Washington Expense Account Form

Description

How to fill out Expense Account Form?

It is feasible to spend hours online searching for the legal documents template that meets the state and federal criteria you need.

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

You can easily download or print the Washington Expense Account Form from our platform.

To find another version of the form, use the Search field to locate the template that fulfills your needs and specifications. Once you have found the template you want, click Buy now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Retrieve the format of the document and download it to your device. Make edits to the document as needed. You can complete, modify, sign, and print the Washington Expense Account Form. Access and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the Washington Expense Account Form.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for your county/town of preference. Check the form description to confirm that you have selected the right form.

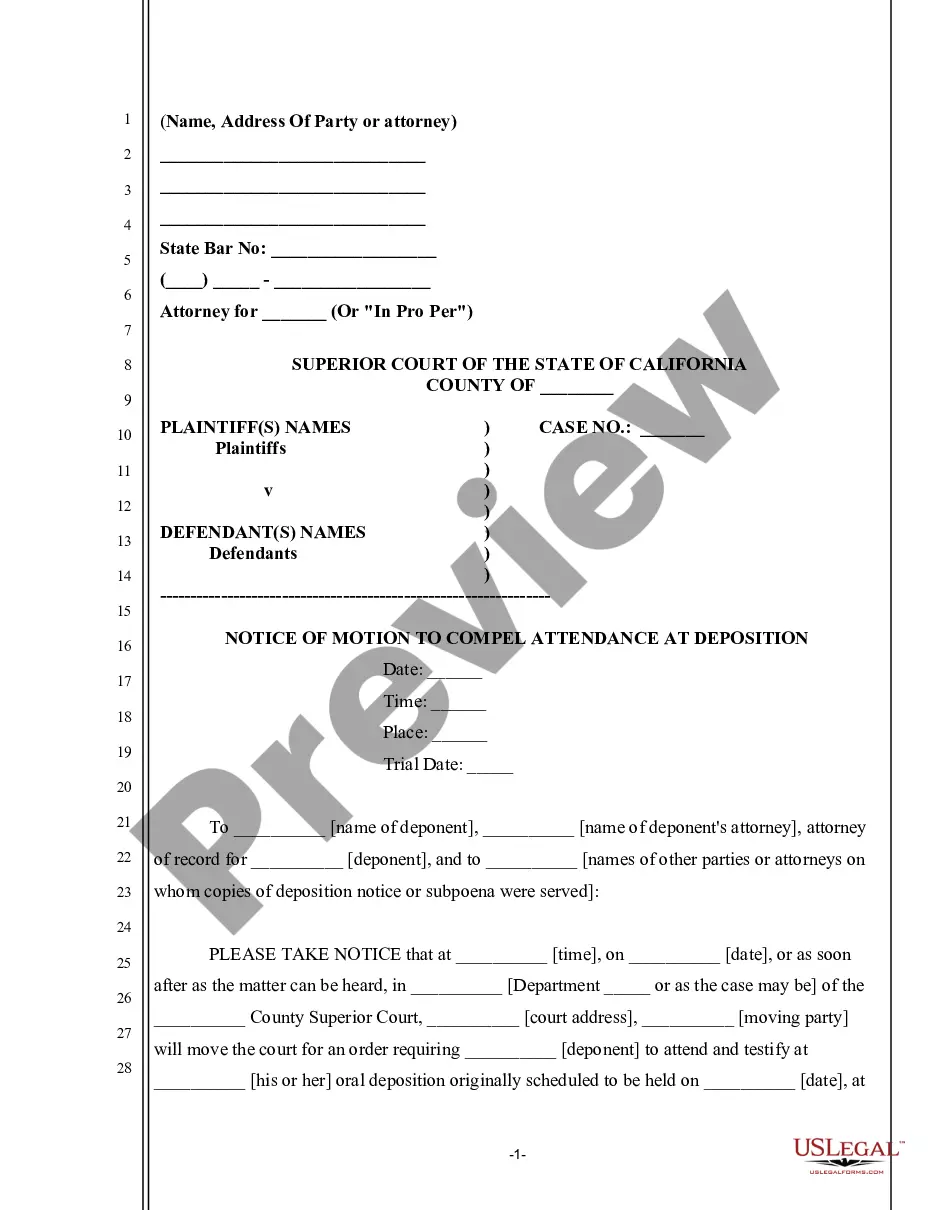

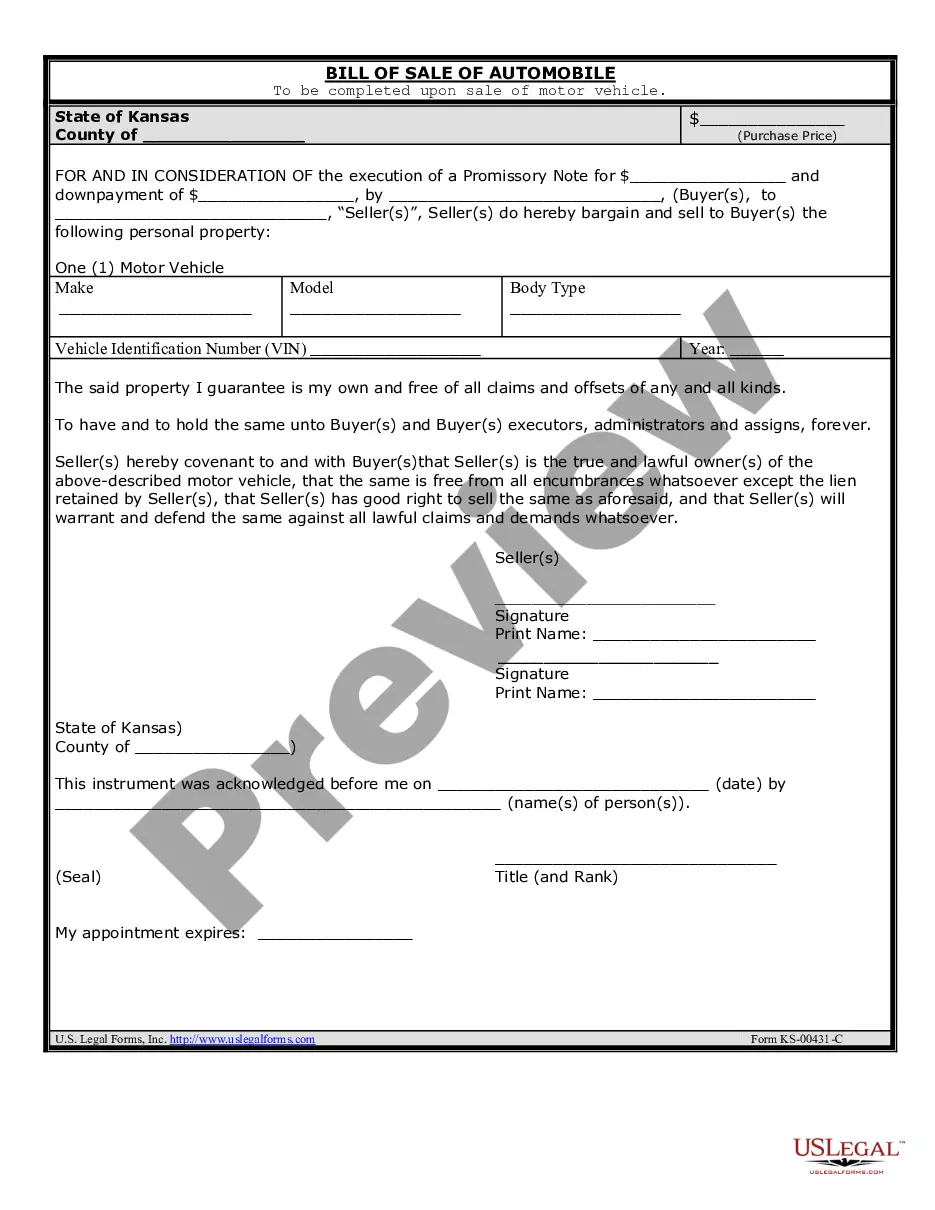

- If available, utilize the Preview option to review the document template as well.

Form popularity

FAQ

All revenue and expense accounts are nominal accounts. The major difference between these two types of accounts is that the balances of nominal accounts zero out at the end of each accounting period and do not accrue like the balances of real accounts.

Expenses are contra equity accounts with debit balances and reduce equity.

Expenses are considered temporary accounts in this equation, because at the end of the period, expense accounts are closed. Because expense accounts decrease the credit balance of owner's equity, expenses must be debited.

Expense accounts, also called expense allowances, are plans under which companies reimburse employees for business-related expenses. These expenses include travel, entertainment, gifts, and other expenses related to the employer's business activity.

At minimum, an expense report should include all of the following information: Information identifying the person submitting the report (department, position, contact info, SSN, etc.) A date and dollar amount for each expense, matching the date and dollar amount on the receipt provided for that expense.

Expense accounts are records of the amount a company spends on day-to-day costs during a given accounting period. These accounts exist for a set period of time - a month, quarter, or year - and then new accounts are created for each new period. For this reason, they're considered temporary accounts.

Examples of Expense Accounts: Examples of expense accounts are Costs of Sales, Cost of Goods Sold, Costs of services, Operating expense, Finance Expenses, Non-operating expenses, Prepaid expenses, Accrued expenses and many others.

In double-entry bookkeeping, expenses are recorded as a debit to an expense account (an income statement account) and a credit to either an asset account or a liability account, which are balance sheet accounts. An expense decreases assets or increases liabilities.

In short, the steps to create an expense sheet are:Choose a template or expense-tracking software.Edit the columns and categories (such as rent or mileage) as needed.Add itemized expenses with costs.Add up the total.Attach or save your corresponding receipts.Print or email the report.

How to create an expense report: 9 easy stepsName, department, and contact information.List of itemized expense names.Date of purchase for each item.Receipts.Total amount spent.Purpose of the expense.Actual cost of item (subtraction of discounts)Repayment amount sought.More items...?09-Jul-2019