Bartering are agreements for the exchange of personal property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal property. Agreements for the exchange of personal property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal property. A binding exchange agreement is formed if an offer to make an exchange is unconditionally accepted before the offer has been revoked. Federal tax aspects of exchanges of personal property should be considered carefully in the preparation of an exchange agreement.

West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt

Description

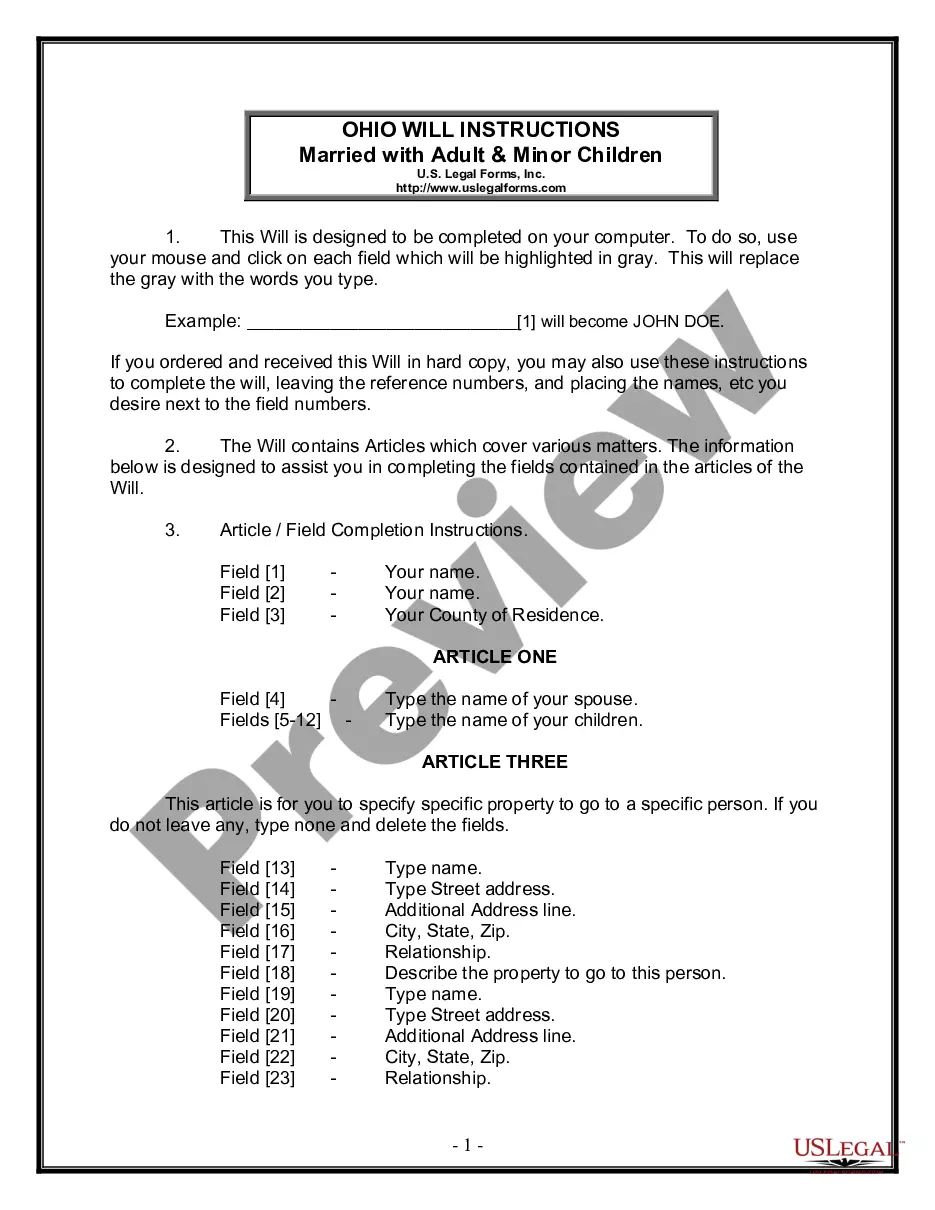

How to fill out Contract Or Agreement To Make Exchange Or Barter And Assume Debt?

Locating the appropriate sanctioned document format could pose a challenge. Clearly, there are numerous templates accessible online, but how can you find the authorized format you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt, which can be utilized for both business and personal purposes. All of the forms are verified by professionals and comply with state and federal standards.

If you are currently registered, Log In to your account and click the Download button to obtain the West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt. Use your account to browse the legal forms you have acquired previously. Navigate to the My documents tab in your account to retrieve another copy of the document you need.

Choose the file format and download the legal document to your device. Complete, edit, print, and sign the acquired West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt. US Legal Forms is the largest repository of legal templates where you can find various document formats. Use the service to obtain correctly drafted papers that meet state requirements.

- First, ensure you have selected the correct form for your state/region.

- You can review the form using the Preview option and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- When you are confident that the form is appropriate, click the Get now button to acquire the form.

- Select the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

In West Virginia, a breach of contract occurs when a party fails to fulfill their obligations as outlined in the agreement. The essential elements include the existence of a valid contract, the breach of that contract, and the damages incurred as a result. Understanding the components of a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt can help you recognize when a breach has occurred. For further assistance, US Legal Forms offers a variety of resources to ensure your contracts are legally sound.

Section 38 1 14 of the West Virginia Code addresses the rights and obligations surrounding the enforcement of contracts in the state. This section provides clarity on the procedures for enforcing a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt, ensuring that parties understand their responsibilities. It emphasizes the importance of proper documentation and adherence to legal requirements in contract creation. Utilizing tools like US Legal Forms can assist you in navigating these legal matters effectively.

For a contract to be legally binding in West Virginia, it must include an offer, acceptance, consideration, and the mutual intent of all parties to create a binding agreement. Importantly, parties must also have the legal capacity to enter into the contract. When drafting a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt, ensure all essential elements are clearly articulated to avoid future disputes.

To assign an agreement, you generally need to create a formal assignment document that outlines the transfer of rights and obligations. Be sure to notify all parties involved about the assignment, ensuring transparency throughout the process. If your agreement is a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt, draft this assignment carefully to maintain enforceability in the state.

A valid contract in West Virginia must include offer, acceptance, consideration, capacity, and legality. These elements ensure that all parties understand their obligations and that the agreement is enforceable. Without any of these components, your West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt may not be valid. Always consult legal resources or professionals to review your contract.

In West Virginia, a verbal agreement can hold up in court, but it is often difficult to enforce. This is because proving the terms of a verbal agreement can be challenging without written documentation. To ensure clarity and protect your interests, it is advisable to formalize any exchange or barter by creating a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt.

For an agreement to be valid, two key actions must occur: an offer must be made, and that offer must be accepted by the other party. The offer needs to be clear and specific to avoid misunderstandings, while acceptance indicates agreement to the terms proposed. This principle is fundamental to any West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt. To ensure clarity and legal standing, turn to uslegalforms for a well-drafted contract.

A legally binding contract requires six conditions: mutual consent, lawful object, consideration, competent parties, a written form (if necessary), and clear terms. Each condition serves a specific purpose in ensuring that the contract can be legally enforced. When forming a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt, it is critical to satisfy all these conditions. Consider uslegalforms as a helpful resource to fulfill these requirements efficiently.

To create a valid contract, six requirements must be met: there must be an offer, acceptance of that offer, sufficient consideration, mutual consent, competency of parties, and legal purpose. These elements ensure the contract stands up in court and reflects a true agreement. Paying attention to these requirements is vital when drafting a West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt. If unsure, using platforms like uslegalforms can guide you through the process.

The six essential elements of a legally enforceable contract include offer, acceptance, consideration, capacity, legality, and intent to create a legal obligation. Offer and acceptance demonstrate mutual agreement. Consideration refers to the value exchanged, while capacity ensures that both parties can legally participate. Legality means the contract's purpose is lawful, and intent confirms that both parties understood their legal responsibilities, crucial in any West Virginia Contract or Agreement to Make Exchange or Barter and Assume Debt.