Virgin Islands Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

You can invest time online searching for the authentic form template that meets the federal and state requirements you need.

US Legal Forms offers thousands of authentic forms that can be reviewed by experts.

You can download or print the Virgin Islands Pipeline Service Contract - Self-Employed from our service.

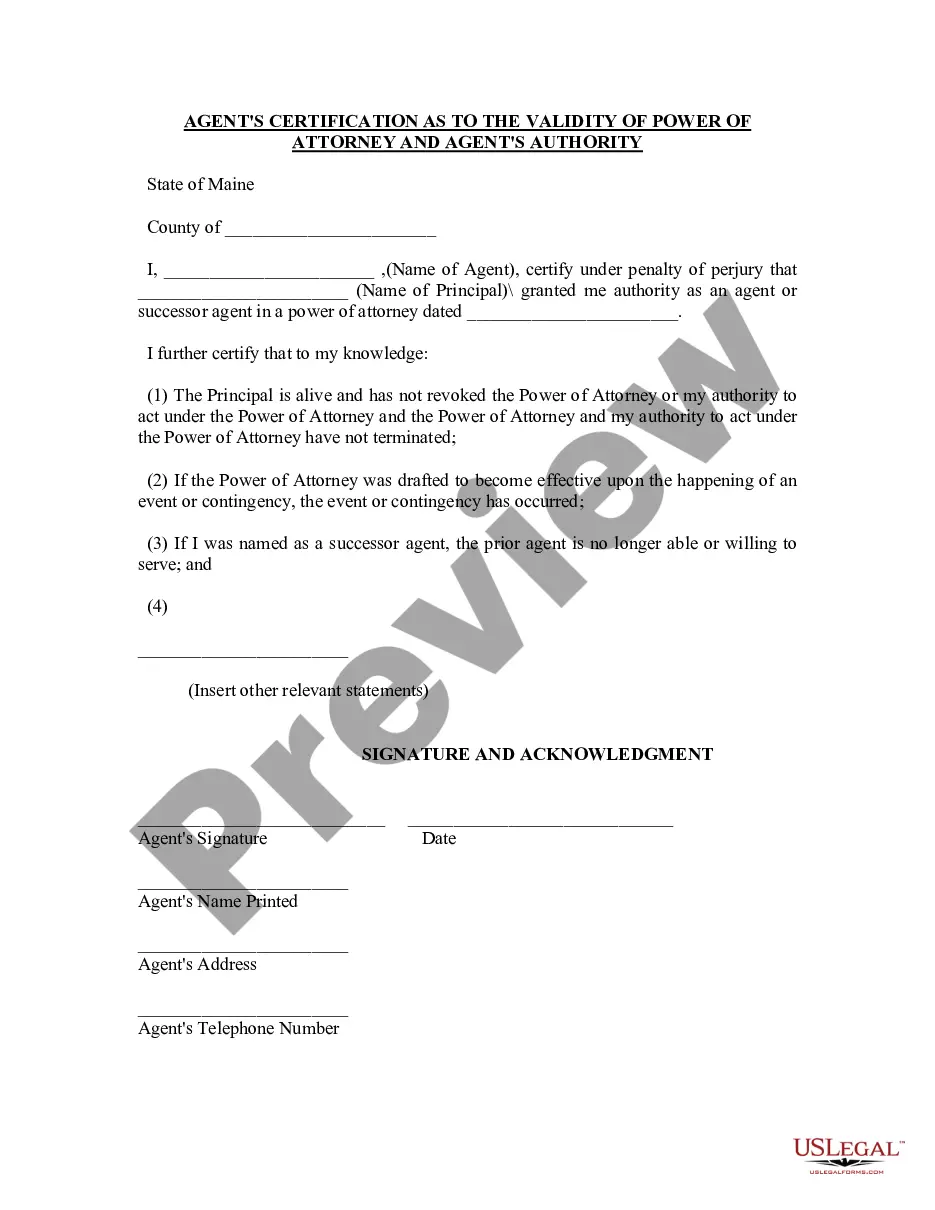

If available, utilize the Preview button to browse through the form template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the Virgin Islands Pipeline Service Contract - Self-Employed.

- Every authentic form template you buy is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the area/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

To start an LLC in the US Islands, begin by selecting a unique name for your business that adheres to local naming rules. Next, file the necessary formation documents with the Department of Licensing and Consumer Affairs. You'll also need to create an operating agreement and obtain any required permits. For a clear, step-by-step approach to forming your Virgin Islands Pipeline Service Contract - Self-Employed LLC, consider leveraging resources from the US Legal Forms platform to simplify the process.

Yes, Americans can work in the US Islands without the need for a work visa, as the islands are a territory of the United States. This allows for a seamless transition into your job or business venture, such as structuring a Virgin Islands Pipeline Service Contract - Self-Employed. However, it's still essential to comply with local laws and regulations. Be sure to research any additional requirements that may apply.

To write a self-employed contract for your Virgin Islands Pipeline Service Contract - Self-Employed, start by including key details such as the services you will provide, payment terms, and project timelines. Clearly outline the rights and obligations of both parties to avoid misunderstandings. It's also helpful to define terms related to confidentiality and ownership of work. For additional guidance and templates, consider using the US Legal Forms platform.

employed contract for a Virgin Islands Pipeline Service Contract SelfEmployed should clearly outline the scope of work, payment terms, and duration of the contract. It is vital to specify responsibilities, confidentiality agreements, and any necessary compliance with laws, such as the SCLS. Additionally, include terms for dispute resolution and termination to protect both parties. Using a trustworthy resource like uslegalforms can greatly aid in drafting a thorough and compliant contract.

The Service Contract Labor Standards (SCLS) sets specific thresholds for covered contracts, usually requiring contracts over a certain monetary amount to comply with wage regulations. For the Virgin Islands Pipeline Service Contract - Self-Employed, this threshold is essential for determining your obligations. Keeping updated on any changes in law can help ensure compliance and prevent potential pitfalls. Platforms like uslegalforms provide resources and templates to navigate these requirements seamlessly.

Professional services are generally not exempt from the Service Contract Act. If a contractor provides services under a Virgin Islands Pipeline Service Contract - Self-Employed, they typically must comply with the act's stipulations. This means they might need to meet wage and benefit requirements, even if their work is deemed 'professional.' Understanding these exemptions and regulations helps maintain compliance and protects workers' rights.

The Service Contract Act primarily applies to contracts in the United States and its territories; however, it can also affect contracts fulfilled overseas under certain conditions. If a company operates in the Virgin Islands and employs workers under a Virgin Islands Pipeline Service Contract - Self-Employed, then employees may still receive protections under this act. It's crucial to understand how local laws interact with U.S. laws to remain compliant. Consulting legal experts is advisable to navigate this complex landscape.

Technically, you can be classified as a 1099 employee without a formal contract, but it is risky. Without a contract, both you and your client may lack clarity on expectations and obligations. Securing a Virgin Islands Pipeline Service Contract - Self-Employed will clarify your status and protect your rights as an independent worker.

Yes, having a contract is beneficial when you are self-employed. A contract details the scope of work, payment schedules, and responsibilities, helping to prevent misunderstandings. Utilizing a Virgin Islands Pipeline Service Contract - Self-Employed can optimize your dealings and enhance your professionalism in the marketplace.

Freelancing without a contract is possible, but it leaves you vulnerable to disputes. A solid agreement can outline payment terms, services, and deadlines, providing a safety net. For those working under a Virgin Islands Pipeline Service Contract - Self-Employed, it's strongly advisable to have a contract for clarity and security.