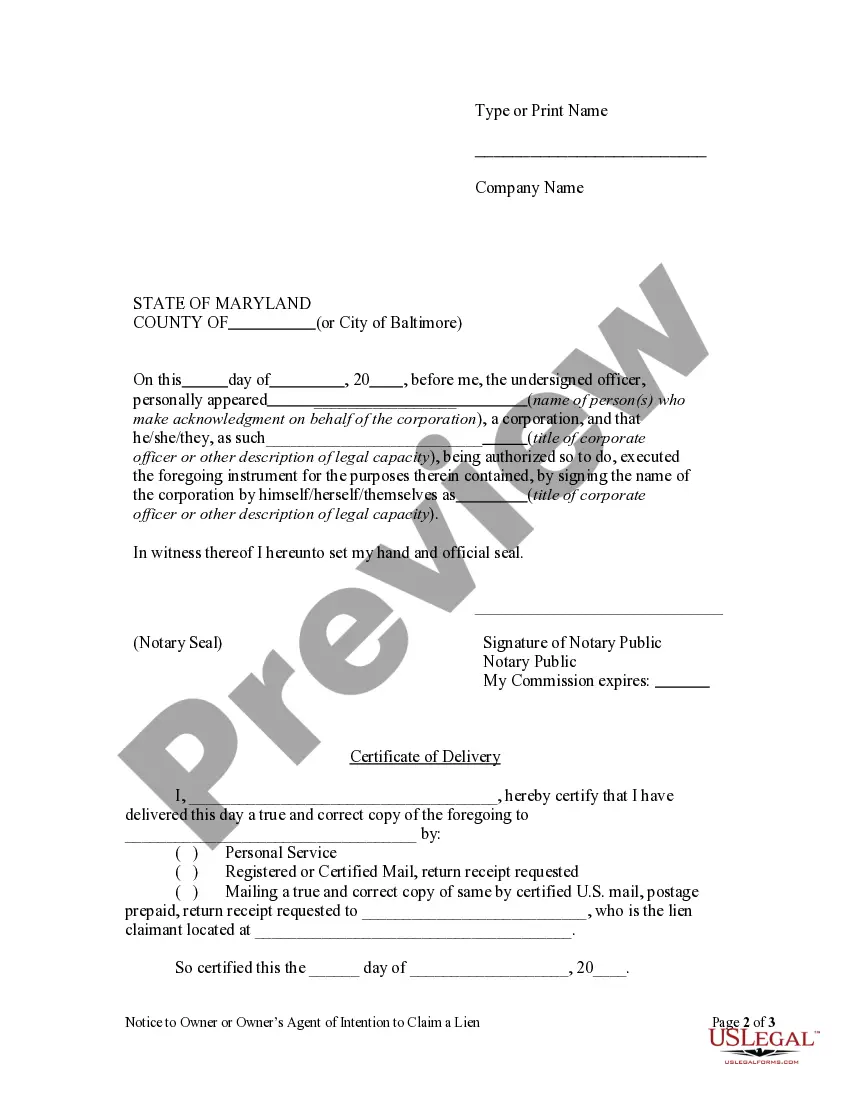

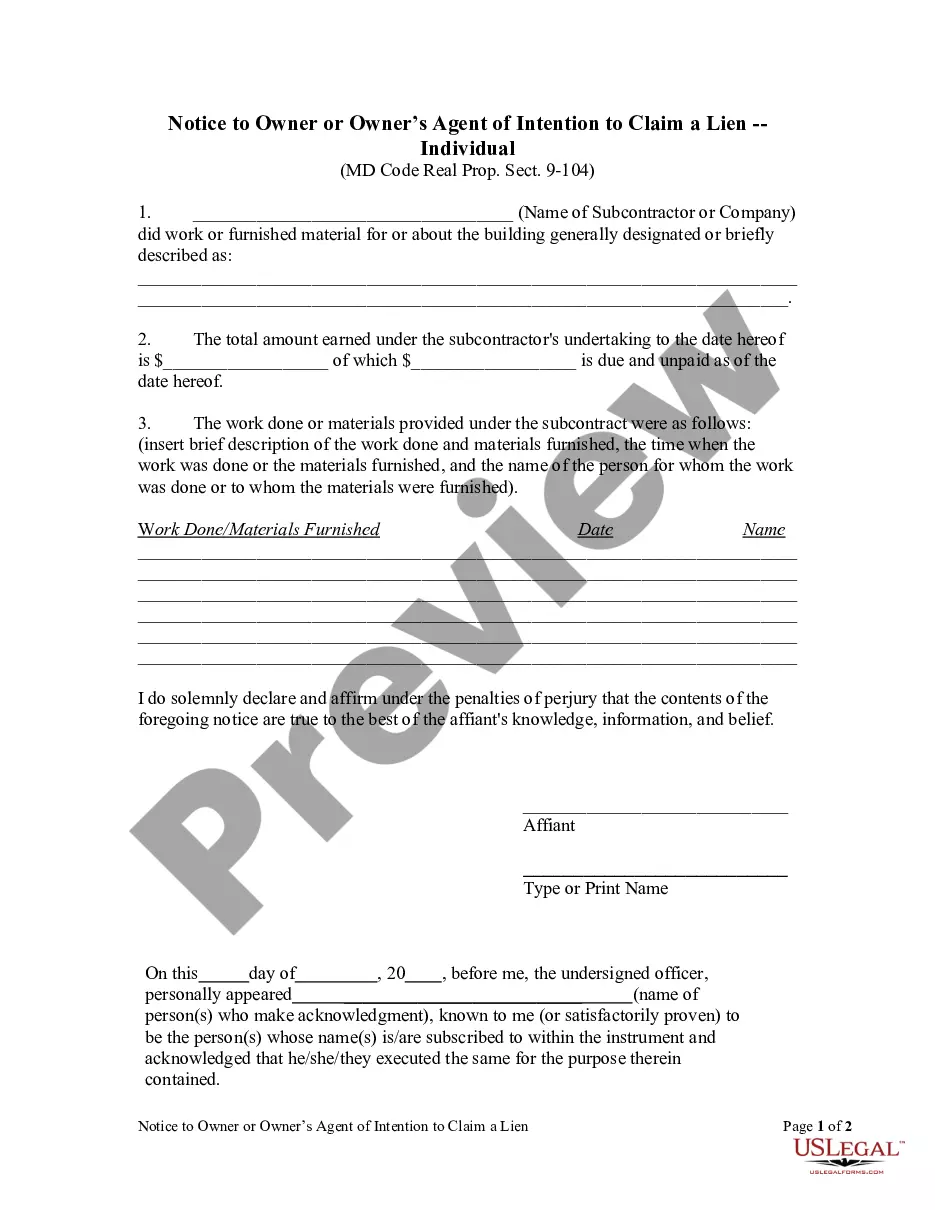

Maryland law requires a party who wishes to claim a lien to file a Petition to Establish a Lien in the appropriate court. A prerequisite to this filing is a valid Notice of Intent to Claim a Lien. The Notice of Intent must be provided to the property owner within one hundred twenty (120) days after doing the work or furnishing the materials. It must be served personally on the property owner or by certified or registered mail.

Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC

Description

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

You are invited to the most important legal documents repository, US Legal Forms.

Here, you can locate any template including Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC forms and store them (as many as you desire or need).

Prepare official paperwork within a few hours, instead of days or even weeks, without the need to spend a fortune with a lawyer or attorney.

If the document meets all your criteria, simply click Buy Now. To create your account, select a pricing plan. Use a credit card or PayPal account to register. Download the template in the format you need (Word or PDF). Print the document and complete it with your or your business’s information. Once you have finished the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC, send it to your lawyer for verification. It’s an additional step, but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

- Obtain the state-specific template with just a couple of clicks and feel confident knowing that it was created by our licensed legal experts.

- If you are already a registered user, simply Log In to your account and click Download next to the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC you require.

- Because US Legal Forms is an online service, you will always have access to your saved documents, regardless of the device you are using.

- View them in the My documents tab.

- If you do not have an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to determine if it is the appropriate sample.

Form popularity

FAQ

If you want to place a lien on a commercial rental property and you are not the landlord, you may need to put a lien on the property by filing with the court of record in the jurisdiction where the property is actually located.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

The people who can file mechanic's liens are identified by state law. A subcontractor or supplier to a subcontractor may not be able to file a lien. Also, unlicensed contractors are often barred from filing a mechanic's lien.

Option 1: Create an account to file your Articles of Organization on the Maryland Business Express website. Once logged in, select Start a New Filing, and then Register a Business. Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

If contractors or suppliers aren't paid on a construction project in Maryland, they can file a mechanics lien to secure payment.

A mechanics lien is one of the most effective payment recovery methods that can pressure construction clients to pay up.When a property gets foreclosed or goes bankrupt, all construction parties with a valid mechanics lien against the property may still recover payment through the proceeds of the foreclosure sale.