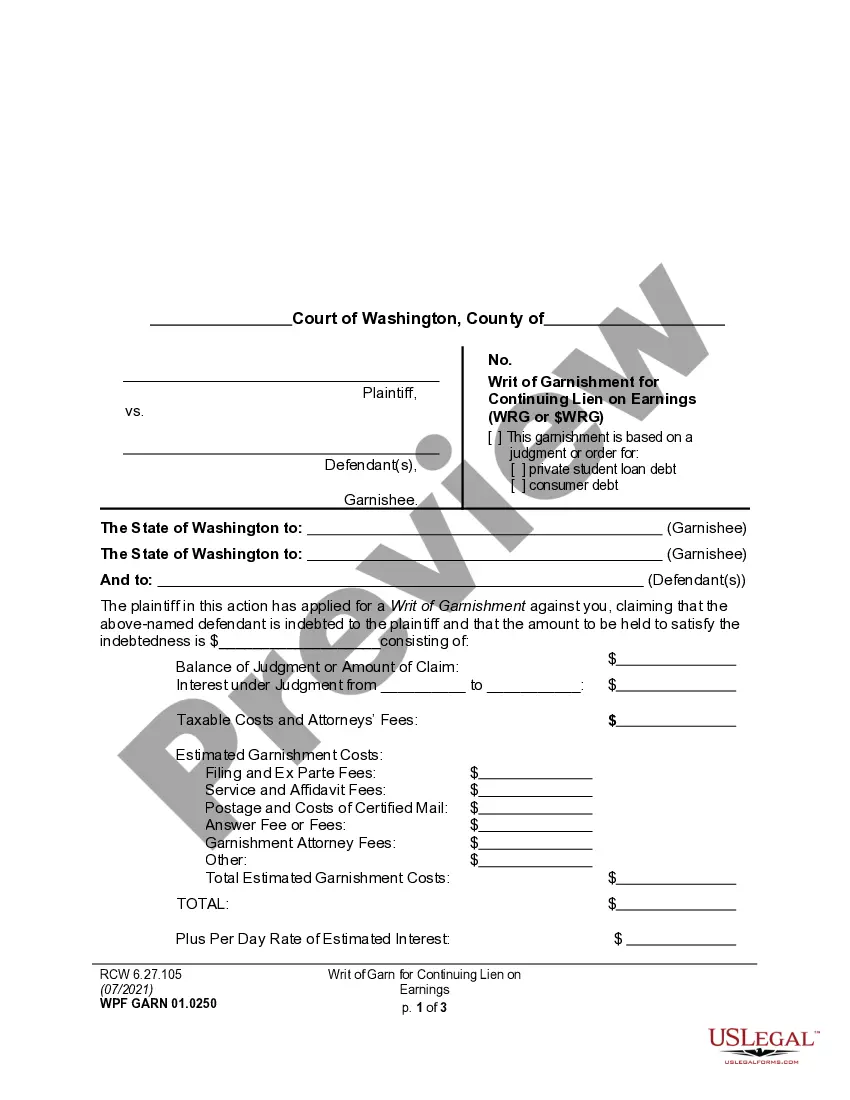

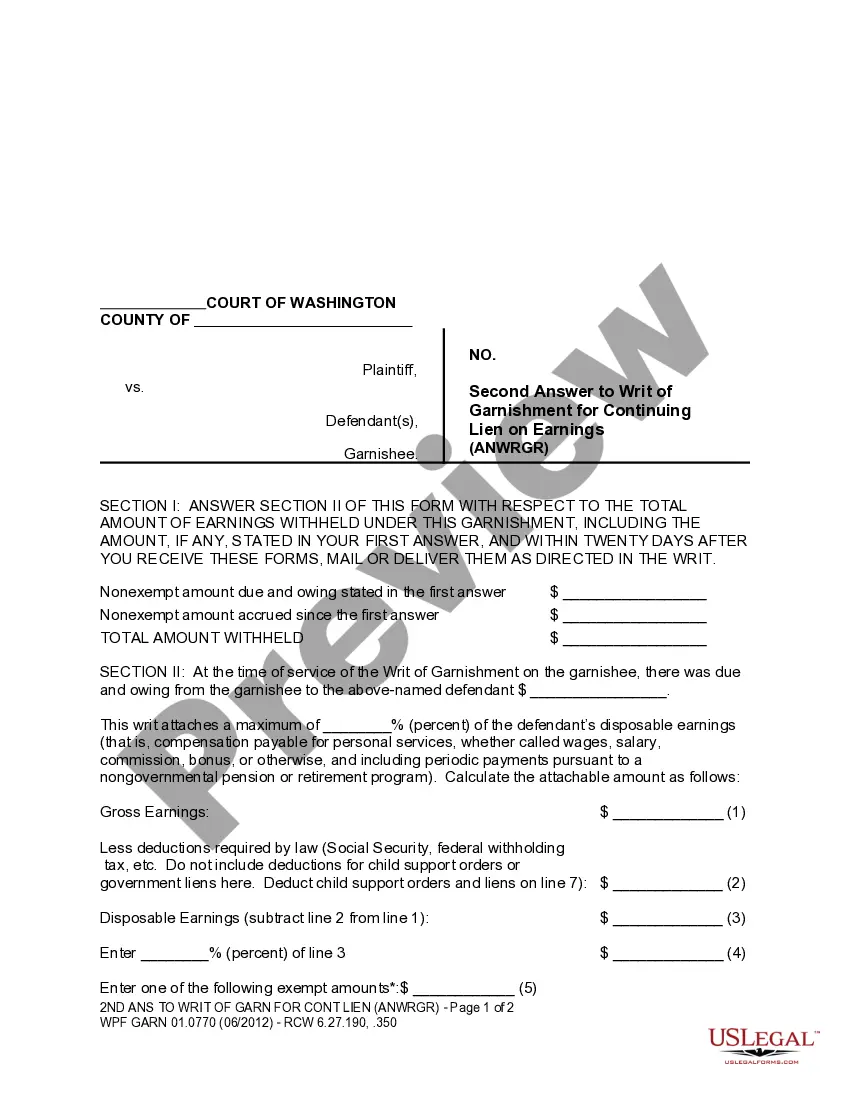

Washington Second Answer To Write of Garnishment For Continuing Lien On Earnings is a legal document used by employers in the state of Washington for responding to a writ of garnishment for a continuing lien on employee earnings. It is used to respond to an order from a court or other authority that requires an employer to withhold a portion of employee wages and turn it over to a creditor. The document includes information such as the employer’s name, the employee’s name, the court order number, the amount of wages to be withheld, and the employer’s signature. There are two types of Washington Second Answer To Write of Garnishment For Continuing Lien On Earnings: one for employers who choose to contest the garnishment and one for employers who do not contest the garnishment.

Washington Second Answer To Writ of Garnishment For Continuing Lien On Earnings

Description

How to fill out Washington Second Answer To Writ Of Garnishment For Continuing Lien On Earnings?

If you’re searching for a way to properly complete the Washington Second Answer To Writ of Garnishment For Continuing Lien On Earnings without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business situation. Every piece of paperwork you find on our online service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Washington Second Answer To Writ of Garnishment For Continuing Lien On Earnings:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Washington Second Answer To Writ of Garnishment For Continuing Lien On Earnings and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments. See RCW 6.15. 010 for a list of other exemptions.

Limits on Wage Garnishment in Washington. In Washington, most creditors can garnish the lesser of (subject to some exceptions?more below): 25% of your weekly disposable earnings, or. your weekly disposable earnings less 35 times the federal minimum hourly wage.

(1) When a writ is issued under a judgment, on or before the date of service of the writ on the garnishee, the judgment creditor shall mail or cause to be mailed to the judgment debtor, by certified mail, addressed to the last known post office address of the judgment debtor, (a) a copy of the writ and a copy of the

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

After 60 days, the judgment creditor's attorney will serve a ?Second Answer.? In response to the Second Answer, the employer must tell the judgment creditor how much was actually withheld during the 60-day period during which the garnishment was effective.

(1) The clerks of the superior courts and district courts of this state may issue writs of garnishment returnable to their respective courts for the benefit of a judgment creditor who has a judgment wholly or partially unsatisfied in the court from which the garnishment is sought.