Washington Expense Reimbursement Request

Description

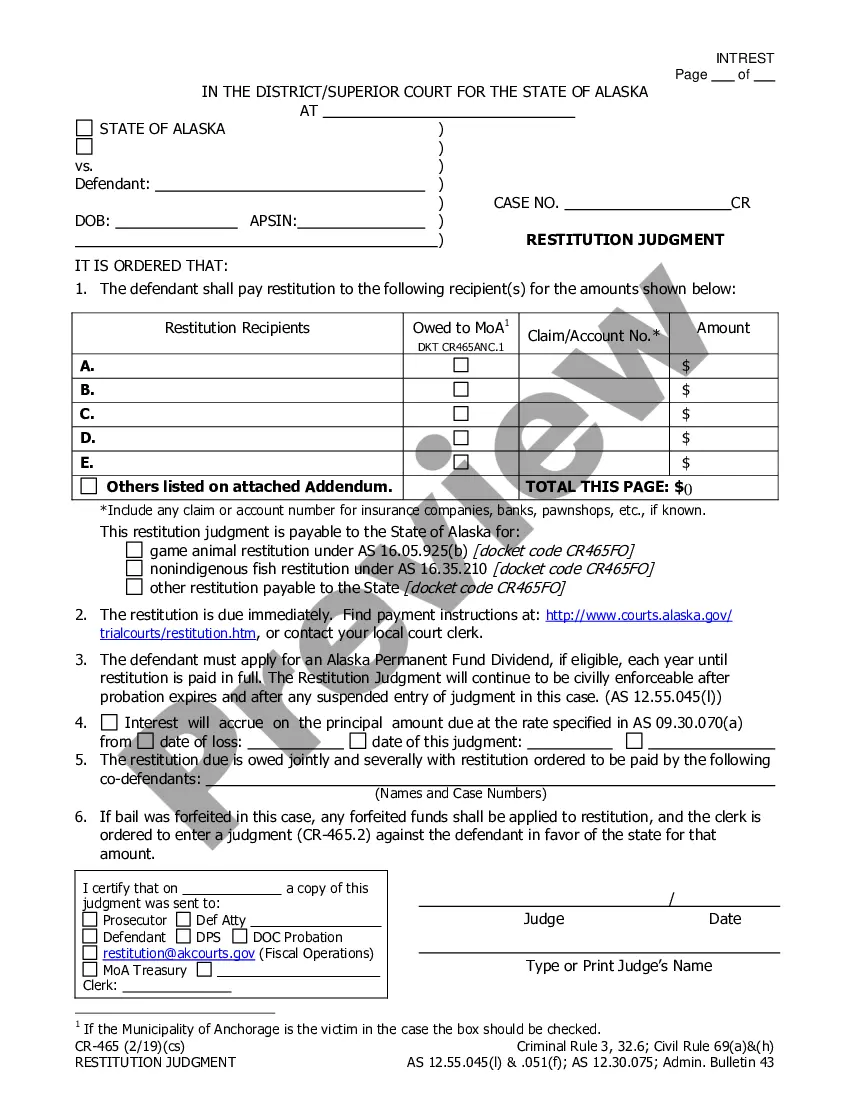

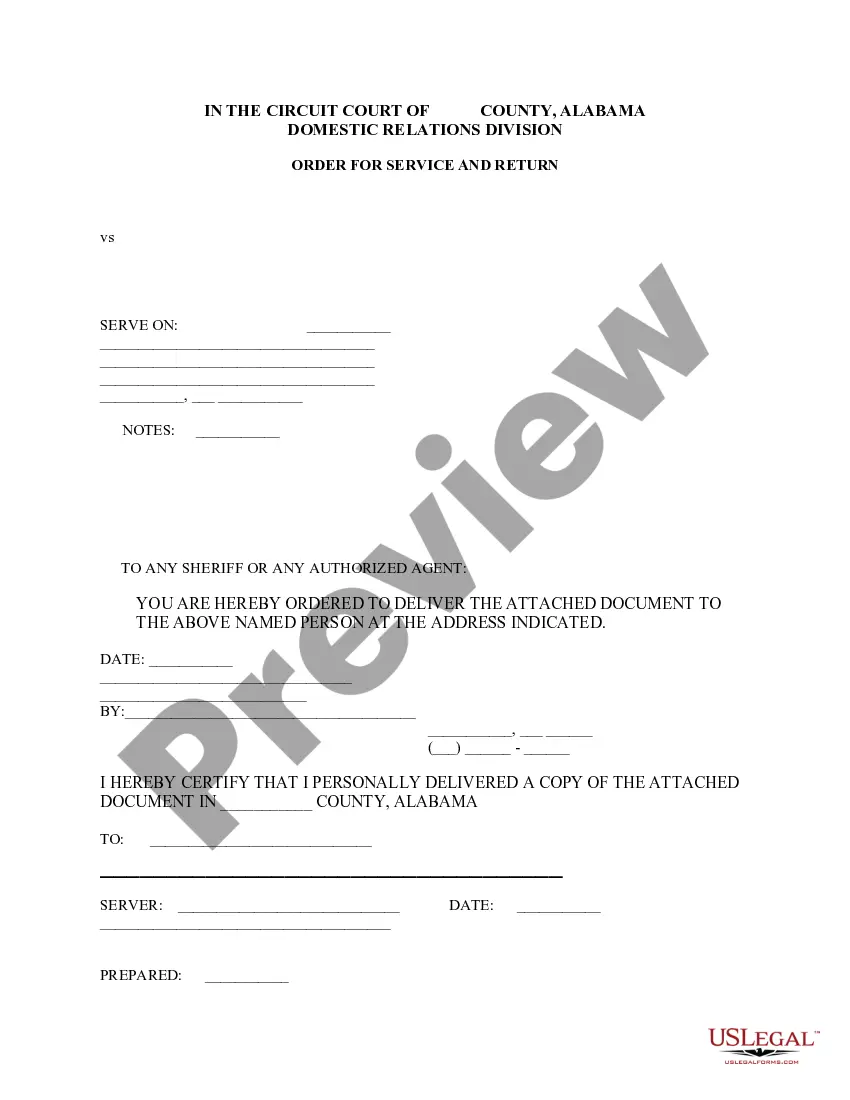

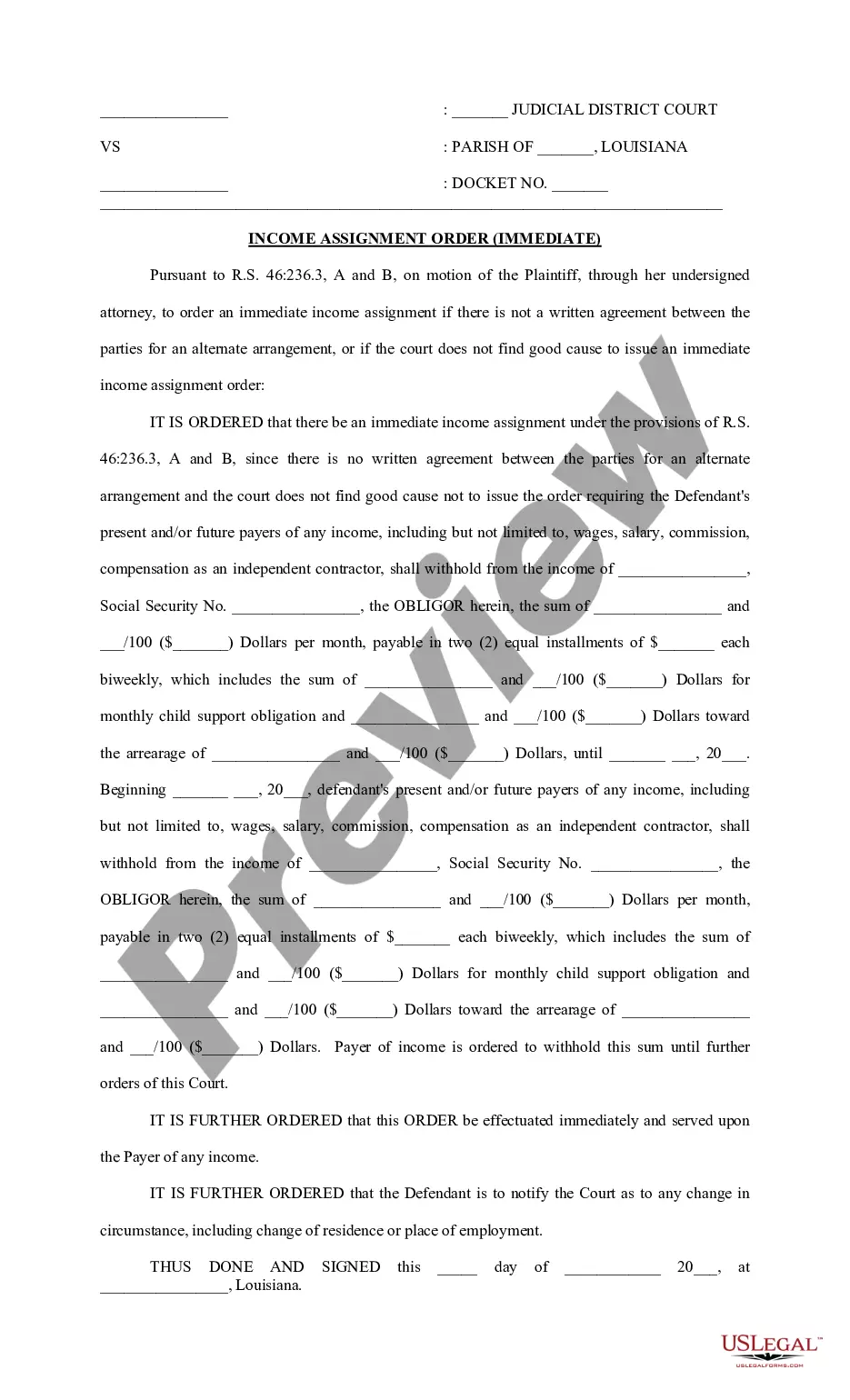

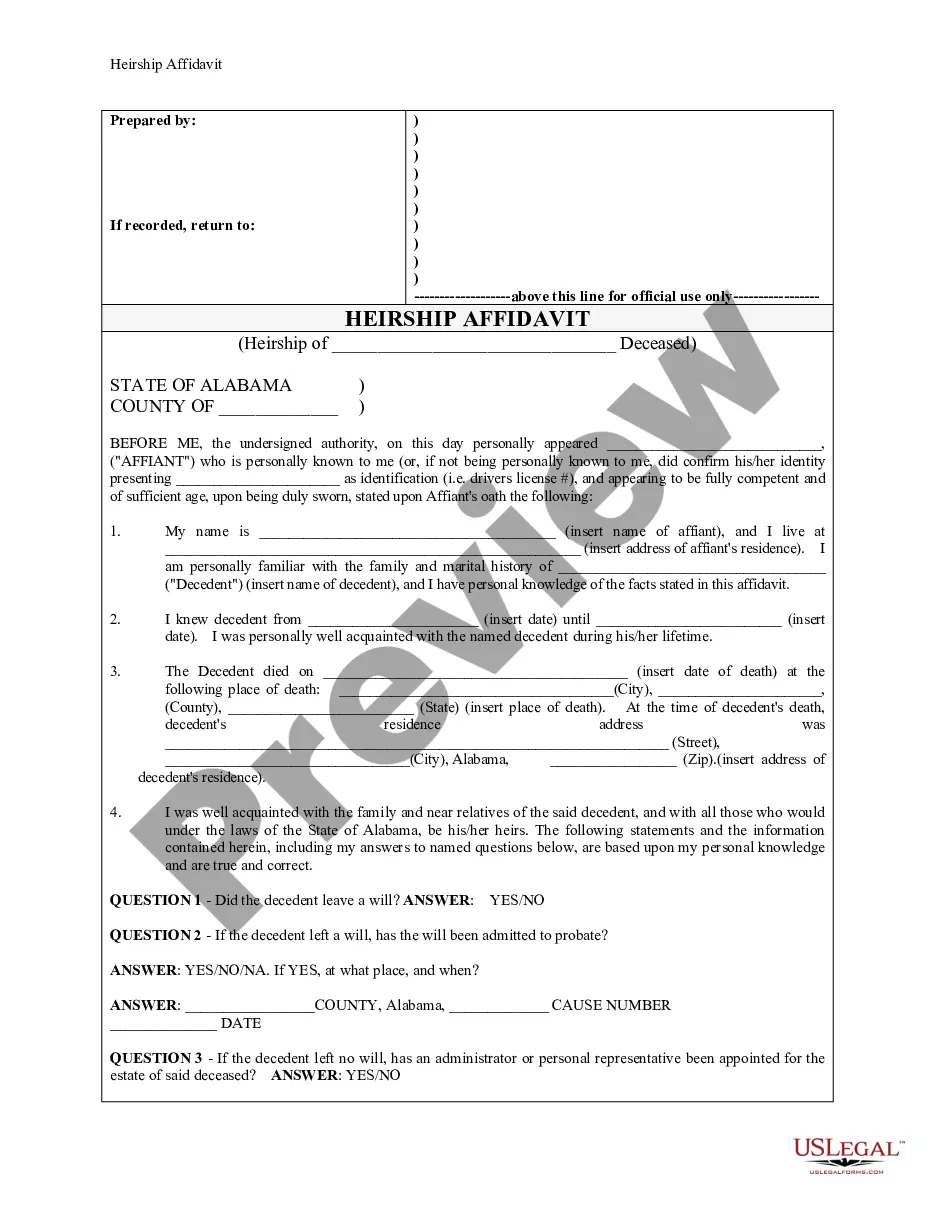

How to fill out Expense Reimbursement Request?

Locating the correct authorized documents format can be a challenge.

Certainly, there are numerous layouts accessible online, but how will you locate the official version you require.

Utilize the US Legal Forms website. The platform provides a vast array of templates, including the Washington Expense Reimbursement Request, suitable for business and personal needs.

You can review the form using the Preview button and analyze the form details to confirm it is suitable for you.

- All forms are verified by professionals and meet federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Washington Expense Reimbursement Request.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the documents you require.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Requesting reimbursement for medical expenses involves gathering all related documents, including medical bills and proof of payment. Clearly state the total amount in your Washington Expense Reimbursement Request and attach all supporting documents. It's beneficial to include a brief explanation of the circumstances surrounding the expenses. This clarity can help expedite the reimbursement process.

The privately owned vehicle mileage reimbursement rate is $0.585 per mile, as of Jan. 1, 2022.

Travel Reimbursement. The travel must be more than 15 miles one way from your home, and the first and last 15 miles of travel are not payable. No other provider of the same type is available closer to your home.

I would like to inform you that on // (Date), I visited (Location). The reason behind the visit was (Professional work/ Meeting/ Any other). For which, I request you to kindly reimburse the ticket amount of (Amount) which I had spent for traveling to the mentioned place.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

Compare the car's odometer reading before and after the trip to calculate miles driven. Employees must fill out an expense report for mileage reimbursement within 10 business days of the trip. Employees receive reimbursement by direct deposit within five business days after submission.

I would like to inform you that on // (Date), I visited (Location). The reason behind the visit was (Professional work/ Meeting/ Any other). For which, I request you to kindly reimburse the ticket amount of (Amount) which I had spent for traveling to the mentioned place.

How to Complete an Expense Reimbursement Form:Add personal information.Enter purchase details.Sign the form.Attach receipts.Submit to the management or accounting department.

If your business is considering implementing a mileage reimbursement program, it may be beneficial to adhere to the Internal Revenue Service standard rate guidelines for tax purposes; however, employers are not required to offer a minimum reimbursement rate or to even offer mileage reimbursement at all.

This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent. I am attaching a copy of the (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.