Virgin Islands Employee Evaluation Form for Farmer

Description

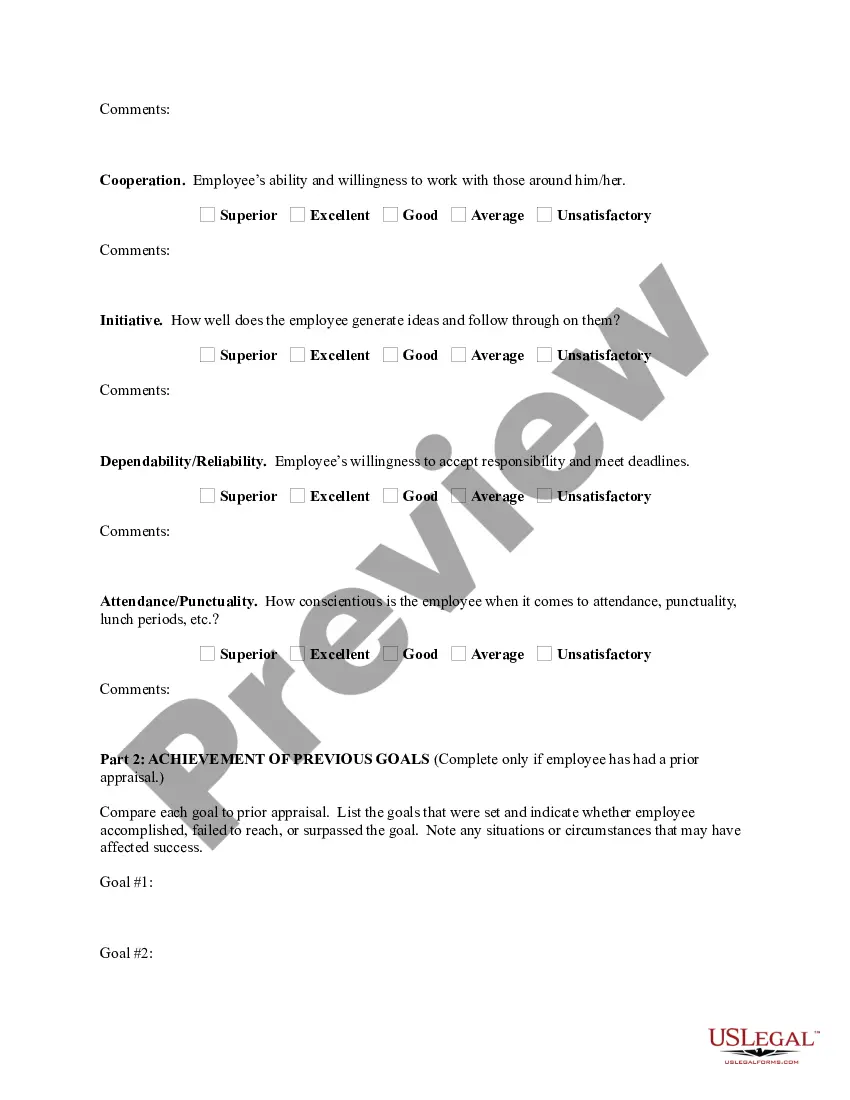

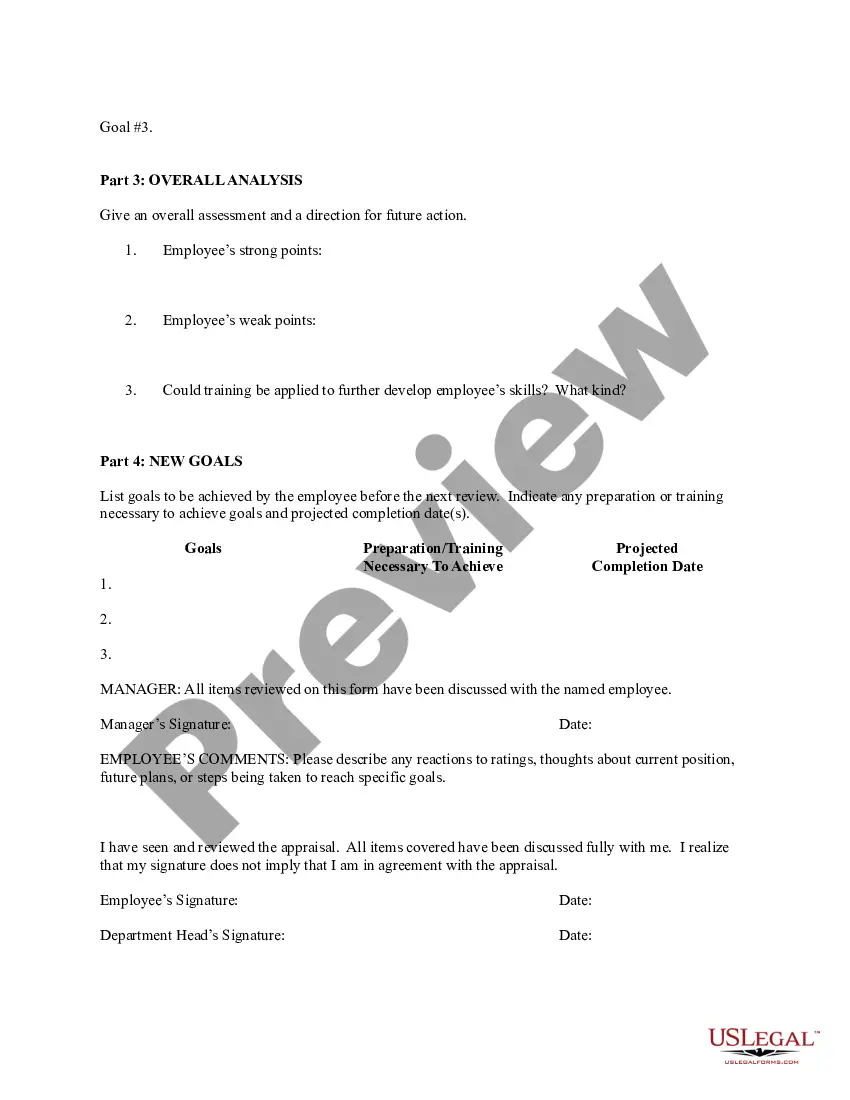

How to fill out Employee Evaluation Form For Farmer?

If you wish to access, retrieve, or print authentic document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Take advantage of the site’s simple and user-friendly search feature to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternatives of the legal form template.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Utilize US Legal Forms to find the Virgin Islands Employee Evaluation Form for Farmers in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Virgin Islands Employee Evaluation Form for Farmers.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If it’s your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the View option to review the form’s details. Be sure to read the description.

Form popularity

FAQ

Gross Cash Income: the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. Gross Farm Income: the same as gross cash income with the addition of non-money income, such as the value of home consumption of self-produced food.

Employers who paid wages to agricultural employees that are subject to income tax, social security or Medicare withholding must file a Form 943, Employer's Annual Federal Tax Return for Agricultural Employees to report those wages.

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

The Internal Revenue Service's classification of "Agricultural Employees" includes farm workers that raise or harvest agricultural or horticultural products on a farm, including raising livestock.

You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

Farmers, like other business owners, may deduct ordinary and necessary expenses paid . . . in carrying on any trade or business. IRC § 162. In agriculture, these ordinary and necessary expenses include car and truck expenses, fertilizer, seed, rent, insurance, fuel, and other costs of operating a farm.

It's designed to be used in place or in addition to Form 941 for businesses that routinely pay farm workers. Form 943 is only used by companies that employ and pay farmworkers wages by cash, checks, or money orders. Non-cash wages are food and lodging, or payment for services other than farm work.

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

Weekly, monthly, and bi-monthly payments should be paid online ( ). A farmer is required to file Form 943 annually to verify payments were correct. All non-farmers are required to file Form 941 quarterly. A new employer must apply for a KY Withholding Account number.

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.