Bartering are agreements for the exchange of personal property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal property. Agreements for the exchange of personal property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal property. A binding exchange agreement is formed if an offer to make an exchange is unconditionally accepted before the offer has been revoked. Federal tax aspects of exchanges of personal property should be considered carefully in the preparation of an exchange agreement.

Guam Contract or Agreement to Make Exchange or Barter and Assume Debt

Description

How to fill out Contract Or Agreement To Make Exchange Or Barter And Assume Debt?

Are you presently in a situation where you require documents for both corporate or particular purposes almost every day.

There are numerous legal document templates available on the internet, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, which are designed to meet state and federal requirements.

If you discover the right form, click Buy now.

Choose the payment plan you want, fill in the necessary information to create your account, and pay for the order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Guam Contract or Agreement to Make Exchange or Barter and Assume Debt template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

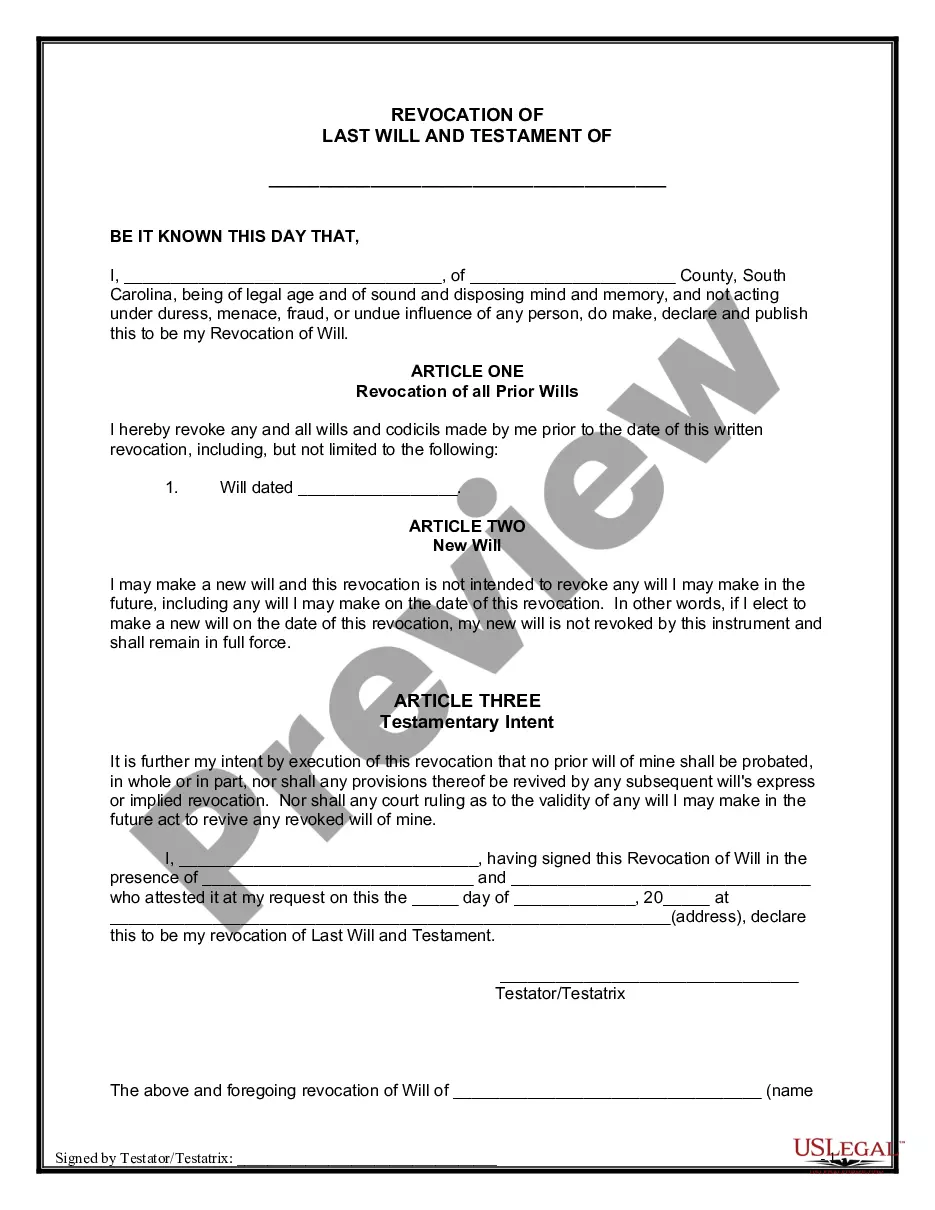

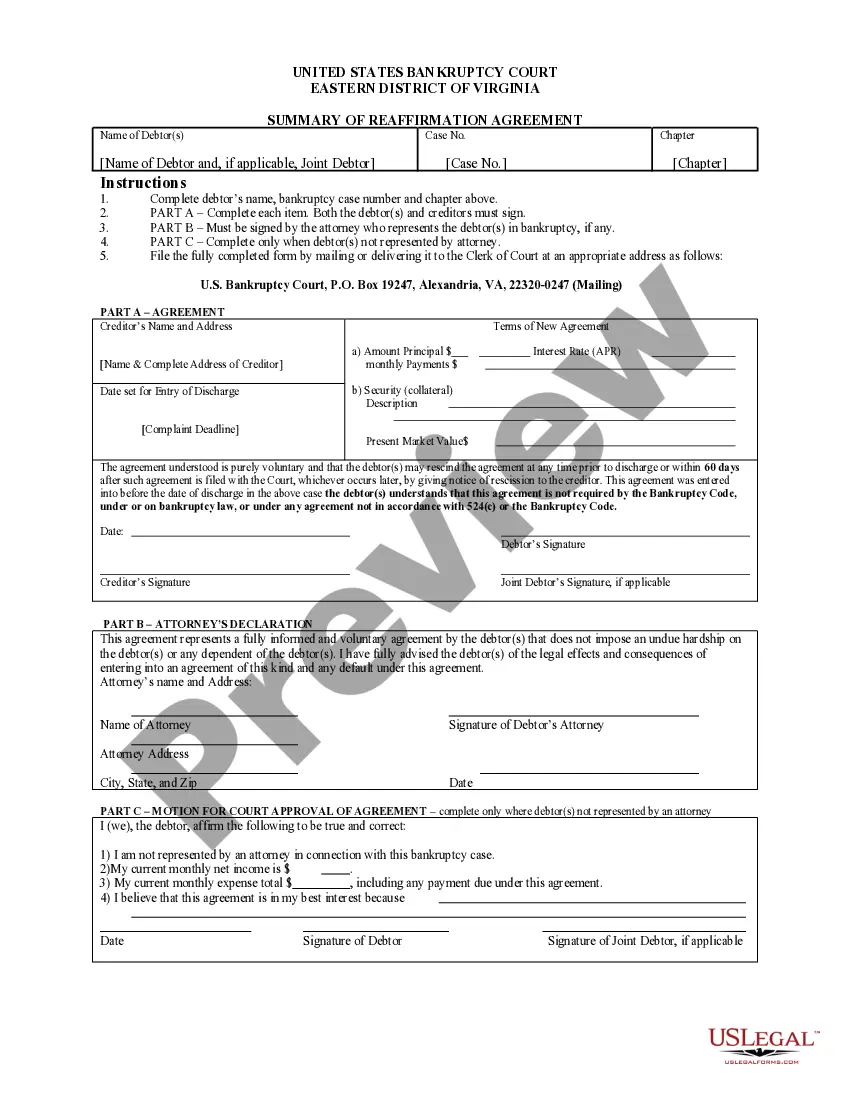

- Utilize the Review button to examine the form.

- Read the details to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup area to find a form that meets your needs and requirements.

Form popularity

FAQ

Writing payment terms in a contract involves specifying the amount due, payment method, and due dates. Clearly state any penalties for late payments to ensure compliance. By integrating the concepts of a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, you can make these terms more robust and enforceable.

To write a barter agreement, start by identifying the goods or services each party will provide. Clearly outline the exchange terms, including delivery dates and responsibilities. Implementing a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt in this context can strengthen the agreement and protect all parties involved.

Writing a simple contract between two parties requires a straightforward approach. Clearly state the parties involved, outline the purpose of the contract, and define the terms and conditions. Including information about a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt ensures the contract serves legal purposes while remaining easy to understand.

Filling out a contract agreement requires careful attention to detail. Start by adding the names and addresses of all parties, followed by the terms of the agreement including services, payment, and deadlines. Incorporating elements of a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt can enhance clarity and enforceability.

Creating a contract agreement between two parties for payment involves several key elements. Begin by stating the details of both parties, specify the payment terms, and outline the consequences for non-compliance. Make sure to include references to a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt to give the agreement a legal basis.

To write a contract agreement for payment between two parties, start by clearly identifying both parties involved. Outline the specifics of the payment, including the amount, due date, and payment method. Ensure the purpose of the agreement is understood by all parties, especially if it involves a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt.

Yes, US territories, including Guam, have sales tax regulations that apply to businesses and consumers alike. This means if you are involved in a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, understanding these tax laws is crucial for compliance. Sales tax can affect various aspects of business operations, so staying informed helps you avoid legal complications. Utilizing platforms like uslegalforms can assist you in drafting compliant agreements.

Guam's sales tax, known as the Gross Receipts Tax, is generally assessed at a rate of 4% on sales made within the territory. If you are using a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, being aware of the sales tax implications is essential for budgeting. This tax applies to most transactions, influencing your overall costs. Therefore, it is wise to include tax considerations in your contractual agreements.

The business privilege tax in Guam applies to businesses earning gross receipts and is calculated on a sliding scale. If you're entering into a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, understanding this tax is vital for your financial planning. It impacts your overall business strategy and should be factored into your financial forecasts. Utilizing legal forms can help you navigate these regulations effectively.

In Guam, failing to comply with tax obligations can lead to penalties, including fines or interest on unpaid taxes. If you are managing a Guam Contract or Agreement to Make Exchange or Barter and Assume Debt, it is crucial to stay informed about these penalties. Timely and accurate tax reporting can help prevent costly measures. Consulting a tax professional is recommended to ensure compliance and protection against penalties.