The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

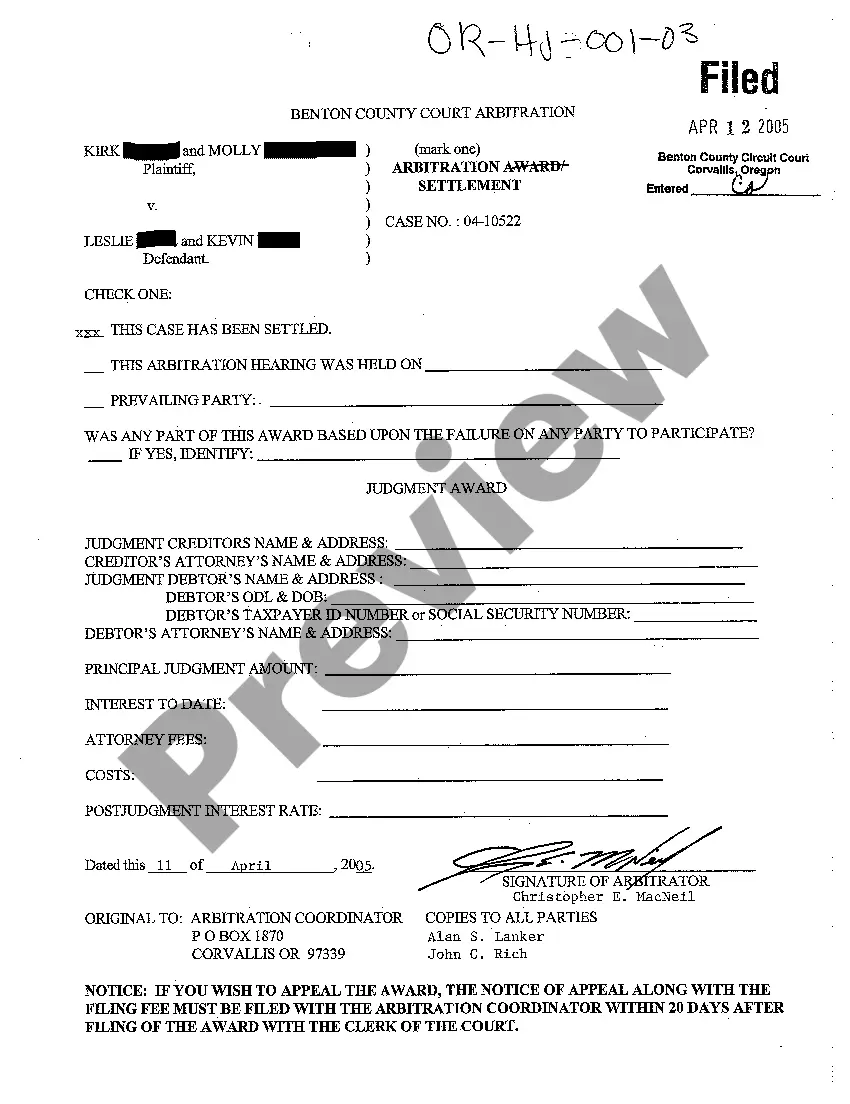

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

It is feasible to spend numerous hours online looking for the appropriate legal document format that complies with federal and state regulations you will require.

US Legal Forms offers a plethora of legal forms that have been reviewed by professionals.

You can conveniently download or print the Washington Debtor's Affidavit of Financial Status to Induce Creditor to Settle or Forgive the Overdue Debt - Assets and Liabilities from their services.

If you wish to obtain another version of your document, use the Search section to find the format that meets your needs and specifications.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you may complete, edit, print, or sign the Washington Debtor's Affidavit of Financial Status to Induce Creditor to Settle or Forgive the Overdue Debt - Assets and Liabilities.

- Every legal document format you purchase is yours permanently.

- To acquire an additional copy of any purchased document, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the state/region of your choice. Review the document description to confirm you have chosen the right form.

- If available, utilize the Preview button to view the format as well.

Form popularity

FAQ

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

If you are unable to pay your debts, you should contact your creditor to let them know and see if they are willing to write off the debt.

Chapter 11 is a form of bankruptcy involving the reorganization of a business's debt and assets. The debtor business must create a repayment or, rather, reorganization plan, and if that plan is followed through, the remaining debt will likely be discharged. The terms of the plan, however, must be fulfilled.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

Chapter 11 can be done by almost any individual or business, with no specific debt-level limits and no required income. Chapter 13 is reserved for individuals with stable incomes, while also having specific debt limits.

The word bankrupt comes from the Latin banca rupta, which literally means broken bench, after the practice of moneylenders breaking the table they used when they were no longer in business.

If you don't pay on your debt for 180 days, your creditor will write your debt off as a loss; your credit score will take a big hit, and you still will owe the debt. Creditors often are willing to negotiate with you even after they write your debt off as a loss.

As long as your charge-off remains unpaid, you're still legally obligated to pay back the amount you owe. Even when a company writes off your debt as a loss for its own accounting purposes, it still has the right to pursue collection.

You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on payment of a debt, consider making your credit report part of the negotiations.

Chapter 11 bankruptcy is the formal process that allows debtors and creditors to resolve the problem of the debtor's financial shortcomings through a reorganization plan. Accordingly, the central goal of chapter 11 is to create a viable economic entity by reorganizing the debtor's debt structure.