Vermont Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

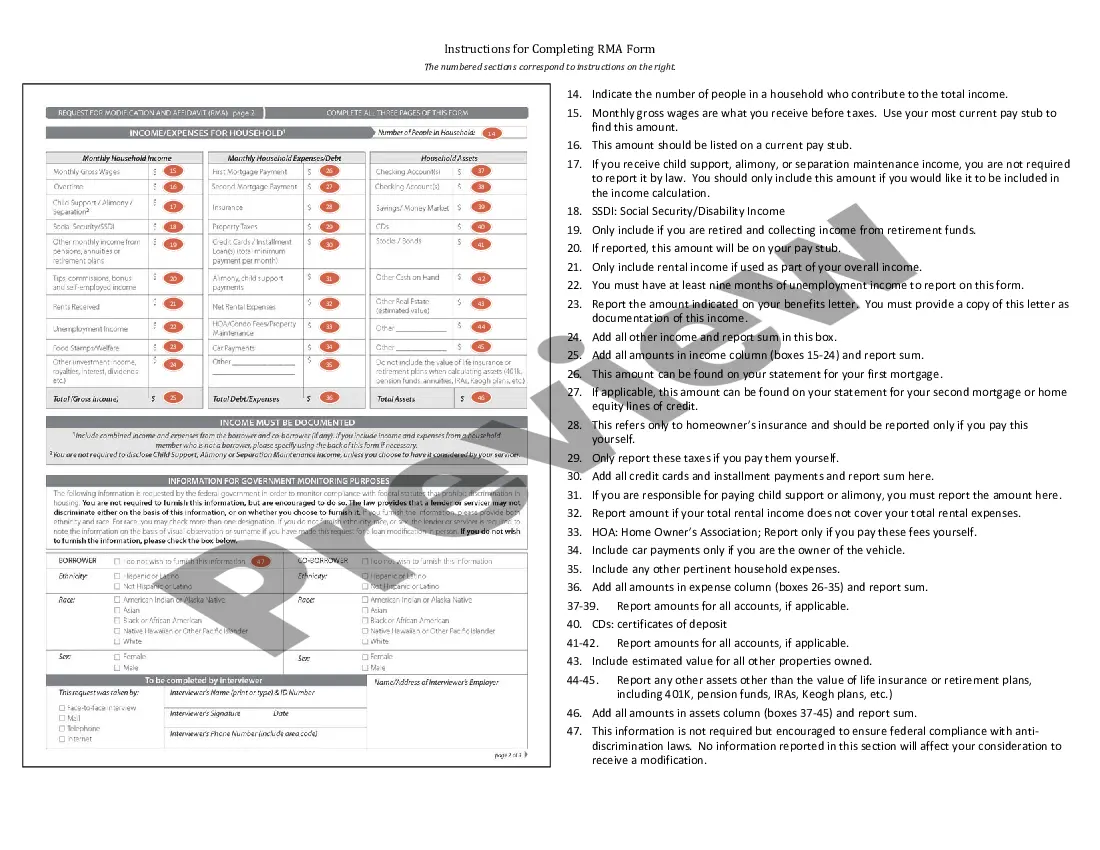

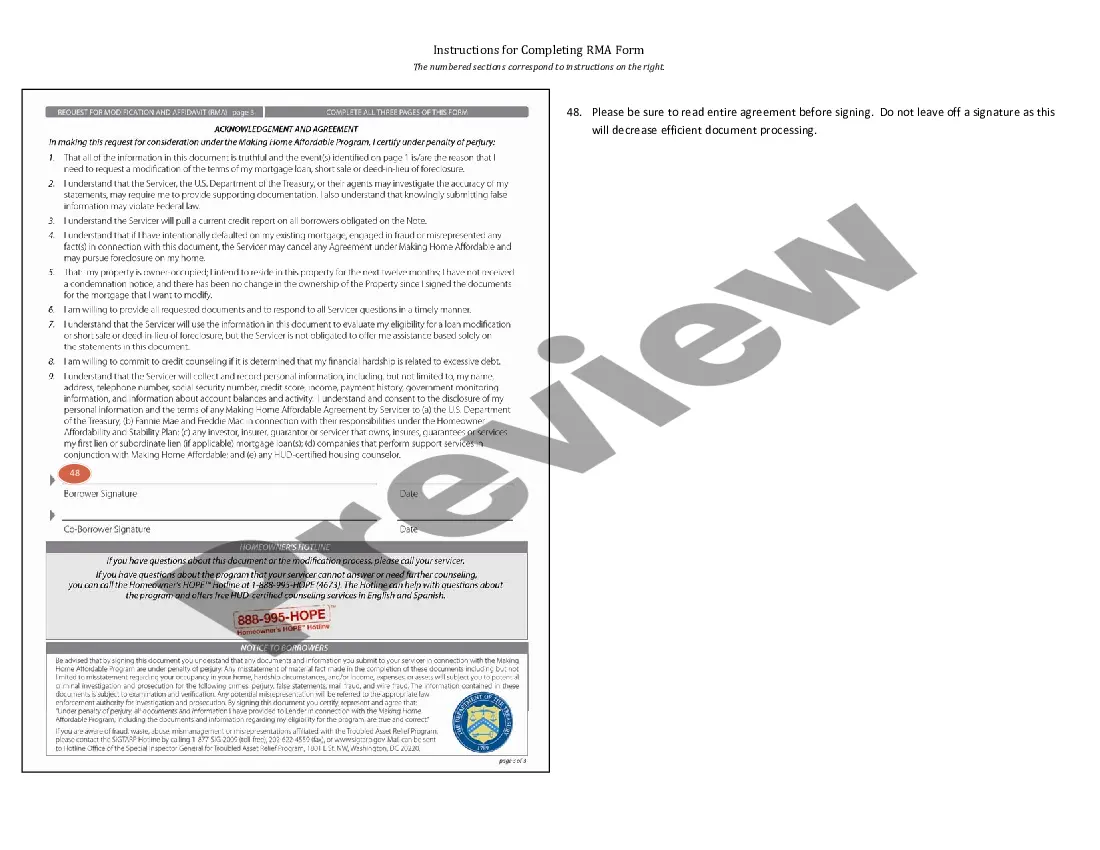

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Are you situated in a location where you need to handle documentation for various organizational or individual activities almost every business day.

There is a range of valid document templates accessible online, but locating those you can trust isn't straightforward.

US Legal Forms offers an extensive collection of form templates, such as the Vermont Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which can be tailored to comply with state and federal regulations.

Once you locate the right form, click on Purchase now.

Select the pricing option you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- From there, you can download the Vermont Instructions for Completing Request for Loan Modification and Affidavit RMA Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct state/county.

- Utilize the Preview button to examine the form.

- Read the description to confirm that you have selected the accurate form.

- If the form isn’t what you are looking for, use the Search box to find the form that fits your needs and requirements.

Form popularity

FAQ

There is no legal limit on how many modification requests you can make to your lender. The rules will vary from lender to lender and on a case-by-case basis. That said, lenders are generally more willing to grant a modification if it's the first time you're asking for one.

The loan modification process typically takes 6 to 9 months, depending on your lender.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

The loan modification processTalk to your servicer. Communicate with your servicer.Utilize the 90-day right to cure If a servicer or lender claims you are in default, they must give you a written notice.Organize your documents.Understand what a modification can and cannot do.Reporting issues with mortgage servicers.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

How do I get a mortgage loan modification? Contact your mortgage servicer or lender immediately to alert them of your financial hardship and ask about loan modification options available. Be ready to provide all documentation requested, which can include financial statements, pay stubs, tax returns, and more.

How to get a loan modificationGather information about your financial situation. You'll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you're experiencing financial hardship and are unable to make your monthly mortgage payments.Plan out your case.Contact your servicer.

Whether the mortgage loan modification agreement will need to be recorded in the public records after it is executed, and. an address to which the executed mortgage loan modification agreement should be returned.

A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.