Virgin Islands Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need. US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to obtain or print the Virgin Islands Self-Employed Independent Contractor Construction Worker Contract from our service.

If you already have a US Legal Forms account, you can Log In and click the Download button. Subsequently, you can fill out, modify, print, or sign the Virgin Islands Self-Employed Independent Contractor Construction Worker Contract. Each legal document template you purchase is yours permanently. To obtain another copy of the purchased document, navigate to the My documents tab and click the appropriate button.

Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can fill out, edit, sign, and print the Virgin Islands Self-Employed Independent Contractor Construction Worker Contract. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice. Review the document details to confirm you have chosen the right form.

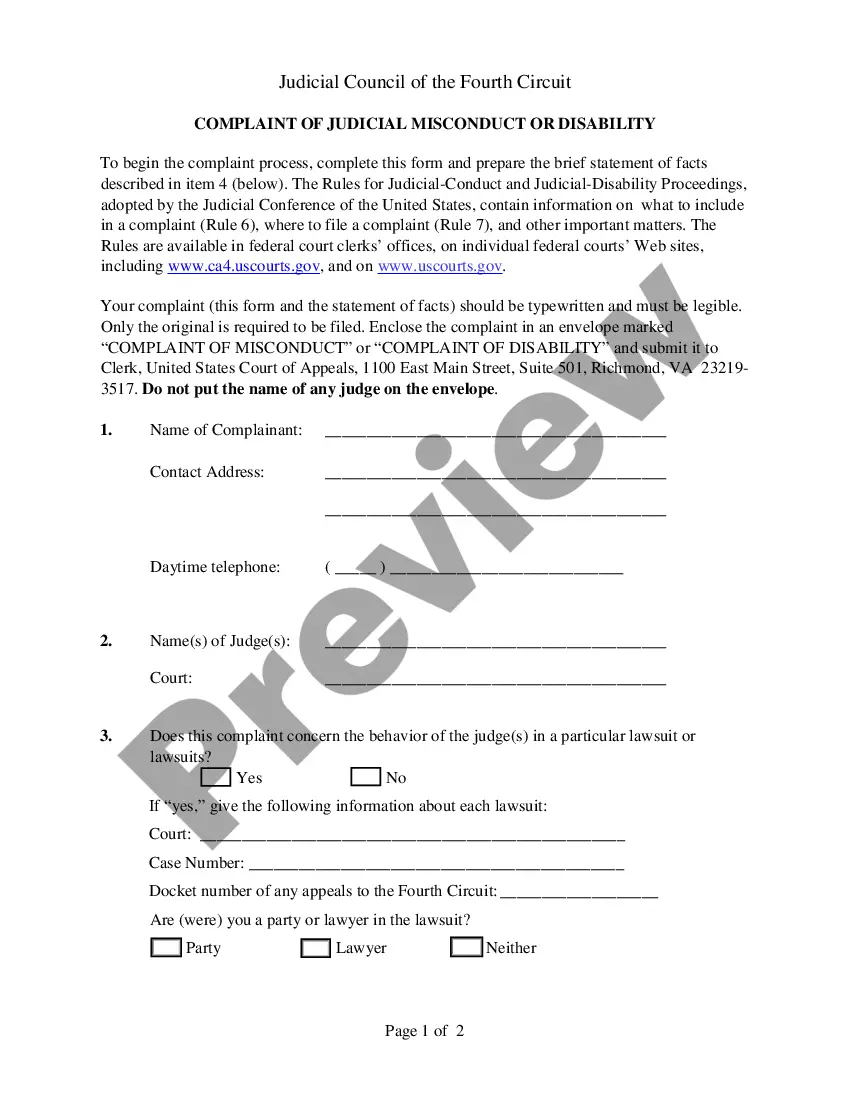

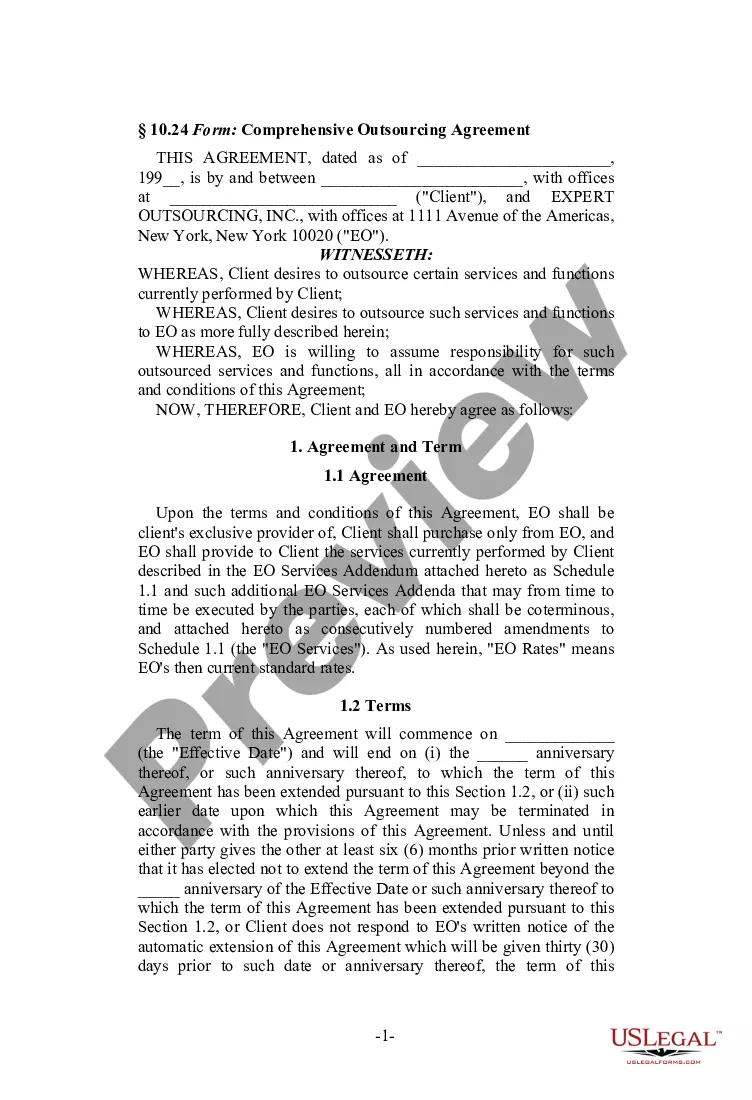

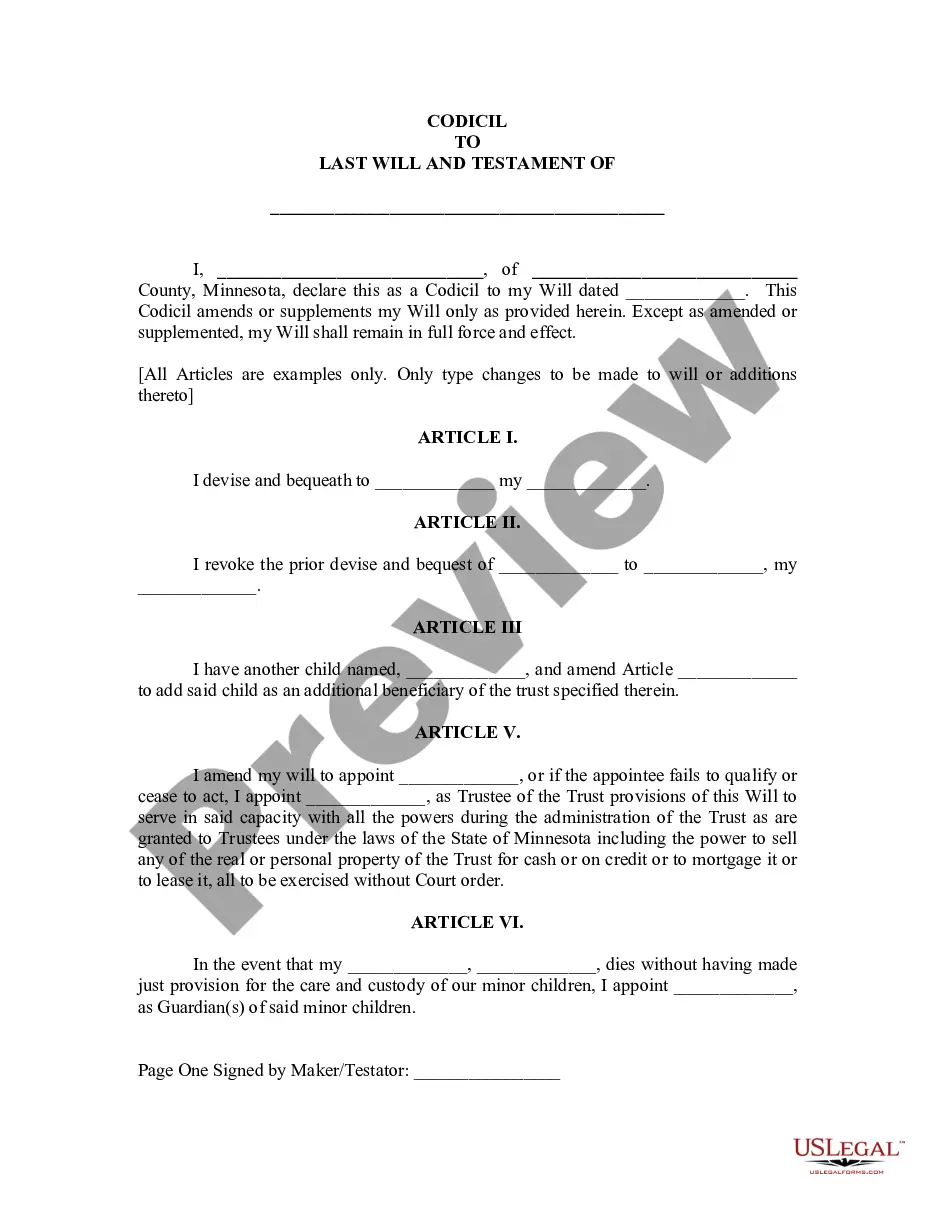

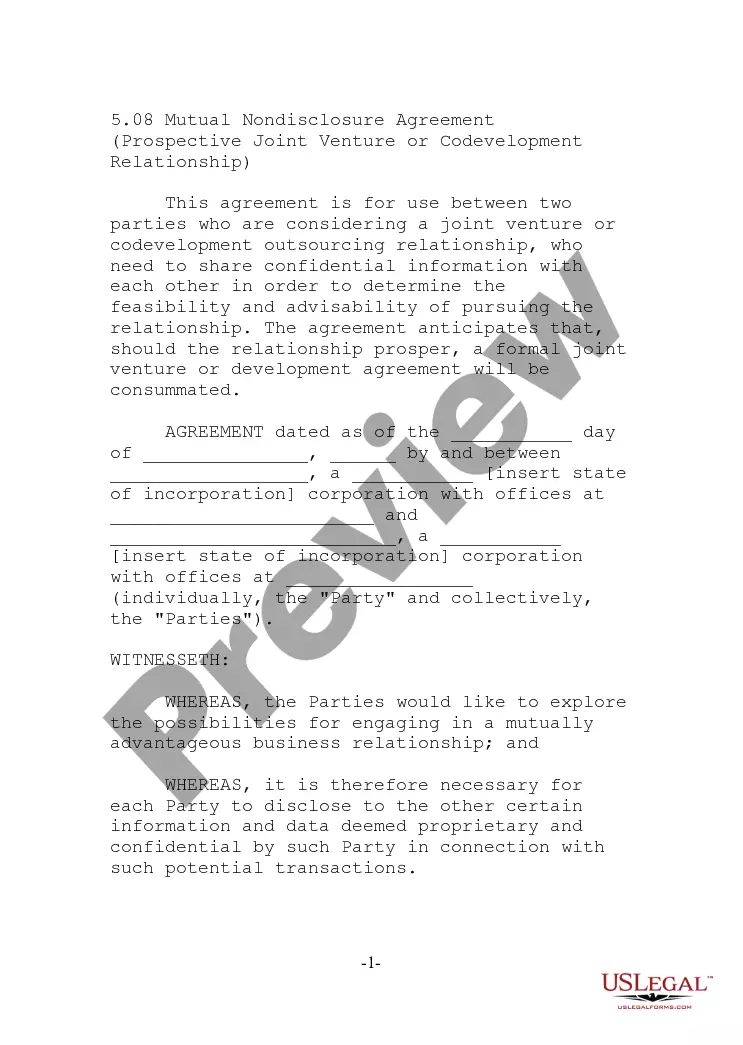

- If available, utilize the Review button to browse through the document template as well.

- If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- Once you have identified the template you want, click Buy now to proceed.

- Select the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

While both terms indicate a similar status, 'independent contractor' is more specific to the nature of your work relationship. For Virgin Islands self-employed independent contractor construction workers, using the term 'independent contractor' clarifies your role, especially when dealing with clients and contracts. This specificity can enhance your professional image.

Yes, independent contractors file their taxes as self-employed individuals. This means you will typically use IRS forms like Schedule C to declare your income and expenses. As a Virgin Islands self-employed independent contractor construction worker, familiarity with these forms simplifies your annual tax obligations.

To declare independent contractor income, you will report it on Schedule C when filing your personal tax return. For Virgin Islands self-employed independent contractor construction workers, it is crucial to accurately report all income to avoid penalties. This ensures you remain compliant with tax regulations.

Independent contractors need several items to file taxes, including a 1099 form, records of expenses, and any relevant business licenses. For Virgin Islands self-employed independent contractor construction workers, understanding deductible expenses can help reduce tax liability. The USLegalForms platform offers valuable resources to help streamline this process.

You can prove your status as an independent contractor by maintaining documents such as contracts, invoices, and proof of income. Keeping a detailed record of your work with clients solidifies your position as a Virgin Islands self-employed independent contractor construction worker. Such documentation supports your tax filings and protects your independent status.

Receiving a 1099 form usually indicates that you are self-employed. As a Virgin Islands self-employed independent contractor construction worker, this form reports your earnings to the IRS. It’s essential to keep track of your 1099s, as they are crucial for filing taxes accurately.

Yes, as a Virgin Islands self-employed independent contractor construction worker, you are considered self-employed. This means you operate your own business and are responsible for your own tax obligations. Understanding this classification helps you navigate your legal and financial responsibilities effectively.

Hiring independent contractors as a sole proprietor requires you to clearly define the job roles and responsibilities in a contract. It is essential to communicate your expectations upfront to avoid misunderstandings. Utilizing a Virgin Islands Self-Employed Independent Contractor Construction Worker Contract can protect both you and your contractors, ensuring a smooth working relationship.

Setting up as a self-employed contractor involves determining your business model, registering your business officially, and obtaining any required licenses. You will also want to create a detailed Virgin Islands Self-Employed Independent Contractor Construction Worker Contract to define your services. This approach not only streamlines operations but also builds trust with your clients.

To become an independent contractor in Virginia, you should start by deciding on your business structure and registering your business name. Then, acquire the necessary licenses and permits related to your specific field. If your path includes working as a Virgin Islands Self-Employed Independent Contractor Construction Worker, you will find that establishing clear contracts will enhance your business credibility.