Washington Software and Product Support Agreement

Description

How to fill out Software And Product Support Agreement?

If you seek to obtain extensive, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Leverage the site's straightforward and convenient search feature to locate the documents you need.

A variety of templates for commercial and personal use are categorized by state or keywords. Use US Legal Forms to quickly find the Washington Software and Product Support Agreement with a few clicks.

Every legal document template you purchase is your own indefinitely. You will have access to every form you downloaded in your account.

Be proactive and download, and print the Washington Software and Product Support Agreement using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to acquire the Washington Software and Product Support Agreement.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate area/state.

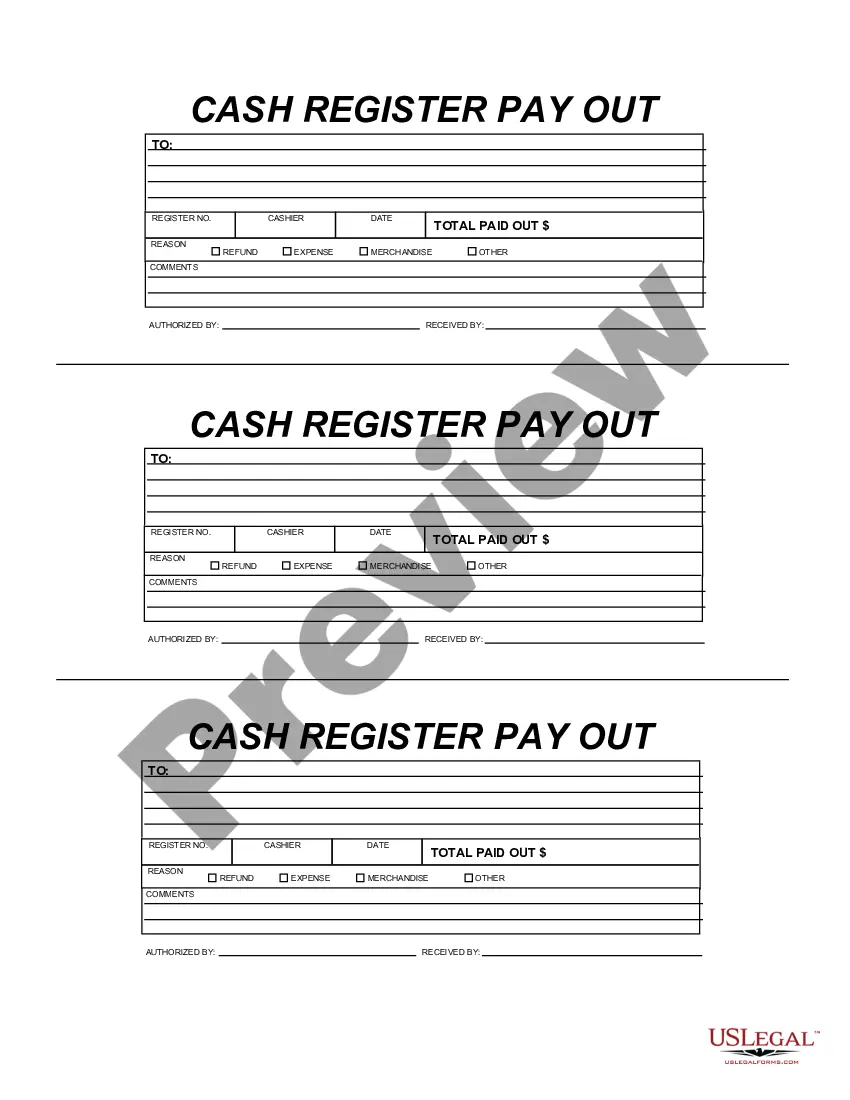

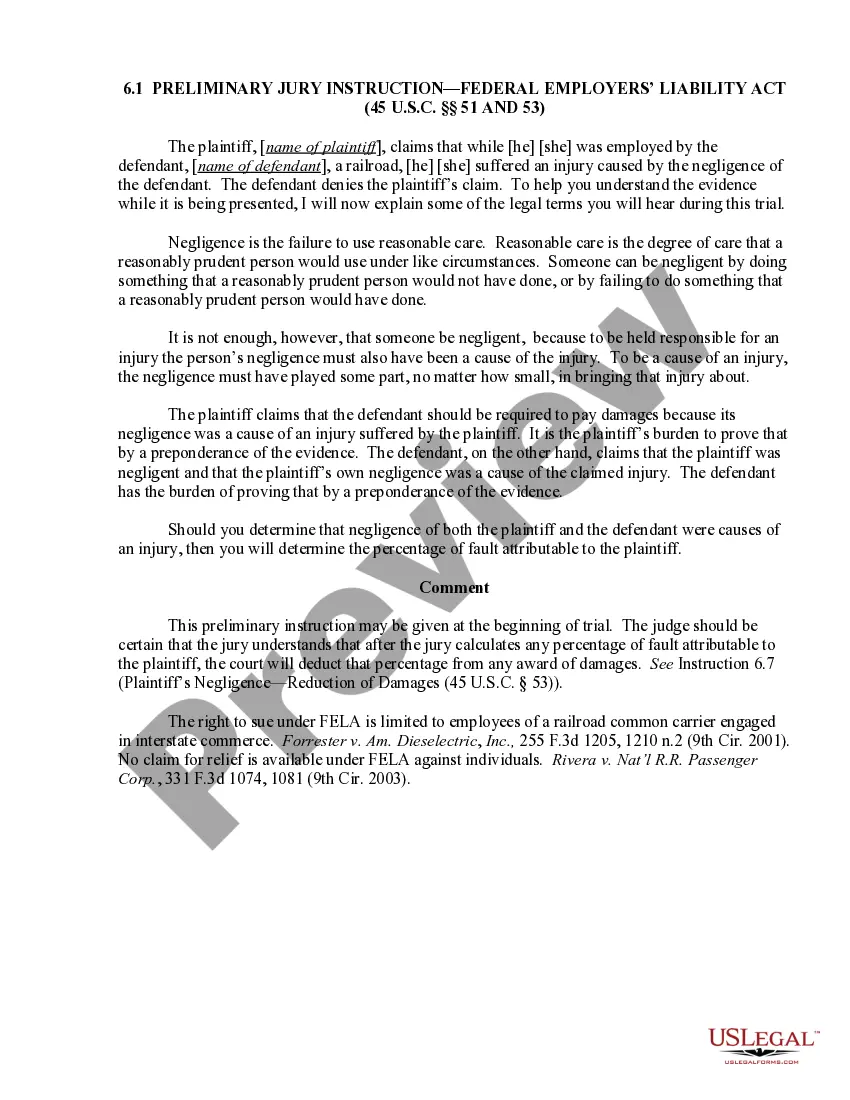

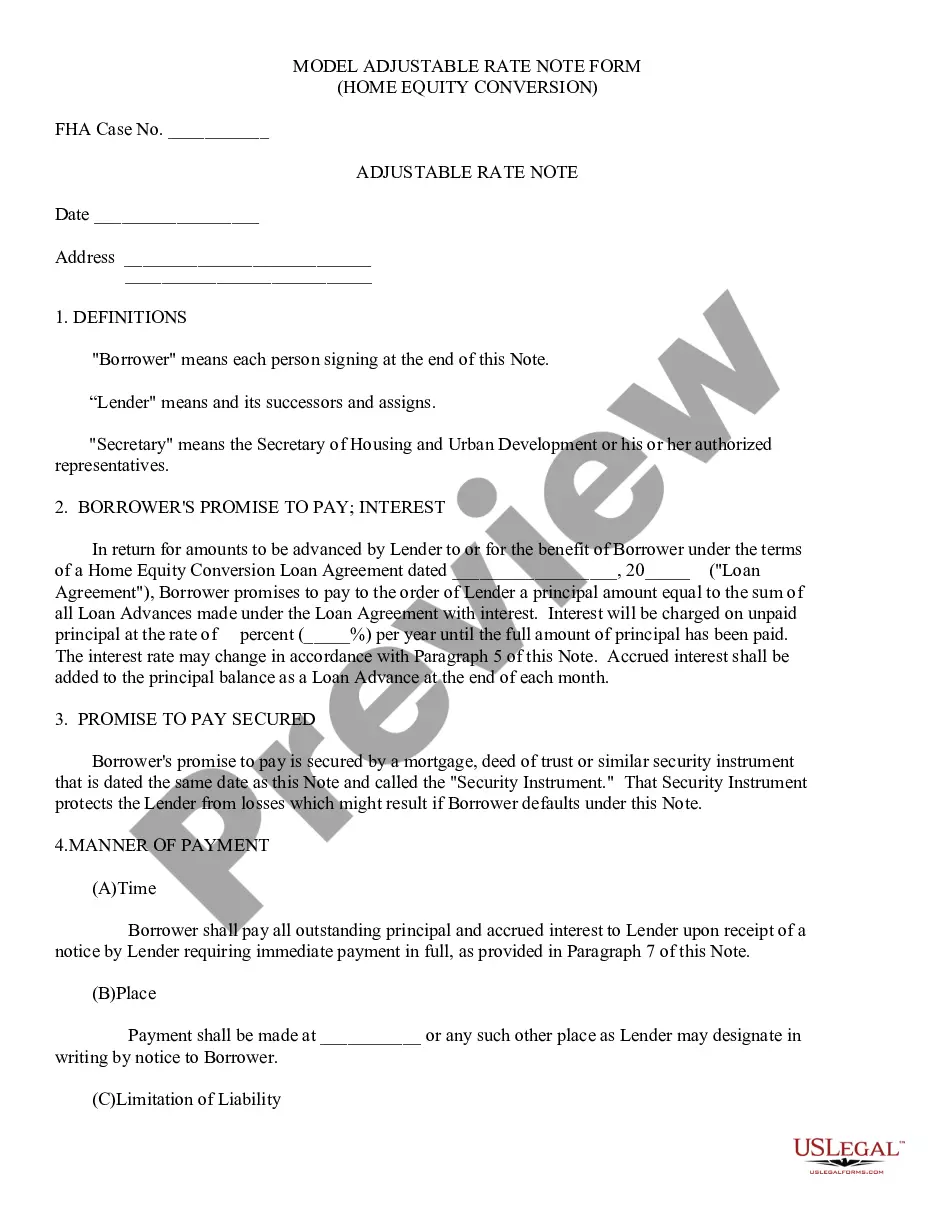

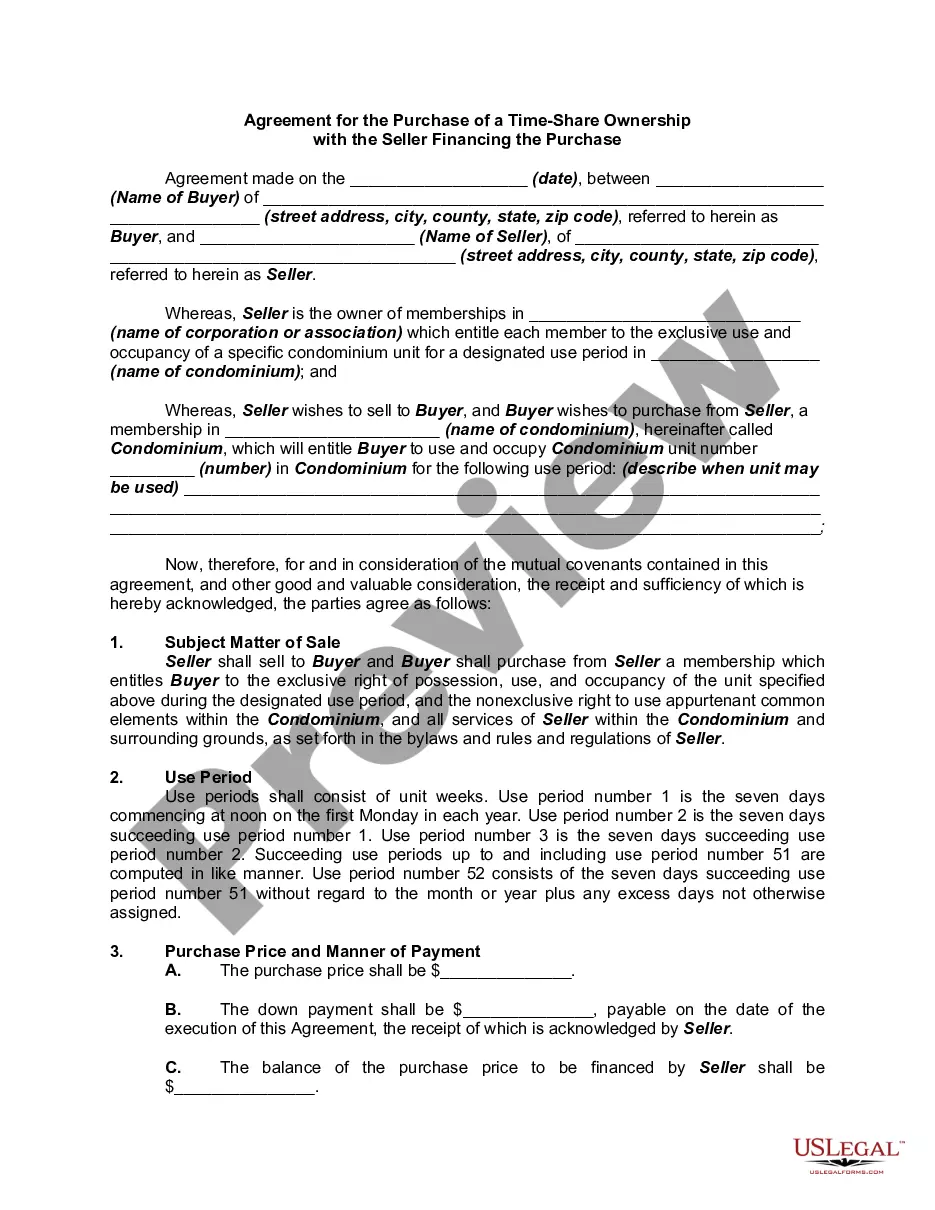

- Step 2. Utilize the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternate versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Select your preferred pricing plan and provide your information to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Washington Software and Product Support Agreement.

Form popularity

FAQ

SaaS is generally always taxable in Washington. Washington refers to SaaS as remotely accessed software (RAS) and says: RAS is prewritten software provided remotely.

Internet access and telecommunications used to provide Internet access are therefore exempt from Washington's retail sales tax.

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Digital goods purchased for a business purpose If a business purchases a digital good (only digital goods, NOT digital automated services or remote access software) for business purposes, then the purchase is exempt from sales tax.

Services to individuals and businesses things like haircuts, medical bills, consultant fees, etc. are not personal property, and most services are not subject to sales tax.

Should your business charge sales tax on SaaS in Washington? SaaS is generally always taxable in Washington.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

SaaS is generally always taxable in Washington. Washington refers to SaaS as remotely accessed software (RAS) and says: RAS is prewritten software provided remotely.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Software-as-a-Service products The definition of SaaS sometimes falls in the gray area of digital service. Washington DC does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.