Pennsylvania Income and Expense Statement

Understanding this form

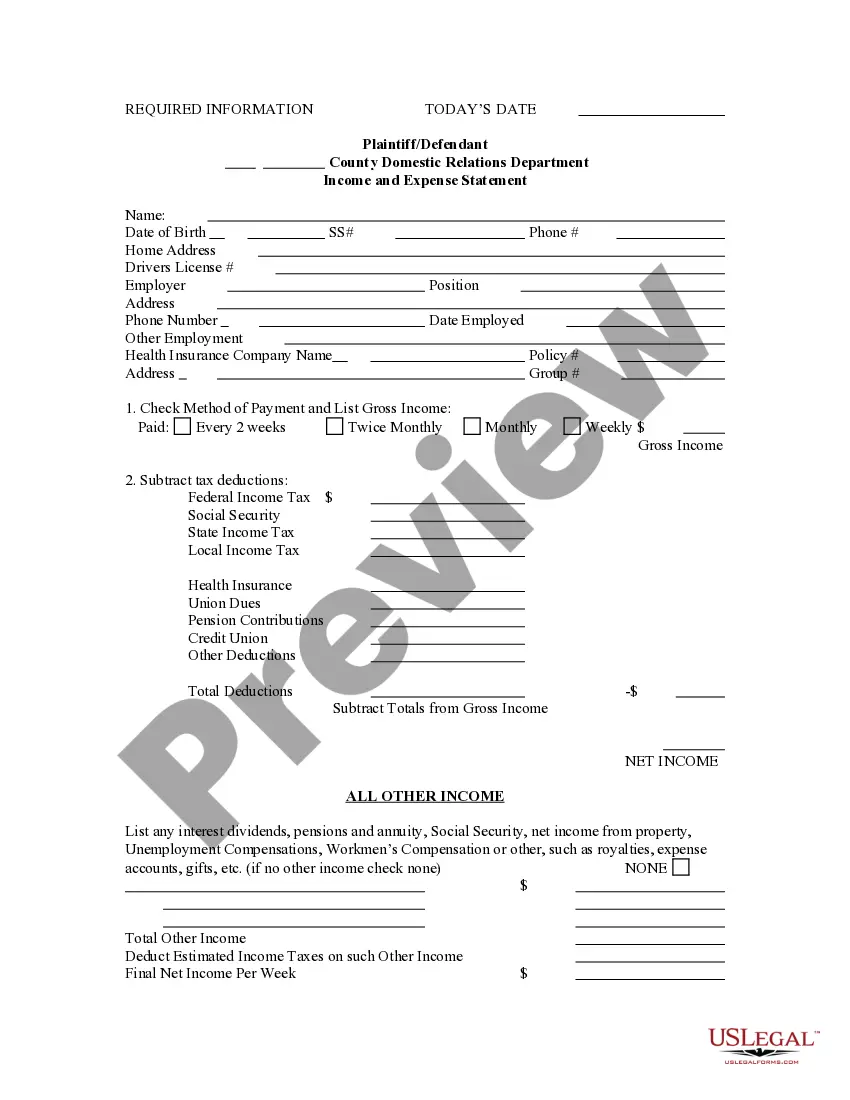

The Income and Expense Statement is a crucial document used in legal proceedings involving children. This form provides the court with essential details regarding the parties' employment, health insurance, income, and expenses. It is specifically designed to facilitate financial transparency in cases where child custody or support is being determined, thereby differing from other financial statements that may not focus specifically on child-related issues.

Key components of this form

- Personal information of the parties, including names and contact details.

- Employment details, such as job title, employer, and income.

- Health insurance coverage information, outlining provider names and costs.

- Monthly expenses, detailing fixed and variable expenses.

- Net income calculated after accounting for taxes and deductions.

Common use cases

This form should be used in legal situations involving child custody, child support, or any case where financial disclosure is necessary to assess the economic standing of parties involved with children. It helps the court gauge each party's financial capabilities, contributing to more equitable decisions regarding child care and support.

Who can use this document

- Parents or guardians involved in custody or support disputes.

- Individuals requiring a clear record of financial standing for legal purposes.

- Attorneys representing clients in family law cases.

Completing this form step by step

- Identify the parties involved by entering their full names and contact information.

- Provide employment details, including job titles, employers, and gross income.

- List health insurance information, specifying the provider and any associated costs.

- Detail your monthly expenses, categorizing them into fixed and variable sections.

- Calculate and enter your net income after accounting for any deductions and taxes.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Forgetting to include all sources of income.

- Not updating monthly expenses to reflect current financial obligations.

- Omitting health insurance details or misrepresenting coverage.

- Failing to sign or date the form, which may invalidate it.

Why complete this form online

- Convenient access to download and fill out the form at your own pace.

- Editability allows for easy updates and adjustments before finalizing.

- Reliable templates drafted by licensed attorneys ensure legal validity.

Legal use & context

- This form is legally recognized in family court to assess financial obligations.

- Failure to accurately complete this form can lead to unfavorable court outcomes.

- Keep copies of this form for your records and future court proceedings.

What to keep in mind

- The Income and Expense Statement is essential for family law cases involving children.

- Accurate and complete information is crucial for fair legal determinations.

- Utilizing this form online can streamline the process and ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Work Out the Details. To set a budget, first, you would like to understand each of your financial gain and expenditure very well. Determine Your Net Income. Account for Future Income and Expenses. Account for Change. Be Disciplined.

Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income.

Income and Expenditure Account is a nominal account. Therefore, the rule of nominal account (debit all expenses and losses and credit all incomes and gains) is followed while preparing it. While preparing the account, only items of revenue nature are recorded and all items of capital nature are ignored.

Expenditure This is the total purchase price of a good or service. For example, a company buys a $10 million piece of equipment that it estimates to have a useful life of 5 years. This would be classified as a $10 million capital expenditure.

Lists and summarizes income and expense transactions that have taken place over a specific period of time, usually a month or year. Insurance. A product that transfers risk from a individual to an insurance company or organization.

An expense is the cost of operations that a company incurs to generate revenue. As the popular saying goes, it costs money to make money. Common expenses include payments to suppliers, employee wages, factory leases, and equipment depreciation.

Definition: An expense is the cost of an asset used by a company in its operations to produce revenues. In other words, an expense is the use of assets to create sales.Expenses are created when an asset is used up, not when cash is paid out. Take depreciation expense for example.

Cost of goods sold. Sales commissions expense. Delivery expense. Rent expense. Salaries expense. Advertising expense.

Fixed expenses, savings expenses, and variable costs are the three categories that make up your budget, and are vitally important when learning to manage your money properly. When you've committed to living on a budget, you must know how to put your plan into action.