Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

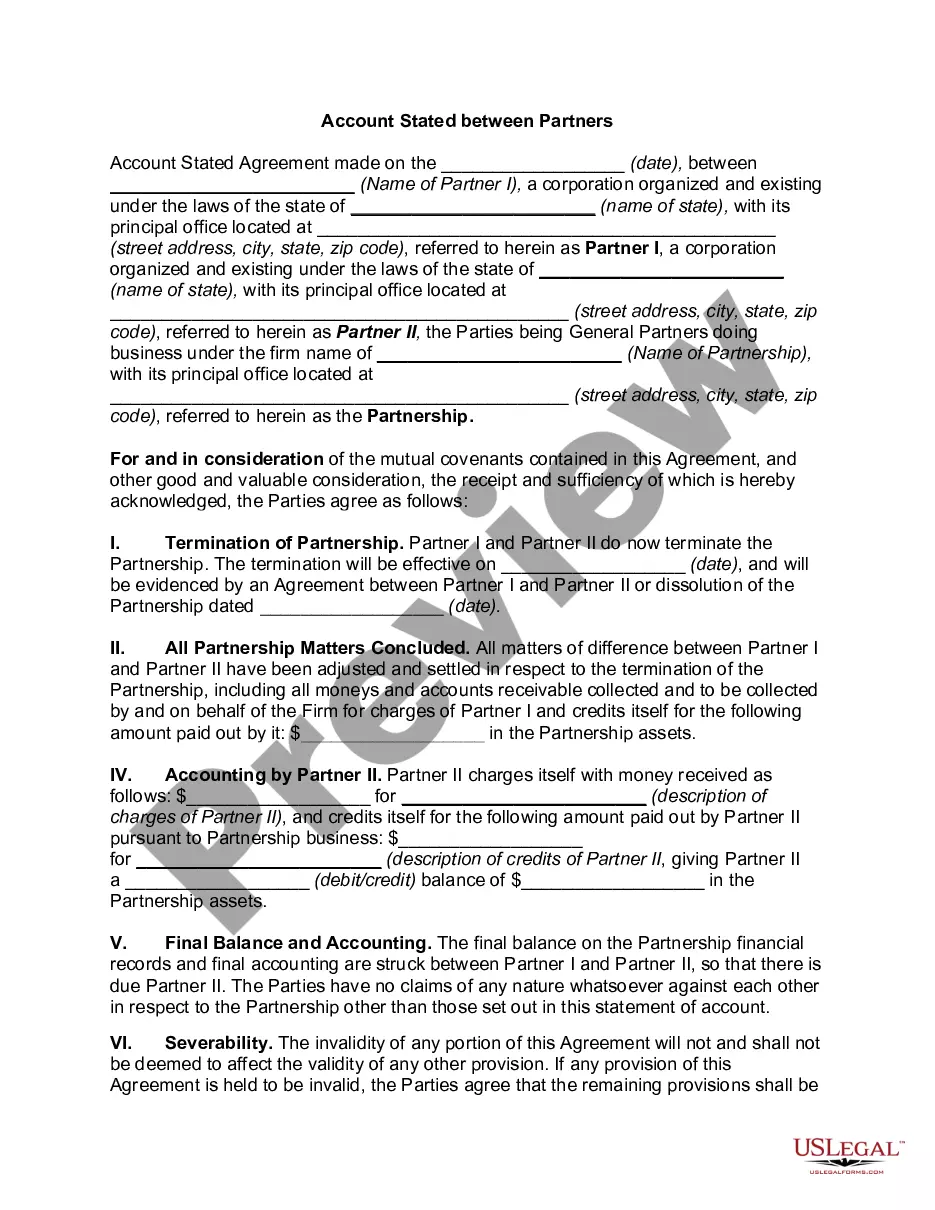

You might invest time online trying to locate the legal document template that meets the federal and state requirements you will need.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

You can download or print the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor from our platform.

If available, utilize the Review button to browse through the document template as well. To find a different version of the form, use the Search field to locate the template that suits your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To get an additional copy of the purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Check the form description to confirm you have selected the appropriate template.

Form popularity

FAQ

Independent contractors should fill out various forms, including tax forms and contracts specific to their agreements. A W-9 form is often required for tax purposes. Additionally, using the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor will ensure that all legal protections are in place, benefiting both parties involved.

To fill out an independent contractor form, begin with personal information such as your name and contact details. Next, provide details about the services performed, payment terms, and project duration. A straightforward approach to completing a Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor form helps streamline your contracting process and protects your rights.

Yes, independent contractors do need work authorization to operate legally. This authorization typically involves verifying that the contractor is allowed to work in the United States or specific territories. It is crucial to ensure compliance with local and federal regulations when engaging in a Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement involves entering specific information tailored to the project. Begin by providing the names and addresses of both the contractor and the client. Then, detail the services to be provided, payment rates, and timelines. Using the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring all necessary elements are included.

To write an independent contractor agreement, start by clearly defining the scope of work. Include essential details such as payment terms, project deadlines, and any specific obligations for the contractor. A well-structured Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor outlines both parties' expectations to ensure a smooth working relationship.

Yes, you can obtain a work visa as an independent contractor, though the process may differ from that of traditional employees. In the context of the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor, you must demonstrate that your role meets specific requirements outlined by immigration authorities. Consulting with legal experts or using platforms like USLegalForms can help you navigate the necessary paperwork and increase your chances of success.

To create an independent contractor agreement, start by outlining the terms of the arrangement between you and the contractor. Include essential details such as the scope of work, payment terms, and deadlines. You can use resources like USLegalForms to access templates specifically designed for a Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor. This platform simplifies the process, ensuring you include all necessary clauses for compliance.

Yes, an independent contractor is typically considered self-employed. This classification means they run their own business and provide services to clients under the Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor. As self-employed individuals, they manage their taxes and business operations independently. Understanding this status can help with better financial planning and legal obligations.

No, a temporary employee and an independent contractor are different classifications. A temporary employee works for a specific organization with defined hours, while an independent contractor is self-employed. The Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor outlines the distinctions clearly. It is crucial to understand these differences to ensure proper legal and tax compliance.

In the Virgin Islands, independent contractors may require a work visa depending on their country of origin and the nature of their work. The Virgin Islands Temporary Worker Agreement - Self-Employed Independent Contractor can provide clarity on visa requirements. It is essential to understand local immigration laws to ensure compliance. Consulting with a legal expert can simplify this process.