Virgin Islands Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

Are you presently in the situation the place you require paperwork for sometimes company or individual reasons virtually every day? There are tons of lawful record web templates available online, but getting versions you can rely on is not easy. US Legal Forms gives 1000s of type web templates, like the Virgin Islands Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005, that are published to fulfill federal and state needs.

In case you are already acquainted with US Legal Forms site and also have a free account, basically log in. Afterward, it is possible to acquire the Virgin Islands Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 web template.

If you do not offer an account and would like to start using US Legal Forms, adopt these measures:

- Discover the type you require and make sure it is for the correct metropolis/area.

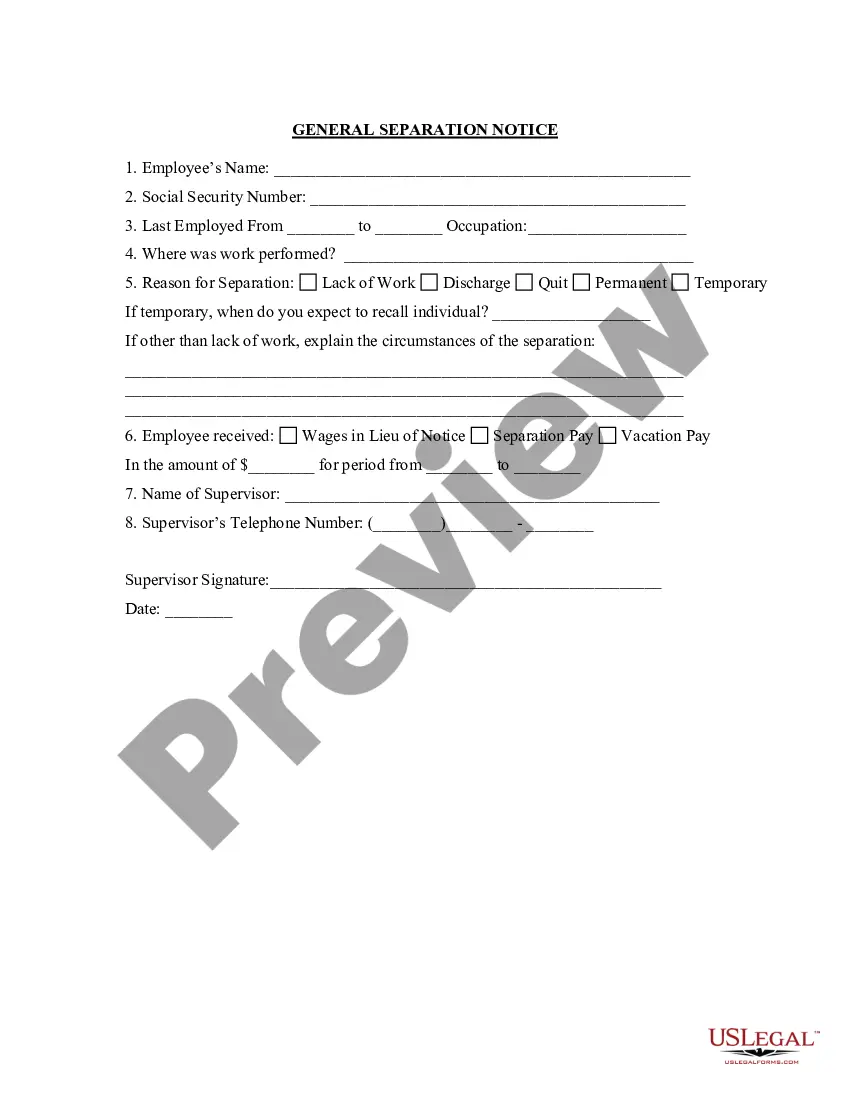

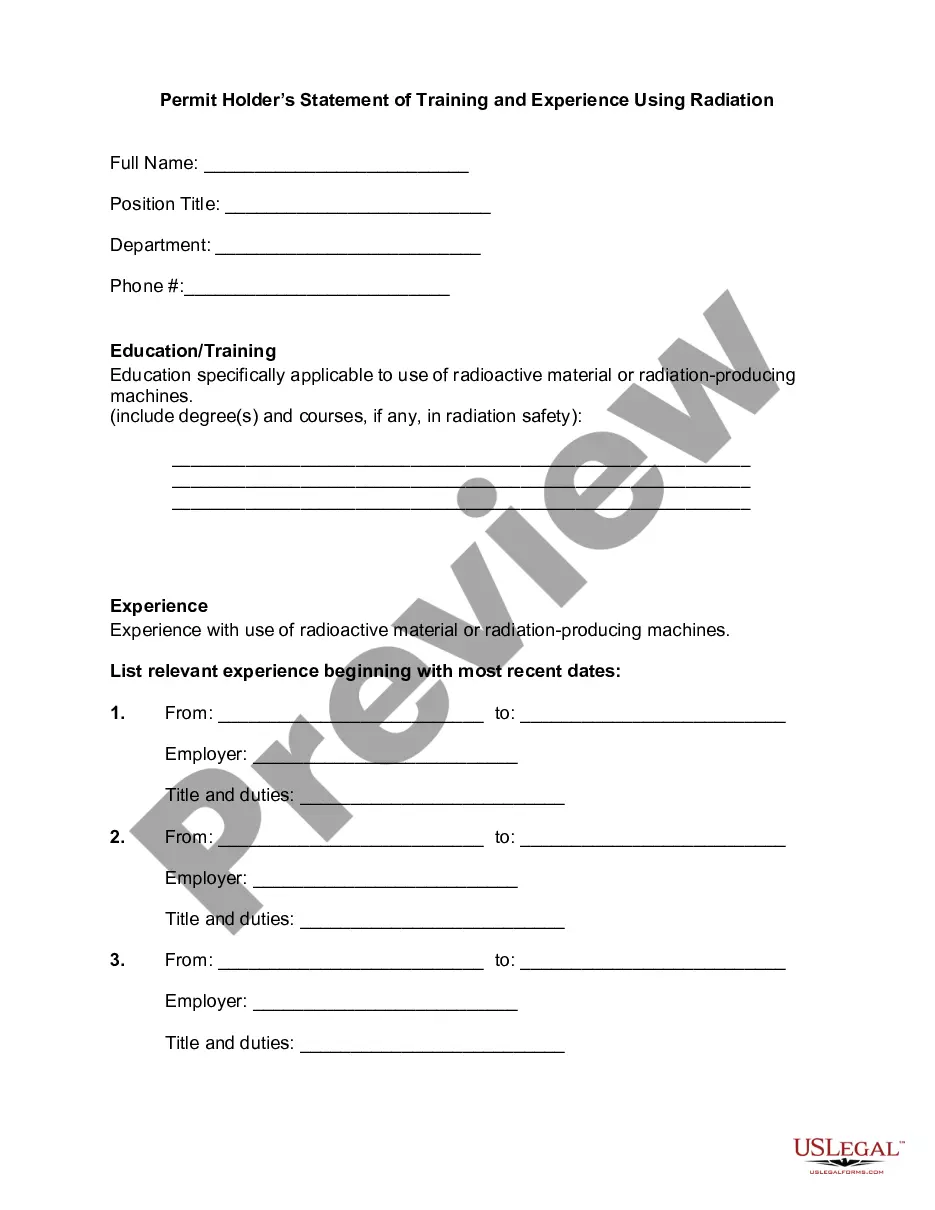

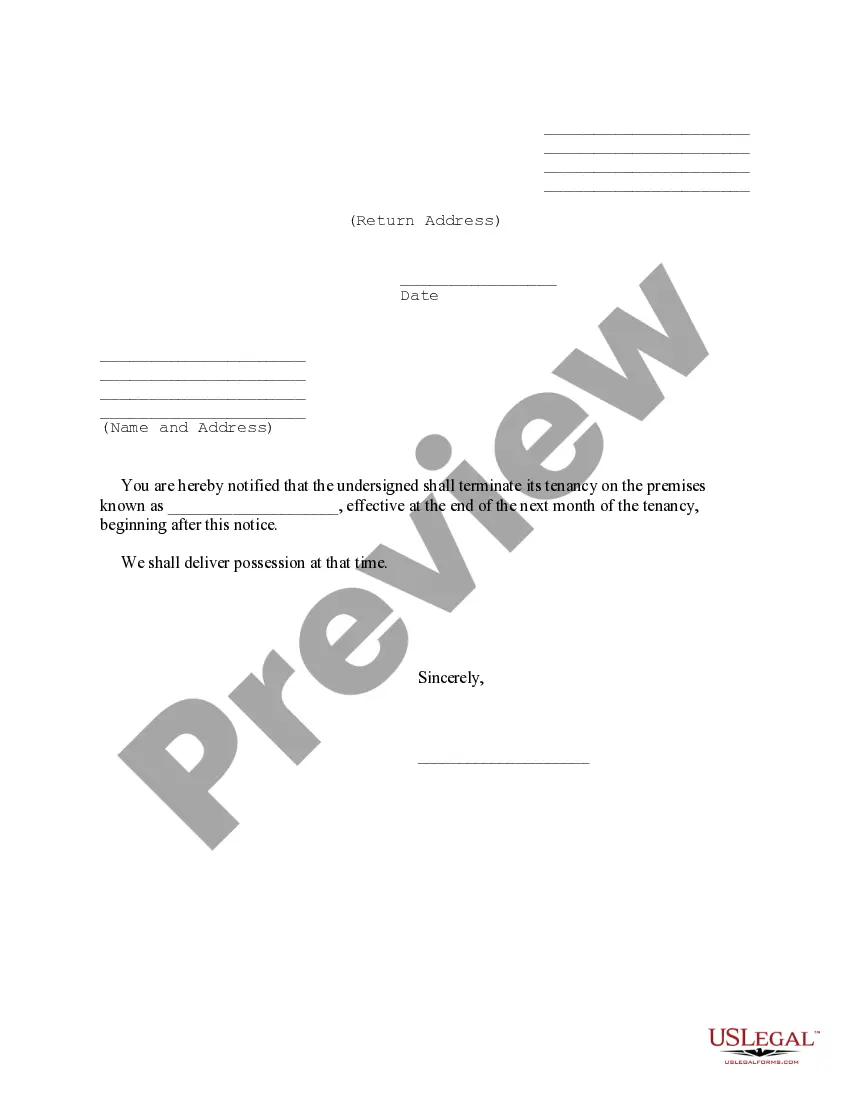

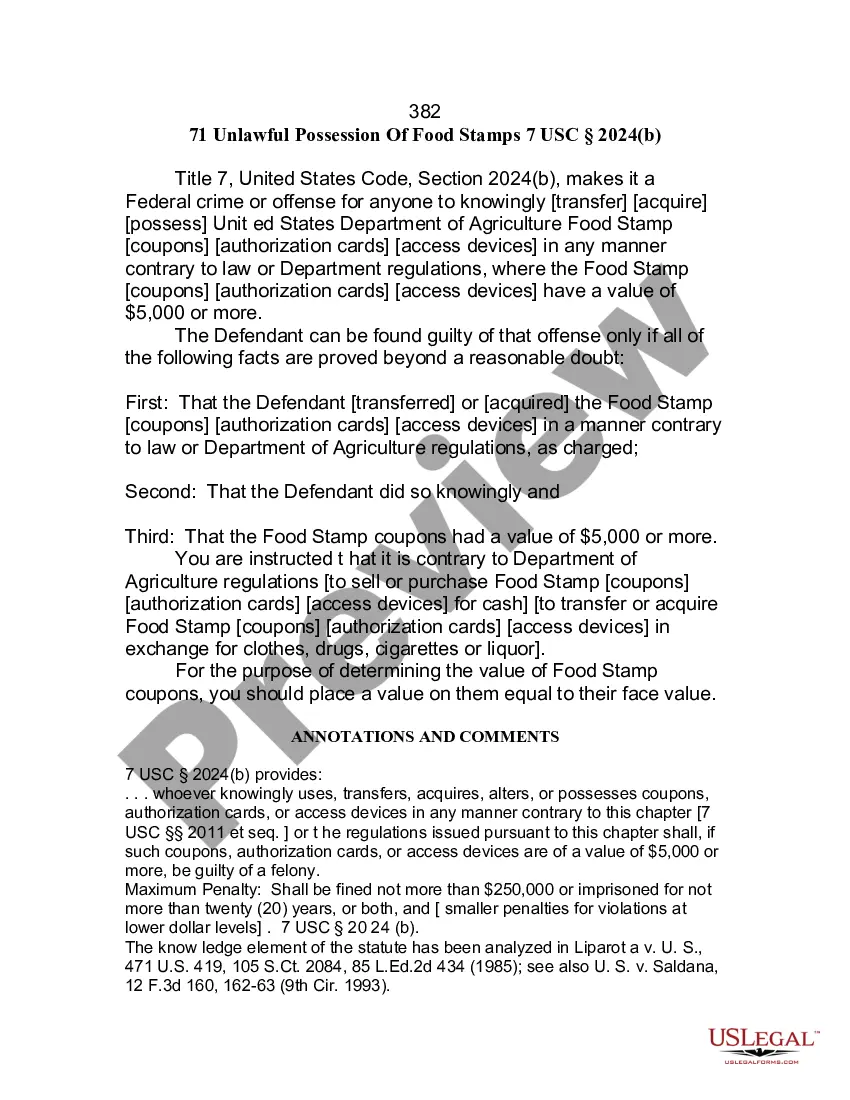

- Take advantage of the Review key to analyze the form.

- See the description to actually have selected the correct type.

- When the type is not what you are trying to find, take advantage of the Look for field to get the type that meets your needs and needs.

- When you find the correct type, click on Purchase now.

- Choose the costs program you desire, complete the specified information and facts to make your bank account, and pay for the transaction with your PayPal or bank card.

- Pick a practical paper structure and acquire your copy.

Locate all of the record web templates you might have bought in the My Forms menu. You can obtain a extra copy of Virgin Islands Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 any time, if required. Just click on the needed type to acquire or produce the record web template.

Use US Legal Forms, by far the most extensive assortment of lawful forms, to conserve time and avoid mistakes. The service gives expertly created lawful record web templates that can be used for an array of reasons. Create a free account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

Creditors with priority unsecured claims are treated differently from general unsecured creditors. Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. Understanding Secured vs. Unsecured Debt - Leinart Law Firm leinartlaw.com ? resources ? secured-unsecu... leinartlaw.com ? resources ? secured-unsecu...

Preferred creditors take priority for payment during bankruptcy, but unsecured creditors are less likely to be paid out any assets.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders. Which Creditors Are Paid First in a Liquidation? - Investopedia investopedia.com ? ask ? answers ? corporat... investopedia.com ? ask ? answers ? corporat...

Non-priority debts include the bulk of unsecured debts, such as: Past-due credit card bills and outstanding credit card balances. Unpaid personal loan payments. Private debts to friends and family members. Overdue bills, including those for rent, utilities and cellphones. Understanding Priority and Non-Priority Debt in Bankruptcy experian.com ? blogs ? ask-experian ? unde... experian.com ? blogs ? ask-experian ? unde...

A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims. These might include bank lenders, employees, the government if any taxes are due, suppliers, and investors who have unsecured bonds.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans. Bankruptcy: Secured vs. Unsecured Claims | Dethlefs Pykosh & Murphy dpmlawyers.com ? bankruptcy-secured-vs-unsecu... dpmlawyers.com ? bankruptcy-secured-vs-unsecu...

Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.