Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

If you would like to compile, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's straightforward and convenient search feature to locate the documents you need. Diverse templates for commercial and personal purposes are sorted by categories and states, or keywords.

Utilize US Legal Forms to obtain the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your commercial or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

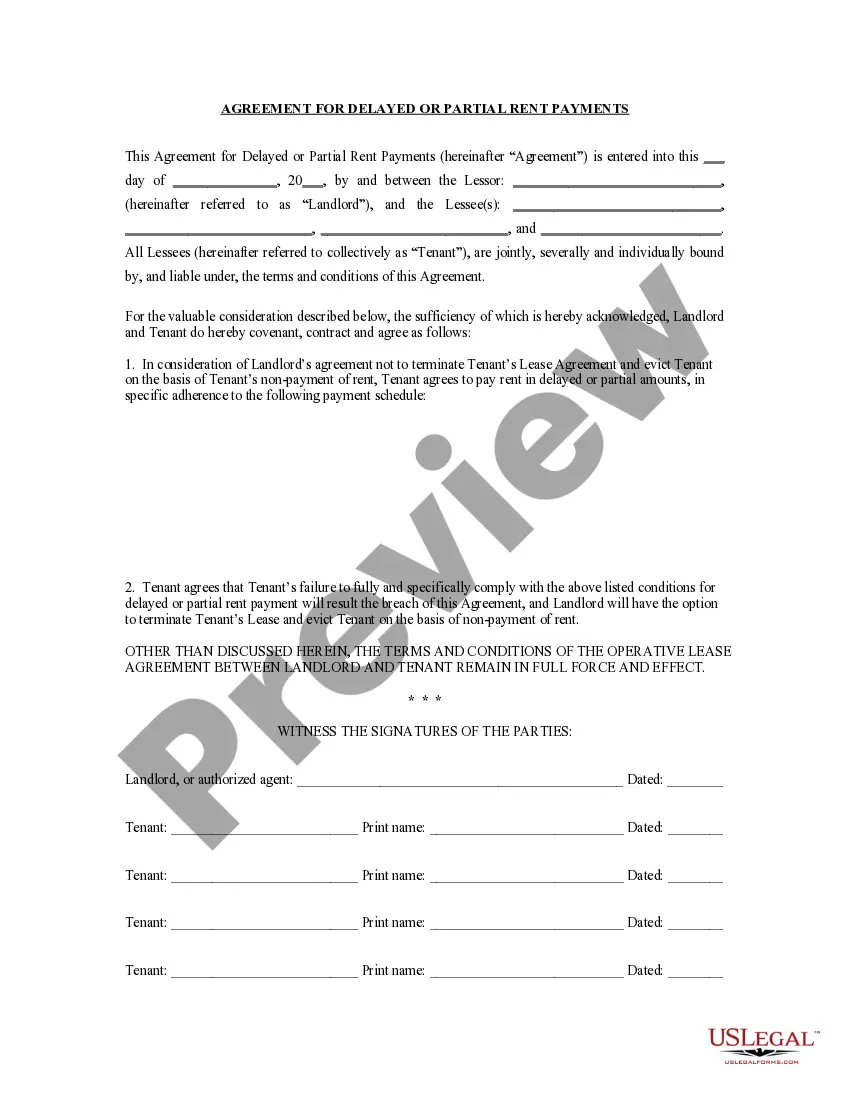

- Step 2. Use the Review option to browse through the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal document template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

Form popularity

FAQ

As of now, the Home Affordable Modification Program HAMP has officially ended, and it will not be available in 2025. However, options for loan modification may still exist through other programs or lenders. The Vermont Request for Loan Modification RMA can guide you toward finding alternative solutions suited to your situation. Always consider exploring new avenues to achieve a more favorable mortgage reduction.

A request for loan modification refers to the process where borrowers seek to change the terms of their existing mortgage loan. This could include a reduction in the interest rate, an extension of the loan term, or a change in the monthly payment amount. Specifically, the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP aims to assist homeowners facing financial difficulties by providing more affordable loan terms. Utilizing our platform, you can easily navigate the requirements and submit your loan modification request effectively.

To apply for a loan modification, begin by reviewing your mortgage statement and gathering necessary financial documents. You will then need to fill out a Request for Mortgage Assistance form as part of your Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application. Many homeowners find it helpful to use platforms like uslegalforms to guide them through this application process, ensuring all required information is prepared correctly.

A HAMP loan modification involves adjusting the terms of your existing mortgage loan through the Home Affordable Modification Program. This initiative aims to lower your mortgage payments and help you avoid foreclosure by making your loan more affordable. If you are submitting a Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you are leveraging a valuable resource aimed at improving your financial situation.

In the context of mortgages, RMA stands for Request for Mortgage Assistance. This request is an essential step for homeowners seeking help under programs like the Home Affordable Modification Program. If you are submitting a Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you are taking a significant step toward gaining relief from financial strain.

HAMP modification refers to the process of changing the terms of your existing mortgage under the guidelines of the Home Affordable Modification Program. This modification can include reducing the interest rate, extending the loan term, or adjusting other terms to make payments more manageable. If you're navigating the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, it's crucial to understand how these modifications can fundamentally improve your financial landscape.

A mortgage loan modification can be an excellent option for homeowners struggling to meet their mortgage payments. By altering the terms of your loan, you can lower your monthly payment, making it easier to keep your home. The Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is designed to help those in need, allowing for adjustments that align better with your current financial capacity.

The Home Affordable Modification Program, commonly known as HAMP, is a federal initiative designed to assist homeowners facing financial difficulties. Through HAMP, eligible borrowers can modify their mortgage loans to make payments more affordable, thereby preventing foreclosure. If you are looking to take advantage of the Vermont Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, understanding HAMP is essential as it can help stabilize your financial situation.