Virgin Islands Runner Agreement - Self-Employed Independent Contractor

Description

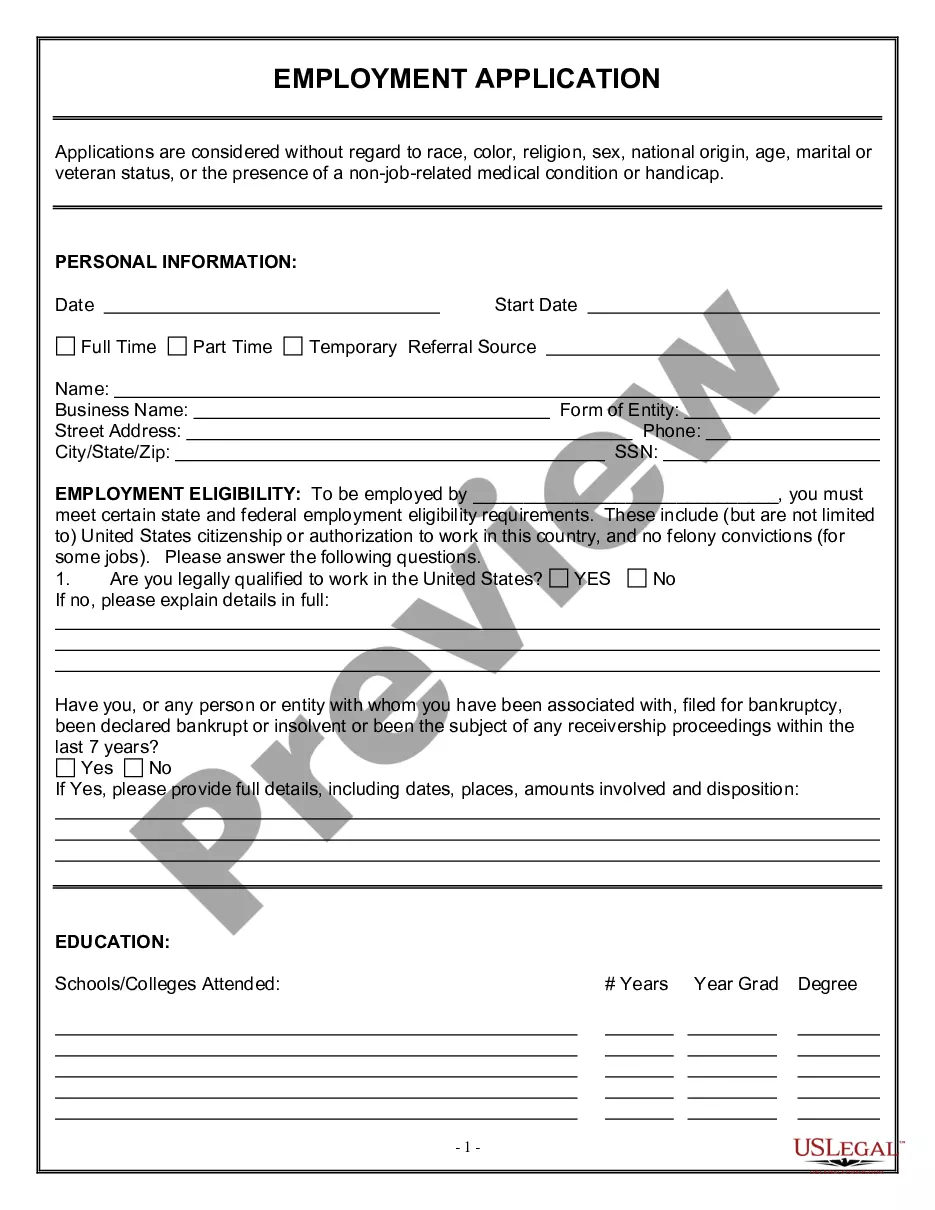

How to fill out Runner Agreement - Self-Employed Independent Contractor?

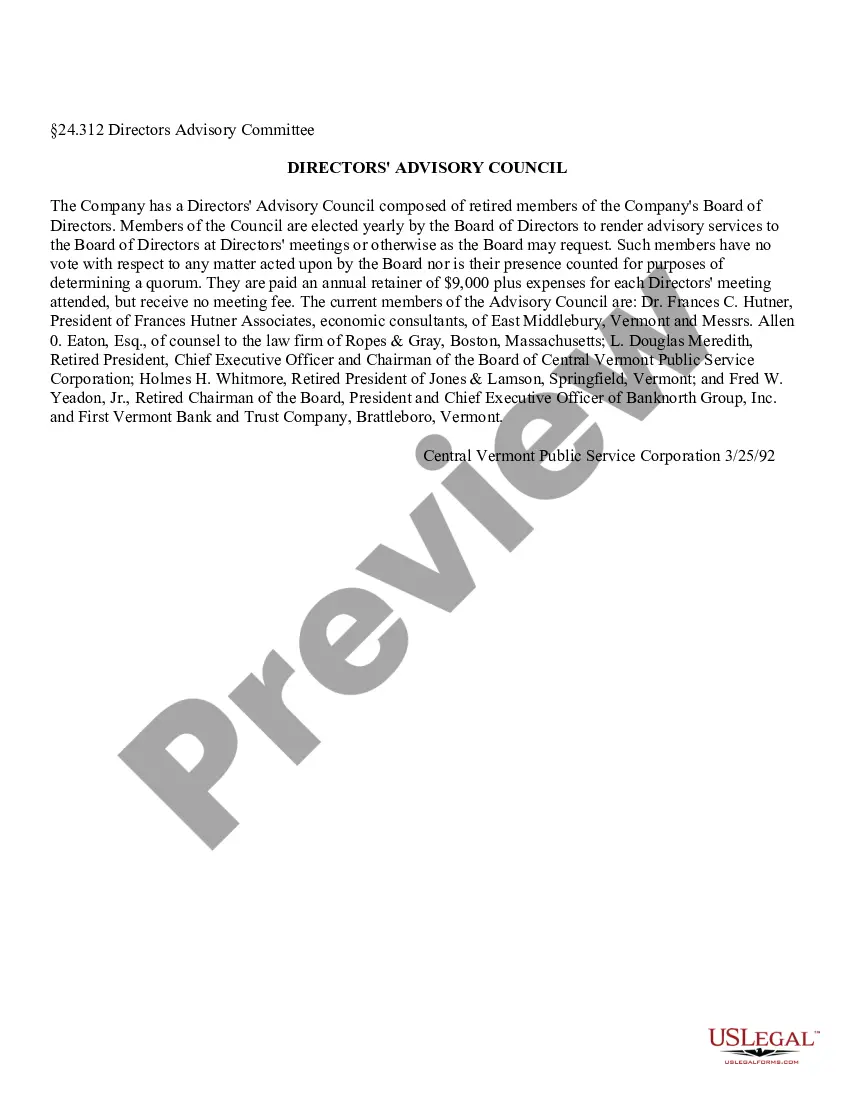

If you want to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the finest collection of legal forms, which can be accessed online.

Employ the site's simple and user-friendly search feature to locate the documents you require. Various templates for commercial and personal purposes are categorized by types and regions, or keywords.

Utilize US Legal Forms to locate the Virgin Islands Runner Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you purchase is yours indefinitely. You retain access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and secure, and print the Virgin Islands Runner Agreement - Self-Employed Independent Contractor with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Virgin Islands Runner Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to inspect the form's details. Be sure to read the description.

- Step 3. If you are dissatisfied with the type, use the Search box at the top of the screen to find additional forms in the legal document template.

- Step 4. Once you have located the form you require, click the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Virgin Islands Runner Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

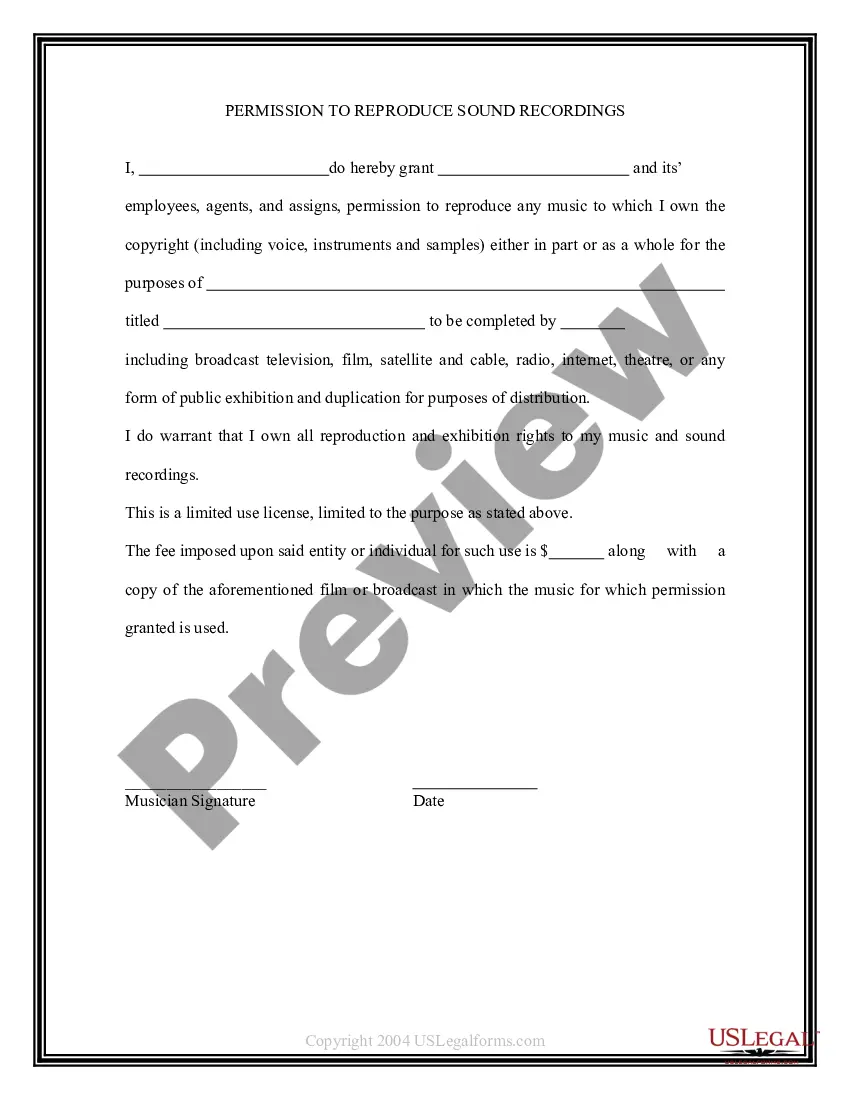

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

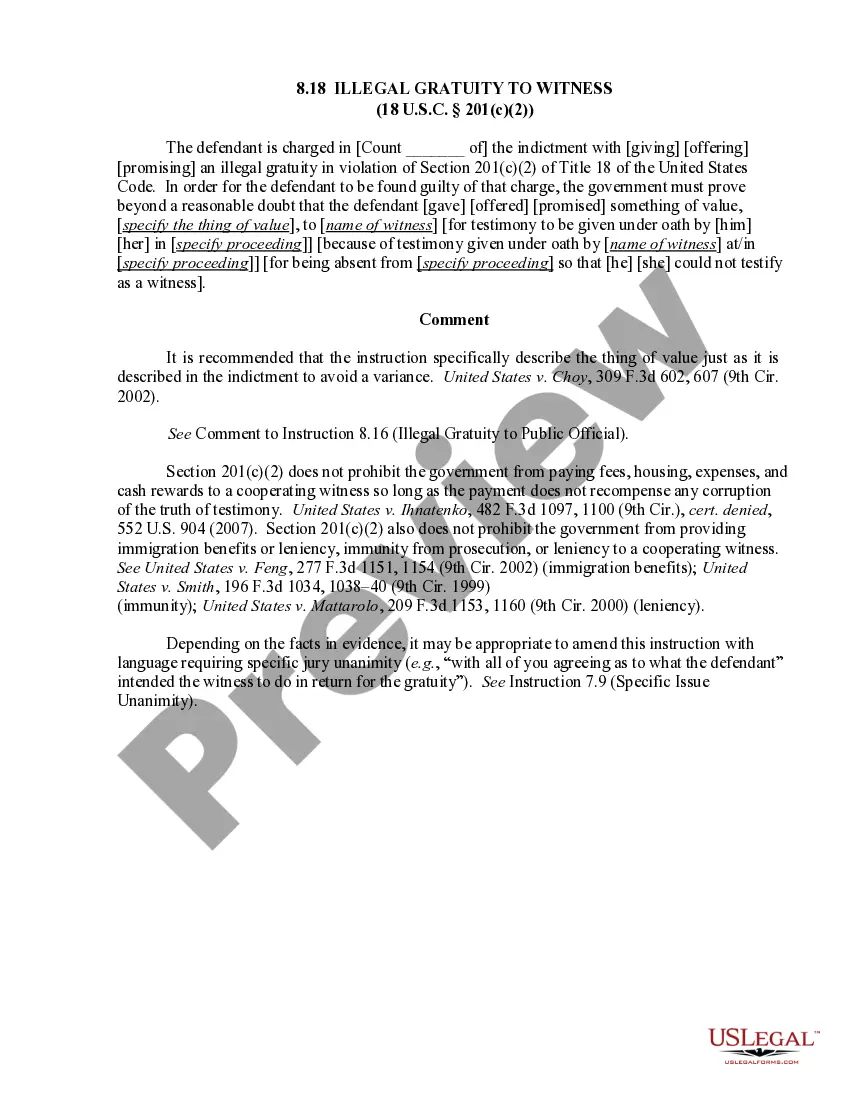

As a green card holder, you can work as an employee and receive a W-2 and/or you can work as an independent contractor and receive a 1099. You can do both at the same time. Congratulations on your new green card.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Yes! Classify nonresident aliens as either an independent contractor or an employee using the same rules as you use for U.S. Citizens who work for you.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Yes, you can obtain an O-1 visa as an independent contractor. Keep in mind, however, that you are subject to the same requirements as other applicants. According to the United States Citizenship and Immigration Services (USCIS), an O-1 visa beneficiary may not petition for herself or himself.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.