An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

If you are looking to finalize, acquire, or print legal document templates, utilize US Legal Forms, the top collection of legal forms available online.

Employ the site’s simple and convenient search feature to find the documents you require.

A wide array of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the necessary form, click the Acquire now button. Choose your preferred pricing plan and input your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to acquire the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

- You can also access forms you previously purchased in the My documents section of your account.

- For first-time users of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

- Step 2. Utilize the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Washington state does not impose a state gift tax, allowing residents to gift during their lifetime without additional state taxes. However, gift laws are governed by federal regulations, including exemptions and the need for reporting certain types of gifts. Understanding the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer is essential, as it may involve significant gifts of property that need proper documentation to comply with legal requirements.

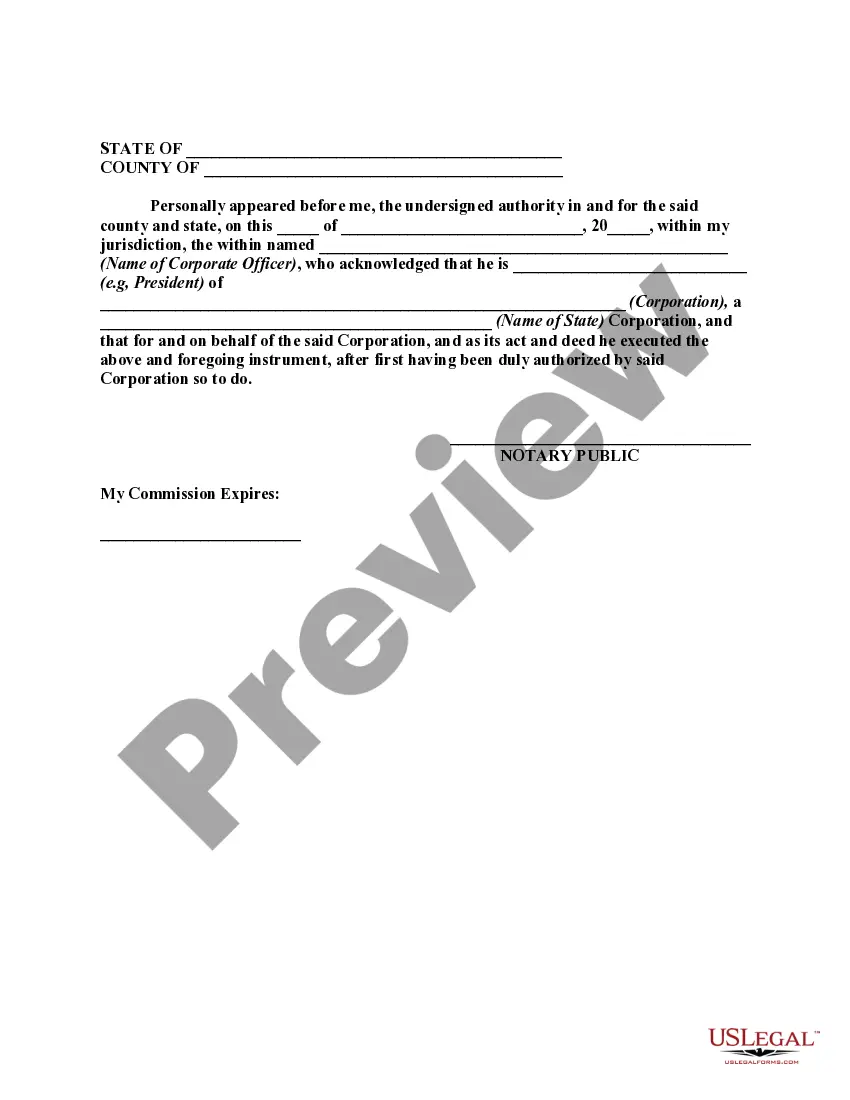

Transferring ownership of a property in Washington state typically requires drafting a new deed that reflects the new owner's name. You will need to have the document signed, notarized, and then recorded at the local county office. If you are considering the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, it is advisable to work with a qualified attorney to ensure all legal requirements are met and the transfer proceeds smoothly.

To gift a house to a family member in Washington state, you need to prepare a deed that clearly states the transfer of ownership. After drafting the deed, it should be signed and notarized, then filed with the county recorder’s office. Utilizing the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer might also affect how the transfer is handled, making it crucial to understand the implications of your decision.

Yes, a seller can back out of a real estate contract in Washington state, but there are specific conditions that must be met. Typically, if a seller wishes to withdraw, they may need to consider any contingencies outlined in the contract. It's advisable to consult a legal expert to discuss the implications of backing out, especially in the context of the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer to avoid potential legal issues.

In Washington state, there is no state gift tax, which means you can gift assets, including real property, without incurring state taxes. However, it's important to be aware of the federal gift tax regulations. The IRS allows an annual gift tax exclusion, which is applicable if you plan to use the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer. Always consult with a tax advisor to ensure compliance and understand your tax obligations.

The statute of limitations on real estate claims can vary but generally aligns with the six-year period for written contracts. This includes disputes regarding property sales or lease agreements. Knowing these timelines is vital for prospective sellers when exploring options like the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

The statute of limitations for property damage in Washington is three years. This timeframe requires claimants to act swiftly if they've experienced any kind of property damage. Recognizing these limitations is crucial when considering real property issues, such as the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

Yes, in Washington state, there is a general time limit of 18 months to settle an estate, though this may vary based on complexity. Executors should prioritize timely resolution to avoid complications. Being aware of these constraints can be beneficial when considering options such as the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

Washington state has various statutes of limitations depending on the type of claim. Generally, the period ranges from three to six years. Understanding these timelines is essential when navigating legal matters, including agreements related to the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

For property damage claims in Washington state, the statute of limitations is typically three years. This means you have three years to file a lawsuit if you suffer damage to your property. Knowing this can assist you in managing your rights effectively, especially when considering options like the Washington Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.