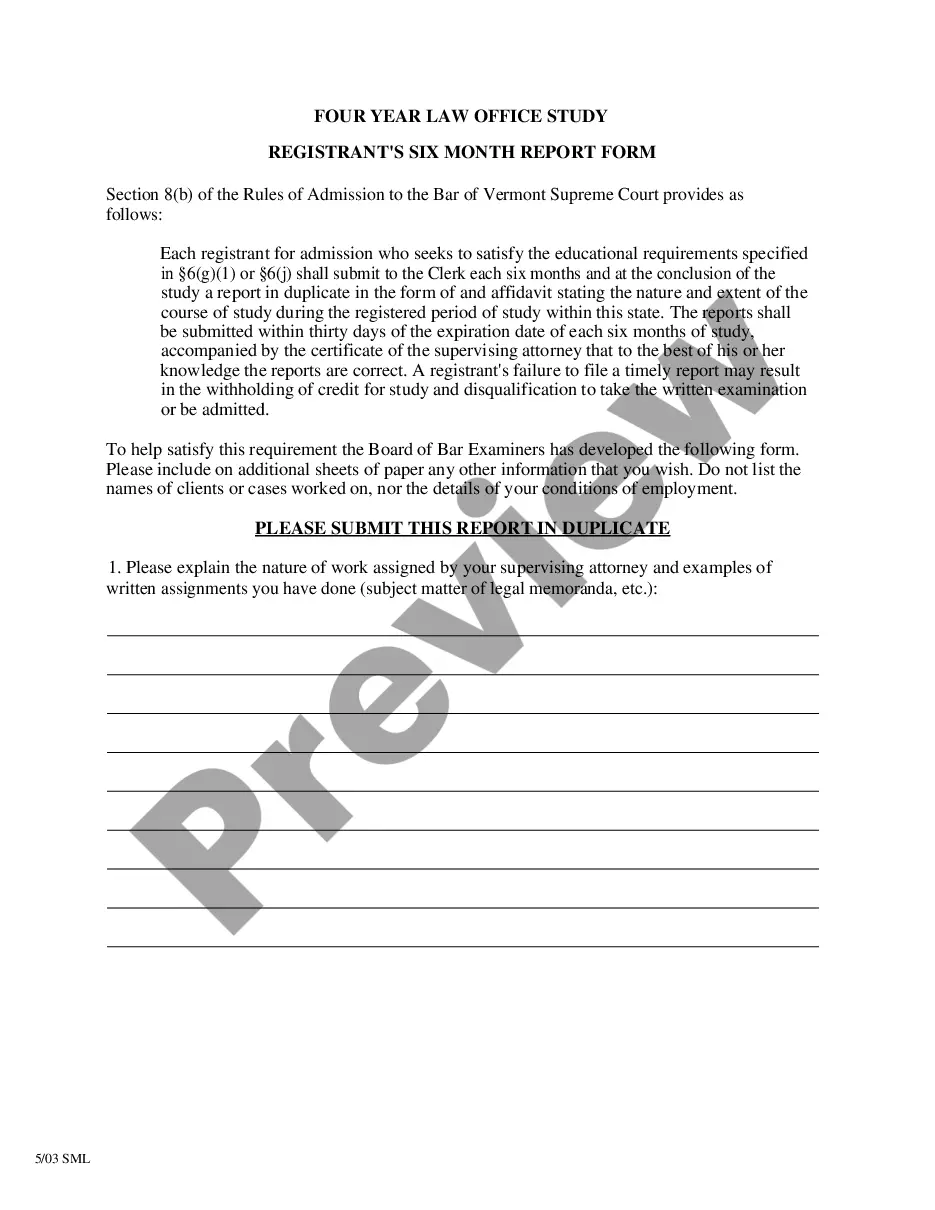

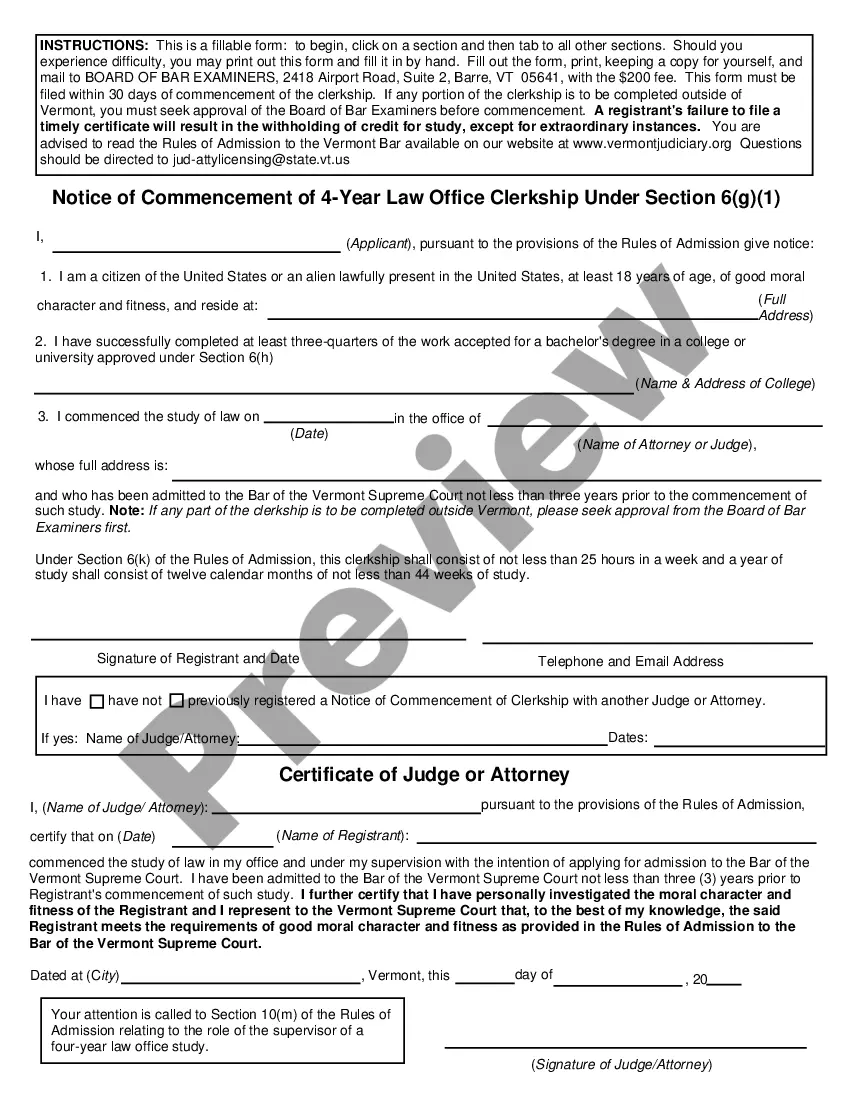

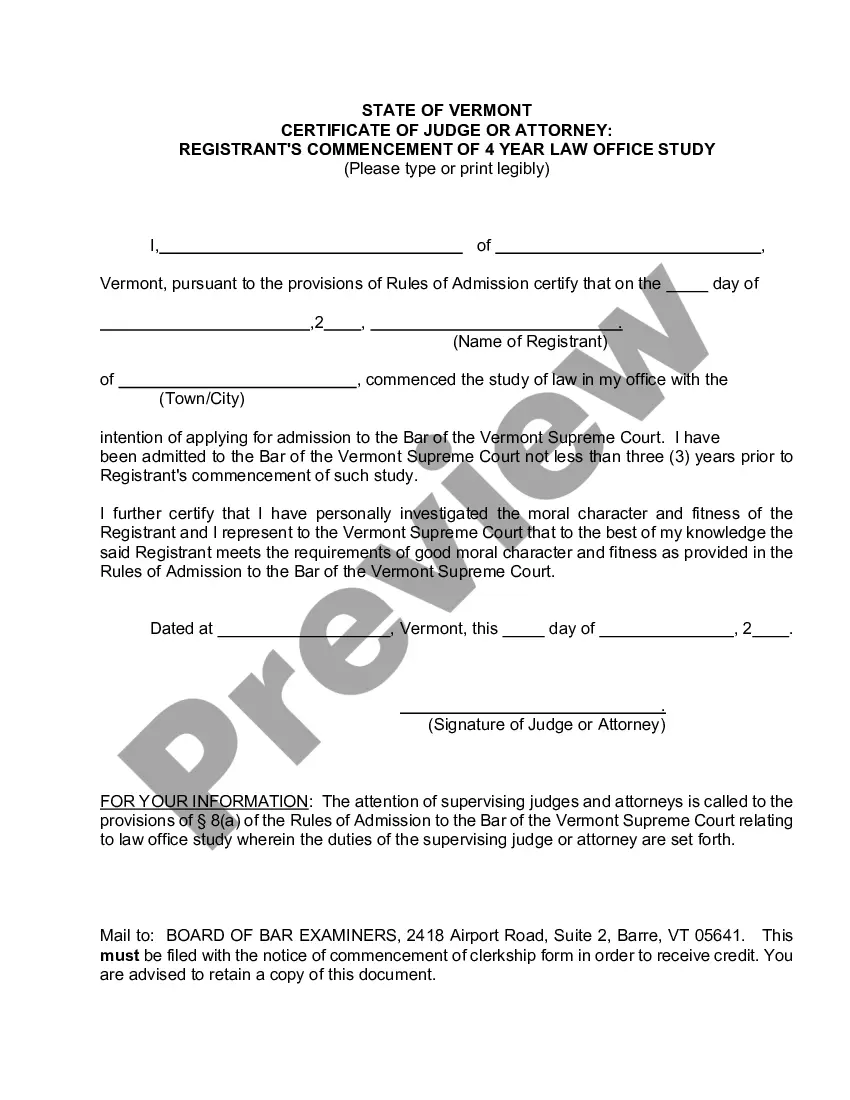

Vermont 4 Year Law Office Study - Time Report Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Vermont 4 Year Law Office Study - Time Report Form?

Searching for a Vermont 4 Year Law Office Study - Time Report Form online can be stressful. All too often, you find files that you simply believe are fine to use, but find out later on they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added to the My Forms section. If you do not have an account, you need to register and choose a subscription plan first.

Follow the step-by-step guidelines below to download Vermont 4 Year Law Office Study - Time Report Form from the website:

- Read the document description and click Preview (if available) to check if the form suits your requirements or not.

- If the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted templates, users are also supported with step-by-step guidelines concerning how to find, download, and fill out forms.

Form popularity

FAQ

PURPOSE - Complete Form NC-4, Employee's Withholding Allowance. Certificate, so that your employer can withhold the correct amount of. State income tax from your pay. If you do not provide an NC-4 to your. employer, your employer is required to withhold based on single with zero allowances.

In 2020, the W-4 form changed to help individuals withhold federal income tax more accurately from their paychecks.Now that the IRS has officially rolled out the changes, the updated form should provide you the means to more accurately withhold federal income tax.

The standard deduction for single taxpayers in the 2020 tax year is $12,400. It's $24,800 for married couples filing jointly. Those who file as head of household have an $18,650 standard deduction. Now, if you want to change the amount your employer withholds for taxes, you have to use the new W-4.

On December 5, 2019, the Internal Revenue Service (IRS) released the final 2020 Form W-4, Employee's Withholding Certificate.For newly hired employees after 2019, and for all existing employees who wish to adjust their withholding after 2019, the 2020 version will be the only valid Form W-4.

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

The W-4 Form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS. Accurately completing your W-4 will help you avoid overpaying your taxes throughout the year or owing a large balance at tax time.

On December 5, the IRS issued the redesigned 2020 Form W-4 (Employee's Withholding Certificate). The new form no longer uses withholding allowances. Instead, there is a five-step process and new Publication 15-T (Federal Income Tax Withholding Methods) for determining employee withholding.

Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Add Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date W-4 Form.

You're allowed to give your employer a new W-4 at any time. That means you can fill out a W-4, give it to your employer and then check your next paycheck to see how much money was withheld. Then you can start estimating how much you'll have taken out of your paychecks for the full year.