Connecticut Promissory Note - Horse Equine Forms

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Promissory Note - Horse Equine Forms?

The greater the number of documents you need to produce - the more anxious you grow.

You can find an extensive array of Connecticut Promissory Note - Horse Equine Forms templates online, yet you remain uncertain which ones to trust.

Eliminate the trouble of obtaining examples, making the acquisition much easier with US Legal Forms.

Provide the required information to create your account and process payment using your PayPal or credit card. Select a convenient document format and obtain your copy. Access all templates available to you in the My documents section. Simply navigate there to generate a new copy of the Connecticut Promissory Note - Horse Equine Forms. Even with professionally crafted templates, it is still advisable to consult your local attorney to verify that your document is properly completed. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms membership, Log In to your account, and you will see the Download button on the Connecticut Promissory Note - Horse Equine Forms page.

- If you haven’t used our site before, follow the guidelines to complete the registration process.

- Verify whether the Connecticut Promissory Note - Horse Equine Forms is applicable in your state.

- Confirm your choice by reviewing the description or utilizing the Preview feature if available for the chosen file.

- Hit Buy Now to commence the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

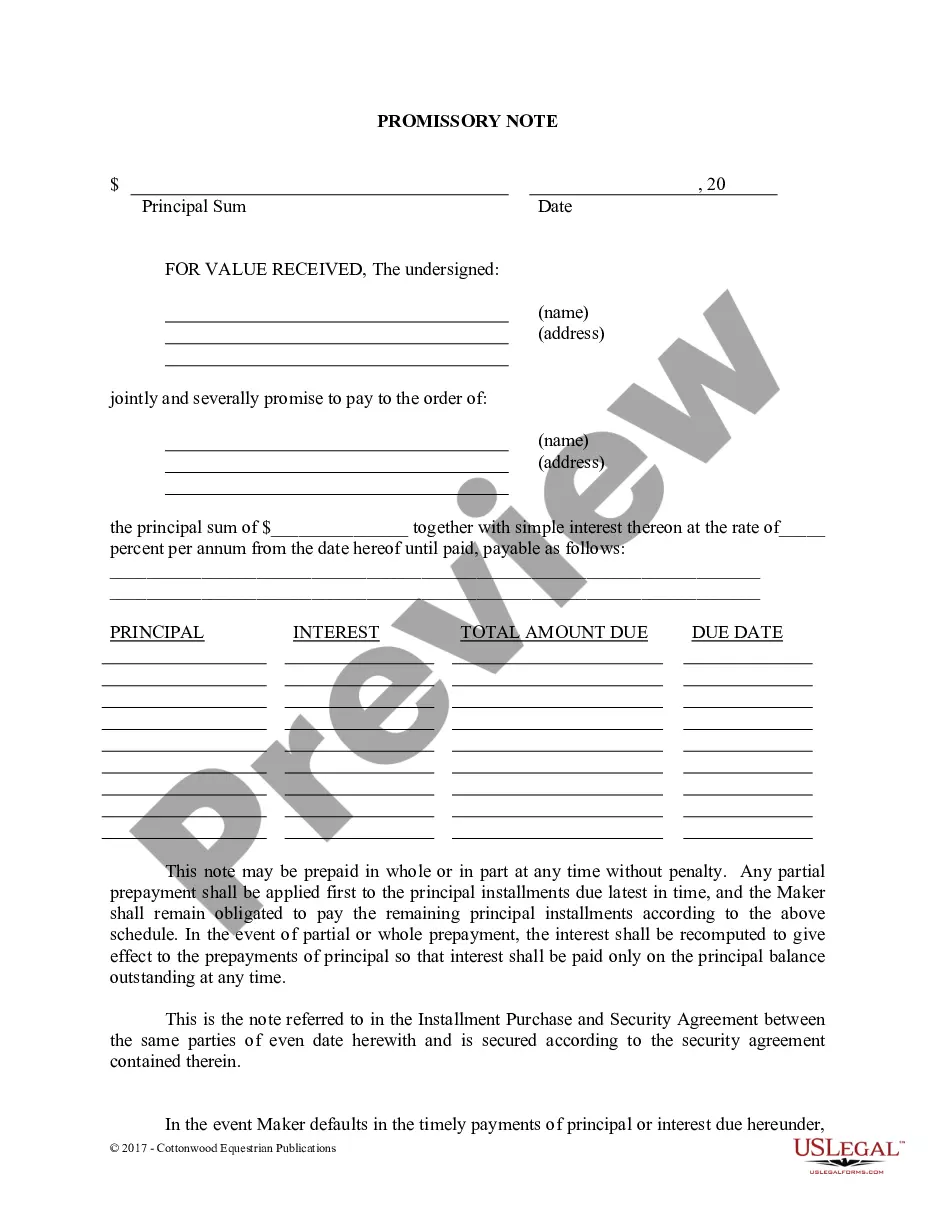

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document. To make a Promissory Note enforceable, I must contain the following information.Date of Repayment - The note must clearly state the date on which the repayment for the loaned amount must be paid.

Banks hold the majority of mortgage notes but it is possible for individuals and companies to also buy and hold notes.Individual people do buy promissory notes but it is wise to go with an established company who has the experience, knowledge and funds to buy notes.