Virgin Islands Department Time Report for Payroll

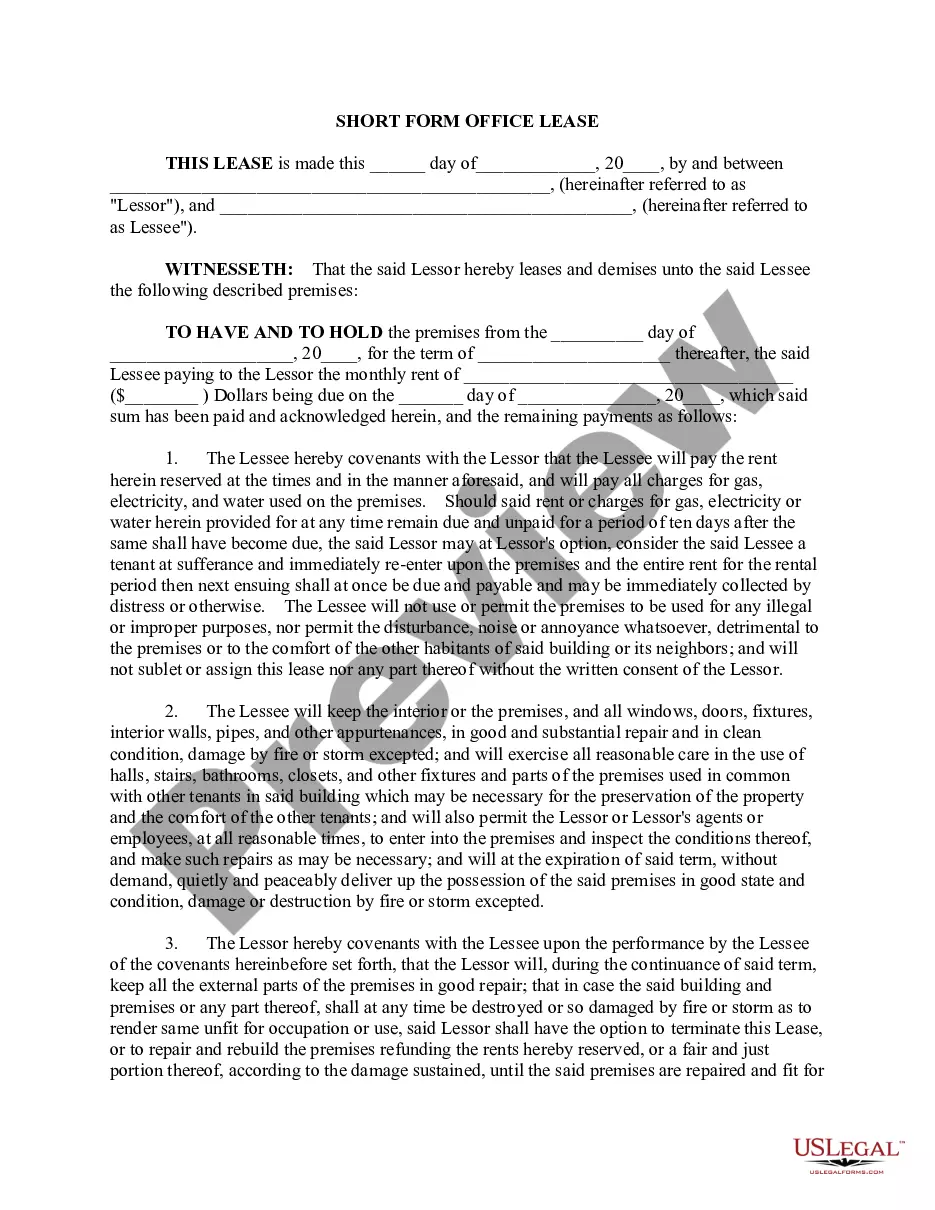

Description

How to fill out Department Time Report For Payroll?

Are you in a location that requires documentation for either business or personal purposes every time.

There are numerous legitimate document templates accessible online, but locating dependable versions is not easy.

US Legal Forms offers thousands of form templates, including the Virgin Islands Department Time Report for Payroll, which are crafted to meet both state and federal regulations.

Once you find the correct form, click Purchase now.

Select the payment plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- You will then be able to download the Virgin Islands Department Time Report for Payroll template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to check the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Amount and Duration of Unemployment Benefits in Hawaii The current maximum benefit amount is $639 per week (in 2021); the current minimum is $5 per week. You may receive benefits for a maximum of 26 weeks. (In times of higher unemployment, additional weeks of benefits may be available.)

To file a UI claim online, visit .

The U.S. Virgin Islands imposes a tax of 4% on the gross receipts of U.S. Virgin Islands businesses. There are exemptions from the tax for exempt companies, FSCs, IDC Program beneficiaries, and certain other businesses.

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.

By paying the Virgin Islands Bureau of Internal Revenue the tax on all worldwide income, a bona fide United States Virgin Islands resident is relieved of any income tax liability to the United States, even on non-United States Virgin Islands source income.

The state with the highest weekly payout for unemployment is Massachusetts. The maximum weekly payout is $855. What states are ending the extended unemployment benefits early?

Code W in Box 12 of your W2 indicates that you have an employer-sponsored Health Savings Account and that there was money deposited into your HSA through the payroll system at work. Code W opens up Form 8889, Health Savings Accounts, on your tax return.

2VI form is used to report wage and salary information for employees earning Virgin Island wages. Example use: Those with one or more employees use this form to report Virgin Island wages and salary with U.S. income tax withheld.

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.