Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client

Description

How to fill out Resignation Letter From Accounting Firm To Client As Auditors For Client?

Have you found yourself in a situation where you consistently require documentation for either professional or personal reasons almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides an extensive collection of form templates, such as the Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client, designed to comply with federal and state regulations.

If you locate the appropriate document, just click Purchase now.

Choose the pricing plan you prefer, enter the required details to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the document you need and ensure it corresponds to your specific city/state.

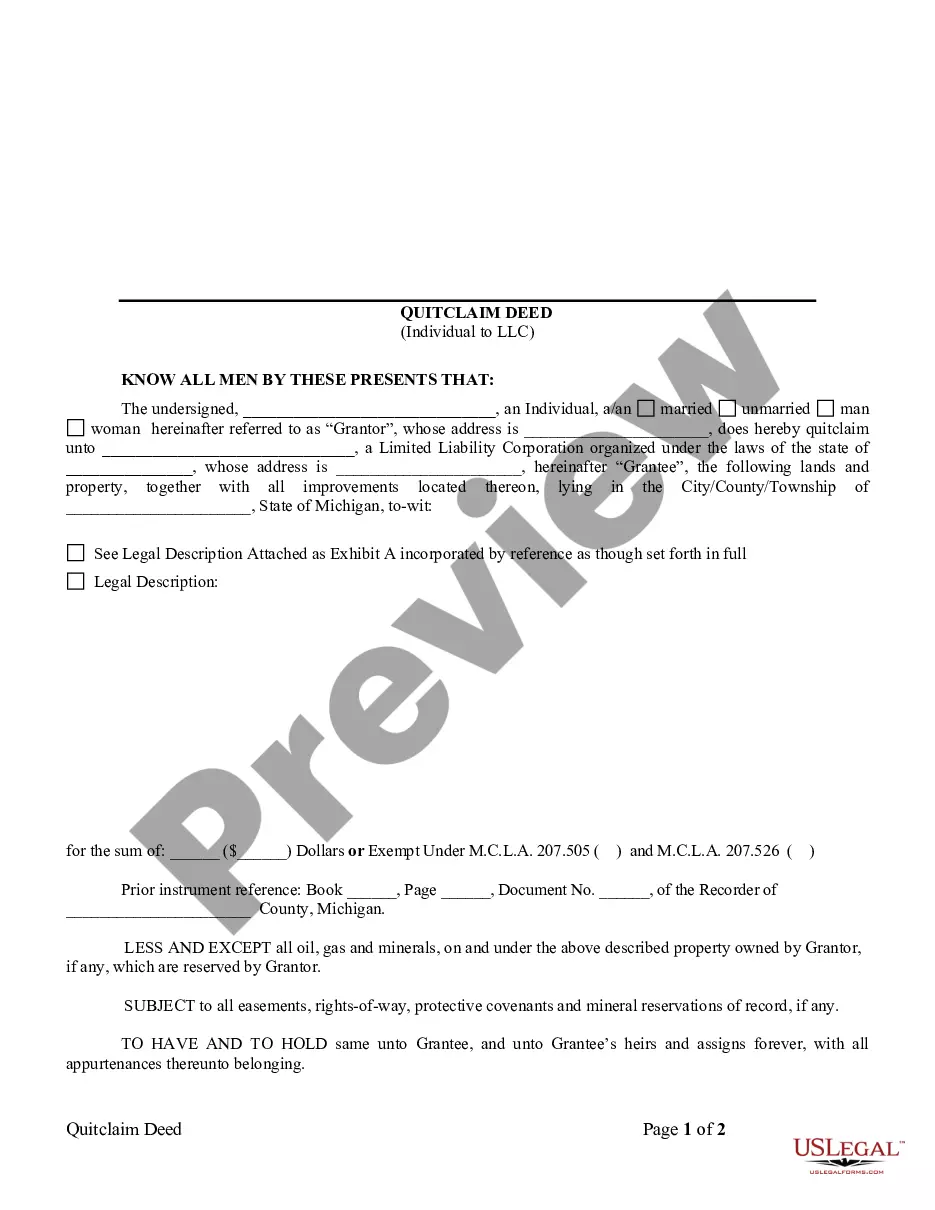

- Utilize the Review button to evaluate the document.

- Check the description to ensure you have selected the correct document.

- If the document is not what you need, use the Search box to find a document that fulfills your requirements.

Form popularity

FAQ

Writing a client termination letter should be straightforward and respectful. Start with a clear statement of your intention to terminate the relationship, then explain your reasons succinctly. Use a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client template to ensure your letter is structured correctly and covers all necessary points.

Firing an accounting client requires careful consideration. Assess the relationship and any contractual obligations before proceeding. Sending a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client ensures that your intentions are documented clearly and professionally, helping to maintain good relations.

Ending a relationship with an accountant involves clear communication. Start by expressing your thoughts and reasons for the decision. Providing them with a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client is a professional way to finalize the relationship and keep a record of your correspondence.

To terminate a contract with an accountant, you should first review the terms of your agreement. Check for any specific procedures regarding termination. Once you understand your obligations, you can draft a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client to formally notify your accountant of your decision.

A disengagement letter from a tax agent serves to formally notify a client that the tax services will no longer be provided. This letter should detail the reasons for the disengagement and any important deadlines or required actions. For a clear and effective communication, consider using a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client, which can guide you through the process.

To resign from a client, first assess the situation and ensure the timing is appropriate. Follow up with a direct conversation outlining your reasons for resigning, then provide a formal communication. A well-structured Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client will help maintain professionalism during this transition.

The purpose of a disengagement letter is to formally communicate the end of an accounting relationship. This letter clarifies the reasons for disengagement, specifies final tasks, and includes any obligations for both parties. Ultimately, a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client helps protect both the accountant and the client by ensuring clarity and professionalism.

To politely disengage a client, approach the situation with sensitivity and respect. Start with a conversation to explain your reasons, focusing on professionalism and client care. Following this, create a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client to formally conclude the agreement, ensuring both parties feel respected throughout the process.

A disengagement letter is a formal document informing a client that an accounting firm will cease services. This letter outlines the reasons for disengagement, details about the final financial statements, and any other necessary information. It’s essential for both parties to have a clear understanding, and a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client provides a useful template for this process.

A disengagement letter to a client should begin with a professional greeting followed by a clear statement of disengagement. It must outline your reasons for ending the relationship and include any necessary details about transitioning records or outstanding work. Consider using a Vermont Resignation Letter from Accounting Firm to Client as Auditors for Client for proper structure and legal language.