Vermont Assignment of Production Payment Measured by Quantity of Production

Description

How to fill out Assignment Of Production Payment Measured By Quantity Of Production?

You are able to devote hours online searching for the legitimate file web template that meets the state and federal demands you need. US Legal Forms offers a large number of legitimate types that are analyzed by professionals. You can actually down load or print out the Vermont Assignment of Production Payment Measured by Quantity of Production from my assistance.

If you already possess a US Legal Forms account, you can log in and then click the Acquire button. Afterward, you can total, revise, print out, or signal the Vermont Assignment of Production Payment Measured by Quantity of Production. Each and every legitimate file web template you acquire is your own eternally. To obtain one more copy of the acquired develop, visit the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website for the first time, adhere to the basic directions beneath:

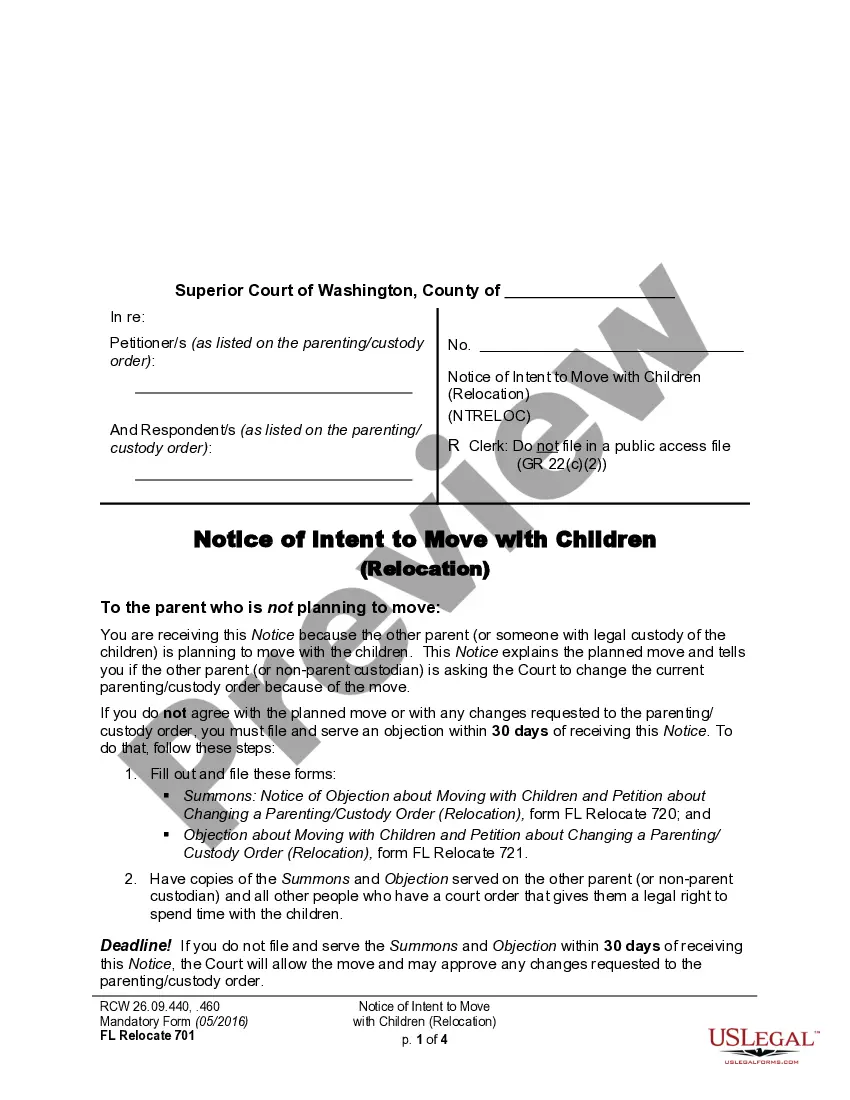

- Very first, make certain you have selected the correct file web template to the state/metropolis that you pick. Browse the develop outline to make sure you have selected the proper develop. If readily available, utilize the Review button to look throughout the file web template as well.

- In order to find one more model of your develop, utilize the Lookup discipline to find the web template that suits you and demands.

- When you have discovered the web template you would like, click Get now to carry on.

- Find the prices prepare you would like, key in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal account to fund the legitimate develop.

- Find the format of your file and down load it in your gadget.

- Make adjustments in your file if needed. You are able to total, revise and signal and print out Vermont Assignment of Production Payment Measured by Quantity of Production.

Acquire and print out a large number of file themes while using US Legal Forms web site, which provides the largest collection of legitimate types. Use professional and express-particular themes to deal with your organization or specific requirements.

Form popularity

FAQ

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed.

There are two types of property taxes in Vermont: local property taxes and the state education tax rate. Local property tax rates are determined by municipalities and are applied to a home's assessed value. The assessed value is determined by local assessors, who are called listers in Vermont.

When a transfer is made by deed, the buyer or transferee is liable for the transfer tax.

In Vermont, a real estate withholding tax is imposed on non-resident property sellers to ensure that the state collects any income tax owed on the gain from the sale of the property. This withholding tax is typically calculated at 2.5% of the sale price and is due at the time of the sale.

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.

In the State of Vermont, you have the legal right to refuse access to your property for an inspection by the assessor's office. The assessor is then required to follow State statute and value your property to the best of his/her ability without seeing the grade, condition, updating and other possible improvements.