Washington Executor's Deed - Executor to Individuals as Joints Tenants with Right of Survivorship

Understanding this form

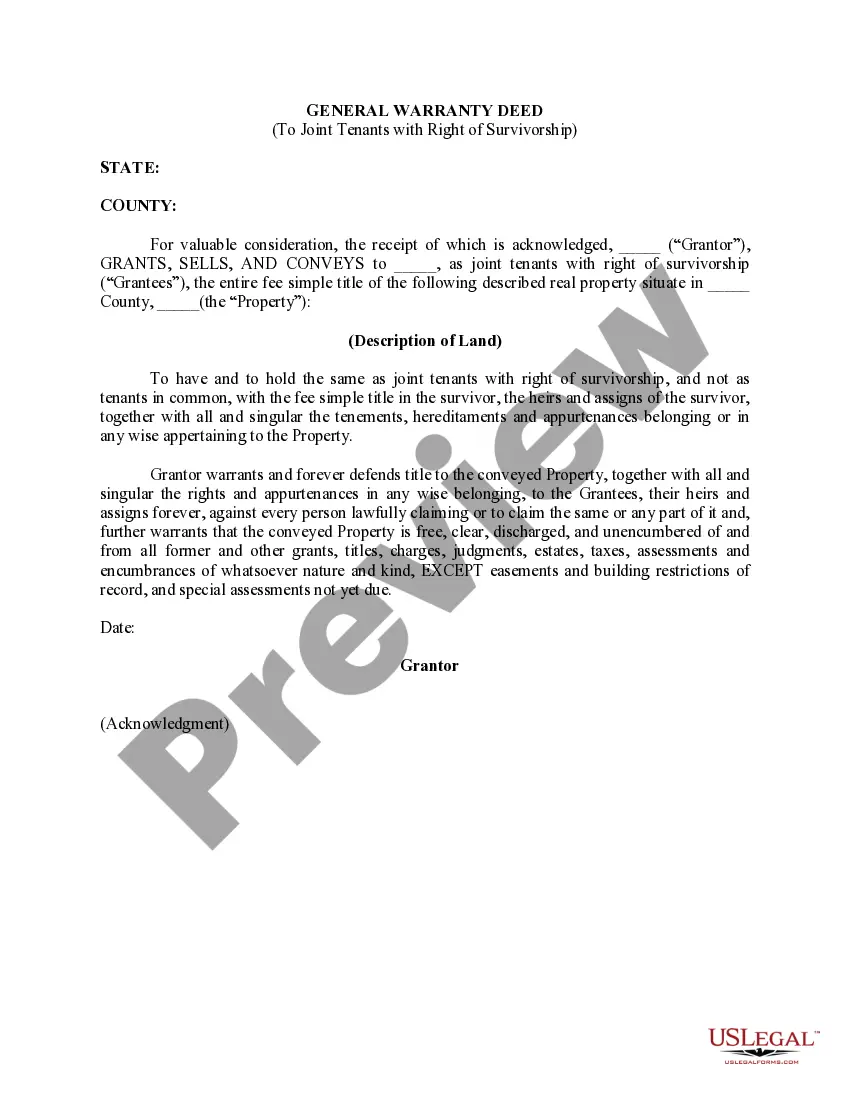

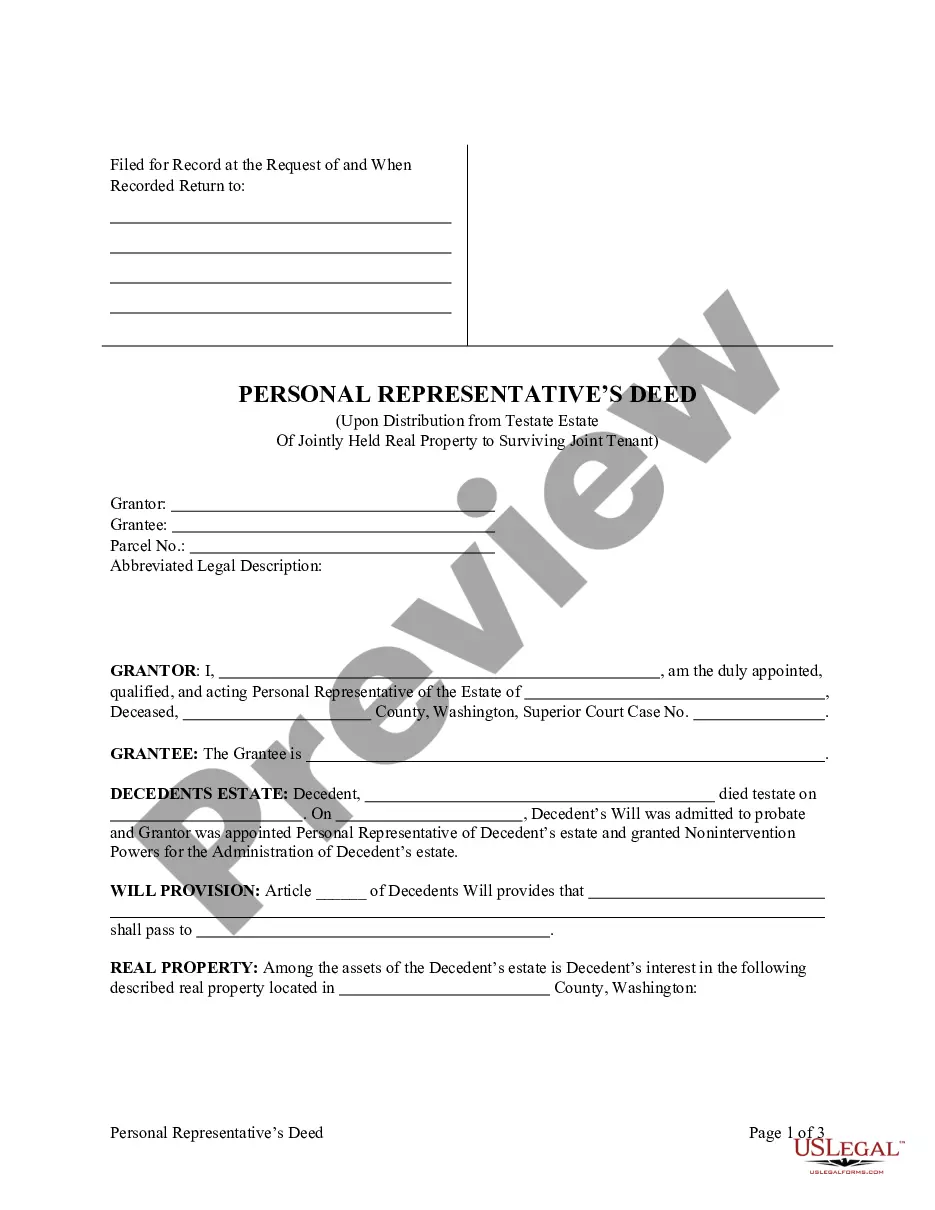

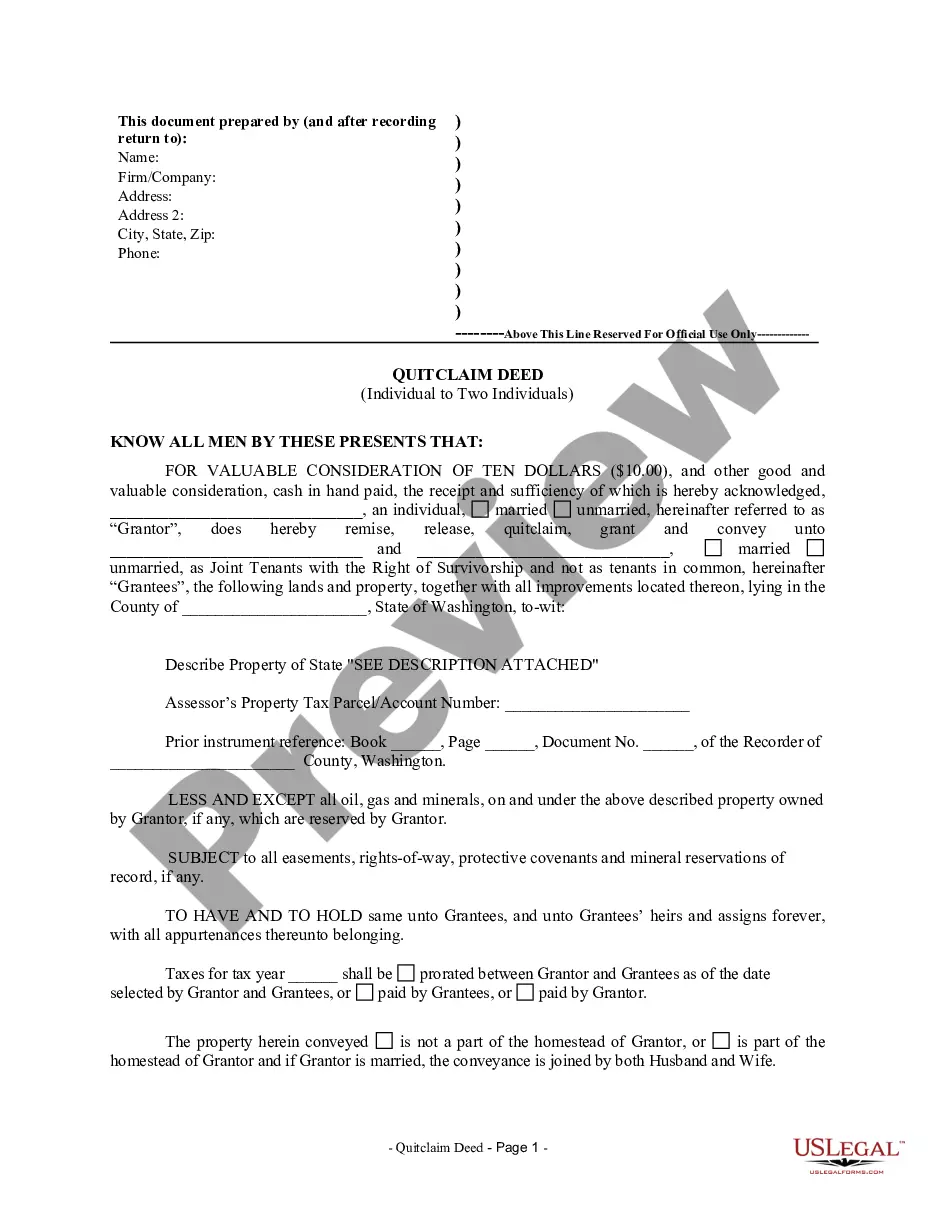

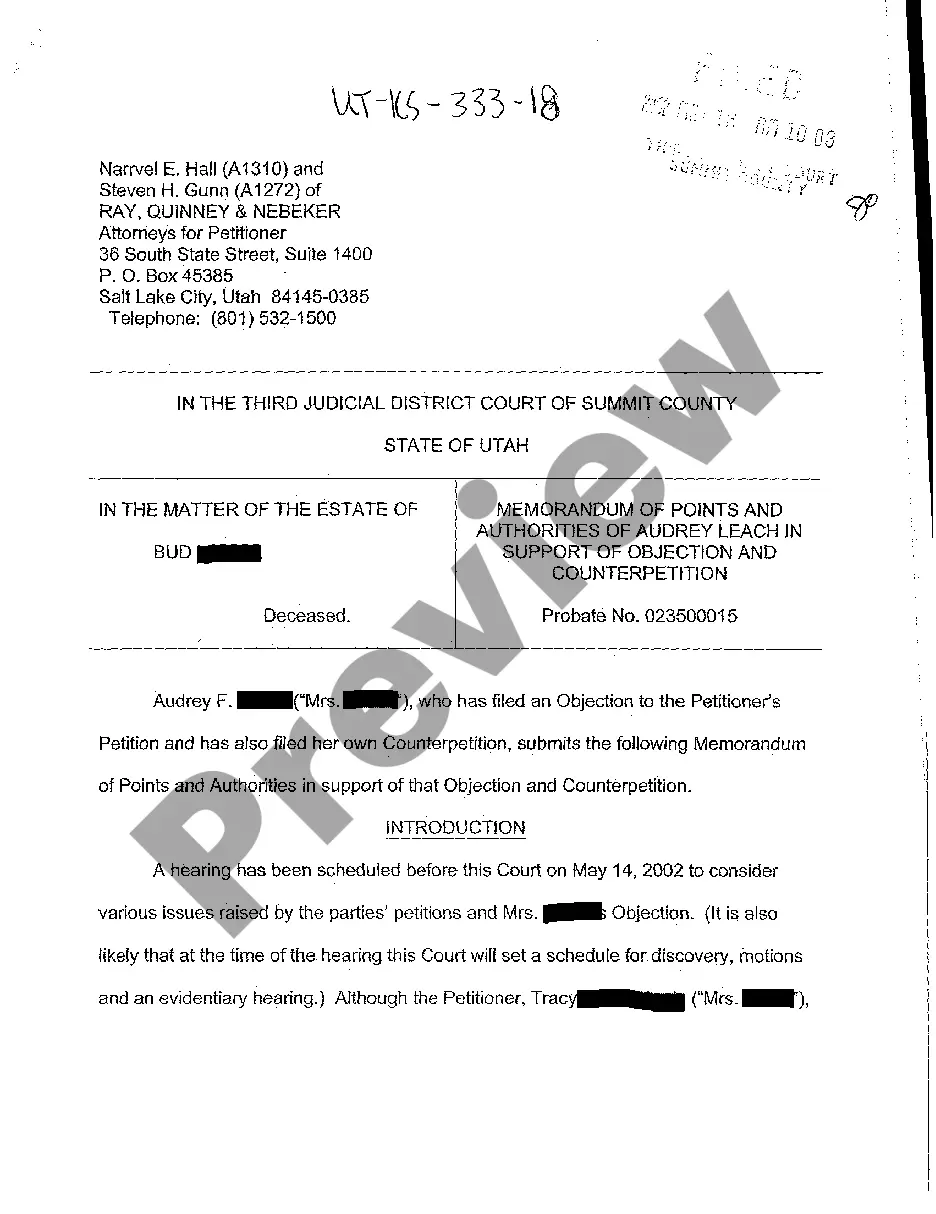

The Executor's Deed is a legal document used by an executor of an estate to transfer property ownership to beneficiaries or purchasers as joint tenants with the right of survivorship. Unlike standard deeds, this document ensures that the grantor, the executor, conveys the property while warranting the title only for events occurring under their administration. This form is crucial for ensuring proper transfer of real property after someone's passing, particularly in accordance with local laws.

Key components of this form

- Identification of the grantor (executor) and grantees (beneficiaries or purchasers).

- Detailed description of the property being conveyed.

- Warranties regarding the title as it pertains to the executor's management.

- Space for signatures, dates, and any seals required for validity.

Common use cases

This form is necessary when an executor needs to transfer real estate from an estate to beneficiaries or buyers while ensuring that the survivorship rights are in place. Use this deed to finalize property transfers that avoid probate complications, keeping in mind that joint tenancy can help in property succession.

Who this form is for

- Executors of an estate who are responsible for asset distribution.

- Beneficiaries who are receiving property as part of an estate plan.

- Individuals purchasing property from the estate through the executor.

How to complete this form

- Identify the parties involved, including the executor and all grantees.

- Clearly specify the property being transferred, including its legal description.

- Enter the date of execution and ensure all necessary signatures are in place.

- Include any required notarization or witnessing information as per state law.

- Keep a copy for your records once completed.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

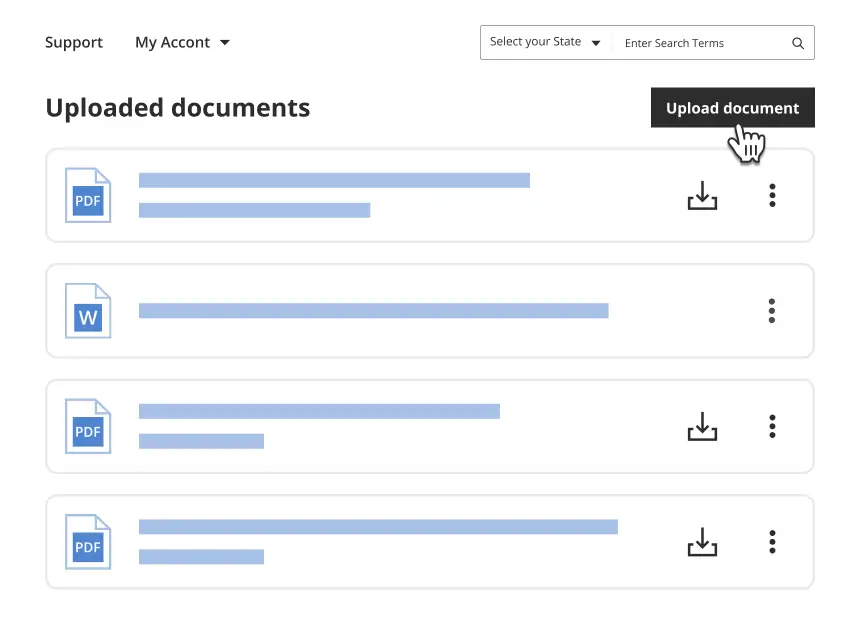

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to fully describe the property being transferred.

- Not obtaining all necessary signatures or dates.

- Omitting vital details about the executor's title and authority.

- Neglecting to check local state requirements for notarization.

Why complete this form online

- Convenience of downloading and filling out the form from anywhere.

- Easy editing with text fields using computer software.

- Assured compliance with the latest legal standards and formats.

- Saving time with a guided template that simplifies the process.

Main things to remember

- The Executor's Deed is essential for property transfers from estates.

- Understanding the specific requirements of your state is crucial.

- Ensure the form is completed accurately to avoid legal complications.

- Using this form online provides convenience and guarantees legal compliance.

Looking for another form?

Form popularity

FAQ

This is true even if the decedent created a will and bequeathed their interest in the property to someone else. This is known as the right of survivorship.The decedent's portion of the property receives a step-up in basis as of the date of their passing.

Jointly owned propertyProperty owned as joint tenants does not form part of a deceased person's estate on death. But the value of the deceased person's share of jointly owned property is included when calculating the value of the estate for Inheritance Tax purposes.

To hold a real estate property in joint tenancy, you and the co-owners have to write the abbreviation for joint tenants with the right of survivorship, or JTWROS, on the official real estate deed or title. This creates a legally binding joint tenancy.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

Joint Tenancy With Right of Survivorship Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies.

Unity of time. Unity of title. Unity of interest. Unity of possession.

Most jointly owned property is held as joint tenants but you should not assume this.As property held under a joint tenancy will automatically pass to the surviving joint owners it will not form part of the deceased's estate except for the purposes of calculating inheritance tax.

Joint Tenancy With Survivorship In this arrangement, tenants have an equal right to the account's assets. They are also afforded survivorship rights in the event of the death of another account holder. In simple terms, it means that when one partner or spouse dies, the other receives all of the money or property.

The General Rule. In the great majority of states, if you and the other owners call yourselves "joint tenants with the right of survivorship," or put the abbreviation "JT WROS" after your names on the title document, you create a joint tenancy. A car salesman or bank staffer may assure you that other words are enough.