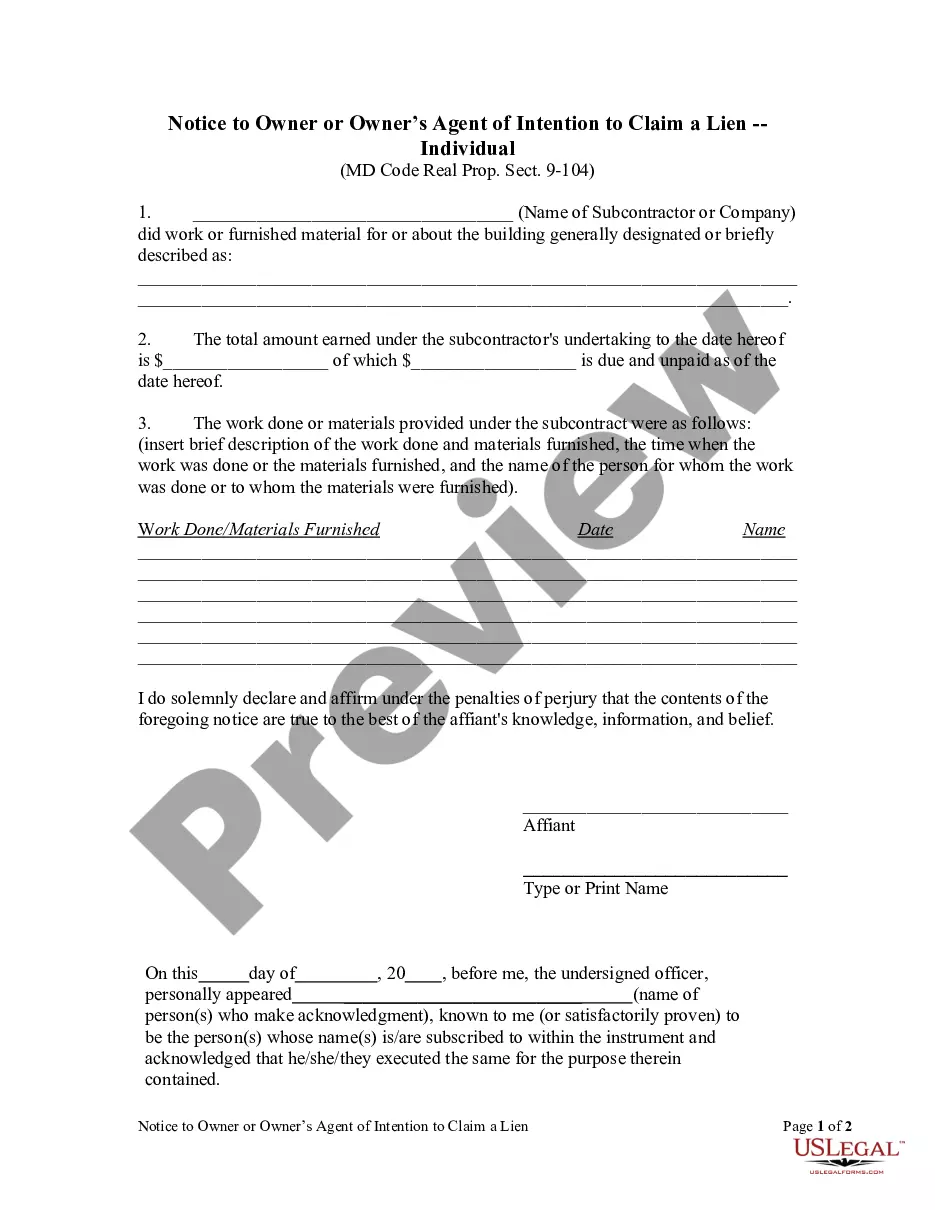

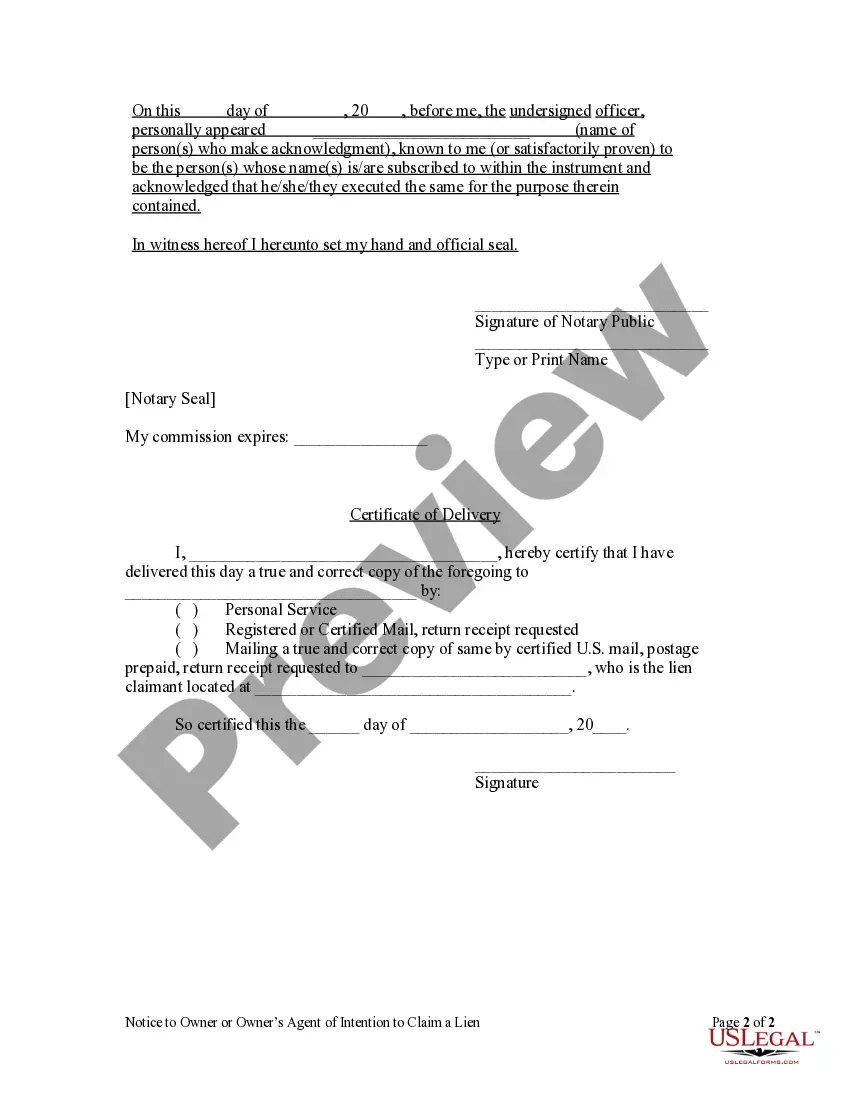

Maryland law requires a party who wishes to claim a lien to file a Petition to Establish a Lien in the appropriate court. A prerequisite to this filing is a valid Notice of Intent to Claim a Lien. The Notice of Intent must be provided to the property owner within one hundred twenty (120) days after doing the work or furnishing the materials. It must be served personally on the property owner or by certified or registered mail.

Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Individual

Description

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Individual?

Greetings to the most important legal documents repository, US Legal Forms.

Here you can discover any template such as Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Individual forms and store them (as many as you desire/require). Create official documents in just a few hours, instead of days or even weeks, without the necessity of spending a fortune on an attorney.

Obtain the state-specific template in a few clicks and feel confident knowing it was crafted by our licensed attorneys.

If the template meets all your requirements, click Buy Now. To create your account, choose a pricing plan. Use a credit card or PayPal account to register. Download the document in the format you require (Word or PDF). Print the file and complete it with your/your business’s information. Once you’ve finished the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Individual, send it to your lawyer for verification. It’s an extra step but a crucial one to ensure you’re thoroughly protected. Join US Legal Forms today and gain access to thousands of reusable samples.

- If you’re already a subscribed user, just Log In to your account and then click Download next to the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Individual you need.

- Because US Legal Forms is online, you’ll always have access to your downloaded forms, no matter what device you’re using.

- Find them within the My documents section.

- If you don't have an account yet, what are you waiting for.

- Follow our steps below to begin.

- If this is a state-specific document, verify its validity in the state where you reside.

- Review the description (if available) to determine if it’s the correct template.

- Explore more content with the Preview option.

Form popularity

FAQ

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

Even in states like California, which prohibits creditors explicitly from placing liens on joint tenancy property, spouses are not covered.Nevada, Arizona, Washington, Idaho, California, New Mexico, Texas, Puerto Rico, Wisconsin, and Louisiana are currently community property states.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

Yes, a lien may be placed on property that is jointly owned. However, the effects of that lien depend on the type of ownership that the property is under.

The people who can file mechanic's liens are identified by state law. A subcontractor or supplier to a subcontractor may not be able to file a lien. Also, unlicensed contractors are often barred from filing a mechanic's lien.

The most common way to reduce or even eliminate mechanic's lien risk is through the use of lien waivers. A lien waiver is a private agreement in which a party surrenders the right to file a lien in exchange for payment.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

If contractors or suppliers aren't paid on a construction project in Maryland, they can file a mechanics lien to secure payment.