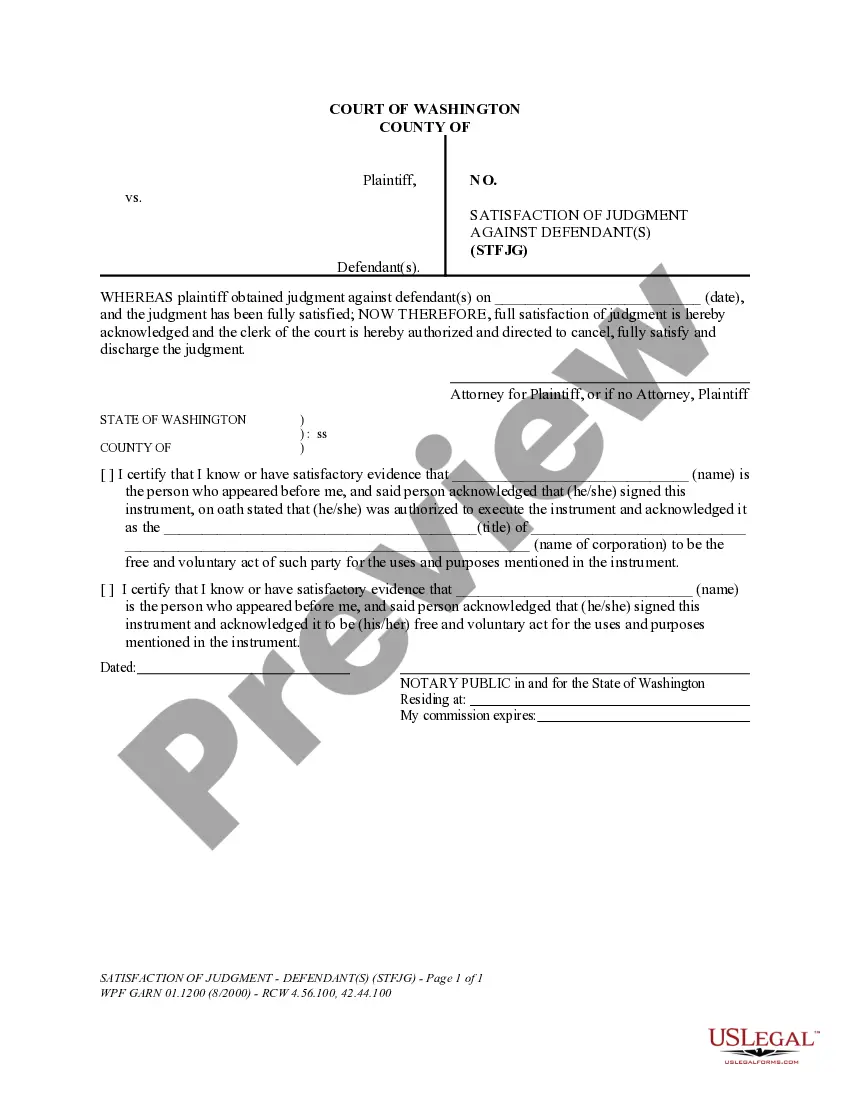

Washington Satisfaction of Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Satisfaction Of Judgment?

Handling legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Washington Satisfaction of Judgment template from our service, you can be certain it meets federal and state laws.

Dealing with our service is simple and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Washington Satisfaction of Judgment within minutes:

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington Satisfaction of Judgment in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Washington Satisfaction of Judgment you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later. It's easy to get a copy of a Satisfaction of Judgment form.

A satisfaction of judgment is a document signed by a judgment creditor and generally filed with the court, indicating that a judgment has been paid in full.

Satisfaction of a judgment means that the judgment is no longer a lien on the debtors real property. The courts cannot control the actions of third parties, but usually, the fact of satisfaction is recorded by the major credit reporting agencies and included in the debtors credit history.

Tells the court and others that a judgment has been paid in full or in part. Can be recorded with a county to release a lien against the judgment debtor's land or filed with the Secretary of State to release a lien against the debtor's personal property.

If the prevailing party receives payment of the judgment, the prevailing party shall file a satisfaction of such judgment with all courts in which the judgment was filed.

Generally, a defendant/debtor must pay the judgment within 30 days or within the amount of time mandated by the court. If a judgment debtor does not pay, the court cannot collect the debt for you. However, you can pursue collection on your own.

A money judgment in your favor does not necessarily mean that the money will be paid, but you can take steps to collect that money. Two of the most common methods involve using the garnishment process to take money from a paycheck or a bank account, or hiring a collection agency to seek payment.

How long does a judgment lien last in Washington? A judgment lien in Washington will remain attached to the debtor's property (even if the property changes hands) for ten years.