Kentucky Sample Operating Agreement for Professional Limited Liability Company PLLC

What is this form?

The Sample Operating Agreement for Professional Limited Liability Company (PLLC) is a legal document that outlines the operational procedures and governance of a professional limited liability company in Kentucky. It differentiates itself from other operating agreements by focusing on the unique requirements for professional services. This form is important for ensuring that all members have a clear understanding of their roles, responsibilities, and the structure of the organization.

What’s included in this form

- Formation details of the PLLC, including members' names and the company's purpose.

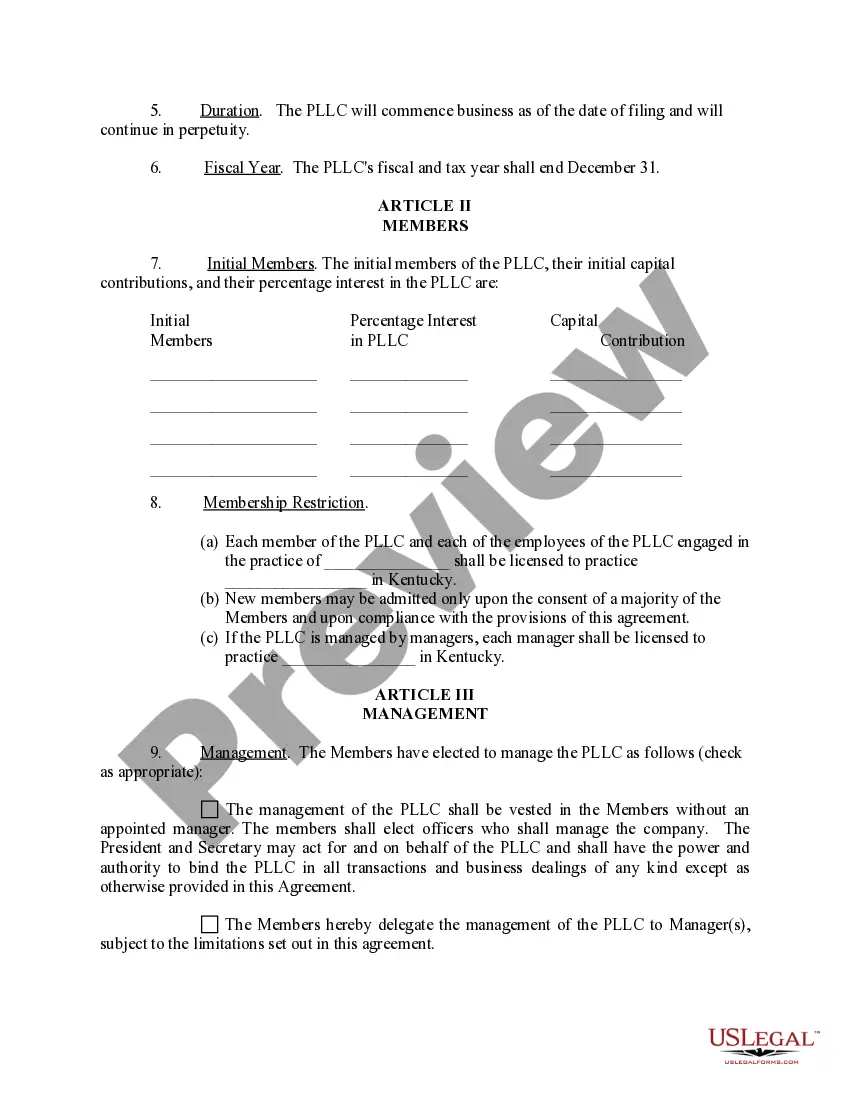

- Management structure, indicating whether the PLLC is member-managed or manager-managed.

- Capital contributions from members and their percentage interests in the PLLC.

- Voting rights and procedures concerning decisions made within the company.

- Distribution of profits and losses among members based on their respective interests.

- Indemnification provisions that protect members and managers from certain liabilities.

When to use this document

This form is useful when forming a professional limited liability company in Kentucky, particularly for licensed professionals such as doctors, lawyers, or accountants. It is needed when multiple members are collaborating and need to establish the rules governing their practices, including financial contributions, managerial authority, and the distribution of profits.

Intended users of this form

- Professionals looking to establish a PLLC in Kentucky.

- Individuals who are licensed to offer professional services.

- Existing PLLC members needing to formalize their operational procedures.

- Any stakeholders seeking clarity around their rights and responsibilities within the organization.

Steps to complete this form

- Identify the PLLC's name and insert it into the designated sections.

- List the names of all initial members and their corresponding capital contributions.

- Indicate the management structure by selecting whether the PLLC will be member-managed or manager-managed.

- Specify the percentage interests of all members in the profits and losses of the PLLC.

- Review and amend any clauses to reflect the specific needs of the members or industry guidelines.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to specify the correct management structure for the PLLC.

- Omitting important details about capital contributions or member percentages.

- Neglecting to update the agreement when changes in membership occur.

- Not ensuring compliance with specific Kentucky professional regulations.

Advantages of online completion

- Convenient access to legal documents from anywhere at any time.

- Easy-to-use templates that can be customized to fit unique business needs.

- Secure storage and retrieval of forms, ensuring compliance with legal standards.

Legal use & context

- This operating agreement serves as an enforceable document setting forth the rules governing the PLLC.

- It helps protect the personal interests of members by outlining their responsibilities and liabilities.

- The agreement must comply with Kentucky law, ensuring that it meets state-specific requirements.

Quick recap

- A PLLC requires a well-defined operating agreement to govern its operation and member interactions.

- Customization of the agreement is essential to reflect the specific needs of professionals within the PLLC.

- Transparency in management and financial contributions is crucial for a successful PLLC operation.

Looking for another form?

Form popularity

FAQ

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

You should check with your profession's regulatory board to determine whether your services are considered professional services under California law. If not, an LLC may be an option for you. PLLCs and LLCs are very similar entity types. The main difference is that only licensed professionals may form PLLCs.

A PLLC is a type of limited liability company, a business that works like a partnership but has the liability protection of a corporation. Some states do not allow certain types of professionals to form an LLC but instead require them to form a PLLC.

When you hire a lawyer in the Priori network, drafting an operating agreement typically costs anywhere from $350-$1000 for a single-member operating agreement and from $750-$5000 for a multi-member operating agreement.

The LLC and PLLC are state constructs; as such, rules vary widely by state.Professionals in California cannot form an LLC or a PLLC, but can form a RLLP (Registered Limited Liability Partnership) or PC (Professional Corporation). And professionals in Arizona can choose between an LLC or PLLC.

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.