Virgin Islands Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

You can devote time on-line trying to find the authorized document template that meets the federal and state requirements you need. US Legal Forms offers a huge number of authorized varieties that are reviewed by professionals. You can easily download or print out the Virgin Islands Term Sheet - Royalty Payment Convertible Note from my support.

If you have a US Legal Forms accounts, you are able to log in and then click the Download switch. Next, you are able to full, change, print out, or indicator the Virgin Islands Term Sheet - Royalty Payment Convertible Note. Each and every authorized document template you get is yours for a long time. To obtain yet another version for any purchased kind, go to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site the very first time, adhere to the easy directions beneath:

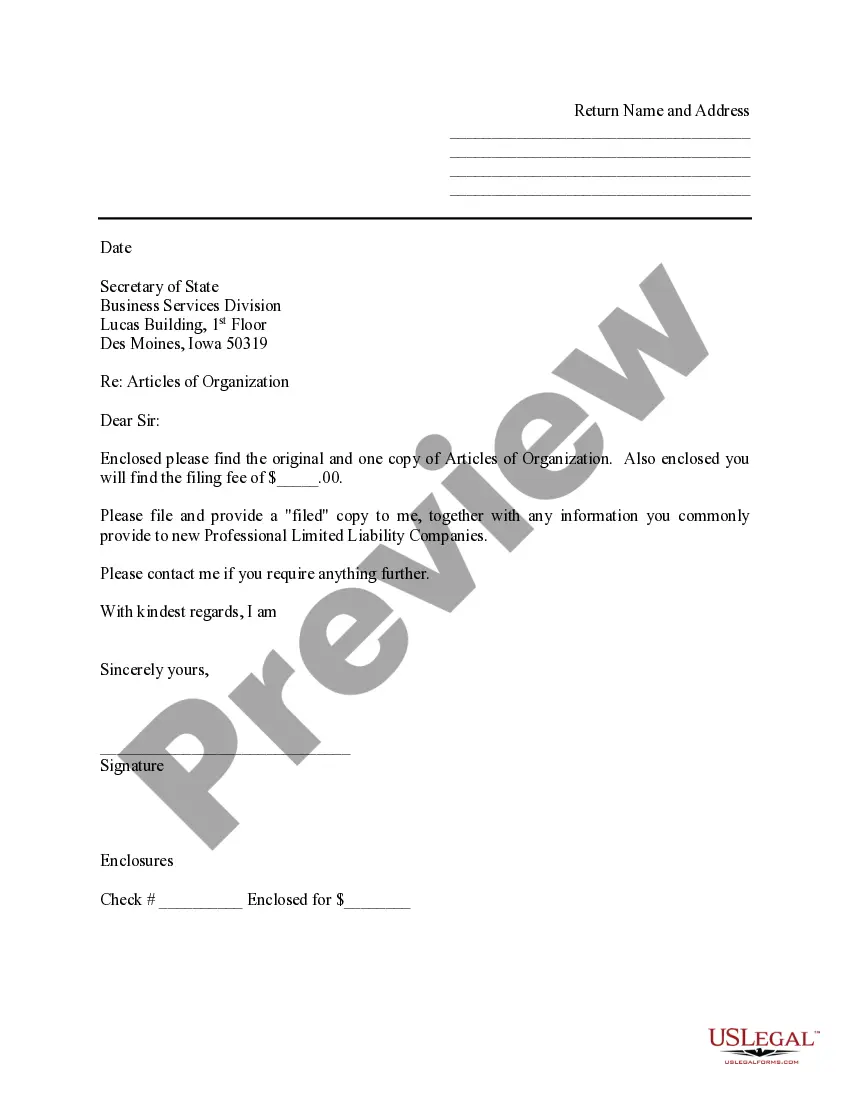

- Very first, ensure that you have selected the proper document template to the region/town that you pick. Browse the kind outline to make sure you have selected the right kind. If accessible, use the Preview switch to search from the document template as well.

- If you wish to locate yet another edition in the kind, use the Lookup area to discover the template that meets your needs and requirements.

- Upon having found the template you desire, just click Purchase now to move forward.

- Find the rates strategy you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your bank card or PayPal accounts to fund the authorized kind.

- Find the formatting in the document and download it for your system.

- Make changes for your document if required. You can full, change and indicator and print out Virgin Islands Term Sheet - Royalty Payment Convertible Note.

Download and print out a huge number of document web templates utilizing the US Legal Forms website, which provides the largest collection of authorized varieties. Use expert and express-specific web templates to take on your organization or specific requirements.

Form popularity

FAQ

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.

Convertible Note - Reporting Requirements FIRC and KYC of the non-resident investor. Name and address of the investor and AD bank. Copy of MOA / AOA. Certificate of Incorporation. Startup Registration Certificate. Certificate from Practising Company Secretary.