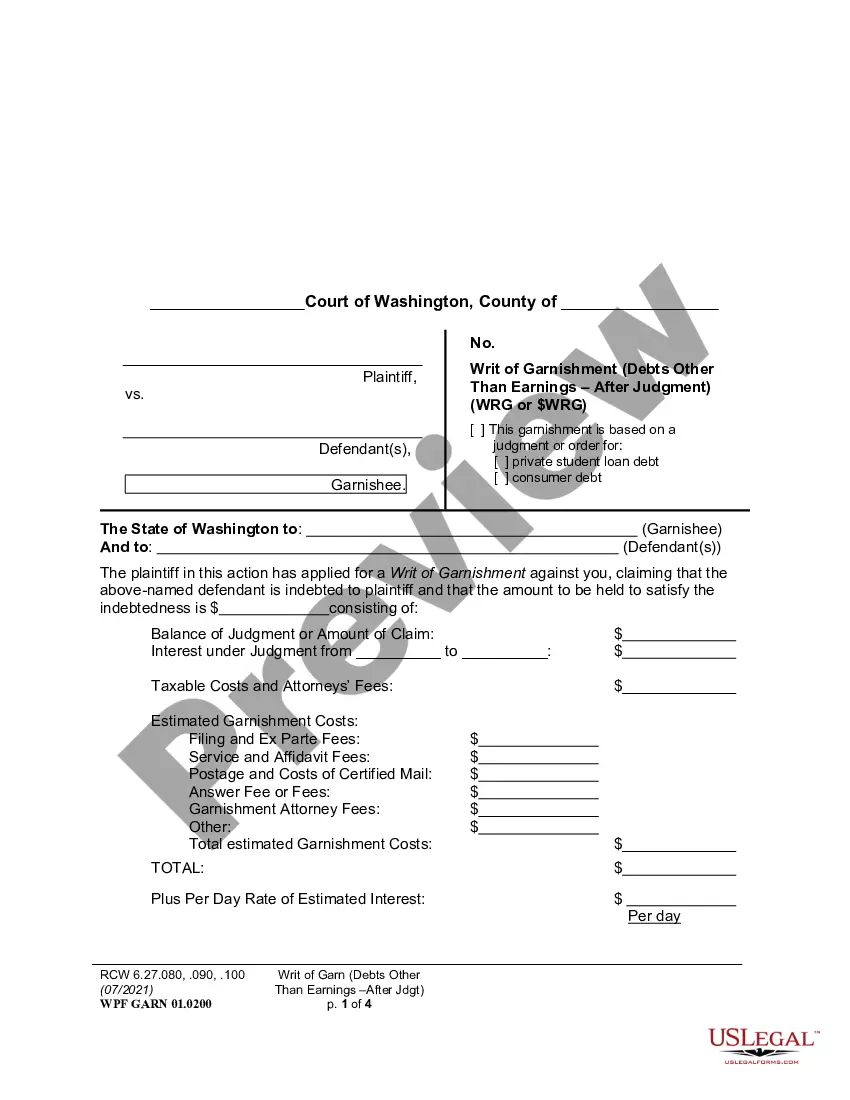

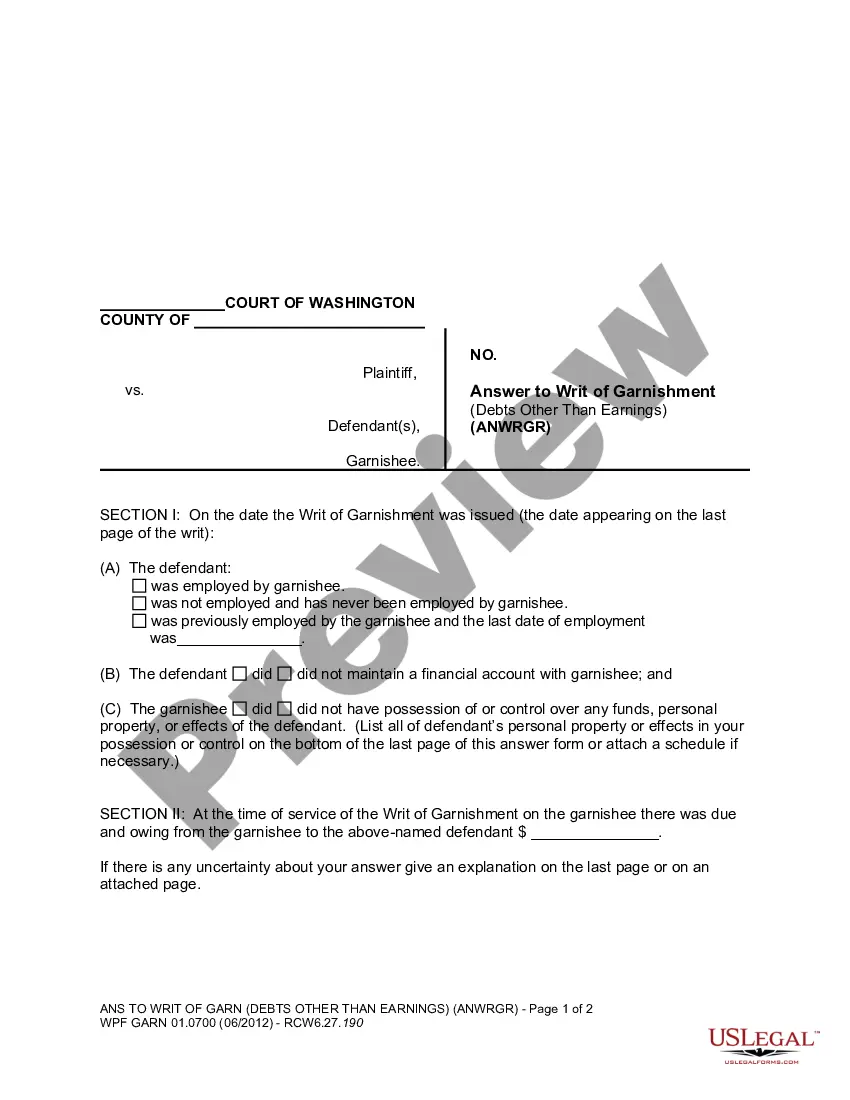

Washington Answer To Write of Garnishment (Debts Other Than Earnings) is an official form that is used in the state of Washington when a creditor attempts to collect a debt from a debtor in the form of a garnishment. This form is used to provide the debtor with an opportunity to respond to the garnishment and assert any defenses or exemptions they may have from the garnishment. This form is completed and filed with the court by the debtor. There are two types of Washington Answer To Write of Garnishment (Debts Other Than Earnings): (1) Answer to Garnishment for Personal Property (Non-Earnings) and (2) Answer to Garnishment of Bank Accounts (Non-Earnings). The Answer to Garnishment for Personal Property (Non-Earnings) form is used when a creditor attempts to garnish the debtor's personal property, such as furniture, jewelry, or vehicles. The Answer to Garnishment of Bank Accounts (Non-Earnings) form is used when a creditor attempts to garnish the debtor's bank accounts, such as checking or savings accounts.

Washington Answer To Writ of Garnishment (Debts Other Than Earnings)

Description

How to fill out Washington Answer To Writ Of Garnishment (Debts Other Than Earnings)?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are examined by our specialists. So if you need to prepare Washington Answer To Writ of Garnishment (Debts Other Than Earnings), our service is the best place to download it.

Obtaining your Washington Answer To Writ of Garnishment (Debts Other Than Earnings) from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should carefully review the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Washington Answer To Writ of Garnishment (Debts Other Than Earnings) and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

In Washington state, creditors can't garnish your wages to collect past-due consumer debt without a court order and judgment. Consumer debt includes credit cards, personal loans, payday loans, car loans, mortgages, rent, and medical debt. Government debt is treated differently.

In Washington, creditors can garnish 25% of your take-home pay. Even if you have a higher income and will need to file a Chapter 13 repayment plan, that is much better than being garnished. In most situations, a garnishment means things have really spun out of control. Only one creditor can garnish at a time.

After 60 days, the judgment creditor's attorney will serve a ?Second Answer.? In response to the Second Answer, the employer must tell the judgment creditor how much was actually withheld during the 60-day period during which the garnishment was effective.

Wage garnishments are taken out of your disposable income, which is the amount left in your paycheck after mandatory deductions are taken out. Also, creditors can never garnish your check for more than the judgment amount. The judgment amount will include the past-due debt, court costs, fees, and interest.

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments.