Washington Expense Reimbursement Form for an Employee

Description

How to fill out Expense Reimbursement Form For An Employee?

If you desire to obtain extensive, download, or generate authorized document templates, utilize US Legal Forms, the largest range of legal forms, available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to each form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Complete and download, and print the Washington Expense Reimbursement Form for an Employee with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Use US Legal Forms to locate the Washington Expense Reimbursement Form for an Employee with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to access the Washington Expense Reimbursement Form for an Employee.

- You can also retrieve forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct region/state.

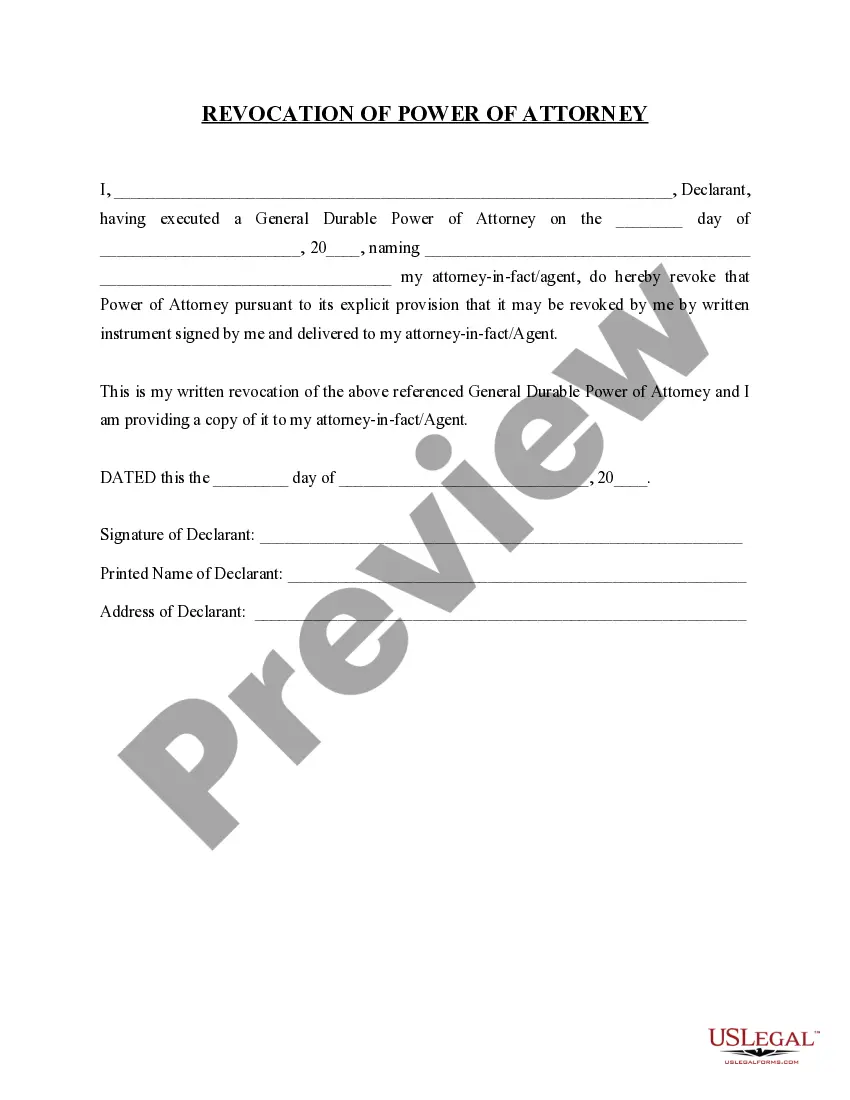

- Step 2. Use the Preview option to browse the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now option. Choose your preferred pricing plan and input your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Washington Expense Reimbursement Form for an Employee.

Form popularity

FAQ

An employee reimbursement form is a document used by employees to request repayment for business-related expenses. In the context of the Washington Expense Reimbursement Form for an Employee, this form allows you to list expenses, attach receipts, and formally submit your request for reimbursement. This streamlined process helps ensure accuracy and efficiency.

An expense reimbursement form is submitted by employees whenever they need to be reimbursed for expenses that they paid for themselves on the company's behalf. Expenses noted on the form may include office supplies, travel, accommodations, etc.

Travel Reimbursement. The travel must be more than 15 miles one way from your home, and the first and last 15 miles of travel are not payable. No other provider of the same type is available closer to your home.

An expense reimbursement claim report should be filed and completed by the employee and submitted to their HR department for approval after the costs have been incurred. As per your company's policy guidelines, communicate what information is needed when submitting expense claims and reports.

An employee reimbursement form is a standardized template an employee may use to report expenses paid on behalf of the company to receive reimbursement. The exact reimbursable items will be strictly up to the agreement between the employer and employee.

You expense reimbursements are probably not reported on your W-2, as they are not considered income. The good new is that the difference between the IRS mileage rate and the amount your were actually reimbursed may be deductible as job-related expenses.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.

Expense reimbursements aren't employee income, so they don't need to be reported as such. Although the check or deposit is made out to your employee, it doesn't count as a paycheck or payroll deposit.

The expense reimbursement process allows employers to pay back employees who have spent their own money for business-related expenses. When employees receive an expense reimbursement, typically they won't be required to report such payments as wages or income.