Washington Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

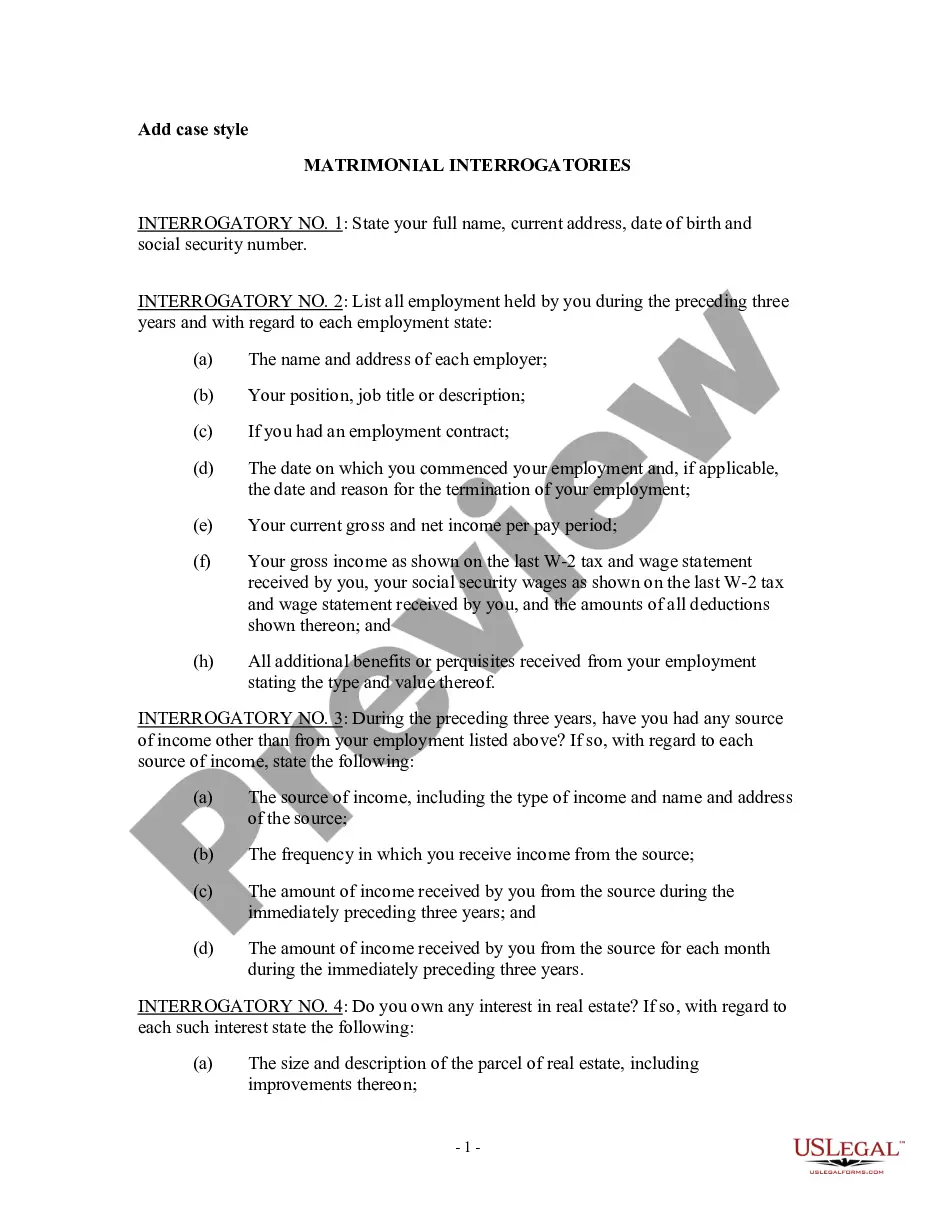

How to fill out Sample Letter For Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

If you need to full, obtain, or print out legal papers themes, use US Legal Forms, the greatest collection of legal types, that can be found on the Internet. Take advantage of the site`s basic and practical look for to get the documents you want. Various themes for enterprise and individual functions are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the Washington Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate with a handful of click throughs.

When you are already a US Legal Forms consumer, log in to the bank account and click on the Download switch to get the Washington Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate. You may also entry types you earlier downloaded within the My Forms tab of your respective bank account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the appropriate town/country.

- Step 2. Use the Preview option to look over the form`s information. Don`t forget to read the explanation.

- Step 3. When you are not satisfied together with the type, use the Lookup field at the top of the screen to locate other types in the legal type format.

- Step 4. Upon having found the shape you want, select the Purchase now switch. Pick the prices plan you like and include your qualifications to sign up for an bank account.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Find the formatting in the legal type and obtain it on your system.

- Step 7. Total, modify and print out or sign the Washington Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate.

Every legal papers format you purchase is yours eternally. You have acces to each and every type you downloaded inside your acccount. Select the My Forms segment and pick a type to print out or obtain again.

Contend and obtain, and print out the Washington Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate with US Legal Forms. There are millions of specialist and condition-particular types you can utilize for your personal enterprise or individual requires.

Form popularity

FAQ

Debt collectors cannot try to collect on debts that were discharged in bankruptcy. Also, if you file for bankruptcy, debt collectors are not allowed to continue collection activities while the bankruptcy case is pending in court. If a debt collector calls and you have filed for bankruptcy, tell the debt collector.

If you are filing for bankruptcy under Chapter 7, you probably can expect to keep your checking account with a bank. If you owe a debt to the bank, however, the bank may have the right to take some of the funds from your account as a set off for the debt. This might arise if you hold a credit card through the bank.

In Chapter 13 bankruptcy, you pay the Chapter 13 bankruptcy trustee the monthly payment required by your Chapter 13 repayment plan and the trustee distributes the funds to creditors each month.

Most Chapter 7 bankruptcy cases take between 4 - 6 months to complete after filing the case with the court. The order erasing eligible debts can be granted as early as 90 days from the date the case was filed. No-asset cases are typically closed a couple of weeks after the discharge date.

It will be discharged in the bankruptcy. To keep the property, you will usually have to either keep the debt and pay off the loan or pay the lender the actual value of the property. There are some exceptions, so talk with your lawyer.

The choice in a Chapter 7 bankruptcy with secured debt is all-or-nothing: if you want to keep the house or car that is secured by the lien, then you must keep making the payments on the loan; if you want to get rid of the secured debt, the lender has the right to take back the property.

However, exempt property in a California bankruptcy is generally described as: Your main vehicle. Your home. Personal everyday items. Retirement accounts, pensions, and 401(k) plans. Burial plots. Federal benefit programs. Health aids. Household goods.