Revocable Trust Agreement - Grantor as Beneficiary

Description

Key Concepts & Definitions

Revocable Trust Agreement Grantor as Beneficiary: A scenario wherein the grantor (the person who establishes the trust) also serves as the beneficiary. This setup allows for flexibility in managing trust assets during the grantor's lifetime. Trust Agreement: A legal document that outlines the terms of the trust including duties of the trustee and rights of the beneficiaries. The Revocable Trust, also known as a living trust, allows the grantor to modify or cancel provisions of the trust during their lifetime.

Step-by-Step Guide

- Establishing the Revocable Trust: Decide on the assets (like property, stocks, or savings) to include in the trust.

- Executing the Trust Agreement: Engage a legal expert to draft the trust document reflecting your decisions as the grantor trustee.

- Appointing a Successor Trustee: Choose a reliable person or entity to manage the trust upon your incapacity or death.

- Transferring Assets into the Trust: Formally move ownership of listed assets into the trust's name to ensure they are governed by the trust's terms.

- Maintaining Records: Regularly update the trust document to reflect any changes in assets or personal wishes.

Risk Analysis

- Control Risks: As both the grantor and beneficiary, conflicts of interest may arise, which could affect impartial decision-making.

- Legal Risks: Improper execution of a trust document could lead to disputes among potential heirs or issues in probate court.

- Financial Risks: Mismanagement of trust assets can lead to diminished value, affecting the financial security of the beneficiary.

Best Practices

- Seek Professional Advice: Always consult with estate planning attorneys to ensure all legal requirements are met and the trust strategy aligns with personal financial goals.

- Regular Review: Periodically review the trust documents and assets to ensure alignment with current laws and life changes.

- Communicate with Successor Trustees: Ensure that the successor trustee understands their role and responsibilities to ease the transition of management if needed.

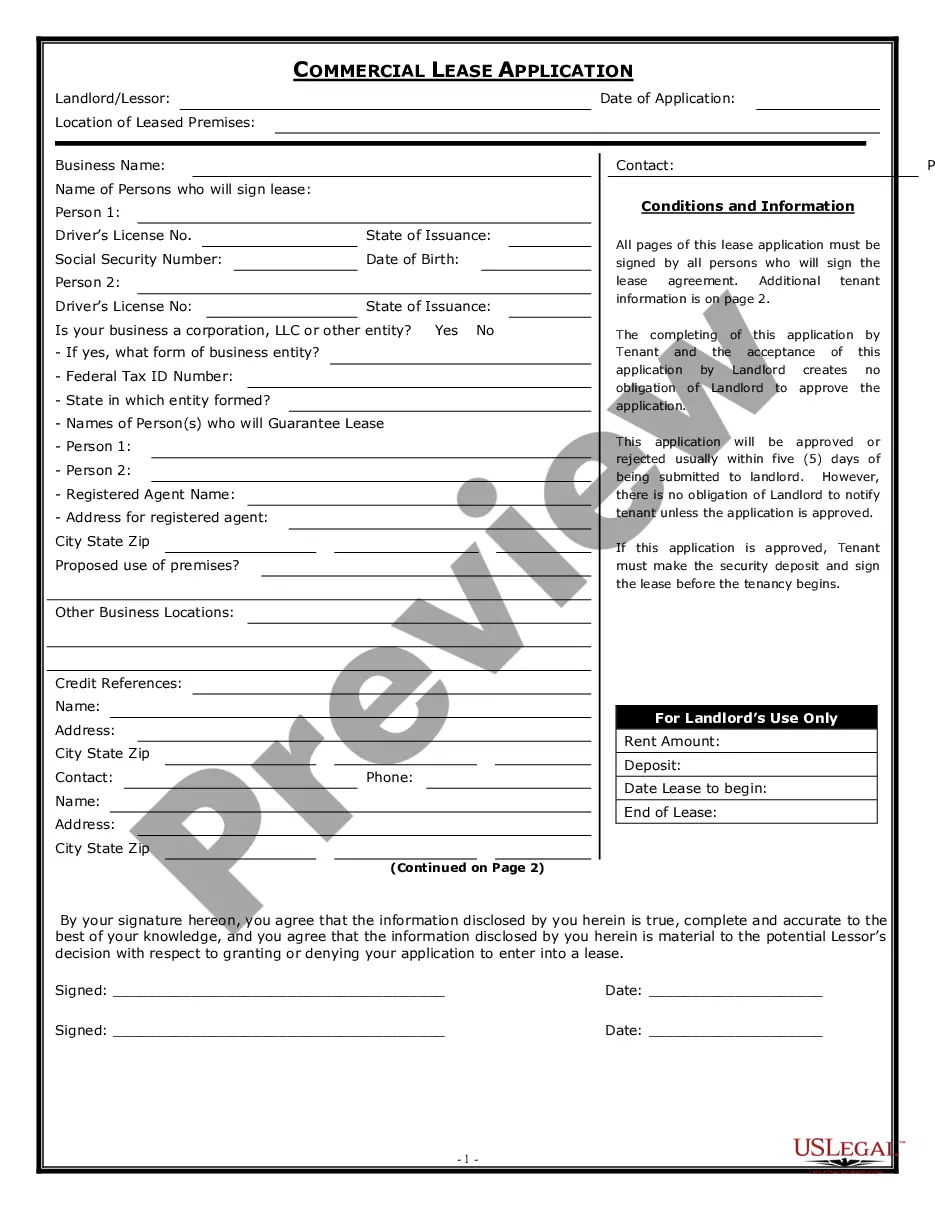

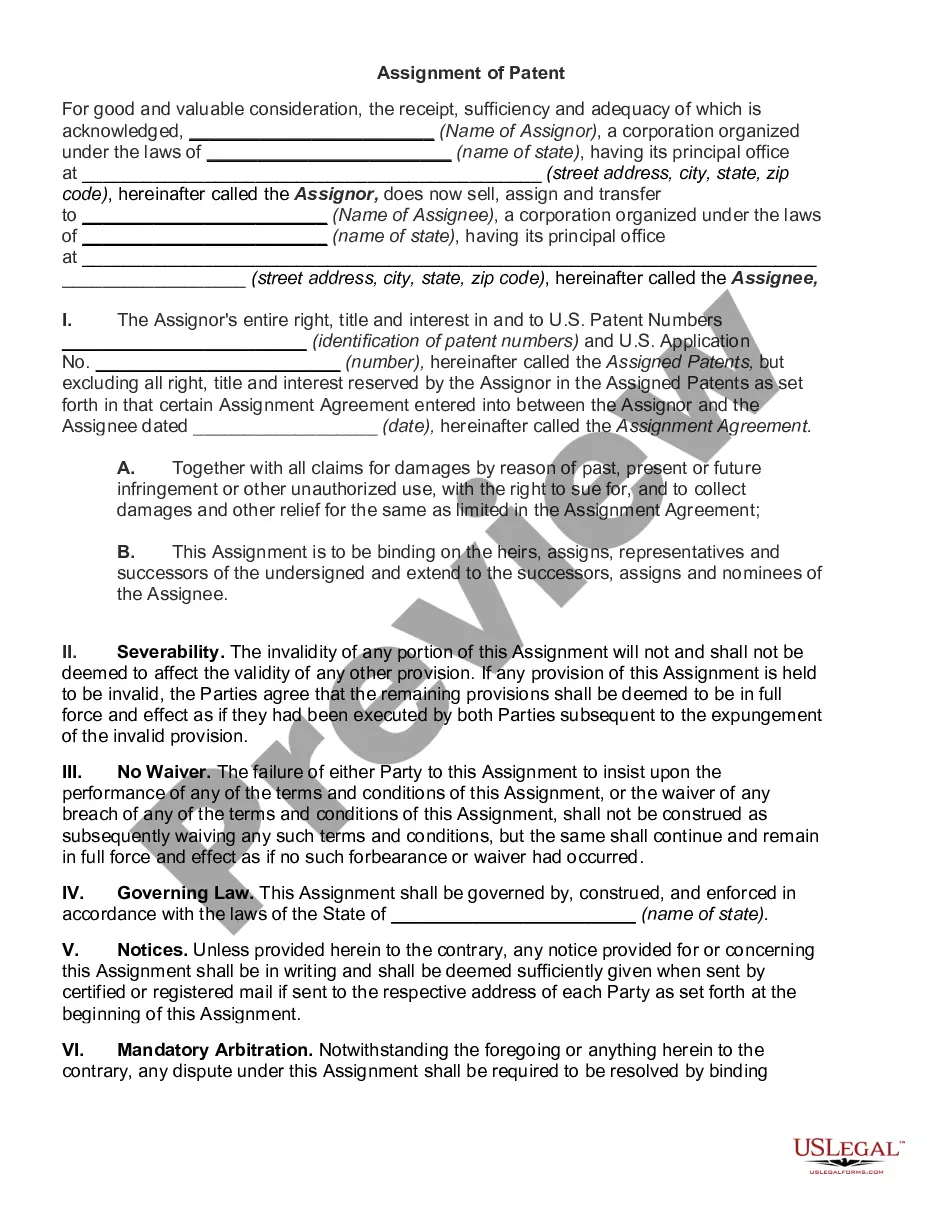

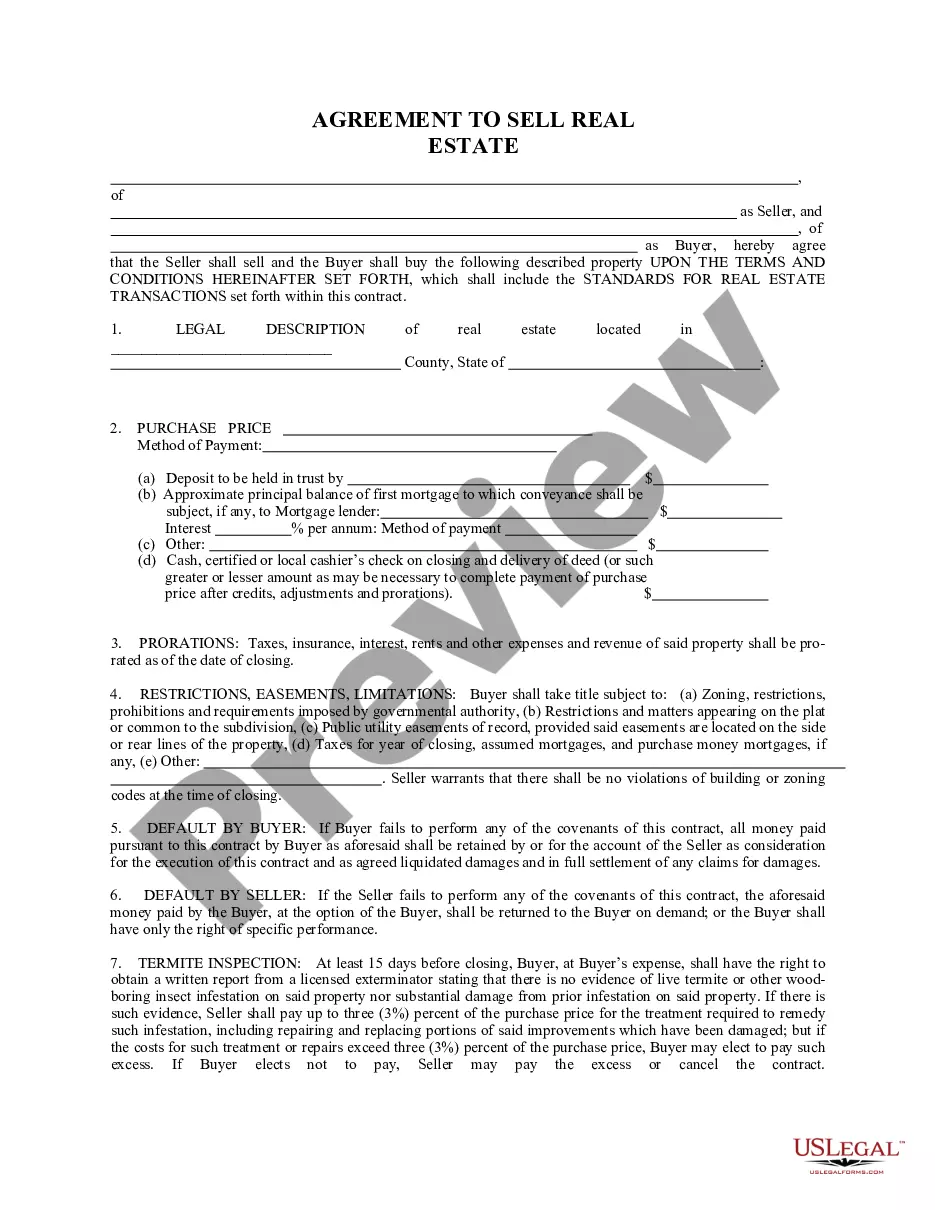

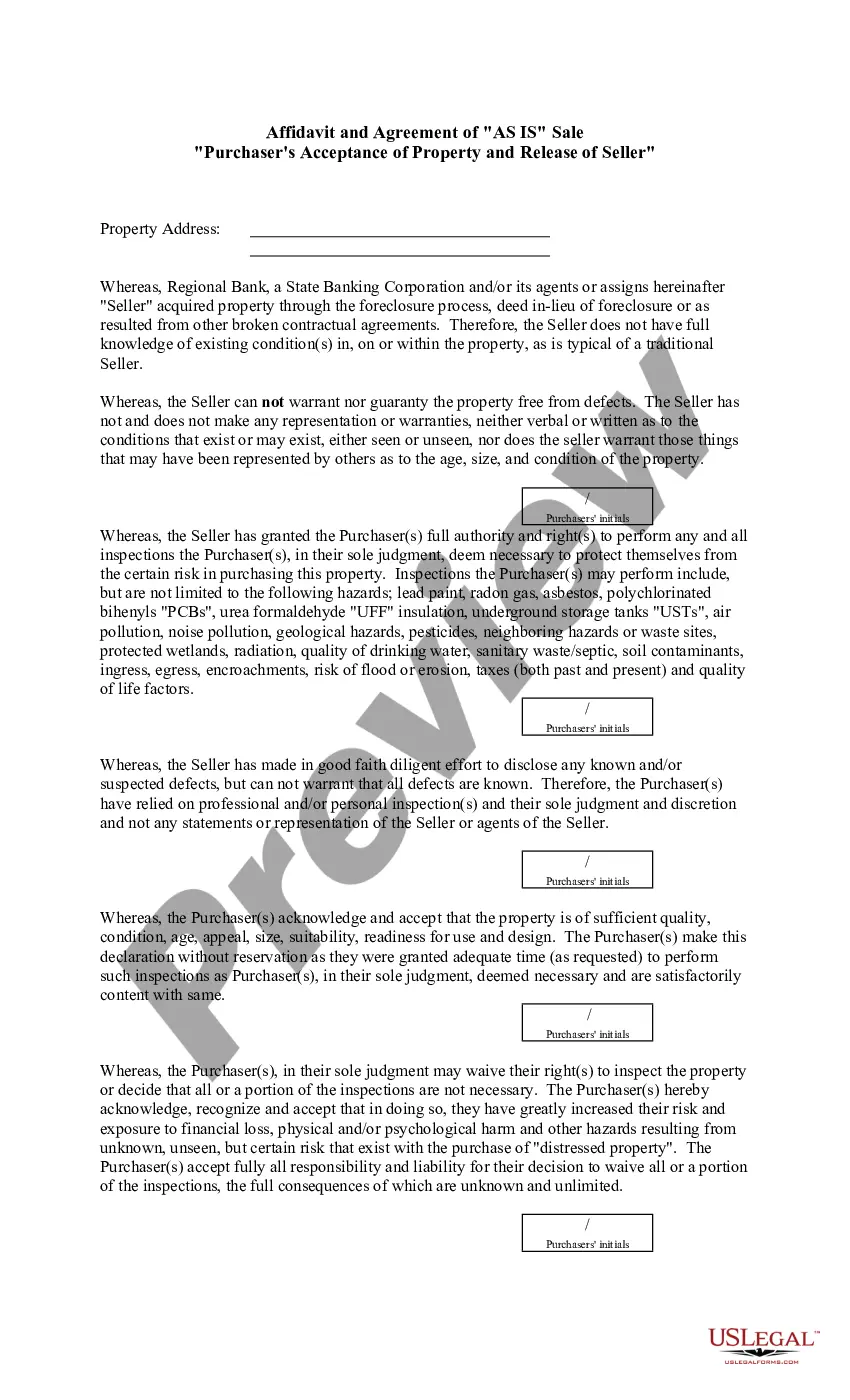

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a Revocable Trust Agreement - Grantor as Beneficiary? US Legal Forms eliminates the lost time millions of American people spend surfing around the internet for ideal tax and legal forms. Our skilled group of attorneys is constantly modernizing the state-specific Samples library, so that it always provides the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete easy actions before having the ability to download their Revocable Trust Agreement - Grantor as Beneficiary:

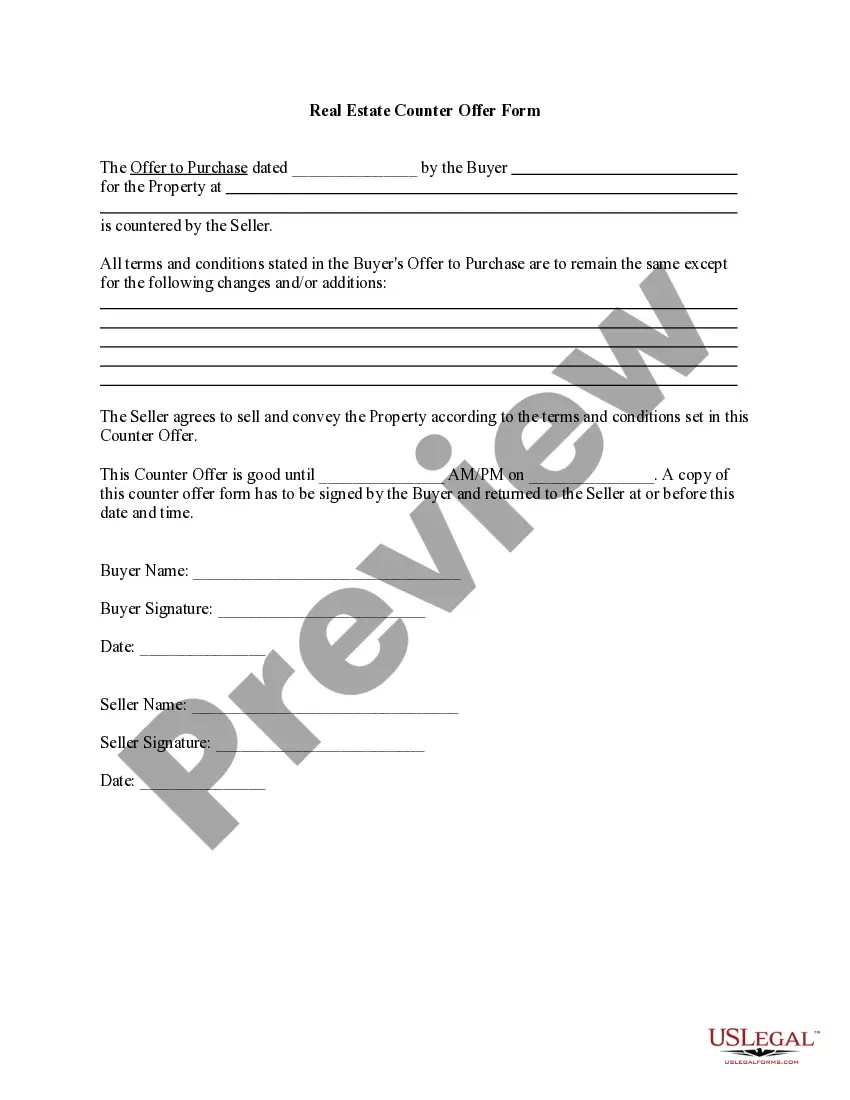

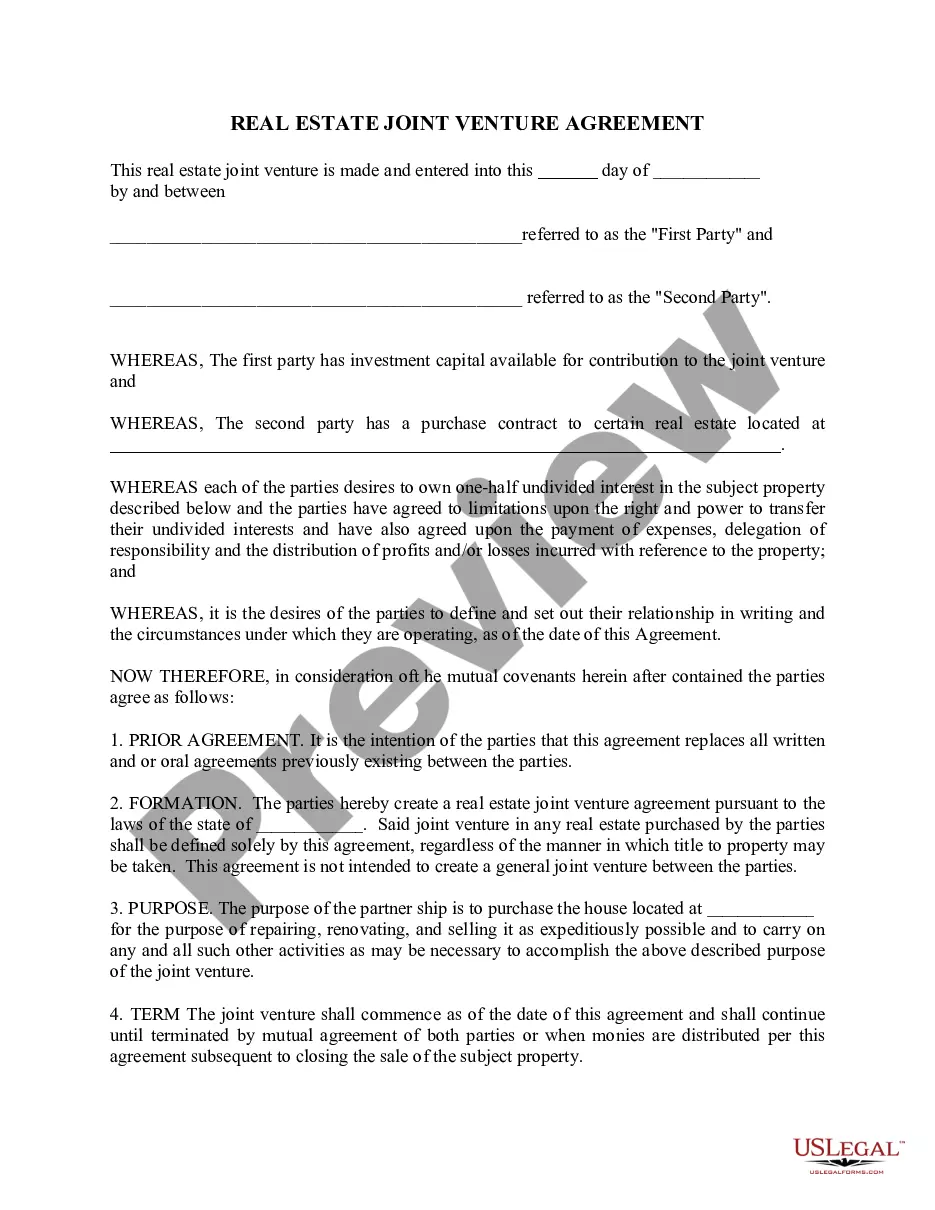

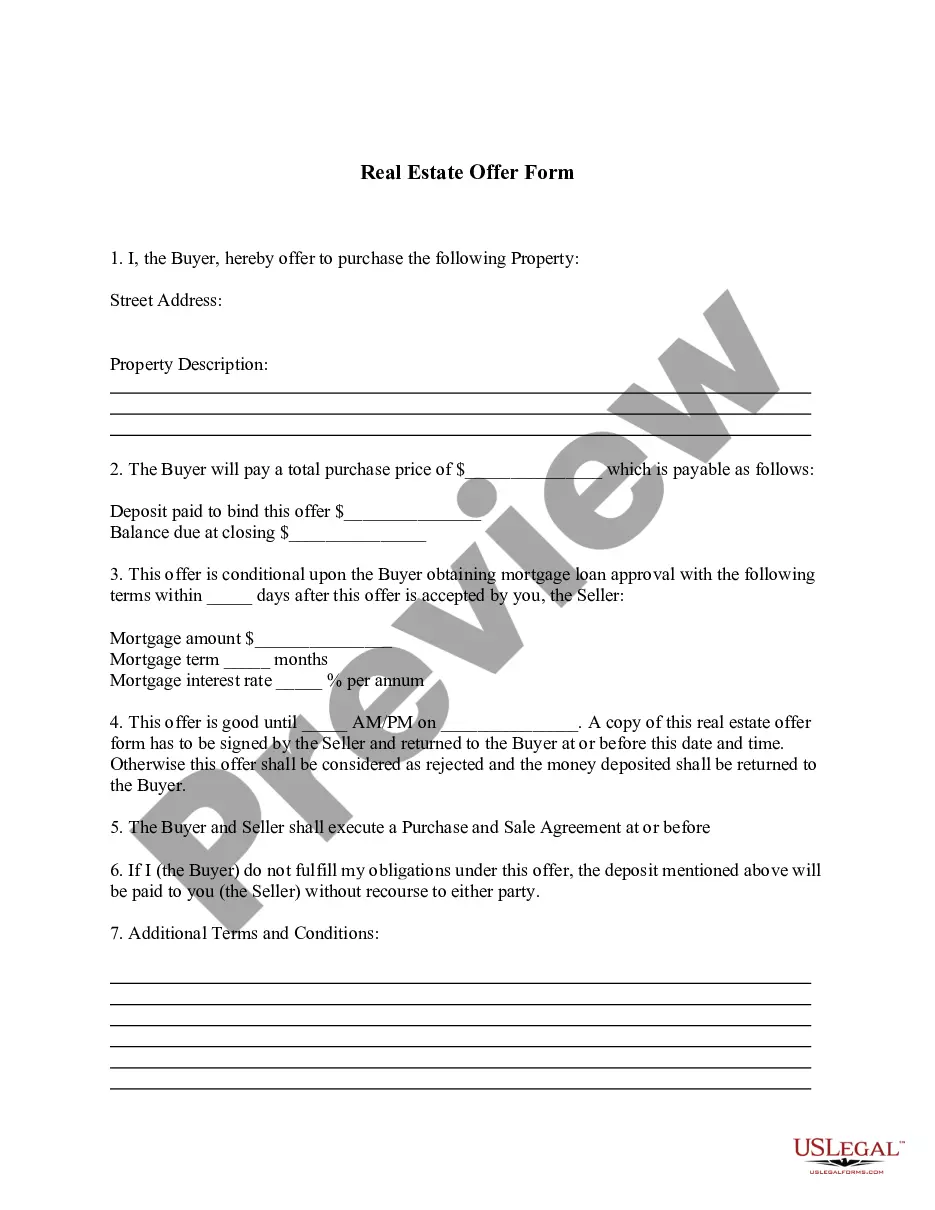

- Utilize the Preview function and read the form description (if available) to ensure that it is the appropriate document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template for the state and situation.

- Utilize the Search field at the top of the site if you need to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a convenient format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever file you want for whatever state you require it in. With US Legal Forms, completing Revocable Trust Agreement - Grantor as Beneficiary templates or any other legal paperwork is easy. Get started now, and don't forget to look at the samples with certified attorneys!

Form popularity

FAQ

If you are talking about an irrevocable trust, then no, the grantor should not be the trustee. One of the purposes behind an irrevocable trust is to typical get assets OUT of the grantor's estate, for various reasons. Having the grantor as a trustee (or beneficiary) would defeat that purpose.

Someone who inherits money from a revocable trust receives it tax-free, but the estate might have to pay estate tax on everything that it contains before distributing it.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

The person or people benefiting from the trust are the beneficiaries. Because a revocable trust lists one or more beneficiaries, the trust avoids probate, which is the legal process of distributing assets of a will.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The Revocable Trust tax implications, following the death of the Grantor, impact both the Grantor's Estate and the Beneficiaries'.However, any income earned by the Trust assets or principal after the date of the Grantor's death is reported in a separate tax return for the Trust.

The short answer is yes, a trustee can also be a trust beneficiary. One of the most common types of trust is the revocable living trust, which states the person's wishes for how their assets should be distributed after they die.

In a Revocable Living Trust, the grantor and the trustee are usually the same person.Beneficiaries: the people who will receive the benefit of the trust's assets. The Grantor (you) is the original beneficiary, and those who receive benefits after your passing are known as "remainder beneficiaries".

A beneficiary is the person or persons who are entitled to the benefit of any trust arrangement. A beneficiary will normally be a natural person, but it is perfectly possible to have a company as the beneficiary of a trust, and this often happens in sophisticated commercial transaction structures.