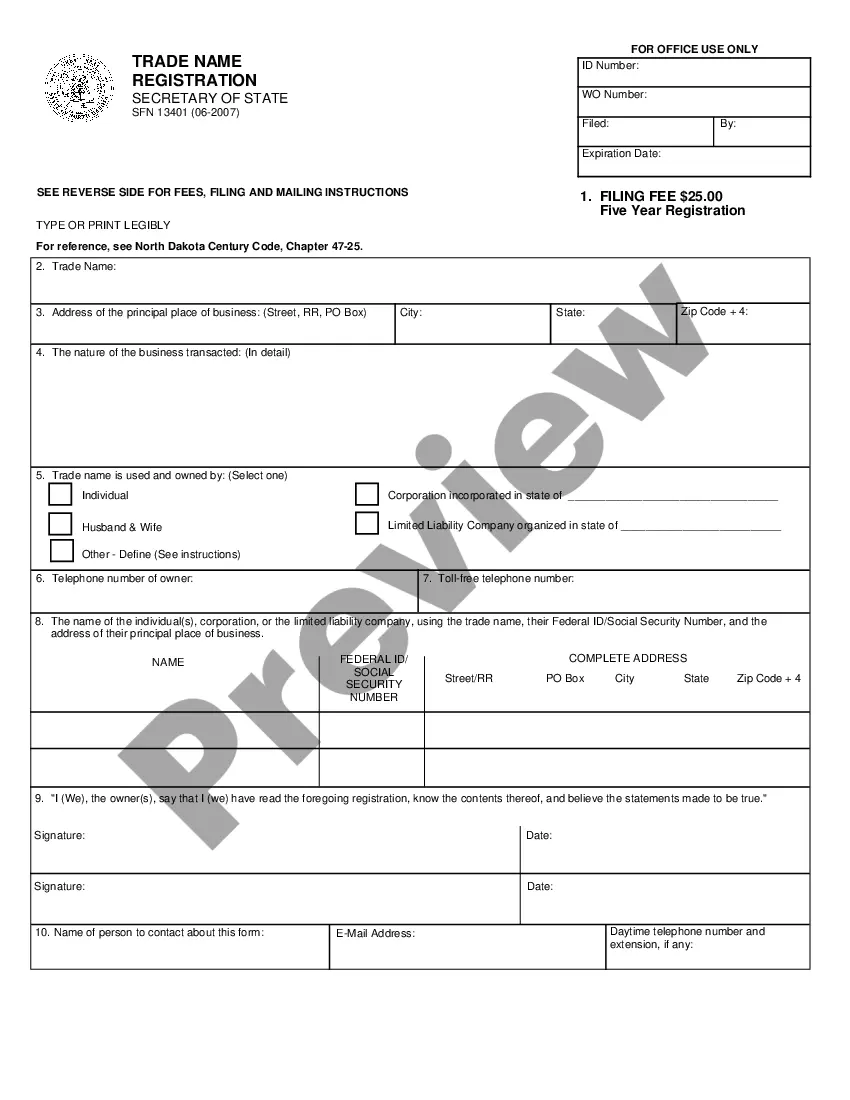

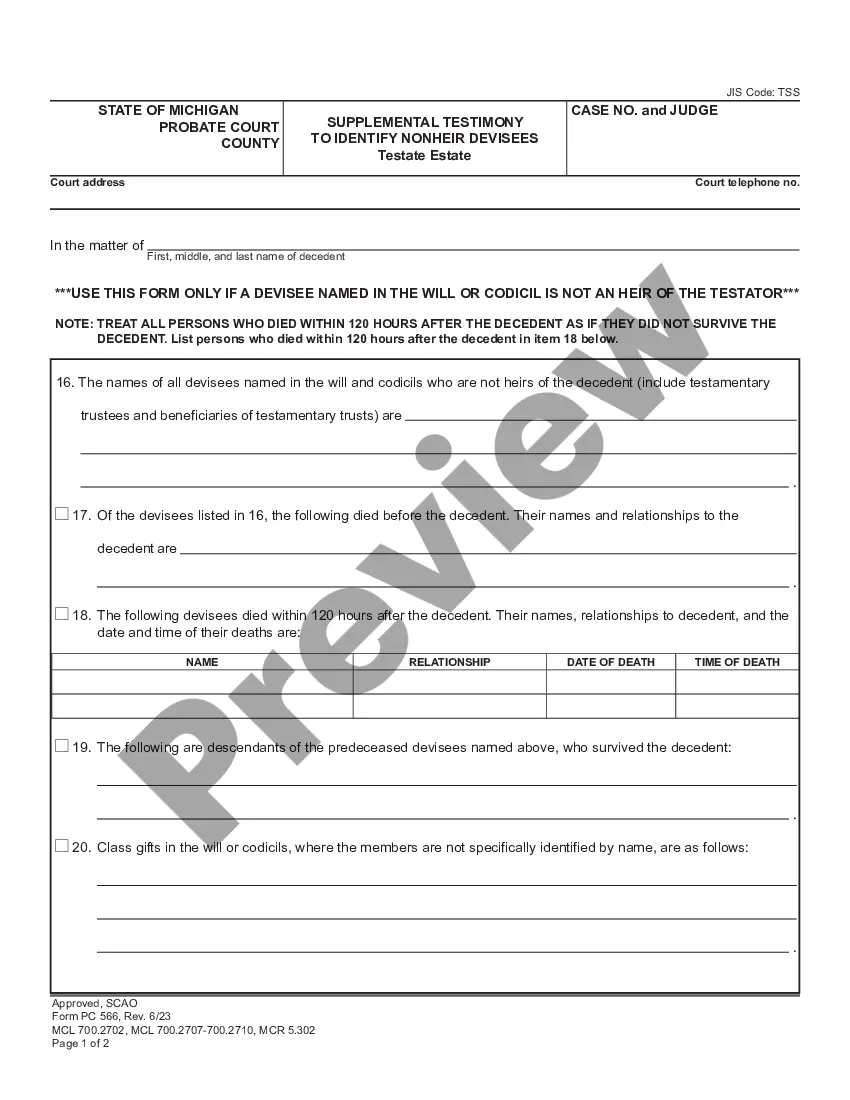

This form is a weekly expense report listing name, period, position, client, project number, project code, the expense items and the daily totals.

Virgin Islands Weekly Expense Report

Description

How to fill out Weekly Expense Report?

If you intend to summarize, retrieve, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to locate the Virgin Islands Weekly Expense Report with just a few clicks. If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Virgin Islands Weekly Expense Report. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the guidelines below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review feature to examine the form's details. Don't forget to read the description. Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find additional types of the legal form template. Step 4. After locating the form you need, select the Buy now button. Choose the payment plan you prefer and input your information to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Virgin Islands Weekly Expense Report.

Each legal document template you acquire belongs to you indefinitely. You can access all forms you have downloaded through your account. Check the My documents section to either print or download a form again.

Be proactive and download, print the Virgin Islands Weekly Expense Report with US Legal Forms. There are many professional and state-specific forms you can utilize for your business or personal requirements.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded in your account.

- Visit the My documents section and choose a form to print or download again.

- Be proactive and download, and print the Virgin Islands Weekly Expense Report using US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

- Take advantage of this resource to simplify your documentation process.

- Ensure compliance and efficiency in your legal paperwork.

Form popularity

FAQ

To fill out an expense claim form, begin by detailing your personal information and the purpose of the claim. List each expense itemized with the date, description, and amount, ensuring that all entries are accurate and supported by receipts. The Virgin Islands Weekly Expense Report requires specific information, so using platforms like USLegalForms can simplify this process and help you stay organized.

A monthly expense report typically includes a summary of all expenses incurred during the month, organized by category. It displays each expense with details such as date, description, and total amount spent. When preparing your Virgin Islands Weekly Expense Report, you can refer to sample templates available on USLegalForms for guidance on formatting and required information.

Filling out an expense report involves listing all incurred expenses in a clear and organized manner. Begin with the name of the project or purpose, then add each expense with relevant details like date, purpose, and total amount. For the Virgin Islands Weekly Expense Report, you can use tools like USLegalForms to streamline the process and ensure you don’t miss any critical information.

To fill out an expense report, start by gathering all your receipts and documentation related to your expenses. Next, clearly categorize each expense, providing details such as date, description, and amount. For the Virgin Islands Weekly Expense Report, ensure you follow any specific guidelines provided by your organization to ensure accuracy and compliance.

Filing taxes in the U.S. Virgin Islands involves completing the appropriate forms, such as the W-2 and Form 8689, based on your income and employment status. It is crucial to meet deadlines to avoid penalties. By using the Virgin Islands Weekly Expense Report on the uslegalforms platform, you can efficiently gather and organize your financial data, making tax filing a more straightforward task.

Form 8689 is specifically designed for U.S. citizens and residents who live and work in the Virgin Islands. This form allows taxpayers to report their income and determine their tax liability accurately. By integrating the Virgin Islands Weekly Expense Report into your financial planning, you can simplify the process of completing Form 8689 and ensure all expenses are accounted for.

2 Islands refers to the tax form used to report wages and salaries earned by employees in the U.S. Virgin Islands. It is essential for both employers and employees to understand this form to ensure accurate tax reporting. If you manage payroll in the Virgin Islands, utilizing tools like the Virgin Islands eekly Expense Report can help streamline your financial processes and maintain compliance.

An expense report typically includes details such as the date of the expense, a description of the item or service purchased, the amount spent, and any related receipts. It's important to categorize expenses for better analysis and tracking. When creating your Virgin Islands Weekly Expense Report, ensure that you include all necessary information to support your claims. This will help you maintain transparency and accountability.

Creating an expense report involves compiling all your expenses into a clear and organized format. Start by listing each expense with the date, amount, and purpose. Tools like US Legal Forms can help you generate a professional Virgin Islands Weekly Expense Report with ease. After compiling, double-check for accuracy and submit it to the relevant authority for reimbursement.

To create an expense report, gather all relevant receipts and documentation for your expenses. Organize them by category, such as travel, meals, or supplies, and input the data into a structured format. Using our platform at US Legal Forms can streamline this process and ensure your Virgin Islands Weekly Expense Report is accurate and compliant. Once completed, review for any discrepancies before submission.