Washington Executor's Deed - Executor to Individuals as Joints Tenants with Right of Survivorship

What this document covers

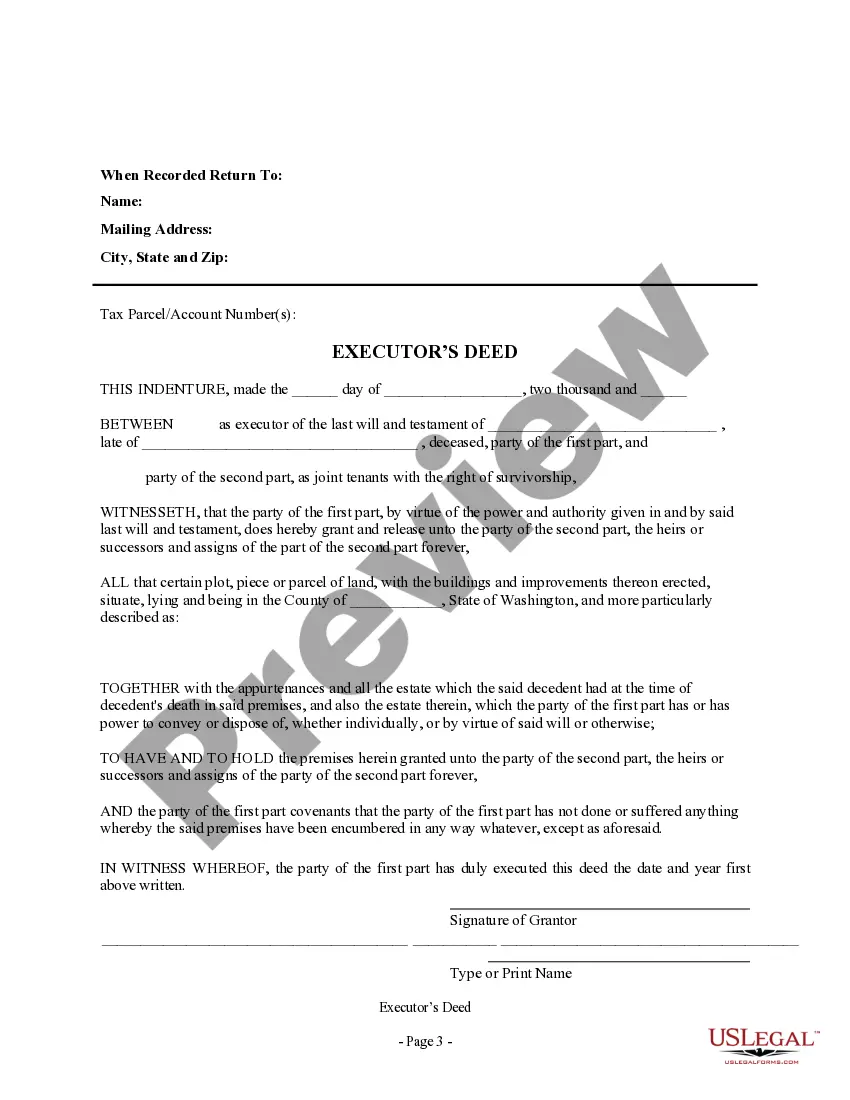

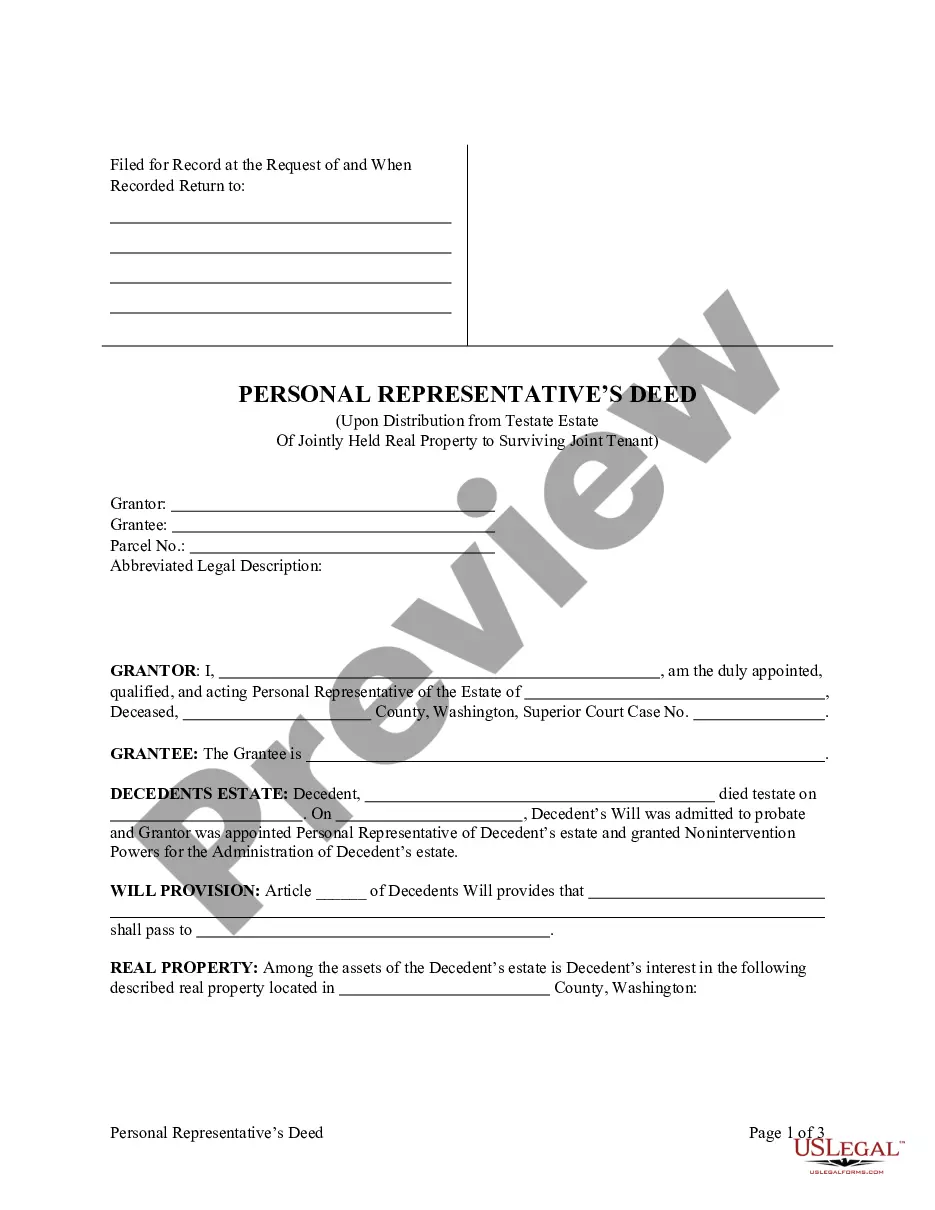

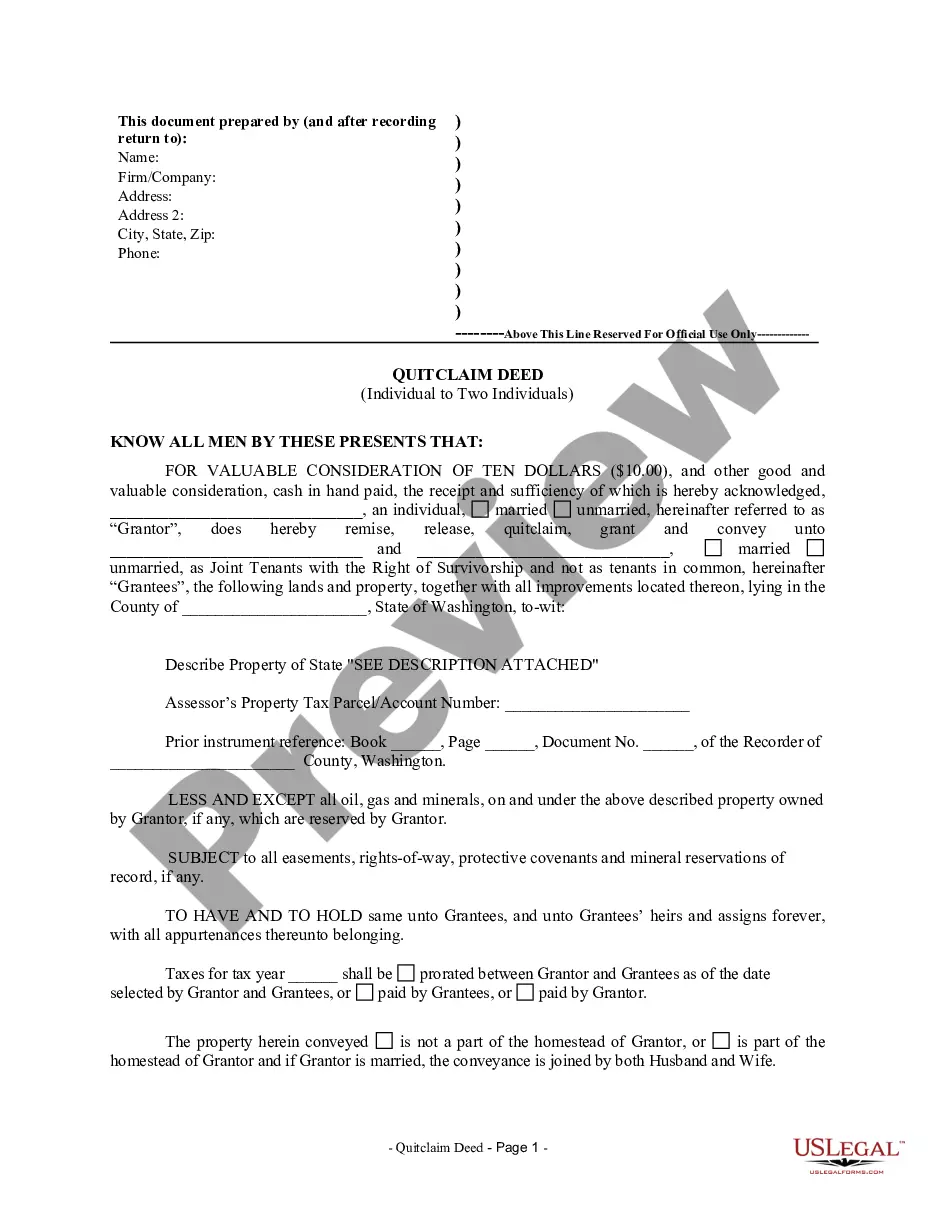

The Executor's Deed is a legal document used when an executor conveys property from an estate to individuals as joint tenants with the right of survivorship. This form ensures that the beneficiaries or purchasers receive clear title to the property. Unlike other deeds, this specific Executor's Deed includes a warranty of title only for actions taken while the executor held the property, offering protection to both the executor and the grantees.

Form components explained

- Identification of the grantor as the executor of the estate.

- Details of the grantees, including their names and designation as joint tenants.

- Legal description of the property being conveyed.

- Warranties regarding the title by the executor.

- Date of execution and necessary signatures.

When to use this document

This form is essential in situations where an executor is distributing property from a deceased person's estate to beneficiaries or buyers. It is commonly used when the executor wants to transfer ownership to individuals directly while establishing that they hold the property jointly with rights of survivorship, ensuring automatic transfer of ownership to the surviving joint tenant upon one tenant's death.

Intended users of this form

This form is intended for:

- Executors of estates handling property distribution.

- Beneficiaries receiving property as part of an estate.

- Individuals purchasing property from an estate.

Steps to complete this form

- Identify and enter the names of the parties involved, including the executor and the grantees.

- Provide a detailed legal description of the property being transferred.

- Include the date of the execution of the deed.

- Ensure all parties sign the document where indicated.

- Consider having the document notarized to ensure its legal validity.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately describe the property in the legal description section.

- Not including all necessary signatures, particularly from the executor.

- Neglecting to check state-specific requirements that may apply.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy corrections without the need for starting over.

- Access to attorney-drafted documents ensures legal reliability.

Looking for another form?

Form popularity

FAQ

This is true even if the decedent created a will and bequeathed their interest in the property to someone else. This is known as the right of survivorship.The decedent's portion of the property receives a step-up in basis as of the date of their passing.

Jointly owned propertyProperty owned as joint tenants does not form part of a deceased person's estate on death. But the value of the deceased person's share of jointly owned property is included when calculating the value of the estate for Inheritance Tax purposes.

To hold a real estate property in joint tenancy, you and the co-owners have to write the abbreviation for joint tenants with the right of survivorship, or JTWROS, on the official real estate deed or title. This creates a legally binding joint tenancy.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

Joint Tenancy With Right of Survivorship Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies.

Unity of time. Unity of title. Unity of interest. Unity of possession.

Most jointly owned property is held as joint tenants but you should not assume this.As property held under a joint tenancy will automatically pass to the surviving joint owners it will not form part of the deceased's estate except for the purposes of calculating inheritance tax.

Joint Tenancy With Survivorship In this arrangement, tenants have an equal right to the account's assets. They are also afforded survivorship rights in the event of the death of another account holder. In simple terms, it means that when one partner or spouse dies, the other receives all of the money or property.

The General Rule. In the great majority of states, if you and the other owners call yourselves "joint tenants with the right of survivorship," or put the abbreviation "JT WROS" after your names on the title document, you create a joint tenancy. A car salesman or bank staffer may assure you that other words are enough.