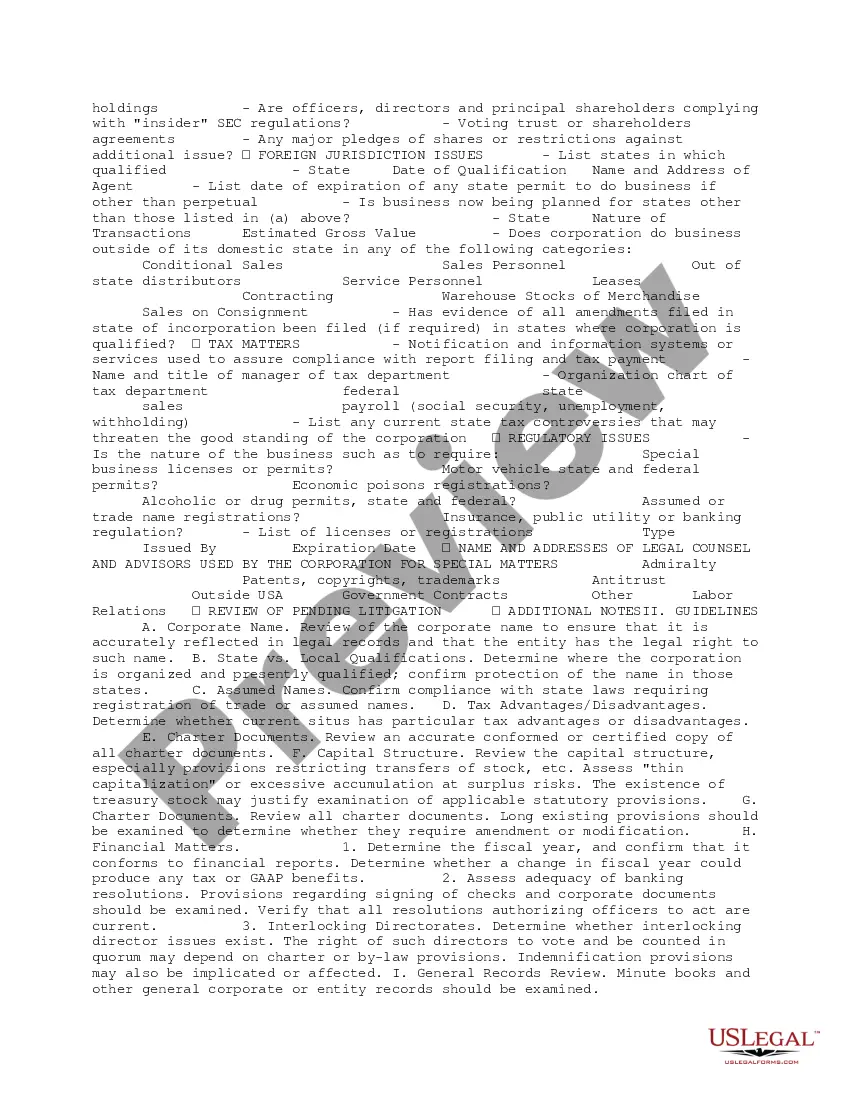

This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

If you require complete, obtain, or printing authentic record templates, utilize US Legal Forms, the largest assortment of legitimate documents available online. Utilize the site's user-friendly and efficient search to find the forms you need.

A collection of templates for business and personal purposes are organized by categories and states, or keywords. Leverage US Legal Forms to find the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Obtain button to locate the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview. You can also access forms you previously downloaded in the My documents tab of your account.

Every legal document template you obtain is yours indefinitely. You can access all forms you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview with US Legal Forms. There are numerous professional and state-specific forms you may utilize for your business or personal needs.

- Step 1. Ensure you have chosen the correct form for your city/state.

- Step 2. Utilize the Review option to view the form's details. Remember to read through the summary.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find different versions of the document template.

- Step 4. Once you've located the required form, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the document and download it to your device.

- Step 7. Complete, modify, and print or sign the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

Form popularity

FAQ

Registering a business in the US Virgin Islands involves a few essential steps to ensure you're compliant. First, you must select a unique business name and submit your Articles of Incorporation with the Department of Licensing and Consumer Affairs. Then, secure any necessary permits that apply to your business's operations. For a complete guide, reference the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview, which will help streamline the registration process.

Companies often choose to incorporate in the British Virgin Islands due to favorable tax regulations and a business-friendly legal system. This territory offers privacy for owners and minimal reporting requirements, making it an appealing choice for many business owners. Additionally, the incorporation process is efficient, allowing businesses to establish themselves quickly. For further insights, consult the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

To legally form a corporation in the Virgin Islands, you will need several key documents. Primarily, you must prepare and file Articles of Incorporation, which outline the corporation's structure and purpose. Additionally, you may need to create corporate bylaws and obtain necessary licenses or permits based on your business activities. For a thorough understanding, refer to the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview to ensure compliance with all requirements.

To enter the Virgin Islands, you will need valid identification, such as a passport. Additionally, depending on your nationality, you may require a visa. It is important to review the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview, as these resources detail the documentation and steps necessary for a smooth entry process. Familiarizing yourself with these requirements beforehand can help you avoid any delays or complications during your travel.

To start an LLC in the U.S. Virgin Islands, you should first choose a unique name that complies with state regulations. Next, you need to file the articles of organization with the Division of Corporations and Trademarks. After that, it is essential to create an operating agreement outlining management and operational procedures. Finally, follow the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview to ensure you meet all legal requirements.

To obtain an Employer Identification Number (EIN) in the Virgin Islands, you need to apply through the IRS. This process can typically be completed online, making it quick and straightforward. Ensure you have the necessary documentation ready by reviewing the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview. If you find the application process overwhelming, uslegalforms can provide the support you need to navigate it successfully.

Yes, obtaining a business license is necessary if you plan to operate a business in the Virgin Islands. Licenses help ensure compliance with local laws and regulations, protecting both the business owner and the community. Make sure to consult the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview to understand the licensing requirements specific to your business type. Using uslegalforms can assist you in filing the correct forms efficiently.

A good salary in the U.S. Virgin Islands can vary based on your job and industry. However, the average income hovers around $40,000 to $60,000 annually, allowing for a comfortable lifestyle on the islands. It’s wise to assess the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview if you plan to start a business, as this will impact your earning potential. Tracking job trends will help you better understand salary expectations specific to your field.

To set up an LLC in the Virgin Islands, start by choosing a unique name for your business that complies with local regulations. Next, file your Articles of Organization with the Department of Licensing and Consumer Affairs. Additionally, familiarize yourself with the Virgin Islands Short Form Checklist and Guidelines for Basic Corporate Entity Overview to ensure you understand the required steps and documentation. Finally, consider using uslegalforms to streamline the process and ensure compliance with local laws.