...

Yes, generally, partners can open bank accounts for the entity. Your entity's governing document may say so. Generally, partners are each individually liable for the debts of the partnership, regardless of which partner incurred those debts.