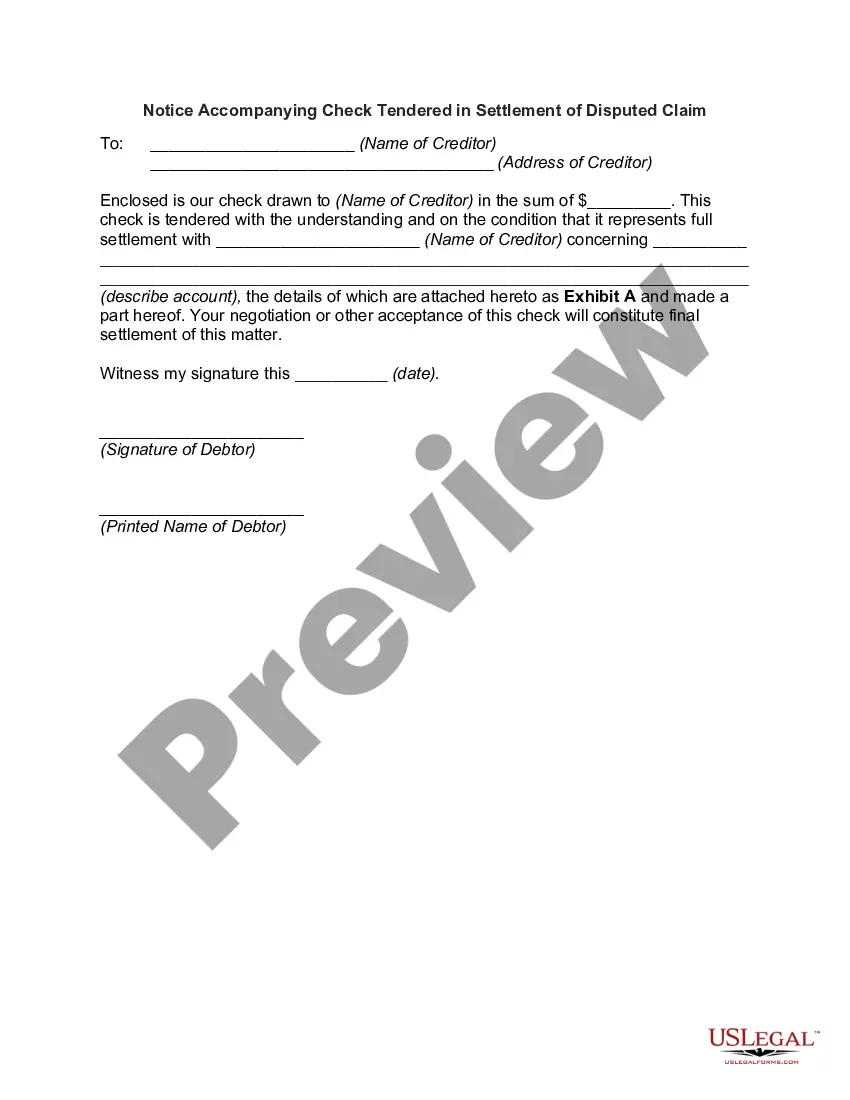

Vermont Notice of Returned Check

Description

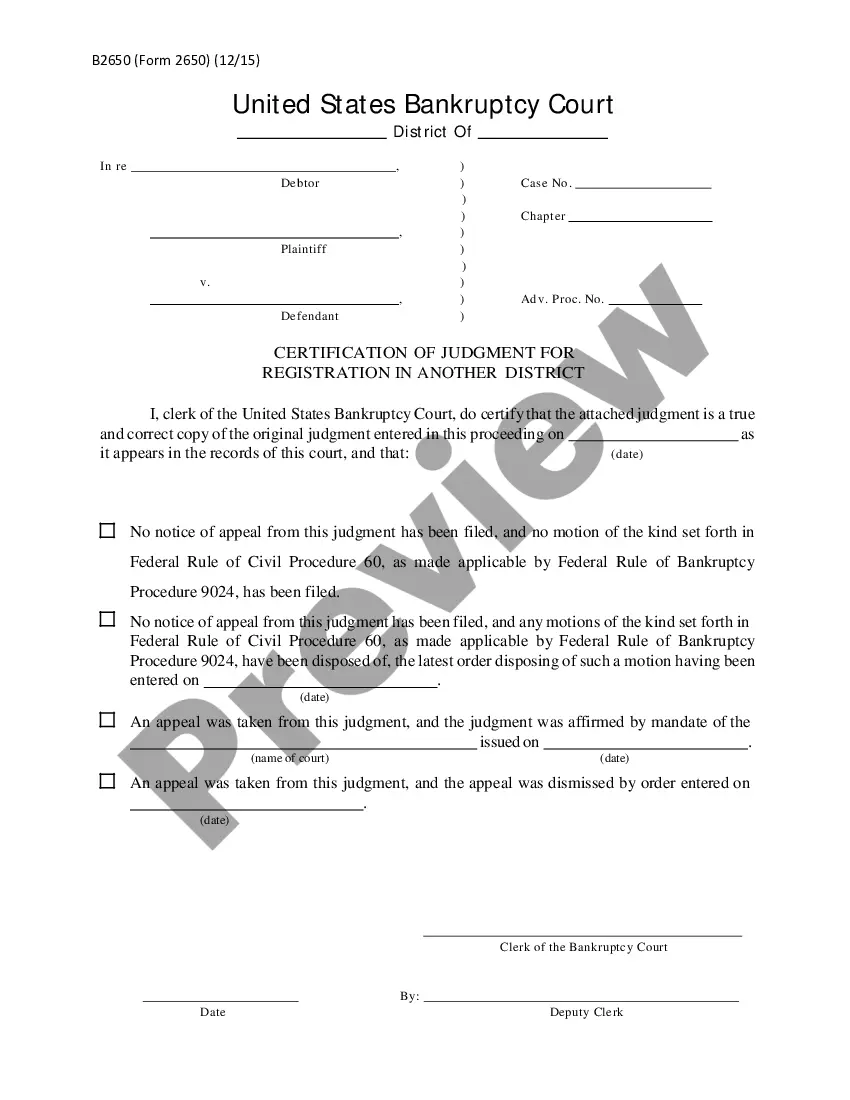

How to fill out Notice Of Returned Check?

You can allocate time on the web searching for the authorized document format that satisfies the federal and state requirements you need.

US Legal Forms offers a vast number of legal templates that are reviewed by professionals.

You can acquire or print the Vermont Notice of Returned Check from the service.

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Next, you can complete, modify, print, or sign the Vermont Notice of Returned Check.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for the state/town of your choice.

- Review the form summary to ensure you have selected the appropriate form.

Form popularity

FAQ

In Vermont, the process to evict a tenant can vary but typically takes 3 to 7 weeks from the filing of an eviction complaint, depending on court schedules. Before initiating an eviction, landlords should ensure they have served appropriate notices, including any related to non-payment of rent through a Vermont Notice of Returned Check. Using forms available on US Legal Forms can help landlords navigate this process more smoothly.

The statute of limitations on debt in Vermont is six years for most types of debt, including written contracts and open accounts. After this period, creditors may be unable to take legal action to collect the debt. Understanding this timeframe is essential when dealing with debts related to returned checks, especially when issuing a Vermont Notice of Returned Check.

When a check is returned to the sender, it usually indicates an issue such as insufficient funds or a closed account. The sender should receive a Vermont Notice of Returned Check detailing the reason for the return. This notice is crucial for the sender to assess their next steps, whether it's contacting the issuer or pursuing collections.

Statute 4467 in Vermont pertains to the handling of returned checks and outlines the rights of both the issuer and the recipient. This law describes what constitutes a returned cheque and the remedies available to the recipient. Awareness of this statute can help you address issues efficiently, and templates from US Legal Forms can simplify the communication process.

Generally, banks do not automatically redeposit returned checks. The issuer of the check must authorize the bank to attempt another deposit, usually through a Vermont Notice of Returned Check that explains any fees or consequences associated with the returned item. Always check with your specific bank's policy regarding returned checks.

In Vermont, there are no statewide rent control laws, which means landlords can set and adjust rents at their discretion. However, they must provide proper notice to tenants, typically 30 days, before increasing rent amounts. It's a good practice for landlords to document any changes in rent through a Vermont Notice of Returned Check if payments are missed due to rent hikes.

Collecting a returned check begins with notifying the payer about the issue. Providing a Vermont Notice of Returned Check can facilitate a clearer understanding of the situation. If the payer does not respond, consider using a collection agency or seeking legal advice. Utilizing tools from US Legal Forms can help streamline this process.

To collect a rejected cheque, first, try to communicate with the payer to understand why the cheque was returned. You may need to provide them with a Vermont Notice of Returned Check, which outlines the reason for the rejection. If informal communication does not work, you may consider sending a formal notice or pursuing legal actions with assistance from platforms such as US Legal Forms.

Filing Vermont taxes involves several straightforward steps. First, gather all necessary documents, including your W-2s and 1099s, to ensure you have complete information. Next, you can choose to file online or via mail using the Vermont Department of Taxes website or their mailing address. If you're dealing with issues like a Vermont Notice of Returned Check, consider using a service like USLegalForms, which provides resources to help you understand your tax obligations and navigate any complications effectively.

If you have a returned check, consider contacting the check issuer to discuss the situation. You may request an alternative payment method or ask for the original amount to be reissued. Furthermore, utilizing the Vermont Notice of Returned Check can help communicate your expectations and protect your rights in this matter.