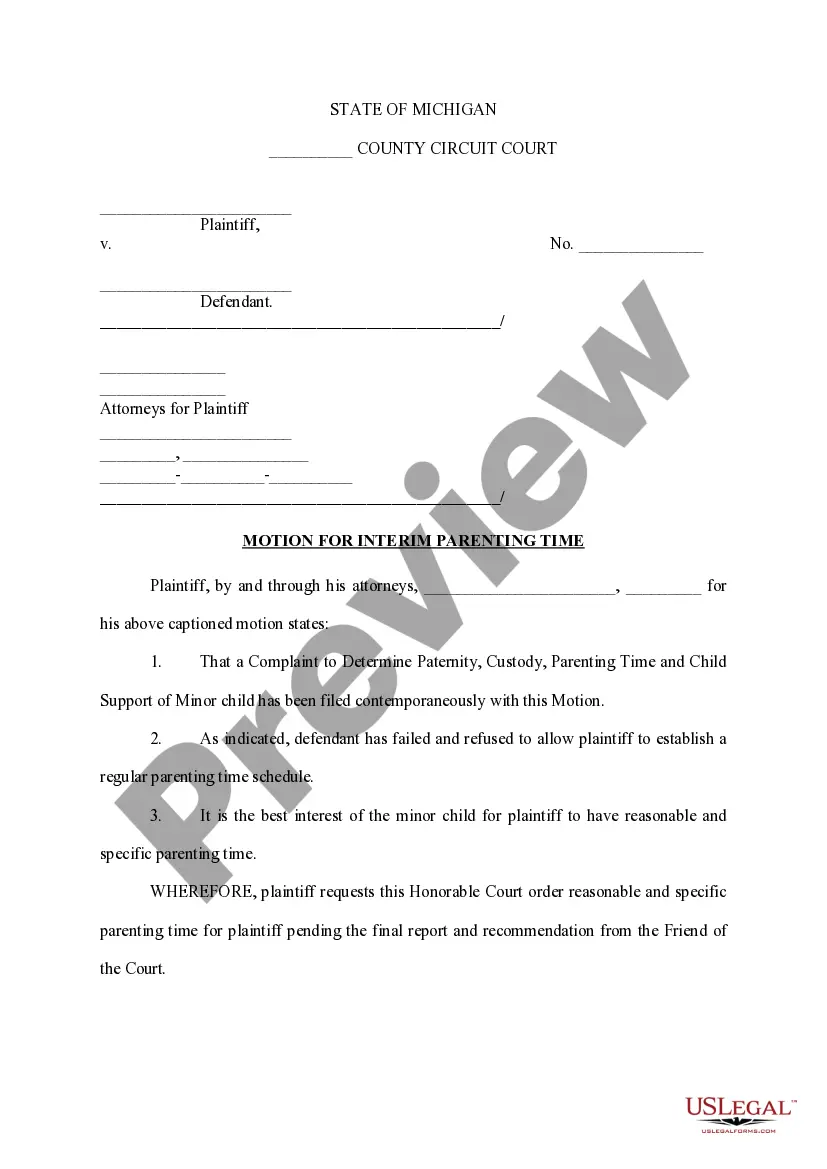

This Plan of Dissolution of a Law Firm covers covers all necessary topics for the dissolution of the firm. Included are: Plan of dissolution, liquidation objectives, surrender of leasehold estates, estimated balance sheet items, termination of personnel, accounts receivable billing and collecting, cash management, professional liability, and indemnity issues.

Vermont Dissolving a Law Firm

Description

How to fill out Dissolving A Law Firm?

Choosing the best lawful papers design could be a battle. Naturally, there are plenty of templates available on the Internet, but how do you find the lawful develop you need? Use the US Legal Forms internet site. The services offers 1000s of templates, for example the Vermont Dissolving a Law Firm, which can be used for company and private requires. Each of the varieties are checked by professionals and fulfill state and federal specifications.

When you are previously authorized, log in to your profile and then click the Download switch to get the Vermont Dissolving a Law Firm. Make use of profile to check throughout the lawful varieties you have bought formerly. Check out the My Forms tab of your profile and acquire one more duplicate in the papers you need.

When you are a whole new user of US Legal Forms, listed here are straightforward guidelines that you can comply with:

- Initial, ensure you have selected the correct develop for the city/county. You can examine the shape using the Review switch and read the shape outline to guarantee this is the right one for you.

- If the develop does not fulfill your preferences, make use of the Seach field to get the appropriate develop.

- When you are positive that the shape is proper, go through the Get now switch to get the develop.

- Select the pricing strategy you desire and type in the necessary information and facts. Design your profile and pay for your order using your PayPal profile or bank card.

- Choose the document formatting and download the lawful papers design to your gadget.

- Total, modify and produce and signal the acquired Vermont Dissolving a Law Firm.

US Legal Forms may be the greatest library of lawful varieties that you can discover numerous papers templates. Use the company to download professionally-made files that comply with state specifications.

Form popularity

FAQ

Email: tax.rett@vermont.gov Hours: Mon, Tue, Thu, Fri, a.m. - p.m. We can also help with questions regarding Land Gains Tax, Real Estate Withholding, Land Gains Withholding Tax, and Property Transfer Tax.

How do you dissolve a Vermont Corporation? To dissolve your Vermont Corporation, file Articles of Dissolution, in duplicate, with the Vermont Secretary of State, Corporations Division (SOS). You do not have to use the Vermont SOS forms. You may draft your own corporate articles of dissolution.

The easiest way to close your business tax account online is to log in to your myVTax account at and select Close Account. If you have more than one type of business tax account, you must close each individually.

Taxpayer Services Division: 802-828-2865 or (toll free in Vermont) 866-828-2865 on Monday, Tuesday, Thursday, and Friday at a.m. to p.m. Tax examiners in this division can answer questions about Vermont personal income tax, Homestead Declaration, Property Tax Adjustment Claim, and Renter Rebate Claim.

Online: Log into myVTax and click on the link to "Cease Account." Each account used by a particular business must be closed individually (for example, you may close a withholding account if the business no longer has employees, but keep the sales and use account).

To obtain such a certificate, voluntarily dissolving corporations must complete the following steps: Give Notice of its Authorization of Dissolution to the Commissioner; Pay all taxes that have been assessed or deemed assessed against it; and, Provide for any unassessed corporate excise liabilities.

When you dissolve a Vermont LLC, you must file a Limited Liability Company ? Termination form with the Vermont Secretary of State, Corporations Division (SOS). You are not required to use the forms provided by the Vermont SOS. You can draft your own articles of termination.