Washington Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Choosing the right legitimate record template can be quite a have a problem. Needless to say, there are tons of web templates accessible on the Internet, but how do you find the legitimate kind you need? Utilize the US Legal Forms internet site. The services offers thousands of web templates, like the Washington Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, which you can use for enterprise and personal demands. All the types are inspected by experts and fulfill state and federal specifications.

Should you be already listed, log in to the profile and click the Obtain button to find the Washington Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss. Make use of your profile to look with the legitimate types you possess acquired earlier. Proceed to the My Forms tab of your own profile and obtain one more version in the record you need.

Should you be a brand new user of US Legal Forms, allow me to share simple instructions that you can comply with:

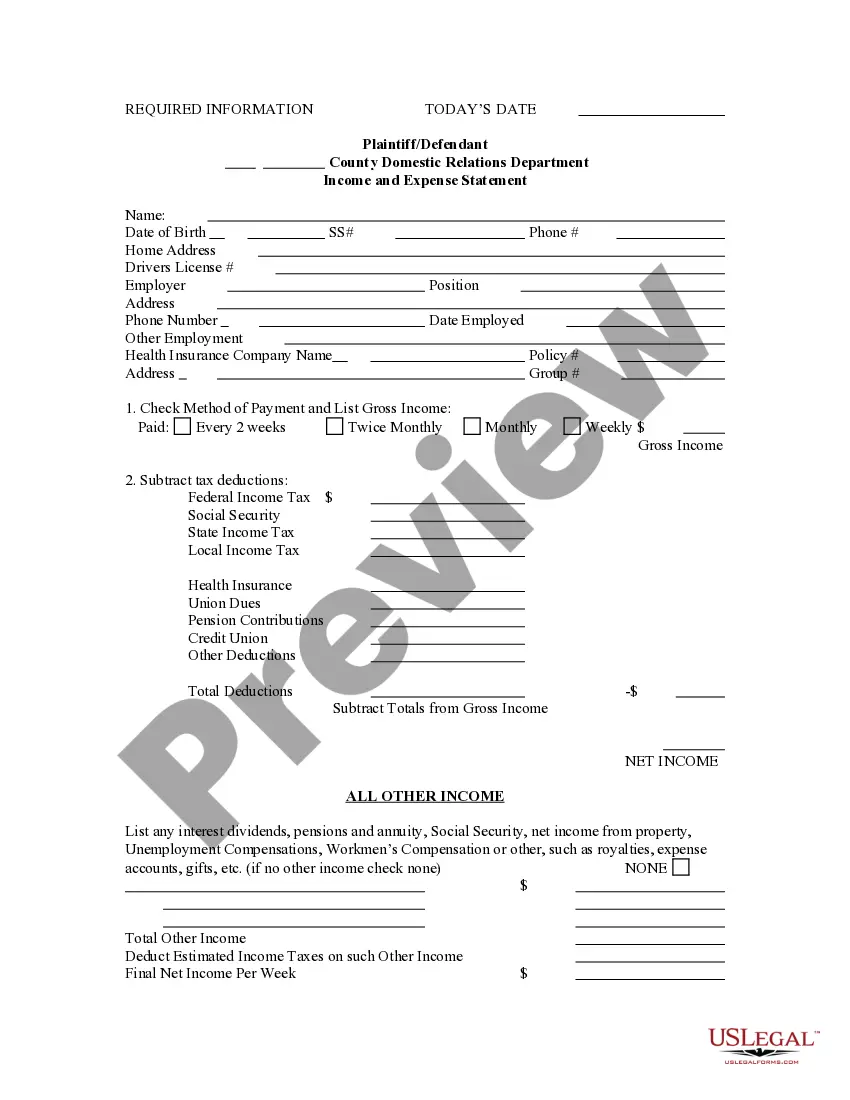

- Initially, be sure you have selected the right kind for the town/region. It is possible to look through the form utilizing the Preview button and look at the form outline to ensure it is the best for you.

- If the kind will not fulfill your expectations, take advantage of the Seach field to obtain the proper kind.

- Once you are positive that the form is acceptable, select the Acquire now button to find the kind.

- Choose the pricing prepare you would like and type in the necessary information. Design your profile and purchase your order utilizing your PayPal profile or credit card.

- Pick the file format and download the legitimate record template to the gadget.

- Total, revise and printing and indication the obtained Washington Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

US Legal Forms is the largest collection of legitimate types in which you will find numerous record web templates. Utilize the service to download professionally-created paperwork that comply with status specifications.