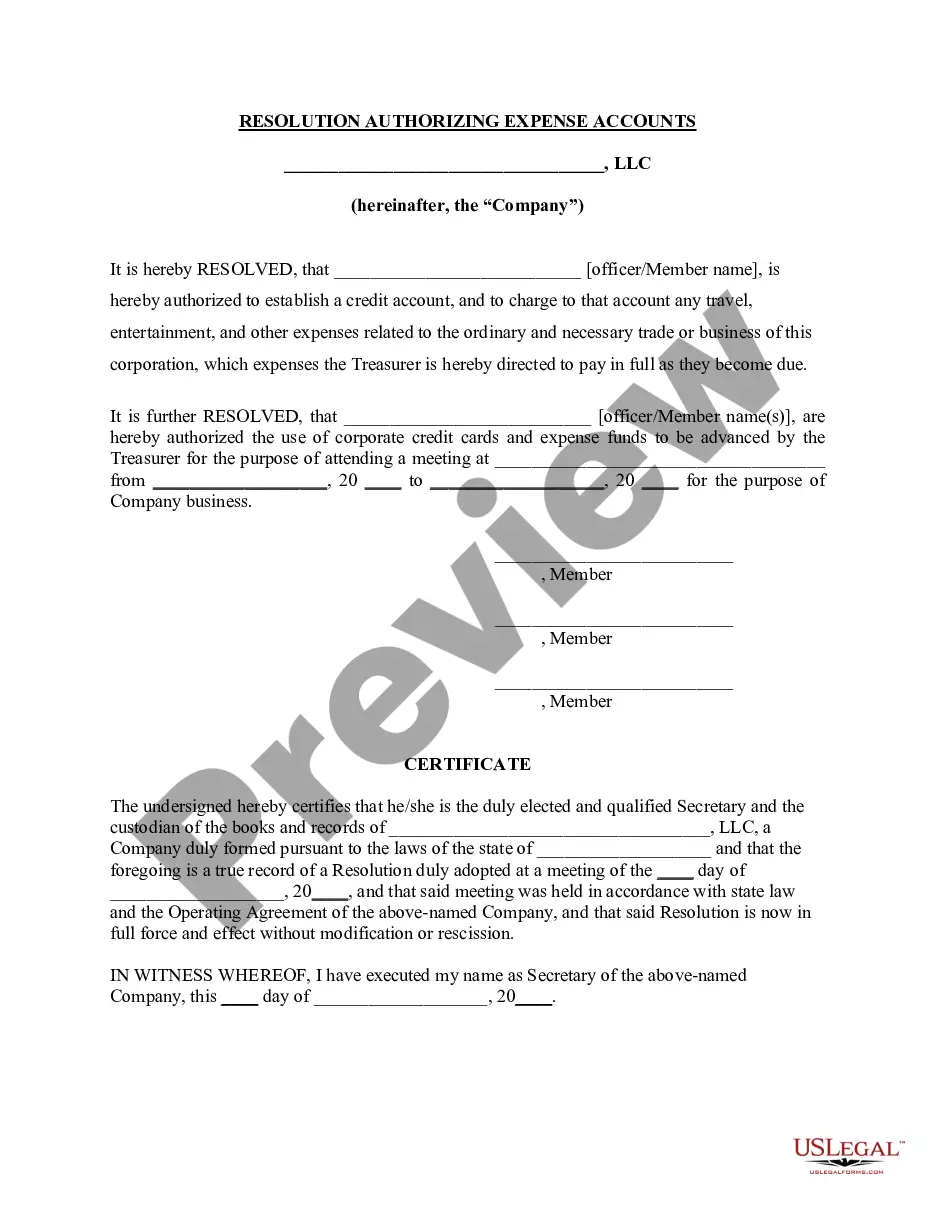

Washington Resolution of Meeting of LLC Members to Authorize Expense Accounts

Description

How to fill out Resolution Of Meeting Of LLC Members To Authorize Expense Accounts?

In case you need to compile, obtain, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available on the web.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to create an account.

- Leverage US Legal Forms to quickly find the Washington Resolution of Meeting of LLC Members to Approve Expense Accounts.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the Washington Resolution of Meeting of LLC Members to Approve Expense Accounts.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for your appropriate city/state.

- Step 2. Use the Preview option to review the form's contents. Always remember to read the description.

Form popularity

FAQ

To convert a single-member LLC to a multi-member LLC, you will need to admit new members and draft an amendment to your operating agreement. It’s advisable to create a Washington Resolution of Meeting of LLC Members to Authorize Expense Accounts, documenting the addition of new members and their roles. This resolution lays a strong foundation for the new structure of your LLC.

A resolution to appoint a manager of an LLC is a formal document that designates a specific individual to manage the LLC’s operations. This resolution outlines the powers and duties of the appointed manager, which may include handling expense accounts. This process is essential for clarifying roles and ensuring effective management within the LLC.

If you have business partners or employees, an LLC protects you from personal liability for your co-owners' or employees' actions. An LLC gives you a structure for operating your business, including making decisions, dividing profits and losses, and dealing with new or departing owners. An LLC offers taxation options.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution. amending the articles of organization or operating agreement.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

A Washington state LLC is a limited liability company formed in or registered to do business in Washington state. This type of business entity provides personal asset protection from business losses and prevents the double taxation of corporations. An LLC combines features of a partnership with those of a corporation.

Disadvantages of creating an LLCStates charge an initial formation fee. Many states also impose ongoing fees, such as annual report and/or franchise tax fees. Check with your Secretary of State's office. Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

All LLC's must obtain a business license registration with the Department of Revenue. In Washington, a company that hires employees or pays state taxes is required to have this license. Apply for the business license registration after filing an LLC Certificate of Formation.