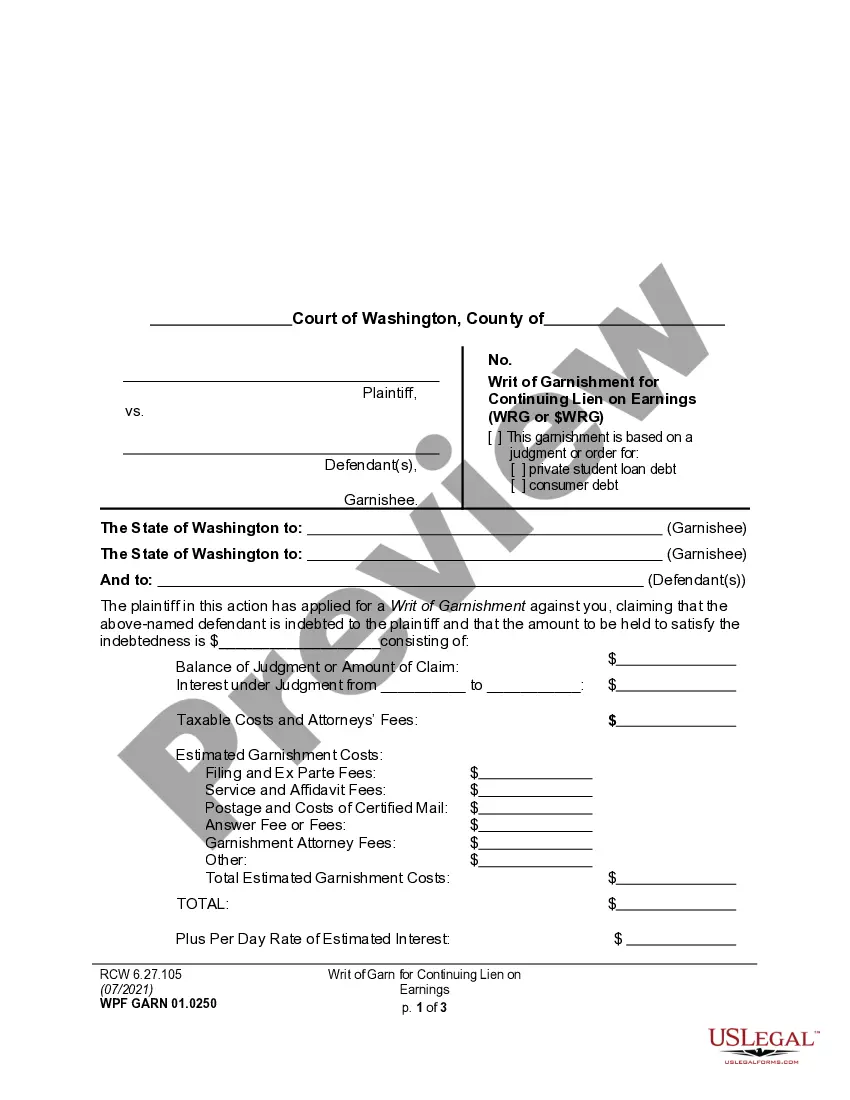

A Washington Writ of Garnishment For Continuing Lien On Earnings is a court order that requires a garnishee (the employer or other party) to withhold and turn over a portion of a debtor’s earnings to the creditor. This type of garnishment is different from a one-time garnishment, which is a single payment to the creditor. A continuing garnishment is a long-term obligation that continues until the debt is paid in full. There are two types of Washington Writ of Garnishment For Continuing Lien On Earnings: 1. Wage Garnishment: A wage garnishment is a court order that requires a garnishee to withhold a portion of the debtor’s wages and turn that money over to the creditor. The amount withheld is based on the debtor’s salary, the amount owed to the creditor, and the state’s maximum garnishment limits. 2. Bank Account Garnishment: A bank account garnishment is a court order that requires the garnishee to freeze the debtor’s bank accounts and turn over any funds in the accounts to the creditor. The amount of the funds that can be taken is based on the amount owed to the creditor and the state’s maximum garnishment limits.

Washington Writ of Garnishment For Continuing Lien On Earnings

Description

How to fill out Washington Writ Of Garnishment For Continuing Lien On Earnings?

If you’re looking for a way to appropriately prepare the Washington Writ of Garnishment For Continuing Lien On Earnings without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business situation. Every piece of documentation you find on our web service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple guidelines on how to get the ready-to-use Washington Writ of Garnishment For Continuing Lien On Earnings:

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Washington Writ of Garnishment For Continuing Lien On Earnings and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Stopping Wage Garnishment in Washington. There are some options for protecting your wages from garnishment, such as by objecting to a writ of garnishment or filing an exemption claim with the court. You can also stop most wage garnishments by filing for bankruptcy. In most cases, the sooner you can do this, the better.

(1) The clerks of the superior courts and district courts of this state may issue writs of garnishment returnable to their respective courts for the benefit of a judgment creditor who has a judgment wholly or partially unsatisfied in the court from which the garnishment is sought.

Second Answer Use the second answer form to tell the creditor what amounts you deducted from the employee's earnings. In filling out the form, calculate the exempt and non-exempt earnings in the same manner as in the first answer form, but indicate the actual amounts withheld as non-exempt earnings.

A Writ of Garnishment is an order that makes the actual garnishment happen. In Washington, the creditor must wait 10 days in superior court (Rule CR 62) and 30 days in district court before they can serve the Writ of Garnishment.

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments.

During the entire 60-day effective period of the garnishment, the employer must withhold the amount due to the judgment creditor from its employee's paycheck.